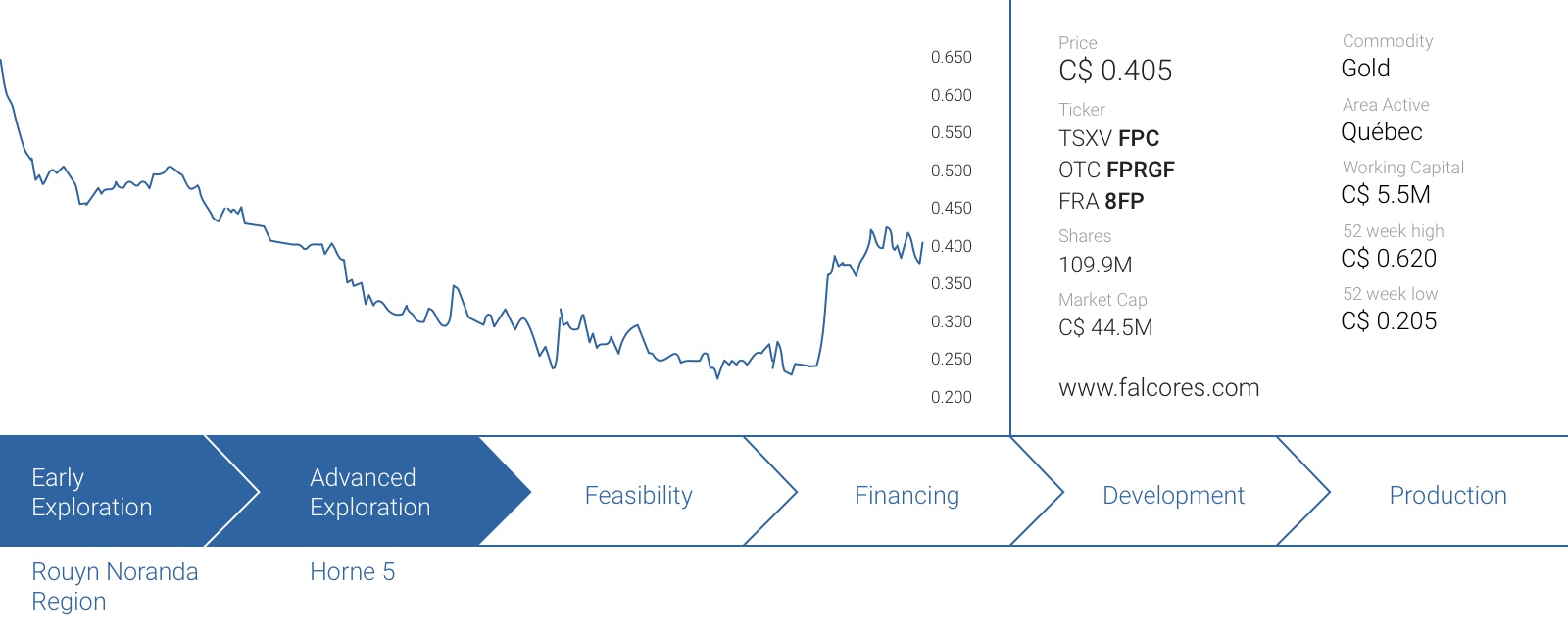

We would like to introduce you to Falco Resources (FPC), an advanced stage exploration company with the past-producing Horne 5 mine as its main asset. This company ticks all our boxes as Horne 5 is located in a mining-friendly region, is a past-producing producer and has now reached the critical mass to be developed as the most recent resource estimate outlined a 6.6 million ounce AuEq global resource estimate. That’s plenty of reasons to have a closer look at Falco Resources to find out if the company’s development plans have merit.

The history of Horne 5

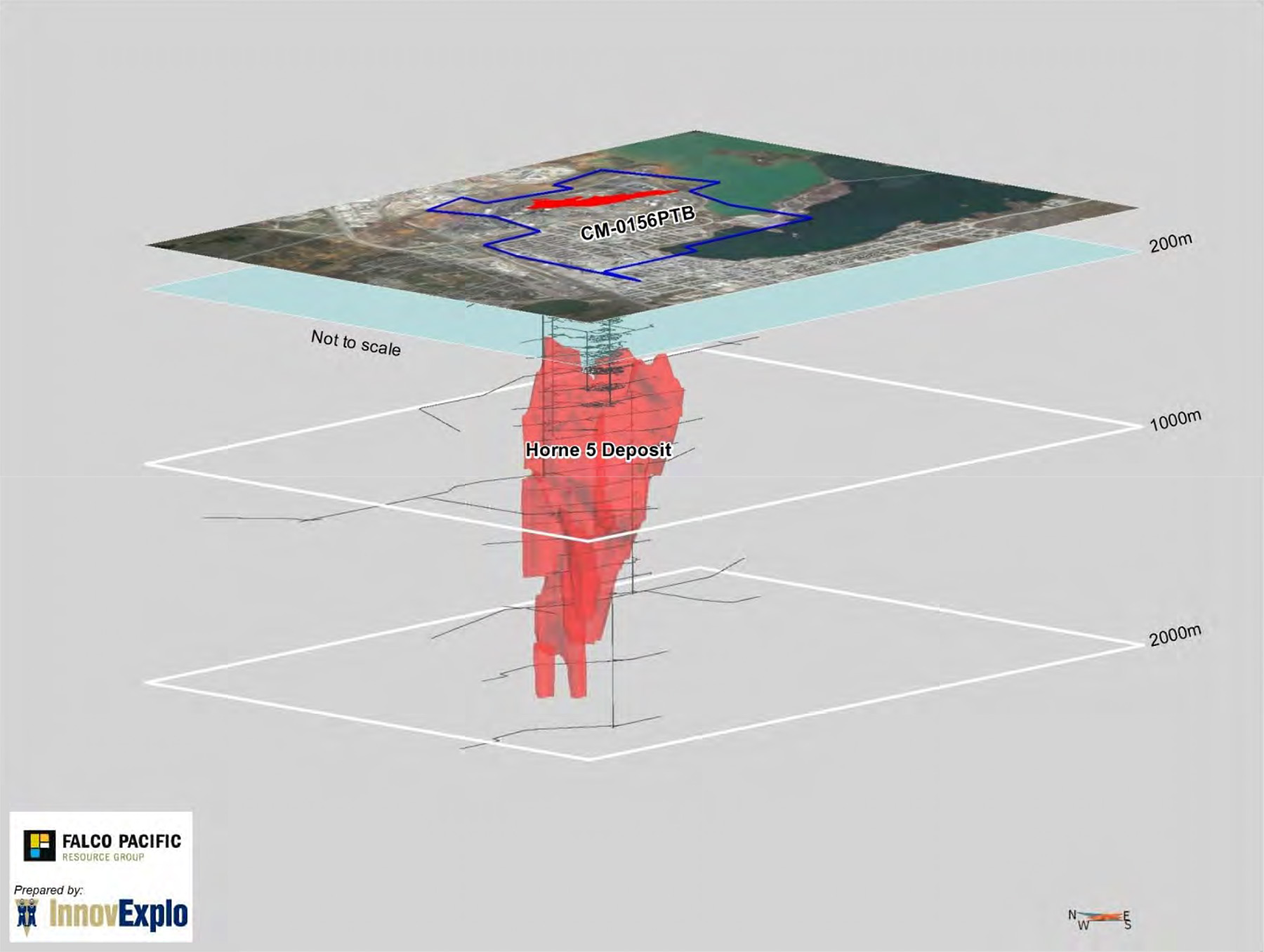

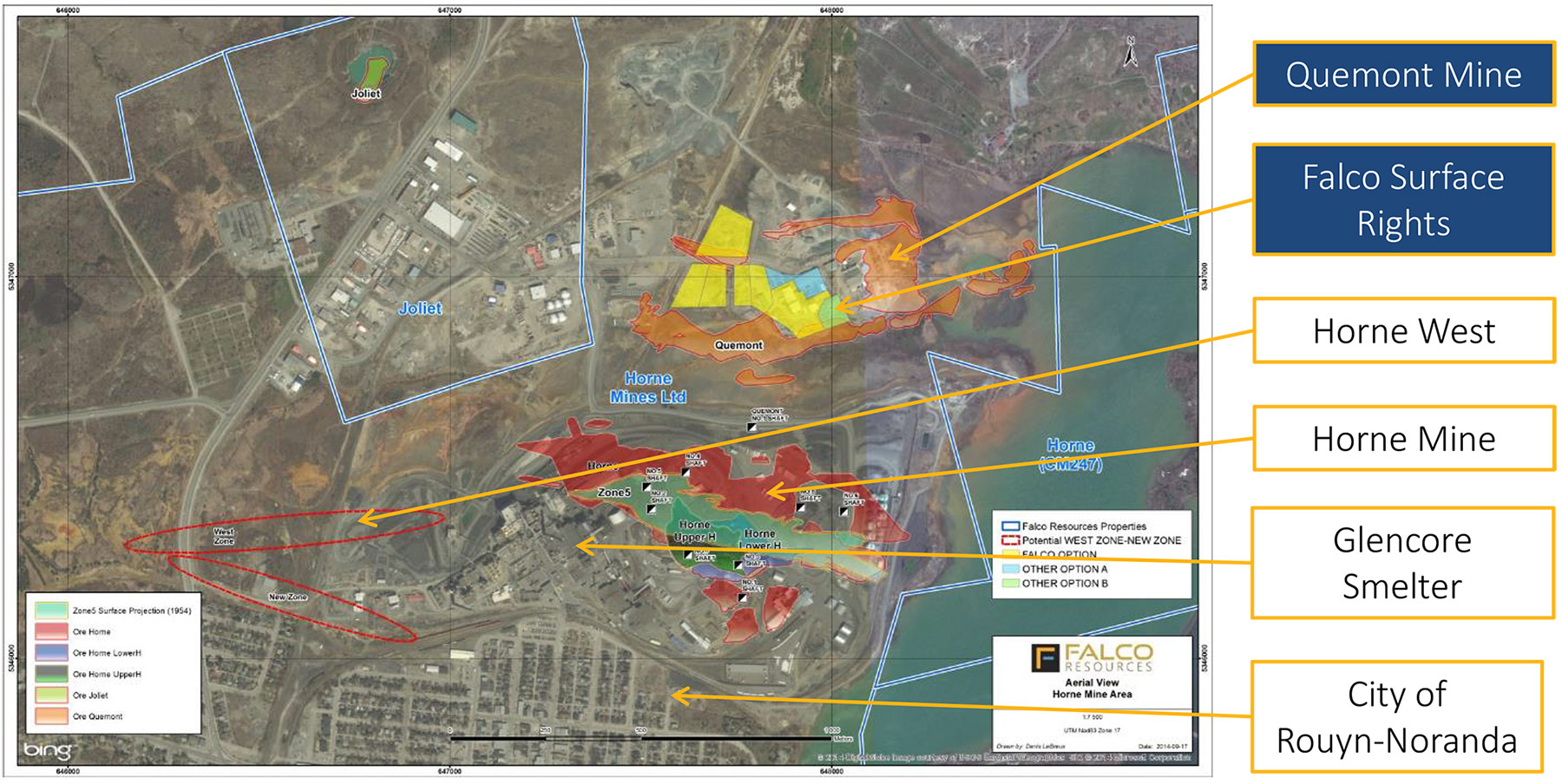

Falco’s land package is located in the Abitibi region in the Québec province and is literally bordering the city limits of Rouyn-Noranda (and it’s technically located within the urban limits of the city). It is actually located in the city’s industrial park. The majority of the land package was owned and mined by Noranda Mines (currently a sub-division of the mining conglomerate Glencore) and Falco was able to get its hands on the historical data from previous exploration and production programs which were conducted at the Horne mine and the surrounding region while it was in operation. Glencore still operates the smelter right next door to the Horne 5 operations, so an underground mining operation won’t really add any additional disturbance to the population of Rouyn-Noranda. Additionally, Falco Resources is not responsible for any environmental liability on the mining concession.

The claims were originally staked by Edmund Horne (hence the name of the mine) in 1920, but he transferred the ownership of the claims to Noranda in 1922. Noranda didn’t waste any time and started production at the Horne mine in 1927 and continued to mine the deposit for almost 50 years. The Horne was closed in 1976. The property remained dormant and was subsequently owned by Noranda, Falconbridge, Xstrata and Glencore, before the latter sold the property to Alexis Minerals (currently called QMX Gold).

QMX Gold subsequently sold the entire package to Druk Capital, where after the company changed its name to Falco Pacific Group and ultimately Falco Resource. Osisko Mining Corporation was one of the founding investors of Falco Resources. Less than 18 months after acquiring the property, Falco released a first maiden resource estimate based on historical drill data only, emphasizing the importance of the acquisition.

A first resource estimate in 2014 was just a prelude to bigger things

Falco Resources was able to use a majority of the historical data which allowed the company to build a first resource model in a very short time frame. This first estimate was already quite substantial and a lot of eyebrows were raised as the total resource estimate came in at 2.8 million gold-equivalent ounces (however, the total gold-equivalent resource in the first resource estimate would have been approximately 4 million ounces using a cutoff value of C$65/t).

As we reported earlier, that first resource estimate was just a very first and very preliminary step, and we immediately identified additional potential to unlock more value, even within the first resource estimate. As the calculation of a gold-equivalent resource estimate contains the (re-)calculations of non-gold metals that have been converted into gold-equivalent ounces based on the value of the metal and the gold, there were some very conservative projections in the gold-equivalent calculation.

One of the most important reasons why we believed the market was underestimating the true value of this first resource estimate was the average recovery rate of the zinc. Falco was very conservative and used the historical average recovery rate for zinc, which was just 37%. Of course, this historical recovery rate was based on antique (well, read: ‘outdated’) metallurgical results which underestimated the effective recovery rate of the zinc. In the newest resource estimate, this recovery rate was already hiked to 71.8% based on more recent metallurgical test work.

Of course, an increase in the average recovery rate of a by-product is great but wouldn’t have had a huge impact on the total value proposition of Falco Resources as the average zinc grade at the base case cutoff grade is less than 1%. The new resource estimate also contained even more data (from both historical and modern exploration) and this resulted in a substantial increase in the total tonnage at Horne 5.

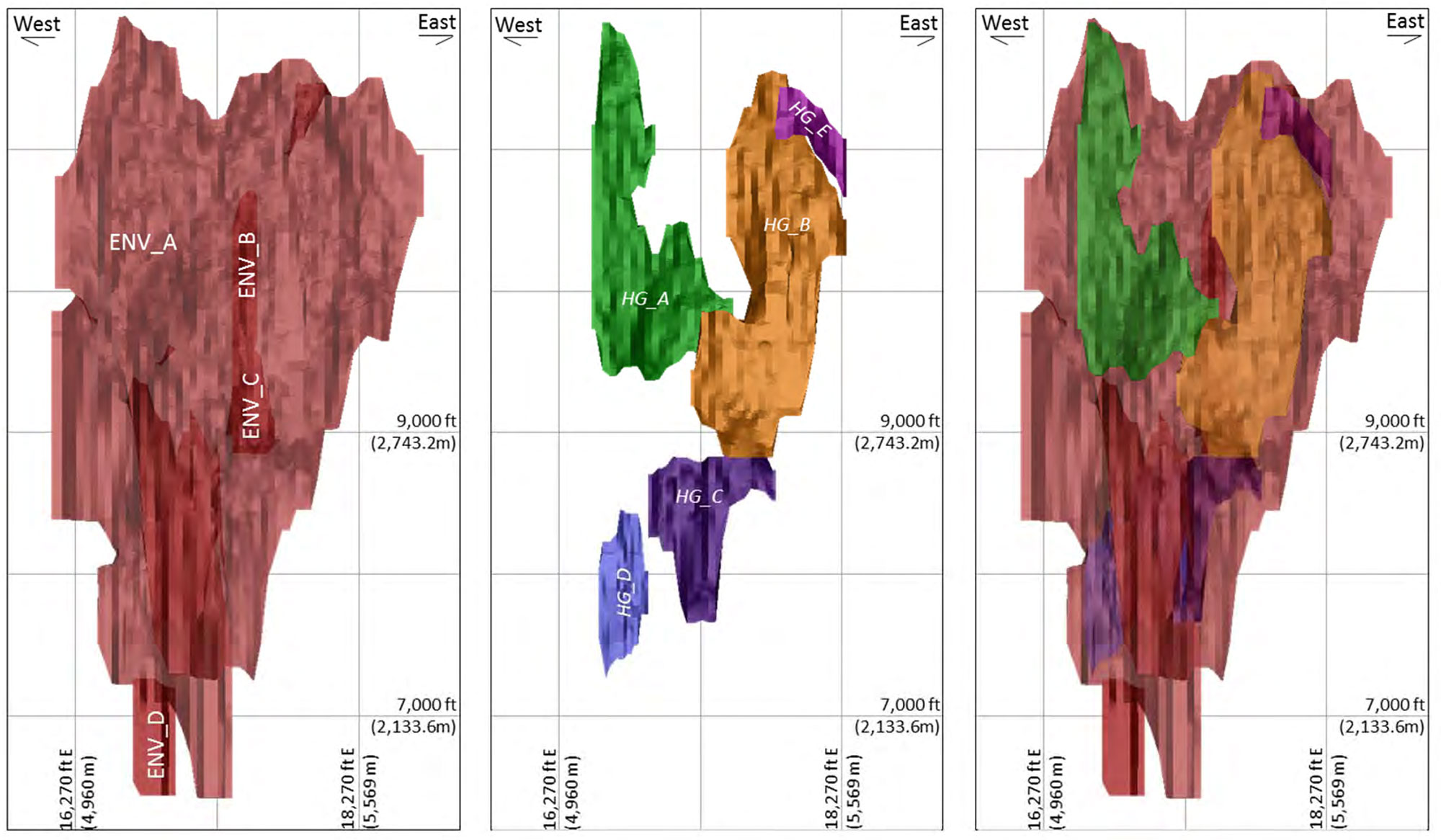

Using a base case cutoff grade of C$65/t, this past-producing mine now contains 58 million tonnes of rock in the indicated category as well as almost 13 million tonnes in the inferred resource category for a total tonnage of 71 million tonnes. This new resource estimate was based on in excess of 300,000 meters of historical drilling completed by Noranda as well as in excess of 17,000 meters drilled by Falco Resources as part of a confirmation drill program.

The total updated gold-equivalent resource came in at 6.6 million gold-equivalent ounces (of which almost 4.3 million ounces consisted of pure gold). That’s a substantial improvement especially knowing that mineralized zones containing in excess of 2 million gold-equivalent ounces can be reached from the current shaft depth, which will simplify a first plan of action and provides easy access to ore zones in the first few years of the mine life.

In 2016, Falco will be targeting to add additional tonnage on the western portion of the upper portion of the Horne 5 deposit. They will be targeting to add tonnage over the 1,200m level as any additional tonnage will delay any potential deepening of the Quemont #2 shaft.

The low grade doesn’t seem to be an issue – an explanation

The main point of criticism we usually hear is that the average grade of Horne 5 makes people nervous. Yes, at first sight you would indeed think that even though there’s a massive amount of gold left at Horne 5 (in excess of 4.2 million ounces, ignoring the by-products), the average gold-equivalent grade of 2.86 g/t in the indicated category sounds quite low.

And, yes, it is low when you compare it with for instance ‘pure’ underground mines like projects operated by for instance Primero Mining and Lake Shore Gold, but don’t forget Horne 5 could (and will) be mined as an underground bulk tonnage mine at a production rate of in excess of 10,000 tonnes per day.

Is this unique on the Canadian mining front? Not really. Both the Goldex mine in Québec and the Young-Davidson mine in Ontario are profitable despite having a lower average grade. At Goldex, the operating cost per tonne is just C$34/t (according to Agnico Eagle’s 2015 production results) whilst Young-Davidson has an expected LOM operating cost of C$53.5/t. Okay, you might think using a cutoff value of C$65/t might be cutting it close, but there are two important features at Horne 5 the aforementioned mines don’t have.

First of all, Falco will use the normal transverse long hole strategy to mine Horne 5 as this is the best method to conduct underground bulk tonnage mining at the mine, but what’s really important here is the extremely low mining dilution. Whereas Young-Davidson and Goldex are expecting an average mining dilution of 20% and 15% respectively, Falco thinks it will be able to keep the mining dilution limited to a low single digit percentage. This increased efficiency will result in Falco mining a higher percentage of ore versus waste.

A second important factor is the average density of the rock at Horne 5. The average density in the world is 2.65 tonnes per cubic meter and for instance the Goldex and Young-Davidson mines have a specific gravity of 2.8 and 2.69 respectively. However, given the massive-sulphide nature of the orebody, the density of Falco’s rock is 3.45, approximately 30% higher than the world’s average.

This basically means the company will have to mine less volume to reach a certain throughput per day. Should Goldex want to process 10,000 tonnes per day, it would have to mine 3,571 cubic meters of ore, whereas Falco would have to mine less than 3,000 cubic meters, generating additional cost savings. The next table summarizes the advantages of the Horne 5 compared to the Goldex mine.

[table caption=”” colalign=”left|left|left”]

Processing rate: 10,000 tpd;Mining rate (tonnes) after dilution;Volume (in m3)

Goldex Mine;11765 tpd;4201 m3

Horne 5 (our estimate, based on 5% dilution);10526 tpd;3051 m3

Difference; -10.5%;-27%

[/table]

So, based on these parameters, Falco would have to mine and haul 27% less volume to meet the same processing rate (expressed in tonnes per day) as Goldex-style operation, and this is exactly where the strength of this project comes to surface.

Another important fact to note, is that the current size of the Quemont #2 shaft will easily accommodate in excess of 10,000 tpd. No slashing or widening of the shaft will be required to reach the foreseen production capacity.

The regional exploration potential is very exciting

Keep in mind the old Horne 5 mine is located on less than 1% of Falco’s total land package, so the company is not just the owner of the mine, but also owns 74,000 hectares of the Rouyn Noranda Mining camp. Horne 5 is definitely the most advanced project, but you shouldn’t forget the RN Mining camp hosts an additional 13 past producing mines, so you should really keep an eye on the bigger picture here.

In a regional exploration program conducted in 2014, Falco made no less than 4 new gold and base metal discoveries on the 740 square kilometer land package. Of course, the main focus and priority right now is to advance the Horne 5 project to the feasibility stage once the Preliminary Economic Assessment will be completed, but we just wanted to highlight Falco isn’t ‘just’ Horne 5, but should be seen as a ‘district play’ in the greater Rouyn Noranda region. The RIMO target is the main early-stage greenfield project the Company is currently focused on. It was identified with Geophysics, Falco is currently following up on several other interesting targets.

A management team with a successful history at Osisko

Luc Lessard, President & CEO, Director

- Former COO of Canadian Malartic Partnership

- Former COO and Senior Vice-President of Engineering & Construction for Osisko Mining

- Former VP of Engineering & Construction forIamgold

- Former Executive Director of Engineering & Construction for Cambior

Sean Roosen, Chairman

- Chairman & CEO of Osisko Royalties

Mario Caron, Lead Director

- Mining executive with over 35 years of experience in the mining industry

Vincent Metcalfe, CFO

- Former mining investment banker

Claude Bernier, Exploration Manager

- Over 40 years of experience on various exploration projects

Claude Léveillée, Vice-President Community Relations & Human Resources

- Former Corporate Director, Human Resources / Organizational Development at Agnico Eagle Mines

Helene Cartier, Director

- Former VP Environment and Sustainable Development at Osisko Mining Corporation

Jim Davidson, Director

- Co-Founder of Falco Resources

- Former CFO of Western Minerals Group

Claude Ferron, Director

- Former COO of Xstrata Copper Canada

Paul Henri-Girard, Director

- Former VP of Canadian Operations at Agnico Eagle

Conclusion

Falco Resources is one of the most exciting exploration plays in Québec as the company is operating as a two-step rocket. The Horne 5 mine is its most advanced project and we are expecting to see a first Preliminary Economic Assessment on the property in the very near future where after we would expect Falco to fast-track the project towards a full feasibility study. They will additionally be initiating the environmental impact study following the PEA release, they will aim to publish the report concurrently to the Feasibility study in 2017.

On top of that, Falco owns a very prospective 74,000 hectare land package where it has already made numerous discoveries. As the current market capitalization of the company is just C$40M, Falco is effectively trading at less than US$5 per gold-equivalent ounce in the ground and that’s very cheap for a company operating in a safe and mining-friendly region.

As this company is being backed by a proven management team that will undoubtedly be offered all the cash it needs to re-open the Horne 5 mine, we think Falco’s road towards production could be a very interesting ride!

Disclosure: Falco Resources is a sponsoring company, we hold a long position.