As we’re getting close to the summer season, some companies are getting ready to aggressively explore their properties that aren’t accessible on a year-round basis. One of the best known regions in Canada with seasonal exploration is the Golden Triangle in British Columbia.

Aben Resources (ABN.V) is one of those companies, as Aben is getting ready to drill its flagship Forrest Kerr Gold project again. The Company’s 2017 exploration season was completed in October last year, but the technical team has had all winter to examine the data from the 2017 work and drill program and analyze these results to help prioritize the focus of the upcoming 2018 exploration program.

The flagship Forrest Kerr property

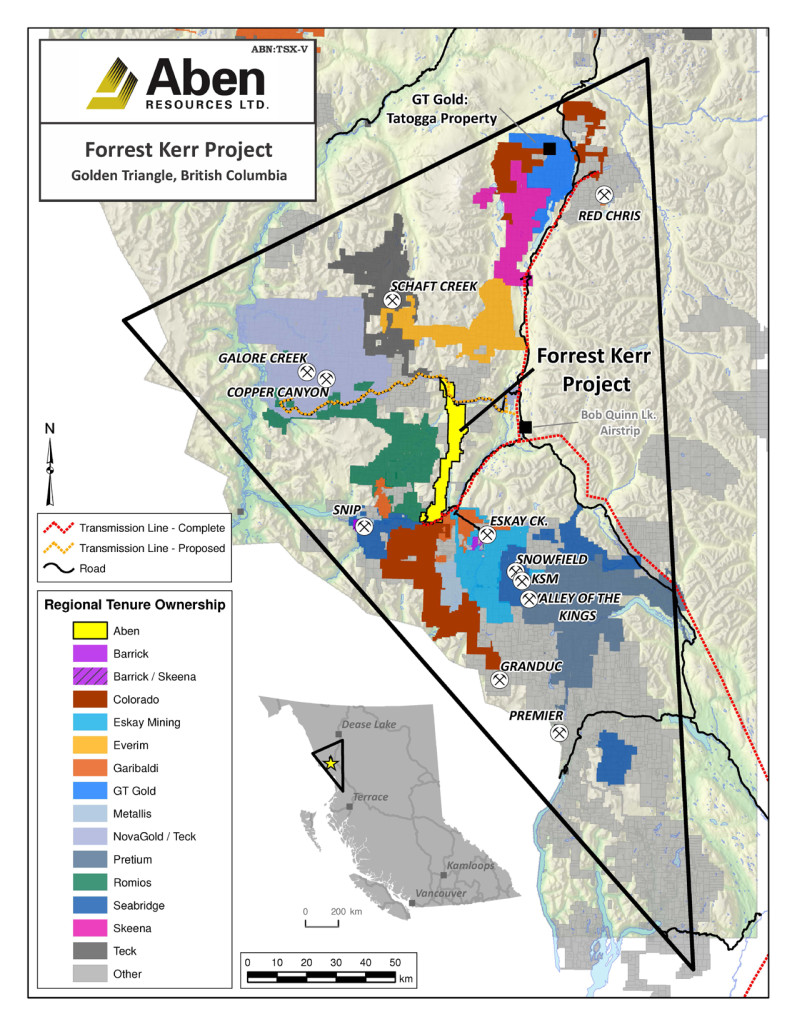

Back in the summer of 2016, Aben Resources acquired the 23,000 hectare Forrest Kerr project in British Columbia’s Golden Triangle region. This region was just heating up again after remaining dormant for a few decades. The development of the Valley of the Kings and Red Chris Mines (owned by respectively Pretium Resources and Imperial Metals) as well as new infrastructure development by the Government has led to the recent resurgence of exploration activity in the region.

The project was acquired from three different vendors (Equity Exploration Consultants, Kiska Metals and CVE), and contrary to the ‘usual’ earn-in agreements whereby the optionee can earn a majority stake of 70% or 80%, Aben negotiated a deal whereby it could gain full control over the asset. The earn-in terms are pretty benign as well, considering Aben has to issue just 7 million shares and complete C$3M in exploration expenditures by June 2020. That gave Aben a 4-year period to test drive the project whilst incurring the expenses to reach full ownership of Forrest Kerr.

After the recent two exploration programs (which included drilling in the summer of 2017), we think Aben is very close to completing its earn-in, and we would expect the company to own 100% of Forrest Kerr by the end of this summer.

Looking at the historical data provided by the previous owners of the project, (over 20,000 rock and soil samples were taken and 120 holes drilled) it’s understandable why Aben’s technical team was charmed by the property. This data compilation took over 6 months to complete and led to an extensive prioritized list of targets to be drilled or further worked over the next several years.

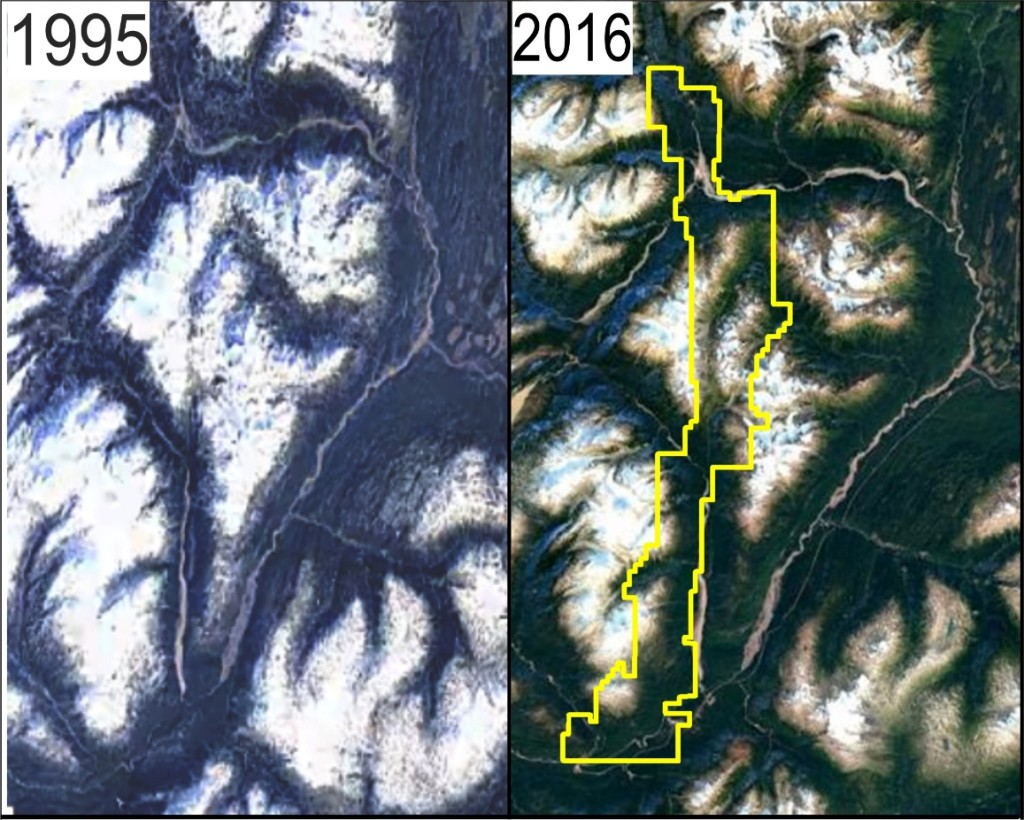

A prime example is where historic drilling revealed a very short but ultra-high-grade interval of 0.45 meters containing 359.7 g/t gold and 1.95 meters containing 101 g/t gold. We obviously cannot generalize these types of high-grade mineralization, but it does give a geologist an indication there was something ‘under the hood’ there. And as the glaciers have been melting, more rocks were uncovered from the ‘eternal snow and ice’, making it easier for geologists to spot the anomalies.

And that wasn’t entirely unexpected. After all, the Golden Triangle region in British Columbia has always been very prospective. In the middle of the 1800’s, placer gold was initially discovered along the Stikine and Anuk rivers in the region, and the exact point where both rivers combined was the scene for a new gold rush. Placer gold operations continued for several decades until a first mine was developed right after the first world war. But the most famous mines in the Golden Triangle district were undoubtedly the Snip mine (1.1 million ounces recovered at an average grade of 27.5 g/t gold) and the Eskay Creek mine (producing 3 million ounces of gold and 160 million ounces of silver). The Golden Triangle is known for its elephant-sized deposits, so it’s a good region to be exploring at.

The recent completion of major infrastructure works at and around the Golden Triangle have renewed the interest of exploration companies in this area as it’s now easier to explore, and a discovered deposit now actually has a chance of becoming a mine without needing Snip-like grades. The Forrest Kerr property is definitely blessed with excellent access to infrastructure: a hydro-dam has been built on the southernmost part of the Forrest Kerr claims on the Iskut River, and this resulted in the construction of access roads and more importantly, a 287 kilovolt power line.

Needless to say this really is a big deal. It doesn’t increase the odds of finding a deposit, but it sure makes it easier and cheaper to explore the tenements.

The 2016 and 2017 exploration programs paved the way for an efficient 2018 summer exploration program

Aben Resources didn’t waste any time and as the summer exploration season was already in full swing when it acquired the property in July 2016, it immediately sent its technical team to the field to get as much work done as possible, to make sure the 2017 exploration season would be as efficient as possible.

2016

As Aben only acquired the Forrest Kerr property late in the summer season, the company didn’t have much time before the winter started. The exploration window was shortened to just one month, but Aben did its best to make it count.

The company took several hundred soil samples to better define the mineralized trends before gearing up for a drill program in the summer of 2017. Fortunately, Aben was able to confirm these mineralized trends, and the sampling program outlined the Boundary zone and the Wedge Zone as main targets. These assay results were only announced in November, and the Golden Triangle was covered under a thick layer of snow so Aben had to wait for 2017 before getting back in the field.

2017

After analyzing all the data gathered from the 2016 exploration season, Aben immediately designed a 9-hole drill program, completing 2,445 meters of diamond drilling. The first three holes were drilled at the Carcass Creek zone, and although no major high-grade discoveries were made, the assay results indicated there’s a lot of smoke down there, as shown by the 8 meters containing 0.35 g/t gold, 1.1 g/t silver and 0.43% zinc and 5 meters containing 0.22 g/t gold and 0.23% copper. Smoke is fine, but it was a bit disappointing to see the company was unable to reproduce the longer and high grade intervals the previous operators encountered (13.4 meters at 4.6 g/t gold and 29.3 meters at 9.8 g/t gold). We discussed this with President Jim Pettit, and he explained to us the Carcass Creek zone wasn’t a high priority target but was drilled due to its location: the drill pads were very close to where the drill rig was mobilized, and it was a cost-based exercise to determine where it would start to drill.

Unfortunately the drill location was sub-optimal (steep cliffs, snow and rocks falling down the hill, …) and the rig was pulled out for safety reasons before it could be re-directed to drill the structure from a different angle.

An additional 6 holes were drilled at the Boundary Zone (which effectively was Aben’s high-priority drill target after seeing the assay results from the 2016 sampling program), and fortunately these holes did yield the desired results. A first batch of three holes was drilled from the same drill pad at different angles (45, 60 and 75 degrees), and encountered 10 meters at 6.7 g/t gold, 6.36 g/t siver and 0.9% copper (with a higher grade interval of 3 meters at 18.9 g/t gold, 16.6 g/t silver and 2.2% copper) in the first hole, followed by 12 meters of 10.9 g/t gold, 14.6 g/t silver and 1.5% copper in the second hole (drilled at a 60° angle). And the final hole of that series of three (drilled at a 75° angle) encountered 14 meters at 2.91 g/t gold, 5.2 g/t silver and 0.6% copper.

These are excellent high-grade results, indicating a narrow high-grade zone within a very broad mineralized zone which Aben Resources will undoubtedly want to follow up on. Again, these three intervals aren’t enough to build a mine on, but if anything, there does seem to be a certain consistency in these results and this is an obvious place to start the next program to test for the extension of this zone.

2018

Aben Resources hasn’t announced its exploration plans for 2018 yet, but we expect to see an exploration update soon as Aben is ready to start drilling as soon as feasible.

The Chico property in Saskatchewan: a story for 2019

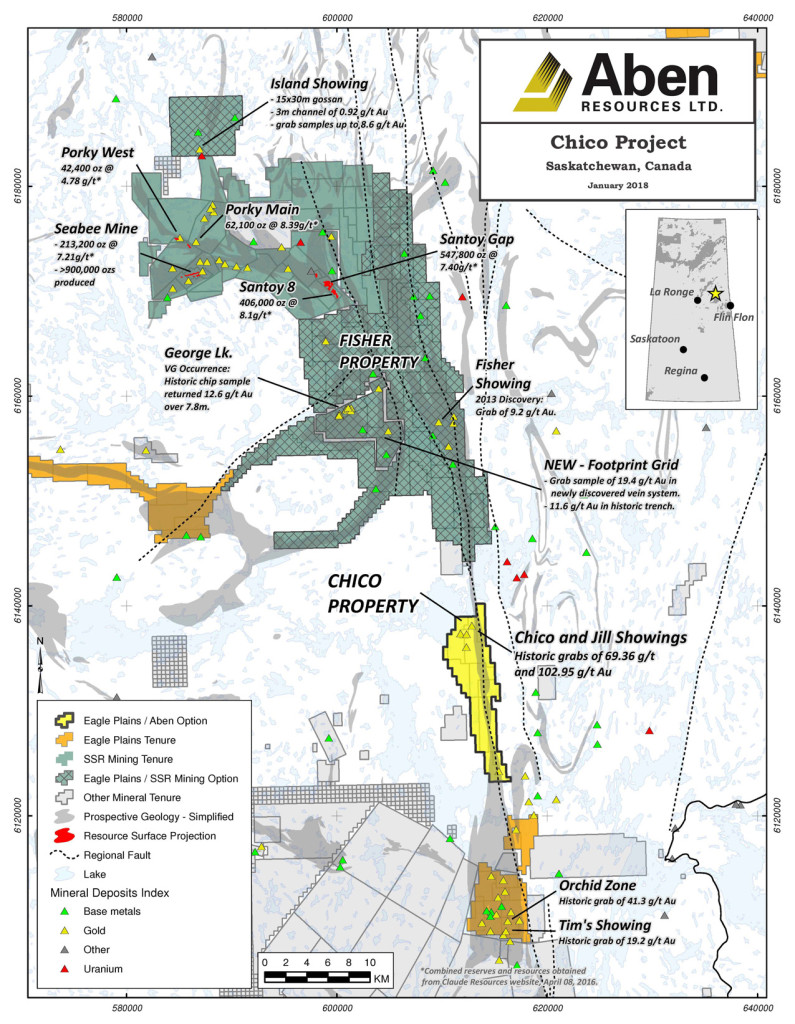

Whilst the Forrest Kerr property undoubtedly is Aben’s flagship asset and the obvious focus of this initial report, we would also like to briefly highlight the Chico property, where Aben Resources is earning an 80% stake from Eagle Plains Resources (EPL.V), which has been active in the region for quite a while. This project would enable Aben to work through the winter and mitigate the impact of having just a few months where exploration is possible, up in the Golden Triangle.

Whilst the Forrest Kerr property undoubtedly is Aben’s flagship asset and the obvious focus of this initial report, we would also like to briefly highlight the Chico property, where Aben Resources is earning an 80% stake from Eagle Plains Resources (EPL.V), which has been active in the region for quite a while. This project would enable Aben to work through the winter and mitigate the impact of having just a few months where exploration is possible, up in the Golden Triangle.

The Chico property is located in Saskatchewan, just 45 kilometers southeast of the Seabee gold mine, owned and operated by SSR Mining (SSRM, SSR.TO). The project has been intermittently subject to exploration programs by the previous owners of the project. The historical data records indicate Hudson Bay Exploration was the first company to do some preliminary work at Chico as it completed an Electro-Magnetic survey in the early 70’s. Other operates came and went over the course of several decades, but it took until 2002 when the property was acquired by Northwind Resources, before the exploration activities accelerated as the latter discovered a new gold zone: the Wingnut zone. Grab samples from this zone returned anomalous and high grade gold values (up to 41.35 g/t gold), and Eagle Plains Resources was obviously keen to continue to work on this property.

Eagle Plains is a project generator and has no real interest in funding all exploration activities on all of their projects, and that’s when Aben Resources appeared on the scene. As part of an earn-in program to earn an 80% stake (see later), Aben Resources was very keen on getting the exploration activities going again, considering SSR Mining was planning an extensive exploration program on nearby land claims.

Aben Resources and Eagle Plains were planning to drill the Chico project this year, but Eagle Plains (as project operator) has suspended the planned (and permitted!) drill program at Chico to re-discuss the plans with the local communities. We don’t anticipate any serious issues, but it does look like we shouldn’t expect Aben Resources to drill the Chico property this year.

Fortunately, the earn-in terms to reach an initial 60% stake in the property were relatively straightforward. Aben is required to spend C$1.5M in exploration (within 4 years), issue 1.5 million shares and pay C$100,000 in cash to Eagle Plains to complete the first part of the option agreement. Aben Resources could subsequently earn an additional 20% in the property by making an additional C$50,000 cash payment whilst issuing an additional 1 million of shares. On top of that, Aben would be required to spend an additional C$2M in exploration expenditures on the property within 2 years.

And although the 2018 exploration plans seem to be delayed (and will very likely be pushed into 2019), we do think the Chico property remains an interesting exploration project for Aben. It’s definitely only a ‘second priority’ after the Forrest Kerr project in British Columbia, but we think it’s definitely fair to keep tabs on it as we would expect Aben to be in a position to drill Chico in 2019.

Share structure

Unlike many other exploration companies, Aben Resources has done a great job in keeping its share count under control. The company currently has just 78.1 million shares outstanding, and this includes the new shares that were recently issued as part of a C$2.3M capital raise.

Aben Resources has issued 6.3M shares at C$0.125/share in a hard dollar financing, and 8.55M flow through shares at C$0.18. Both tranches were accompanied by a 3-year warrant with a strike price of C$0.25 per warrant.

As Aben Resources already had C$1.5M in cash (as of at the end of 2017) and a positive working capital position of C$1.9M, we expect Aben to have approximately C$3.5M in cash right now. Needless to say the company is in a great shape for the 2017 exploration season.

And it looks like Aben will be able to top up its treasury in the final quarter of this year, as two series of warrants are currently in the money. 4.4M warrants with an exercise price of C$0.10 will expire in November, whilst an additional 3.87 million warrants priced at C$0.15 will expire on December 29th. Should both series indeed be exercised, Aben Resources will be able to add C$1M to its treasury.

Management

Jim Pettit – Director, President & CEO

Jim Pettit has been President and Chief Executive Officer and a Director of Aben Resources Ltd. since November 2002. Mr. Pettit is currently serving on the board of directors of five publicly traded companies and offers over 25 years of experience within the industry specializing in finance, corporate governance, executive management and compliance. Mr. Pettit was previously Chairman and C.E.O. of Bayfield Ventures Corp. which was bought by New Gold Inc. in January 2015.

Ron Netolitzky – Director, Chairman

Ron Netolitzky serves as Chairman of the Board of Aben Resources Ltd. Mr. Netolitzky holds a Bachelor of Science degree from the University of Alberta and a M.Sc. degree from the University of Calgary, both in geological sciences. Mr. Netolitzky has been very successful in mining exploration with over 35 years of experience and having been directly associated with three major gold discoveries in Canada that have subsequently been put into production; Eskay Creek, Snip and Brewery Creek.

Mr. Netolitzky has been honored with the Prospector of the Year award from the PDAC, and Developer of the Year award from the BC & Yukon Chamber of Mines. In 2015, he was inducted into the Canadian Mining Hall of Fame.

Tim Termuende – Director

Tim Termuende serves as a Director of Aben Resources Ltd. and is a professional geologist with over 30 years experience in the mineral exploration industry and is a Qualified Person as defined by National Instrument 43-101. Mr. Termuende is currently the President and Chief Executive Officer of Eagle Plains Resources Ltd. in addition to serving as a director of a number of other public companies.

Cornell McDowell – VP of Exploration & Qualified Person

Cornell McDowell is a professional geologist registered in both Alberta and British Columbia and serves as Vice President of Exploration for Aben Resources Ltd. and is the Qualified Person. He has been self-employed as a geological consultant since graduating with a Bachelor of Science (Specialization in Geology) from the University of Alberta in 2005. He has worked with both privately held and publicly listed mineral exploration corporations, most recently with Gold Reach Resources on the Ootsa Project, where in excess of 100,000 meters of drilling has advanced the project from initial stage through resource development to the delivery of a positive PEA. He also serves on the Board of Directors and Audit Committee for Manson Creek Resources Ltd.

Michael Roberts – Aben Technical Advisory Board

Mike is a professional geologist with over 15 years of experience in mineral exploration and was the Vice President of Exploration for Kiska Metals Corporation. As a field geologist for several junior exploration companies and as V.P. for Kiska, Mr. Roberts has conducted and managed grassroots to advanced exploration programs for base and breccia metals in North America and Australia, typically in partnerships with major mining companies. Mr. Roberts is passionate about the mineral potential of B.C., and has been actively involved in exploration programs in the Forrest Kerr area since 2005.

Henry Awmack – Aben Technical Advisory Board

Henry has over 30 years’ experience in the mining industry. As a co-founder of Equity Engineering Ltd. in 1987, Mr. Awmack has managed all aspects of a geological consulting and contracting firm including project planning and execution, hiring of field crews, geological fieldwork, property examinations and preparation of technical reports. He has worked around the world exploring for a variety of commodities, and has extensive “on the ground” experience in the Forrest Kerr, BC area in particular. Mr. Awmack holds a B.Sc (Honours) Applied Science in Geological Engineering from the University of British Columbia and is registered as a professional engineer with the Association of Professional Engineers and Geoscientists of British Columbia.

Conclusion

As we have mentioned several times before, exploration isn’t an exact science. All you can do is increase your odds by identifying the projects (and the targets on those projects) with a good probability of hitting something, and we think that’s exactly what Aben Resources did in 2017 before the drill season in the Golden Triangle abruptly ended.

With C$3.5M in cash in the bank and an even better understanding of the gold mineralization at Forrest Kerr than last year, Aben Resources seems to be ready to hit the ground running to follow up on the interesting drill results encountered at the Boundary zone in 2017. Aben now knows where it should be drilling

Aben will be one of the first companies starting its field work in the Golden Triangle this year, so we would expect the company to be in the pole position to announce assay results throughout the summer. And having the first mover advantage could be important in this market. If the first batch of drill results hits the desired results, Aben might be able to retain the attention from the market throughout the entire exploration season.

The author has a long position in Aben Resources. Aben Resources is a sponsor of the website. Please read the disclaimer