Integra Resources (ITR.V, ITRG) has seen its share price slide by approximately 24% since it released the results of a pre-feasibility study on the DeLamar project after-hours on February 9th. The stock closed at C$1.94 on Friday evening, for a market capitalization of just C$120M.

While it’s understandable the market was underwhelmed by a higher capex and lower NPV5% at $1500 gold (US$203M versus US$466M) compared to the preliminary economic assessment in 2019, there are a few important distinctions to be made beyond the inflationary aspects.

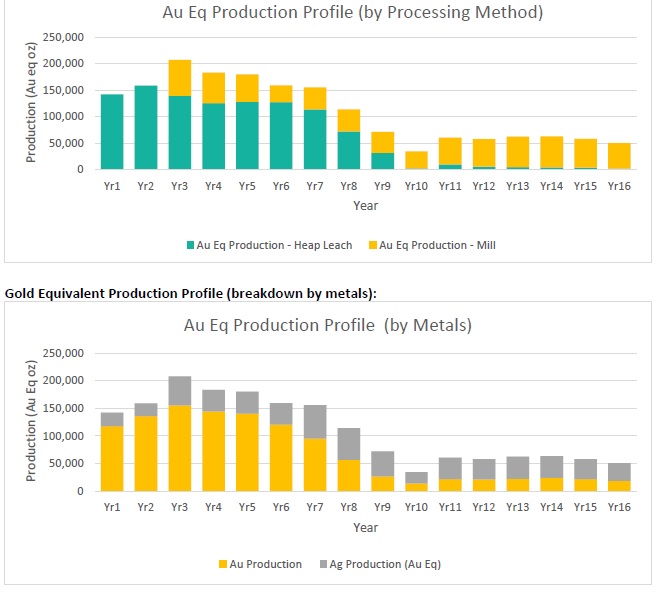

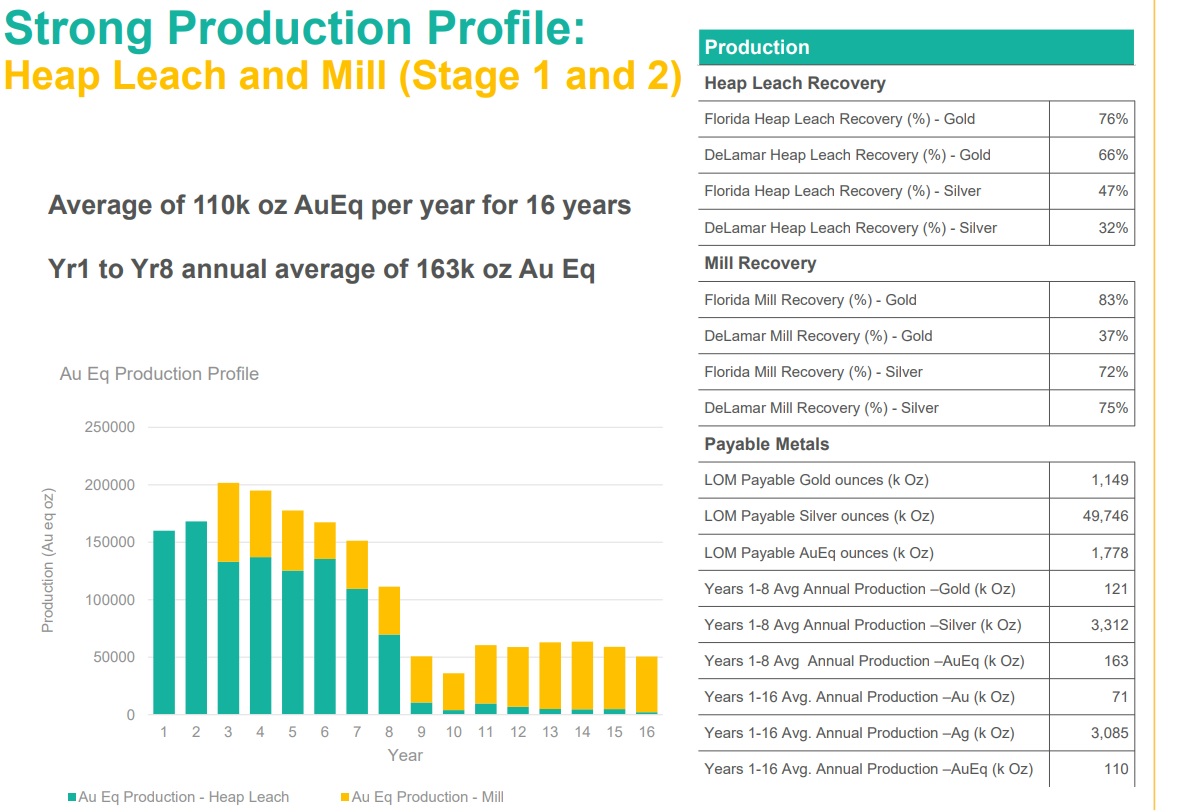

First of all, the pre-feasibility study contains a more expanded milling scenario as the mine plan calls for a 6,000 tonnes per day mill to be built right away at a cost of approximately US$200M. However, when looking at the breakdown of the production profile, we see the milling scenario will barely add any ounces to the mine life. Indeed, according to the mine plan, only 400,000 additional ounces of gold (and 33 million ounces of silver) are recovered and payable in the current scenario.

There are two important reasons for this. First of all, Integra Resources has used the resource estimate with an effective date of March 1st 2021 as basis for the pre-feasibility study. This means that none of the drilling completed in 2021 is actually includes in the resource nor the pre-feasibility study. Adding, say, half a million ounces to the mill scenario would drastically change the economics of the non-oxide mine plan. After all, the capex to build the mill is a sunk cost and the capital efficiency improves quite drastically as more ounces are produced. Thanks to the high silver content the AISC of the milling scenario is just around $550/oz. So if 500,000 recoverable and payable ounces are added to the mine plan, the mill scenario will see its pre-tax and undiscounted sustaining cash flows increase by in excess of $500M. Even after applying taxes and the relevant discount rates, it’s still easy to see a few hundred million dollars being added to the NPV calculation.

Secondly, Integra is doing more work to double-check if the Albion process is a viable strategy to be used in the million process. The Albion process is based on ultra-fine grinding and atmospheric oxidation, followed by agitated cyanidation. According to the press release, these results have shown gold and silver recoveries exceeding 80% from Sullivan Gulch as well as 70% for both gold and silver from the Glen Silver material. This could be important as the current recovery rate for the DeLamar gold is just 37% in the pre-feasibility study while only 72% and 75% of the Florida Mountain and DeLamar silver are being recovered. If we would just focus on the 37% recovery rate for the DeLamar non-oxide material, this basically means that of the 432,000 ounces of gold in the DeLamar proven and probable reserve, only about 160,000 ounces of gold would actually be recovered. You don’t have to be a rocket scientist to see that a higher recovery rate of even just 65% would immediately add over 100,000 ounces of recoverable and payable gold at no extra cost. This means the pre-tax and undiscounted bottom line would be boosted by approximately $150M as well.

While admittedly the headline results of the pre-feasibility study may not have met the expectations, ‘missing’ those expectations can be fully traced back to the milling scenario where a resource and reserve upgrade in combination with higher recoveries upon confirming the Albion process as a viable alternative could immediately drive the value.

But let’s take a step back. Let’s assume a scenario where Albion doesn’t work and where not a single additional ounce of gold can be added to the mine plan. An unlikely scenario but let’s have a look at the heap leach only scenario and forget about the mill.

In that heap leach only scenario, Integra Resources is slated to produce 749,000 payable ounces of gold as well as 16.2 million payable ounces of silver. The initial capex indeed isn’t low at US$273M but the sustaining capex is low ($78M or just around $100/oz) and the all-in sustaining cost per ounce of gold is estimated at $570/oz.

Integra Resources is not allowed to provide a NPV and IRR calculation of the ‘heap leach only’ scenario, but a rudimentary back of the envelope calculation indicates the sum of the undiscounted pre-tax cash flows in that scenario would be US$648M. Even after deducting the taxes and discounting it by 5% the after-tax NPV5% of the heap leach only scenario likely exceeds US$300M at the current gold price. And even at $1500 gold the NPV5% will likely exceed US$200M (we will run a few more scenarios and publish those in a separate report).

And that’s the bottom line. The pre-feasibility study shows ‘optionality’. IF more ounces can be added to the non-oxide mine plan and IF more ounces can be recovered, it makes sense to build the mill. But the ‘downside’ scenario is to build the heap leach mine and re-assess the mill scenario at a later day when it makes more sense. And that seems to be what the market is missing here. If you would completely forget about the mill scenario and only focus on the heap leach mine plan, you have a project with a very robust PFS-level heap leach mine plan with a NPV north of US$200M at $1500 gold and likely exceeding $250M at $1650 gold. Meanwhile, the current market capitalization is less than US$100M indicating the stock is trading at just 0.4 times the after-tax NPV5% of the heap leach only scenario. A scenario that could relatively easily be built by Integra as the 16.2 million ounces of recoverable silver provide some hard currency. Selling half of those ounces in a streaming deal would likely be sufficient to raise enough money to cover the equity portion of the initial capex.

And finally, the company’s executive team doesn’t seem to be too worried. Since the pre-feasibility was published insiders have spent almost C$150,000 on buying more stock with CEO George Salamis adding 45,000 shares to his position while chairman De Jong added 20,000 shares and CFO St-Germain added 5,100 shares to her position. If anything, these strong insider purchases are another convincing argument they are optimistic about the future.

We are working on a more extensive update on Integra’s pre-feasibility study and hope to release that review soon. But after a first read of the press release, adding recoverable ounces to the mill scenario appears to be the main key to unlock additional value at DeLamar.

Disclosure: The author has a long position in Integra Resources. Integra is a sponsor of the website. Please read our disclaimer.

One Comment