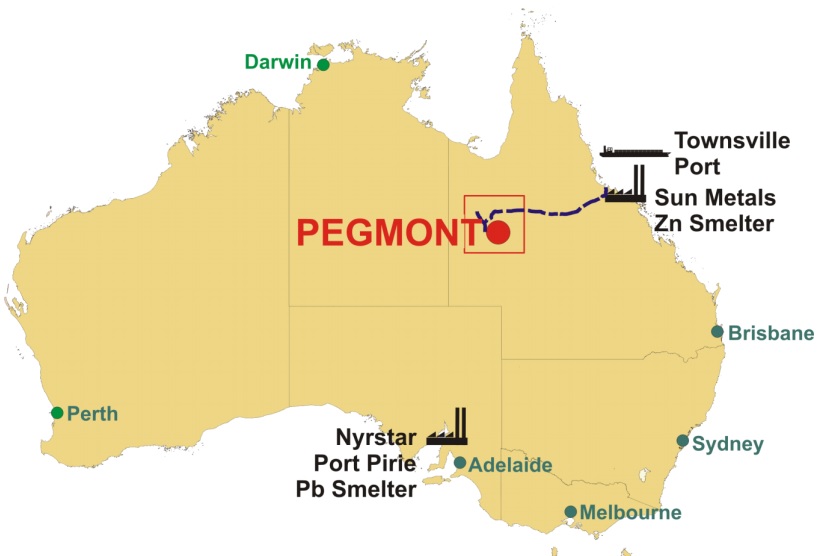

As we wrote a few months ago, Vendetta Mining (VTT.V) was fully cashed up to complete another round of drilling at its Pegmont Lead-Zinc project in Australia. The company has now released the first assay results from 10 holes that have been drilled at the Burke Hinge zone. As Burke Hinge is in an area of the project with higher lead values, we were expecting the drill results to be predominantly lead-weighted which isn’t necessarily a bad thing, as the lead price is trading at an 18 month high.

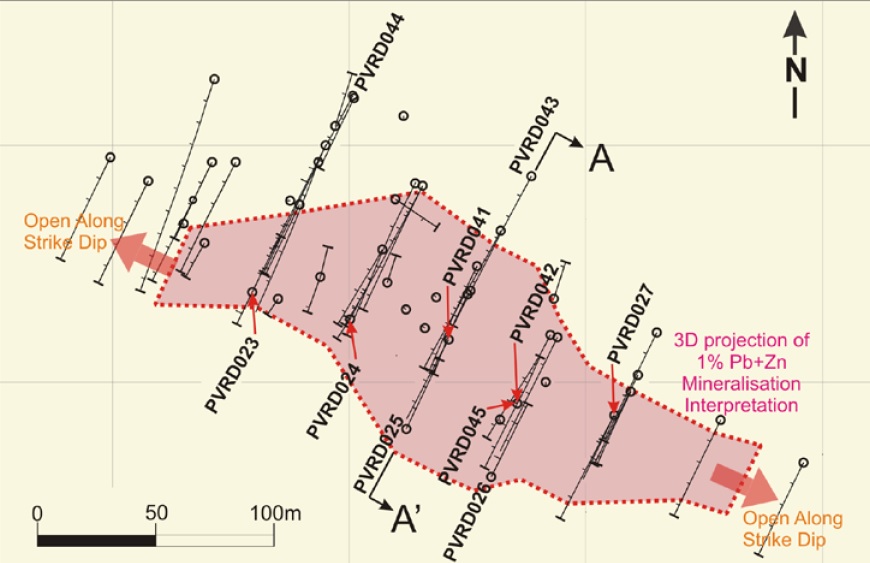

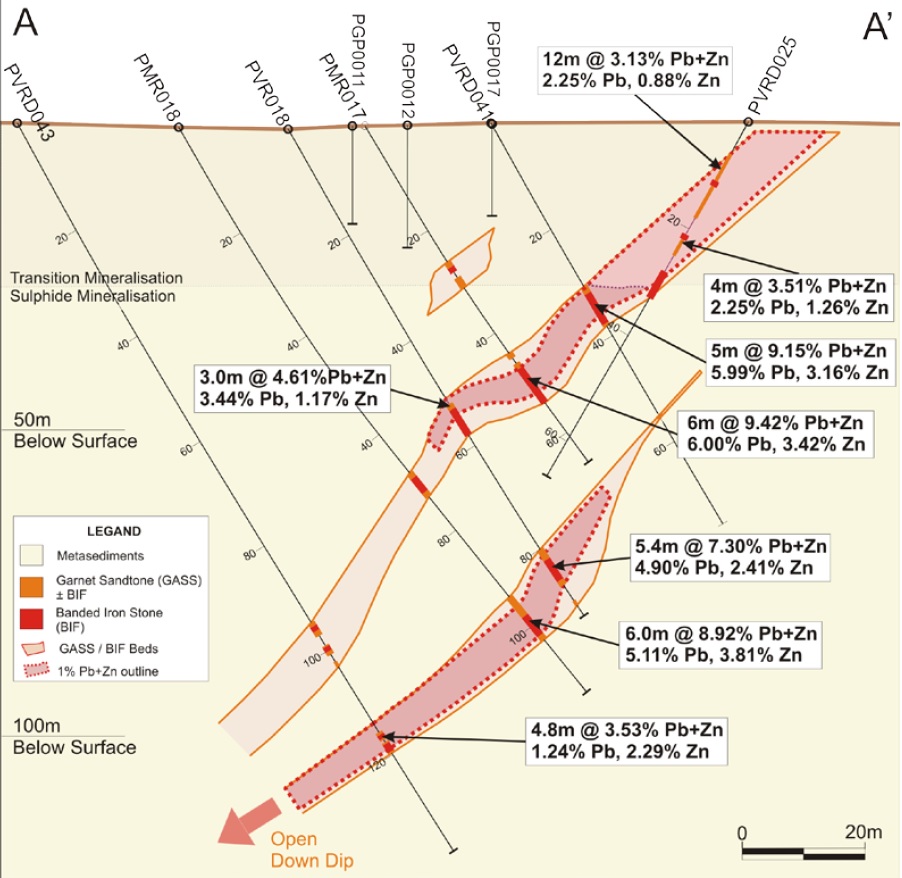

The drill bit didn’t disappoint, and all ten holes have intercepted lead-zinc mineralization with intervals such as 6 meters (true thickness!) of 9.48% ZnPb and 17.8 g/t silver whilst another hole encountered a higher grade zone with a true width of 3.9 meters at almost 17% ZnPb (with 12.28% lead and 4.55% zinc). This is pretty much as good as we were expecting, and not only did all of the company’s holes hit mineralization, the average true width of the holes is in line with our expectations whilst the grades definitely appear high enough.

If we would, for instance, calculate the value of the zinc and lead per tonne of rock in the first hole, the in situ value of 6.08% lead and 3.4% zinc would be $196/t (using a zinc price of $1.05/lbs and a lead price of $0.88/lbs), which is pretty impressive considering it’s located at a depth of just 41 meters.

This also validates the company’s expectation that the Burke Hinge zone might actually be mined through open pit methods rather than driving a ramp down in the mineralization. We are now looking forward to the next assay results which should target some of the zinc zones at Pegmont. This should allow the company to release a resource estimate by the end of this year, and keeps it on track to publish a PEA by the end of next year to prove the viability of Pegmont.

Unfortunately the company’s share price didn’t perform well yesterday, but the lukewarm reaction from the market wasn’t caused by the press release, but is the result of the 5 cent placement coming out of the 4 month hold period. Some investors are clearly missing the bigger picture and prefer to sell out for a 40% gain even though the company’s market capitalization of C$4.5M still is undervaluing the Pegmont project.

Go to Vendetta’s website

The author has a substantial long position in Vendetta Mining. Vendetta is a sponsor of the website. Please read the disclaimer