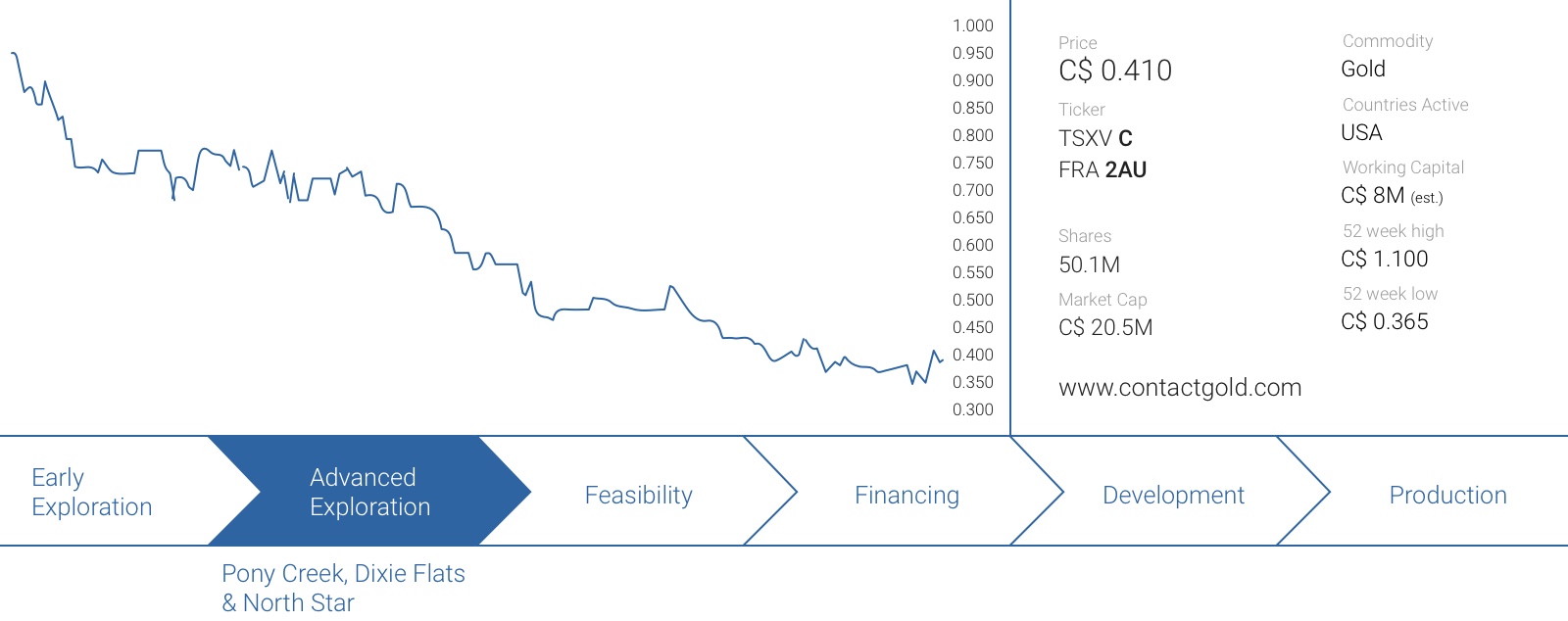

Some exploration companies have to start from scratch, but others are lucky enough to be able to secure a relatively advanced stage exploration portfolio. Contact Gold (C.V) belongs to the latter category as it picked up a substantial Nevada gold asset portfolio from Waterton. Backed by Goldcorp (GG, G.TO) and other high-level institutionals and individuals, Contact listed on the TSX Venture Exchange in June 2017, only to see its share price slide to the current level of 40 cents, approximately 60% below the IPO price of C$1, the level where a bunch of institutionals and Goldcorp invested.

This results in a total enterprise value of approximately C$27M considering the company’s C$8M cash position (and C$15M worth of preferred stock it had to issue to Waterton as part of the acquisition). And this appears to be quite cheap for a multi-asset company in a safe region, where its flagship project, Pony Creek, already has a historic resource estimate containing 1.4 million ounces at an average grade of 1.5 g/t gold.

Sure, these ounces aren’t yet NI43-101 compliant, but Contact Gold is now drilling Pony Creek in an attempt to publish a first compliant resource estimate. And this will be a major step forward for this Nevada-focused advanced exploration company.

The location and history of the flagship Pony Creek property

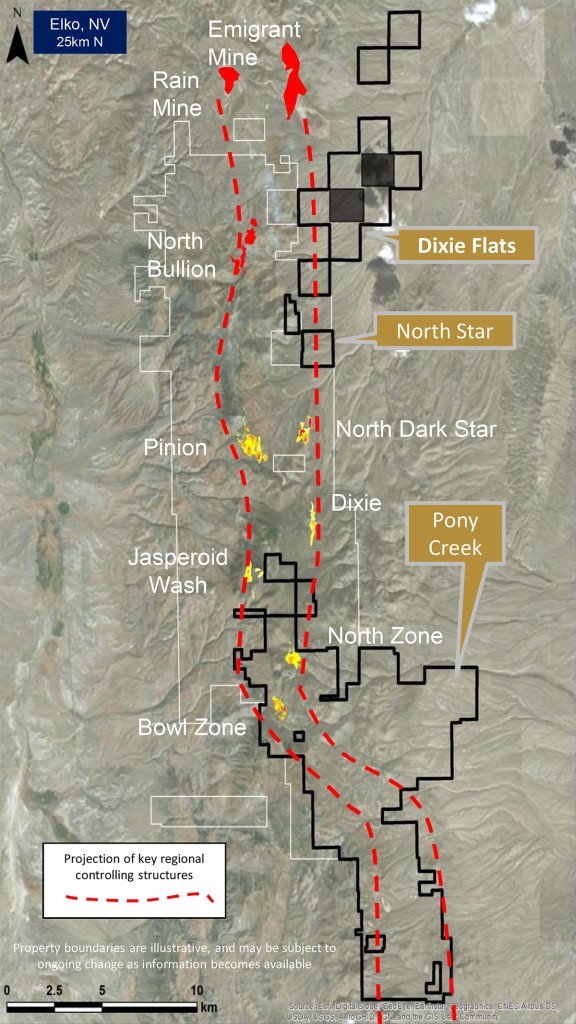

Pony Creek, Contact Gold’s flagship property, is located less than 30 kilometers south of the Emigrant gold mine, currently operated by Newmont Mining (NEM, NEM.TO) in the Piñon range in Elko County, Nevada. As you can see on the map, the Pony Creek claims are directly adjacent to the land package of Gold Standard Ventures (GSV, GSV.TO) which made the Dark Star gold discovery.

There is an apparent structurally mineralized corridor in a north-south direction as five established deposits (Emigrant, Rain, Dark Star, Pinion, North Bullion) have already been outlined on that specific trend whilst Contact Gold’s Bowl zone (which hosts the 1.4Moz historical resource estimate) appears to be right on the same trend.

‘The best place to look for a new mine is in the shadow of an existing head frame’ and with two past-producing and producing mines on the same trend as well as a few advanced-stage exploration projects (Dark Star & Pinion), the deposits outlined by Gold Standard Ventures and Contact Gold’s predecessors at Pony Creek definitely appear to be confirming the proverb.

The Bowl zone was discovered by Newmont Mining just over 30 years ago, and was subsequently owned by Vista Gold which spun it off as part of the Allied Nevada transaction (Allied Nevada owned Vista’s entire Nevada portfolio). Allied Nevada went belly up, and Waterton Global Asset Management ended up with the assets.

Waterton’s natural resources department has an extensive portfolio with dozens of exploration, development and operating projects, but realized it cannot drill and explore all properties by themselves. After looking at several offers (and we would assume Gold Standard Ventures also had a look at the available claims), Waterton accepted an offer from Contact Gold which acquired the land package for a payment in cash, stock and preferred stock. This was Waterton’s preferred solution as it retained substantial upside potential compared to the other offers it received (which were predominantly made in cash and overvalued stock of exploration companies).

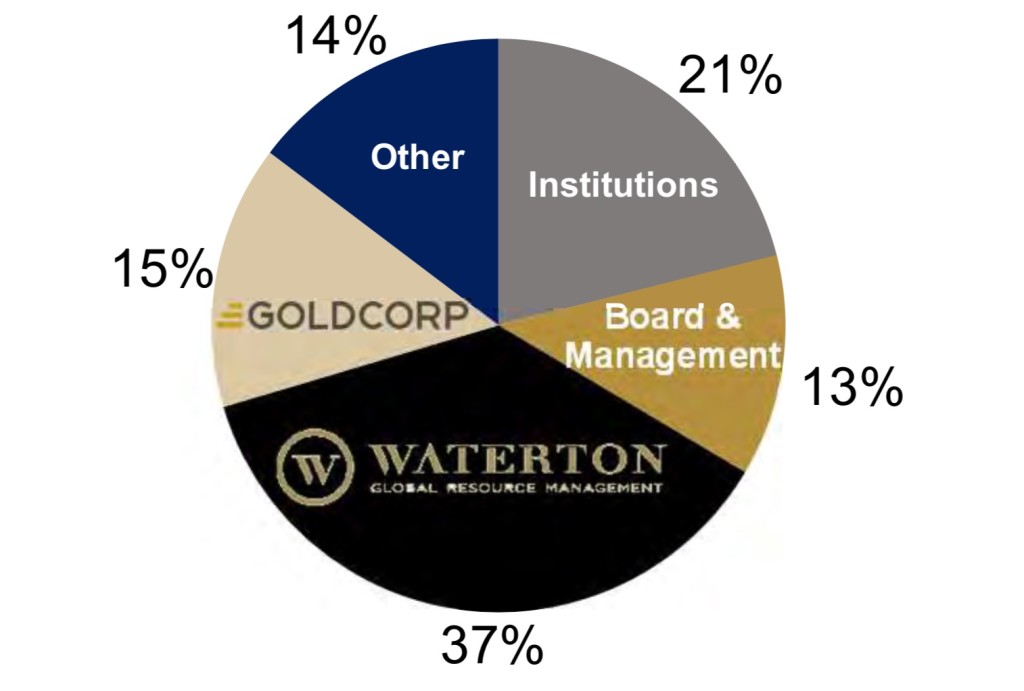

Contact Gold agreed to issue 18.55M shares, 11.111M preferred shares and make a C$7M cash payment to acquire the properties. This gave Waterton an initial 37% stake in Contact Gold, allowing it to participate in the exploration upside at Pony Creek (and the other properties). Not only was this stock component an important part of the consideration for Waterton, the latter was also impressed with the strong technical team at Contact Gold (see later).

The deal closed in June 2017, and Contact Gold started trading with C$11M in cash. As the properties were pretty much drill ready, Contact immediately started a 10,000 meter drill program at Pony Creek in the summer of last year, as well as some more basic exploration activities to define and generate more (new) drill targets.

The 2017 drill program was successful, and the 2018 program will be kicked off any week now

2017

We didn’t really have high hopes for the 2017 exploration program as this program was merely meant to ‘bring the project up to 2017 standards’ as the property hadn’t been drilled in decades. But we feel the company was able to do more than just that.

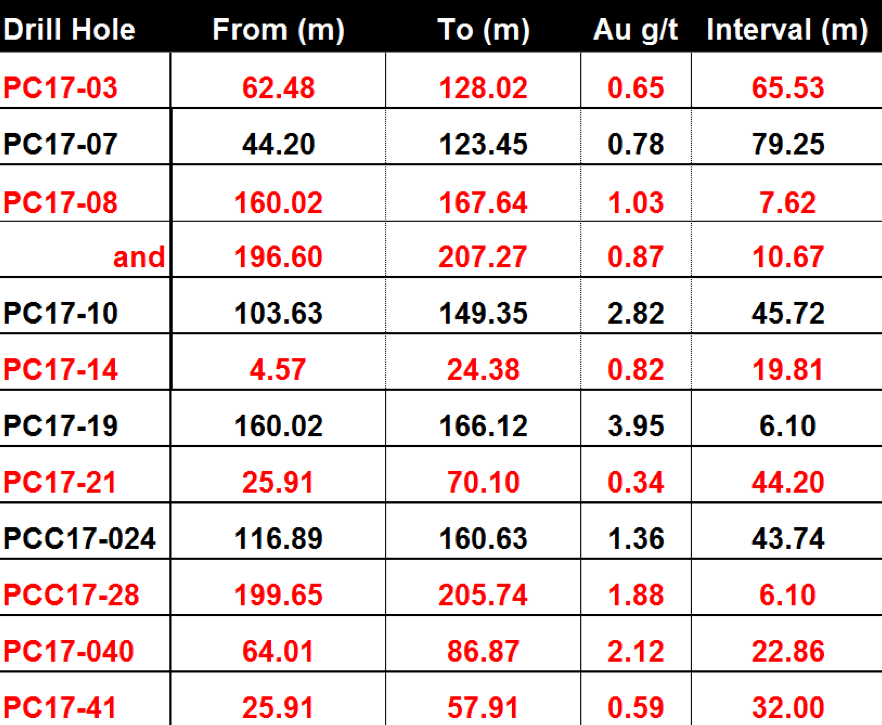

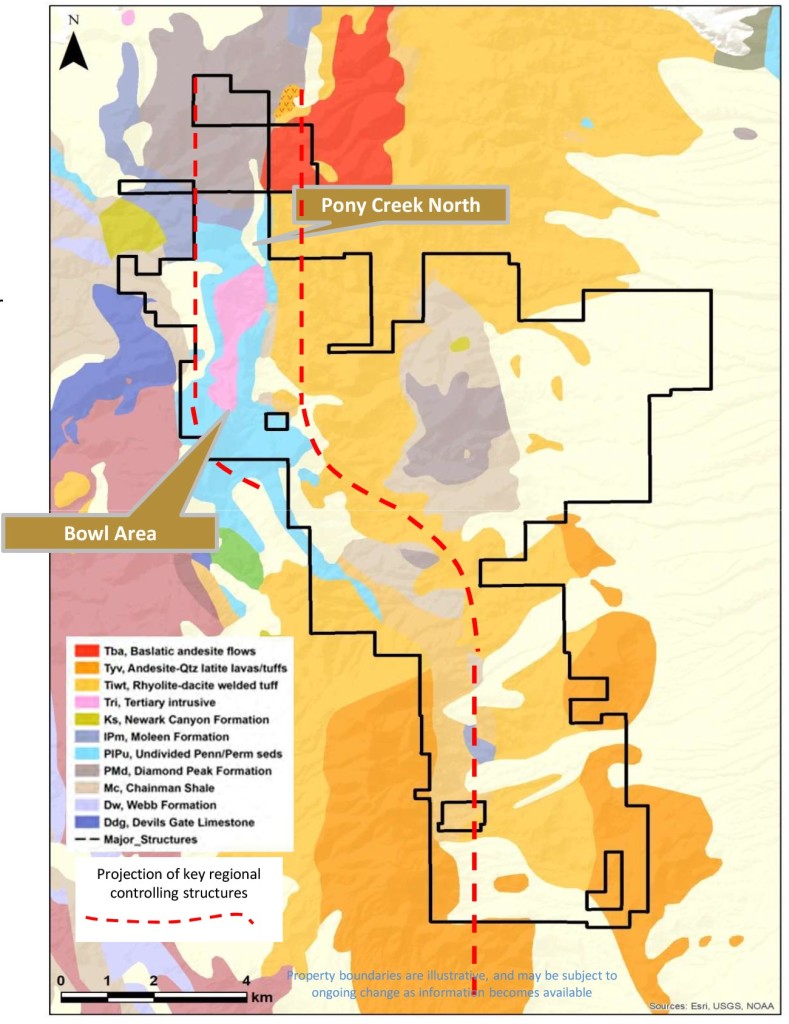

A large part of last year’s drill program was focusing on the Bowl zone of the Pony Creek project, where the historical resource is located. This zone was drilled with a core drill rig to confirm and verify the historical data on this zone, whilst a Reverse Circulation drill rig was used to expand the existing and known mineralized zones. Later in the season, Contact Gold directed a drill rig to the Pony Creek North zone, which is located halfway between the Bowl zone and Gold Standard Ventures’ new Jasperoid Wash discovery (see results on the right).

Pony Creek North was originally discovered in the eighties but it looks like Barrick Gold/Homestake were drilling too far up north and whilst their main interval of 43 meters at 0.47 g/t gold would be viable at today’s gold price thanks to the higher efficiency of heap leach techniques (compared to 30 years ago), there never was any follow up on that hole.

Contact Gold’s management team saw this as an opportunity and squeezed in 2,500 meters of drilling right before winter set in. A total of 11 holes were drilled at Pony Creek North, and assay results of 44 meters at 0.34 g/t gold, 15 meters at 0.33 g/t gold and 14 meters at 0.32-0.33 g/t gold are encouraging results for a first drill program.

Granted, 0.3-0.35 g/t isn’t anything to get really excited about (yet), but there are two important elements we should keep in mind here. First of all, this was a ‘first pass’ drill program. These were the first 11 holes drilled on the property in 29 years, and even Contact Gold is still figuring out where the high-priority zones are. A mineralized corridor of 1000 by 200 meters has now been identified, and we expect Contact Gold to drill a few more holes in Pony Creek North in its 2018 exploration program.

Secondly, the majority of the gold intercepts are very shallow. The 44 meter interval starts at a depth of just 26 meters, whilst other 0.3+ g/t intervals start as shallow as just 5 meters below surface. That’s important, as this means the strip ratio could be very low. Moreover, Pony Creek North doesn’t even have to reach ‘critical mass’ as a standalone project, as it could become a satellite deposit to the Bowl Zone that is the location of the higher grade historical resource estimate. Or perhaps even for Gold Standard Ventures as we could really see a tie-up of Contact’s deposits and Gold Standard Ventures’ projects further down the road.

Drilling at the Bowl Zone was comprised of 31 holes completed for a total of 8,000 meters. The 2017 drill program wasn’t meant to culminate in an updated resource estimate, but was intended to form a basis for this year’s drill program. Contact Gold followed up on the historical data and punched a few additional holes in zones which appear to be prolific for gold mineralization but were ignored by the previous owners of the project.

Virtually every hole drilled at Pony Creek as part of the 2017 exploration program has encountered anomalous gold values. Some holes contained low-grade material whilst other holes returned very respectable gold grades for oxidized material. But again, the 2017 drill program was just designed to be some sort of ‘pathfinder’ exploration program to design the 2018 drill program as efficient as possible.

On top of the 10,400 meters of drilling, Contact Gold’s field team also collected in excess of 3,500 soil samples, completed several geophysical surveys (including a 33 kilometer CSAMT survey) and ran an extensive mapping program. This resulted in the discovery of a new mineralized target, called the ‘West Target’. This target borders the Bowl Zone and, as you can see in the next image, the soil sampling program seems to indicate there’s a huge surface anomaly of approximately 2 kilometers by 3-400 meters. A similar target defined further to the north, named the Moleen target, is a 1.5-kilometer-long soil anomaly target literally bordering the GSV claims (and although it’s still early days, it appears to be an extension of Gold Standard Ventures’ Jasperoid Wash anomaly).

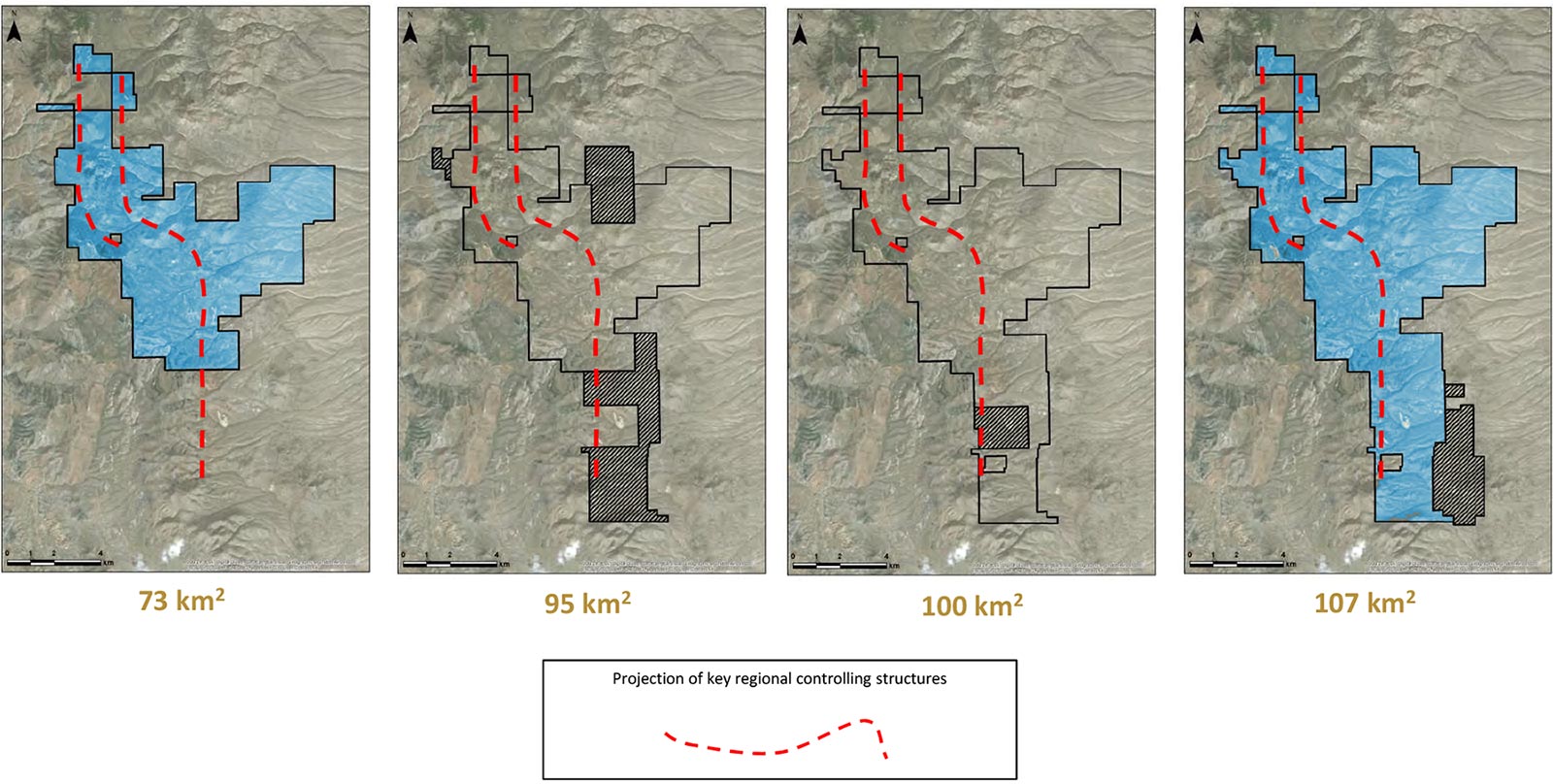

As a final note for 2017 Contact Gold also increased its land position by approximately 40% through well-targeted acquisitions ensuring it has the majority of the gold-bearing trend pretty much locked up.

2018

All the data from the 2017 exploration program has now been received and analyzed, and Contact Gold is in the final stages of putting a 2018 program together. The company plans to complete 16,000 meters of drilling in 70 holes of which 75% will be RC holes, with the remaining 25% to be drilled with a core drill rig.

Contact will drill all four zones of the southern part of the Pony Creek target (Moleen, West, North and Bowl) this year, with the main focus on expanding the gold zones at Bowl and North (which really is where the low hanging fruit is). We would expect this to result in Contact being in a position to release a maiden NI 43-101 compliant resource estimate. It’s still too early for a preliminary guesstimate, but anything between 1-1.5Moz at 1-1.5 g/t would definitely satisfy us.

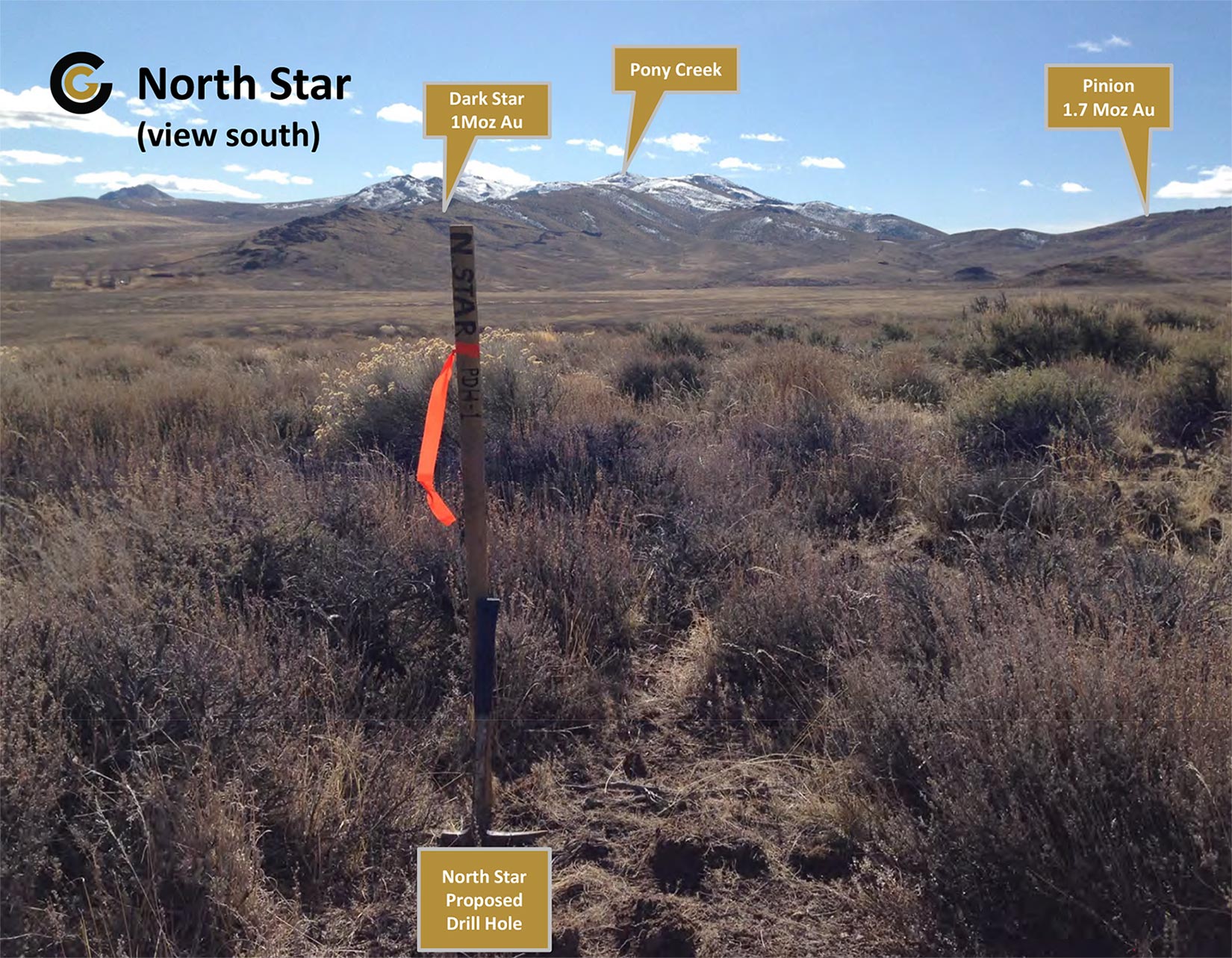

Additionally, Contact Gold will drill 6-8 holes at the North Star target, located immediately north of Gold Standard Ventures’ Dark Star deposit which contains just short of 1 million ounces of gold in oxidized mineralization. The CSAMT survey conducted on the North Star target as part of the 2017 exploration program seems to indicate a similar ‘signature’ as the Dark Star deposit, which appears to be on the same Emigrant – Dark Star fault line.

Contact Gold will be moving ahead on a lot of fronts in 2018, and we expect a very busy summer season.

Trading 60% lower than the IPO price, despite strong shareholders

The share price has been moving down due to some low-volume, but relentless, selling since the company started trading. A part of this could be explained by how Contact Gold actually went public. Rather than a ‘pure’ IPO, it chose to do a Reverse Take-Over (‘RTO’) of an existing shell. This is the fastest and easiest way for a company to go public, but there’s one disadvantage. Sometimes the shareholders of the shell are fed up waiting for a qualifying transaction to be completed, they see the finalization of an RTO as a ‘liquidity event’ and start selling their stock.

Considering 50% of Contact’s stock (the shares owned by the board, management and Waterton) is locked up until the summer of next year, and considering it’s also very unlikely Goldcorp is selling its position and the management has also indicated it’s unaware of any institutional selling, we think the majority of the recent selling pressure is coming from the ‘weaker’ hands who owned the shell.

So, it really boils down to this: weak hands are selling, whilst all the institutionals, strategic investors and the management are holding onto their stock and even increasing their existing positions as for instance Sentry Investments has added to its original position.

There has been some insider buying as well, as CFO Wenger and CEO Lennox-King have been active on the market, buying relatively small amounts of stock. This won’t move the needle, but it’s an encouraging sign.

As the total trading volume since the listing now totals approximately 5 million shares (according to a Stockwatch search), we would expect to see less selling going forward as those who really wanted to sell, should be out by now.

Fortunately, Contact Gold management was smart enough to come out of the gate fully cashed up and the low share price doesn’t derail any financing plans. After having raised money as a private company, Contact Gold went public with a C$18.5M subscription receipt financing (all subscription receipts converted into common stock upon the completion of the deal). C$11M was raised by four large financial institutions in Canada (Cormark Securities, Macquarie Capital Markets, BMO Nesbitt Burns and Paradigm Capital) by issuing 11 million shares at C$1 per share whilst Goldcorp also invested C$7.5M at the same terms.

As a result approximately 37% of the current amount of outstanding shares have a cost basis of C$1/share, whilst an additional 50% are locked up until next year. It’s clear that whoever is still selling now, is very likely doing so at a loss.

The management team

One of the main reasons Waterton decided to accept Contact Gold’s proposal to acquire Pony Creek lies in the strength of its management team; which counts three ex-Pilot Gold executives, and three key ex-Fronteer Gold personnel (as you might remember, Fronteer Gold was sold to Newmont Mining in 2011 for $2B+).

Matthew Lennox-King – President & CEO

Mr. Lennox-King brings over 20 years of experience in mineral exploration to the Company, as a geologist, and mining company executive. From April 2011 to November 2015, Mr. Lennox-King was President and Chief Executive Officer of Pilot Gold Inc., a TSX listed gold exploration & development company, active in the Western United States and Eastern Europe.

John Wenger – VP Corporate Strategy & CFO

From 2011 to 2017, Mr. Wenger served as Chief Financial Officer and Corporate Secretary of Pilot Gold, where he was part of a management team that raised over $100 million, and successfully completed multiple property transaction deals and acquisitions. Mr. Wenger worked for Ernst & Young LLP from 2001 to 2011 where he acquired considerable experience in financial reporting for both Canadian and U.S. publicly listed companies, primarily in the mining industry.

Vance Spalding – VP Exploration

Mr. Spalding’s gold exploration experience spans more than 28 years. A Certified Professional Geologist (AIPG), and Qualified Person, he most recently served as Deputy Director of Brownfields Exploration for Kinross Gold Corporation. Mr. Spalding holds a B.Sc. in Geology from the University of Idaho.

Andrew Farncomb – Senior VP & Dirctor

Mr. Farncomb brings extensive experience in the capital markets to the Company. Mr. Farncomb has diverse experience advising public and private companies on mergers and acquisitions and financing transactions across a range of sectors. In the natural resources sector, Mr. Farncomb has worked with exploration to production stage companies in advisory and Board capacities.

In addition, the board of directors also appears to be very qualified:

John Dorward

Mr. Dorward is President and Chief Executive Officer of Roxgold Inc., a TSX-listed gold producer and has over 20 years of experience in the mining and finance industries. Prior to his time at Roxgold, Mr. Dorward served as Vice-President, Business Development at Fronteer Gold from October 2009 to April 2011 where he was an integral part of the team that sold the large Michelin uranium deposit, acquired AuEX Ventures Inc., and successfully advanced Fronteer Gold’s properties prior to the company’s sale to Newmont for $2.3 billion in 2011.

Mark Wellings

Mr. Wellings is a mining professional with over 25 years of international experience in both the mining industry and mining finance sector and is currently President and Chief Executive Officer and a director of Eurotin Inc., a director of Gran Colombia Gold Corp. and Principal at INFOR Financial Group Inc. From 1988 to 2004, Mr. Wellings worked in the finance industry with a variety of companies and roles including Derry, Michener, Booth & Wahl, Arimco N.L., Inco Ltd. and Watts Griffiths McOuat, acquiring valuable hands-on experience in exploration, development and production.

George Salamis

Mr. Salamis has over 25 years of experience in mineral exploration, mine development and operations and was previously the Executive Chairman of Integra Gold Corp., a gold development company acquired by Eldorado Gold for C$590M in June 2017. Mr. Salamis is also Chief Executive Officer of Pinecrest Resources Ltd., a TSXV-listed exploration company. Mr. Salamis has previously held senior management positions with a number of mining companies including Placer Dome Inc. and Cameco Corporation. He has been involved in mergers and acquisitions transactions valued over $1.8 billion, either through the sale of assets, or of junior mining companies that he played a key role in building. Mr. Salamis holds a degree in geology from the University of Montreal.

Charlie Davies

Mr. Davies has over 15 years of experience in exploration and mining, and is currently the Principal, Exploration for Waterton Global Resource Management, Inc., where his primary duties involve technical evaluations and developing mining projects for study work. Prior to joining Waterton, Mr. Davies served over six years as an Exploration Manager for Kinross Gold. Prior to Kinross Gold, Mr. Davies held senior exploration management roles for Bolnisi Gold NL in Mexico and Ivanhoe Mines Mongolia Ltd in Mongolia.

Riyaz Lalani

Mr. Lalani is the CEO of Bayfield Strategy, Inc., a communications firm that specializes in financial transactions, shareholder actions, crisis communications and media relations. He has been involved with over 100 shareholder actions, and dozens of hostile M&A transactions. Before founding Bayfield, Mr. Lalani served three years as the Chief Operating Officer of Canada’s largest proxy firm. Prior to that, Mr. Lalani was employed by an international asset manager for almost 10 years in New York and Toronto.

Conclusion

This year’s 16,000 meter drill program should allow Contact Gold to gather enough data to publish an updated (and compliant) resource estimate on its Pony Creek gold project in Nevada. This should put the company on the map as Gold Standard Ventures, whose Dark Star property actually borders Contact Gold’s Pony Creek project, is trading at a multiple of Contact’s valuation. Whilst this doesn’t mean Contact Gold should trade at the same valuation as Gold Standard, the current enterprise value of C$27M doesn’t appear to do the company any justice.

Disclosure: Contact Gold is a sponsoring company, we have a long position.