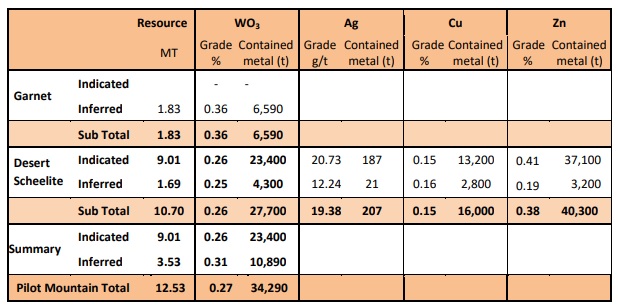

Thor Mining (THR.AX, THR.L) has published an updated resource estimate on its fully owned Pilot Mountain tungsten project in Nevada. The current resource estimate contains 12.53 million t onnes at 0.27% WO3 for a total content of 34,290 tonnes of WO3. Considering one tonne contains 100 mtu, the combined Pilot Mountain resource thus contains 3.43 million mtu of Tungsten with a current pro-forma value of US$740M using a current tungsten concentrate price of $215/mtu (based on an APT price of $275/mtu).

The vast majority of this resource (approximately 85%) is part of the Desert Scheelite zone, where Thor also outlined a silver resource (6.6 million ounces at just over 19 g/t) as well as some copper and zinc in the scheelite. The mix of different commodities is very interesting, but it could also complicate the recovery of the metals. According to Thor’s preliminary findings, a simple flotation process could help to recover the zinc at a ‘minimal additional cost’, so it will be interesting to see the recovery rate for the zinc as well as the quality of the concentrate. The zinc flotation circuit could be interesting as Thor has now also published an exploration target for the zinc-bearing zones on the Garnet part of Pilot Mountain. According to the company, it’s expecting to find 1.4-1.8 million tonnes of rock at an average grade of 0.5-1% zinc, for a total of 7,000-18,000 tonnes of zinc. This could push the total in-situ zinc resource to in excess of 100 million pounds and even after taking a low recovery rate (65%) and payability (85%) into account, recovering and selling 55 million pounds of zinc could be an interesting by-product. But let’s wait for the results of the metallurgical test program before getting too excited.

We would also like to see Thor Mining using a more realistic sales price. In its 2018 scoping study, it used a tungsten concentrate price of US$350/mtu. Considering the average payability ratio of concentrate versus the APT price is 78%, the company’s use of $350/mtu for concentrate implies an APT price of US$450/mtu which is approximately 50% higher than the current price. We’re not saying that’s absolutely impossible, but we would implore Thor Mining to use a more realistic price.

Go to Thor’s website

The author has no position in Thor Mining. Please read the disclaimer