‘Buy on the rumor, sell on the news’ is a very real mantra these days. It was generally expected Excelsior Mining (MIN.TO) would receive its final permit from the EPA, but the company’s share price lost approximately 25% in the subsequent week.

Undeservedly so, as this final approval (which will be confirmed after dealing with an appeal) was the most important step to de-risk the Gunnison copper project in Arizona as this was the final permit Excelsior needed.

Finally, the green light from the EPA

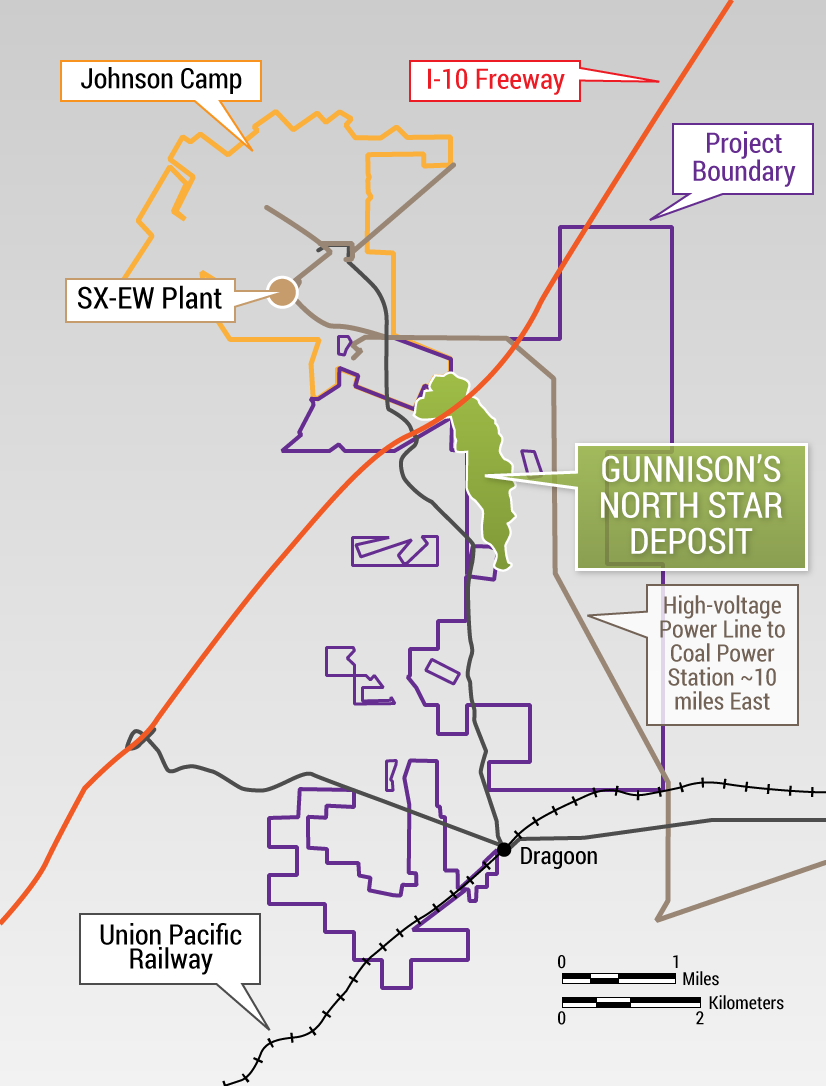

It took a few months longer than we (and the company) initially expected and hoped, but Excelsior Mining has now finally received the final operating permit needed to bring Gunnison into production. The Class III Underground Injection Control permit was issued by the Environmental Protection Agency (‘EPA’), which basically confirmed the previous permitting process on the state level (when the state of Arizona issued the Aquifer Protection Permits for both the Gunnison copper project and the Johnson Camp Mine).

The permit had an effective date of August 1st, and we don’t expect any valid appeals against the permit. Receiving the permit is great news for Excelsior Mining, and the UIC permit is valid for a production rate of up to 125 million pounds of copper per year.

Although we just said we didn’t expect any valid appeals, one appeal has already been filed, on a matter that has already been decided on the state level. So although the appeal definitely is a nuisance, the company seems to be very comfortable it will not derail the project. Excelsior has been guiding for about 60 additional days to be added to the permitting time line, in which case we’d expect the final permit to be issued at the beginning of the third quarter (October).

What’s next?

We expect the financing package to follow hot on the heels of the effective date of the permit. We can’t imagine Excelsior Mining hasn’t already entered the final negotiating stages with its financiers (predominantly on the debt side, considering the company still has in excess of US$20M in cash) and we expect the company just has to dot some i’s and cross some t’s (subject to the definitive and effective date of the federal UIC permit).

Excelsior’s official communication remains relatively superficial (which is completely understandable), but we expect the company to announce the Gunnison financing package within weeks after receiving the final permits. This will allow Excelsior to immediately start the construction activities right after the summer period, and should ensure the initial copper production to start by the summer of 2019 as the timeline towards production is really short.

A brief recap of the economics of the project

The most recent feasibility study was completed (after spending C$30M+ on metallurgical and hydrological test work) at the end of 2016 and filed in January 2017. It discusses a three-staged approach, incorporating the benefits derived from acquiring the Johnson Camp facilities.

The most recent feasibility study was completed (after spending C$30M+ on metallurgical and hydrological test work) at the end of 2016 and filed in January 2017. It discusses a three-staged approach, incorporating the benefits derived from acquiring the Johnson Camp facilities.

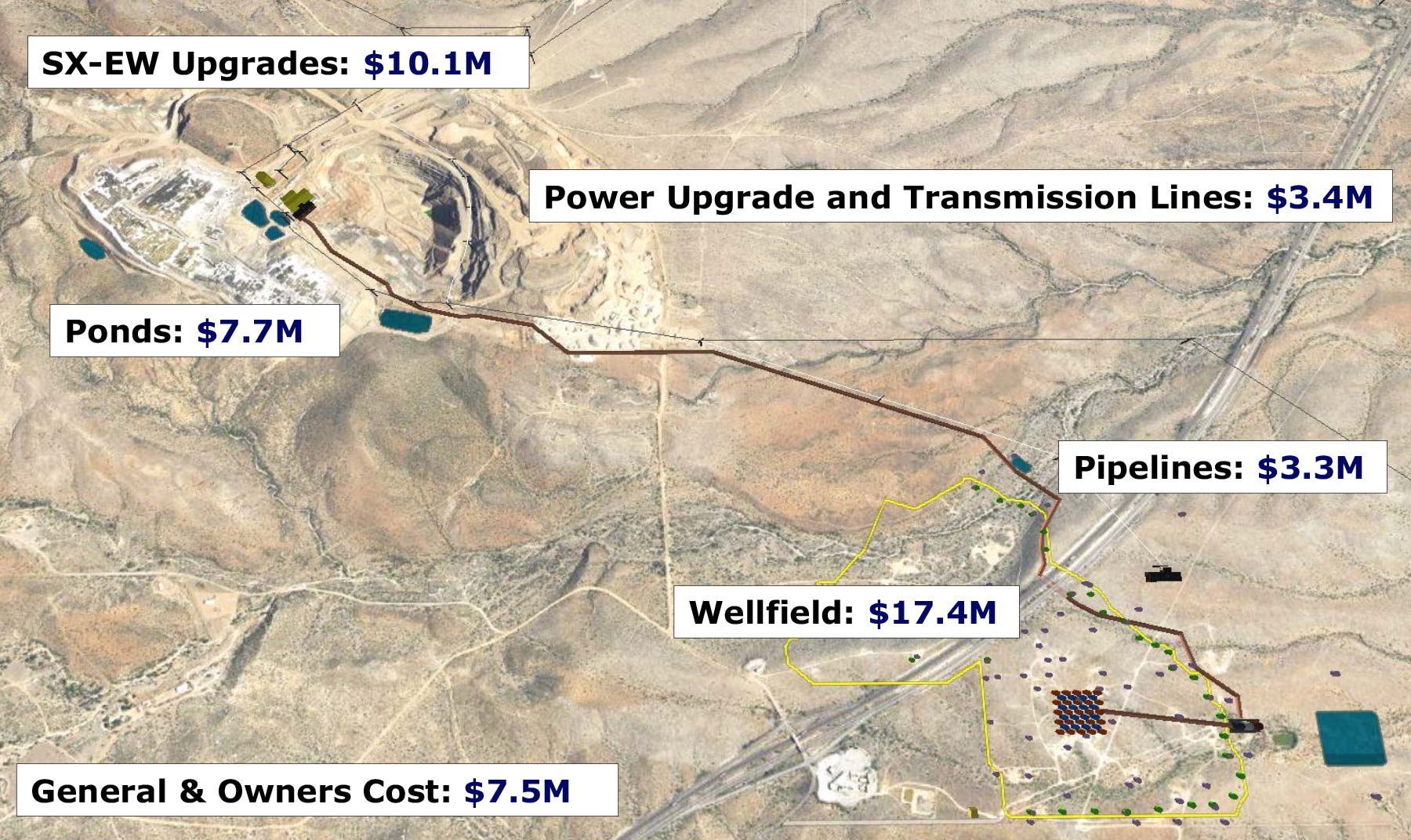

The initial capex estimate is just $47M as Excelsior would use the Johnson Camp as stepping stone to get the production going. In the next phase, which would triple the output to 75 million pounds per year, a new SX-EW plant would have to be built, while Excelsior will also have to add more Electrowinning cells for a total investment of $117M.

And finally, increasing the production rate by an additional 50 million pounds per year (to the targeted full production run rate of 125 million pounds of copper per year) would require an additional $147M in years 6 and 7, which could probably already be funded by its own cash flow from the 75 million pound per year scenario. And if the copper market remains strong with prices above $2.75-3.00 per pound, we think there’s a realistic opportunity for Excelsior Mining to just skip the second phase and immediately boost the output to 125 million pounds per year. But that will obviously depend on A) the copper market and B) the availability of capital.

With an all-in production cost of just US$1.23 per pound (which includes the initial capex and the capex to build the two additional phases), Excelsior Mining should be able to weather any storm.

Is the copper market really slowing down? And why it doesn’t matter for Excelsior

Another potential important factor for the copper price might be the labor contract discussions at the main mines. Codelco and Antofagasta (ANTO.L) have done great jobs in keeping their labor force in Chile happy, but some of the larger copper mines still have to deal with contract negotiations later this year.

Just to name a few: BHP Billiton (BHP) is still negotiating with the unions on the Escondida copper mine (2.2 billion pounds of copper production per year), whilst peers Antamina, Freeport McMoRan (FCX) and Collahuasi still have to start negotiations in the next few months. Those three mines represent an additional output of 3 billion pounds of copper per year.

Whilst we expect most of the labor negotiations to have a positive outcome and will result in new contracts and agreements, it’s not unlikely some companies won’t be able to avoid strikes which could have a negative impact on the worldwide copper supply. These labor negotiations are a continuous process, and once one deal has been completed on one mine, another mine needs to figure out new contract details and bonuses as well.

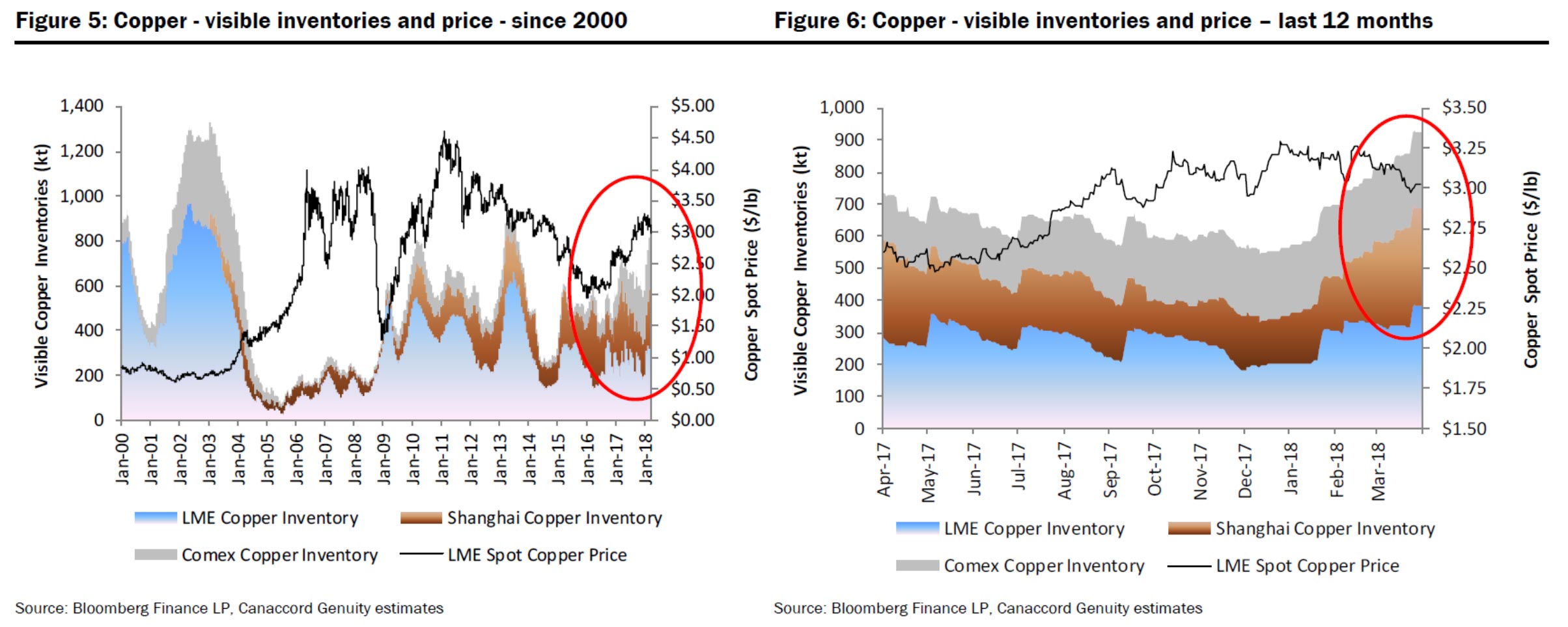

The copper price has recently come down a bit, based on the fears of a worldwide trade war, and the increase of the copper stocks at the Shanghai Exchange. That being said, the build-up of inventory in China appears to be completely due to seasonal effects. According to brokerage house Canaccord Genuity, the production results from Chinese (copper) smelters remained strong, which resulted in a lower premium for refined copper in the first few months of this year. The next chart, provided by Canaccord Genuity, shows the general trends of the copper inventory buildup on a short-term and longer-term basis.

So, let’s now assume this worst case scenario comes true, and the copper price falls to $2.50 per pound. That would be disastrous for companies with a high operating cost, but as Excelsior’s production cost will be absurdly low, the company should remain relatively unharmed by low copper prices. Sure, there will be an impact, but it won’t jeopardize the project nor the company’s future.

Let’s have another look at the company’s definitive feasibility study. Excelsior Mining did a good job in being as transparent as possible. Whilst most companies would publish the results of a Feasibility Study using just the base case scenario and the results of perhaps one or two different copper price scenario’s, Excelsior has provided the pre-tax and after-tax results of the Gunnison NPV calculations using copper prices ranging from $2.25/lb to $3.25/lb.

This makes our lives substantially easier, and the next table provides a really good overview of how the economics of the Gunnison project are changing based on the copper price:

So even if the copper price would be trading at the $2.50 mark for an extended period of time, the after-tax NPV7.5% would still be US$665M in the acid plant scenario and US$548M in case no acid plant gets built.

So whilst a higher copper price would obviously be preferred, the economics are holding up pretty well at lower copper prices as well.

Conclusion

Getting the final green light from the federal EPA was a major step for Excelsior Mining. The fact that an appeal has been filed doesn’t really change the basic thesis, as this appeal will very likely only delay the procedure and not derail it.

The market reacted in a typical ‘buy on the rumor, sell on the news’ kneejerk move, and Excelsior’s stock fell 25% since the news of the final permit has been announced. The slightly lower copper price also doesn’t help, but as we explained earlier in this report, Gunnison will remain profitable even at $2.75, $2.50 and $2.25 per pound of copper.

With the final permit almost in its hands and with the financing pretty much secured (at least, that’s what we assume), it’s now up to Stephen Twyerould and his operational team to ‘make it work’.

Disclosure: Excelsior Mining is a sponsoring company. We have a long position. Please read the disclaimer