Sometimes you come across stories that sound ‘too good to be true’. But when a patented technology to convert used motor oil into useable products has been vetted, confirmed and approved by at least three independent parties (including the Wood Group and Stantec), there must be something to it. On top of that, a 5 barrel per day pilot plant also confirmed the technology really works. And this makes Gen III’s project one of the very few ‘green’ infrastructure projects that does not require subsidies nor grants (the carbon credit to be paid by the Alberta government is a nice incentive, but removing the credit from the equation would not fundamentally change our thesis). On top of that, we can only hope this will be a first step to see more used motor oil being recycled, as unfortunately approximately 50% is currently being used as ‘burner fuel’.

Sometimes you come across stories that sound ‘too good to be true’. But when a patented technology to convert used motor oil into useable products has been vetted, confirmed and approved by at least three independent parties (including the Wood Group and Stantec), there must be something to it. On top of that, a 5 barrel per day pilot plant also confirmed the technology really works. And this makes Gen III’s project one of the very few ‘green’ infrastructure projects that does not require subsidies nor grants (the carbon credit to be paid by the Alberta government is a nice incentive, but removing the credit from the equation would not fundamentally change our thesis). On top of that, we can only hope this will be a first step to see more used motor oil being recycled, as unfortunately approximately 50% is currently being used as ‘burner fuel’.

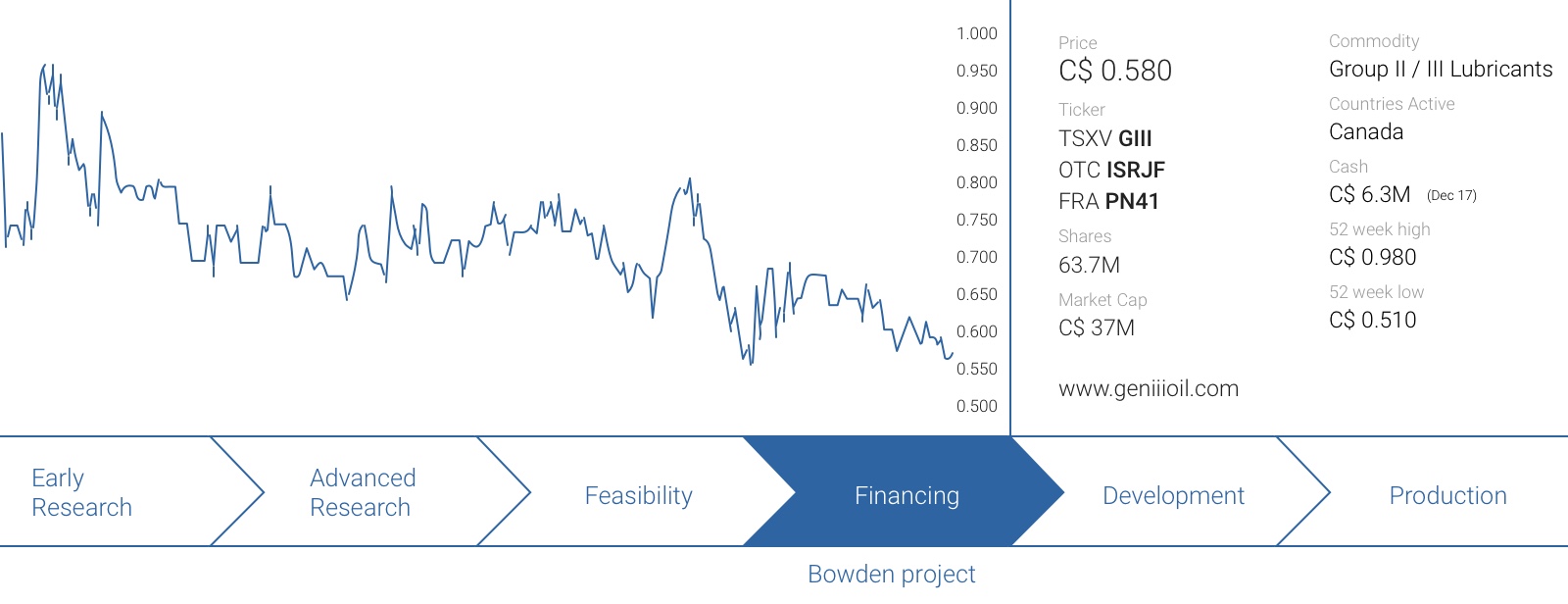

The owner of this patented technology is Gen III Oil (GIII.V) which is aggressively advancing its strategy to start producing Group II and Group III lubricants from the Bowden refinery, which it will lease from Canadian household name Parkland Fuels (PKI.TO). One of Parkland Fuels’ subsidiaries will also market the products produced at the Gen III Oil re-refinery in Alberta. This story has got a lot going for it, and in this report we will explain why the next 12-18 months will be crucial for this company.

The ReGen refining process tested and confirmed by multiple parties

The ReGen refining process (which uses used motor oil to produce Group II and Group III lubricants) isn’t new, but it’s the first time the technology is (finally) being advanced to be used on a large commercial scale basis. Until early 2017, a small company called VeroLube owned the patents on the process, but after defaulting on some loans, a company which later evolved into Gen III Oil acquired the patents which were put up as collateral.

As of this moment, Gen III Oil owns 4 patents in North America as well as 2 patents in Singapore and India (with especially the latter being a potentially huge market for Gen III Oil). An additional 12 patents (including the ones in the European Union) are still pending and will very likely be granted soon.

That’s great, but what’s really important is the fact the ReGen technology isn’t just another technology fairy tale. The process has been tested several times, and has always survived those tests. A 5 barrel per day pilot plant was successful as it was indeed able to convert the used motor oil into new saleable products, whilst no less than three (!) independent engineering firms also tested the technology on critical faults. The Wood Group, Tetra Tech and Stantec confirmed the viability of the technology independent from each other, and that’s a really encouraging sign.

In case you aren’t familiar with those names; all three companies are publicly-listed multi-billion-dollar consulting firms focusing on the engineering and project management part of a project. It’s their main job to provide independent opinions on projects and these firms are for instance widely used in the mining sector to provide independent and NI43-101 compliant resource calculations and feasibility studies. Needless to say that when three of these bigger firms sign off on the technology and the model, they will have thoroughly checked all components.

On top of that, Oakridge Laboratories, one of the independent consultants used by the US Department of Energy has also tested the technology and confirmed it should be feasible to produce Group II and Group III lubricants using used motor oil as the input of the process.

So, one pilot plant and no less than 4 independent outfits have confirmed the technology appears to be feasible, and that was the starting sign for Gen III Oil to use Stantec to complete a more detailed engineering report to figure out the economics of a plant.

An impressive 97% efficiency ratio

What appealed to us the most was the efficiency of the ReGen technology. According to Gen III Oil, 97% of the incoming motor oil will be re-refined to produce other oil derivatives:

And that’s exactly what Gen III Oil’s competitive advantage is. For every barrel of crude oil that’s being refined, only 0.5 gallons is recovered as a lubricant. For every barrel of used motor oil processed by Gen III Oil, 31.5 gallons of Group II and Group III lubricants will be produced.

Perhaps even more appealing is the ratio of Group III and Group II products in the final product mix, as these two groups will contribute the most to the revenue. As a reminder, these two derivatives are used as motor oil, and according to several independent parties the demand for Group III lubricants will only increase as the newer engines in cars require lubricants with a lighter viscosity for an optimal performance.

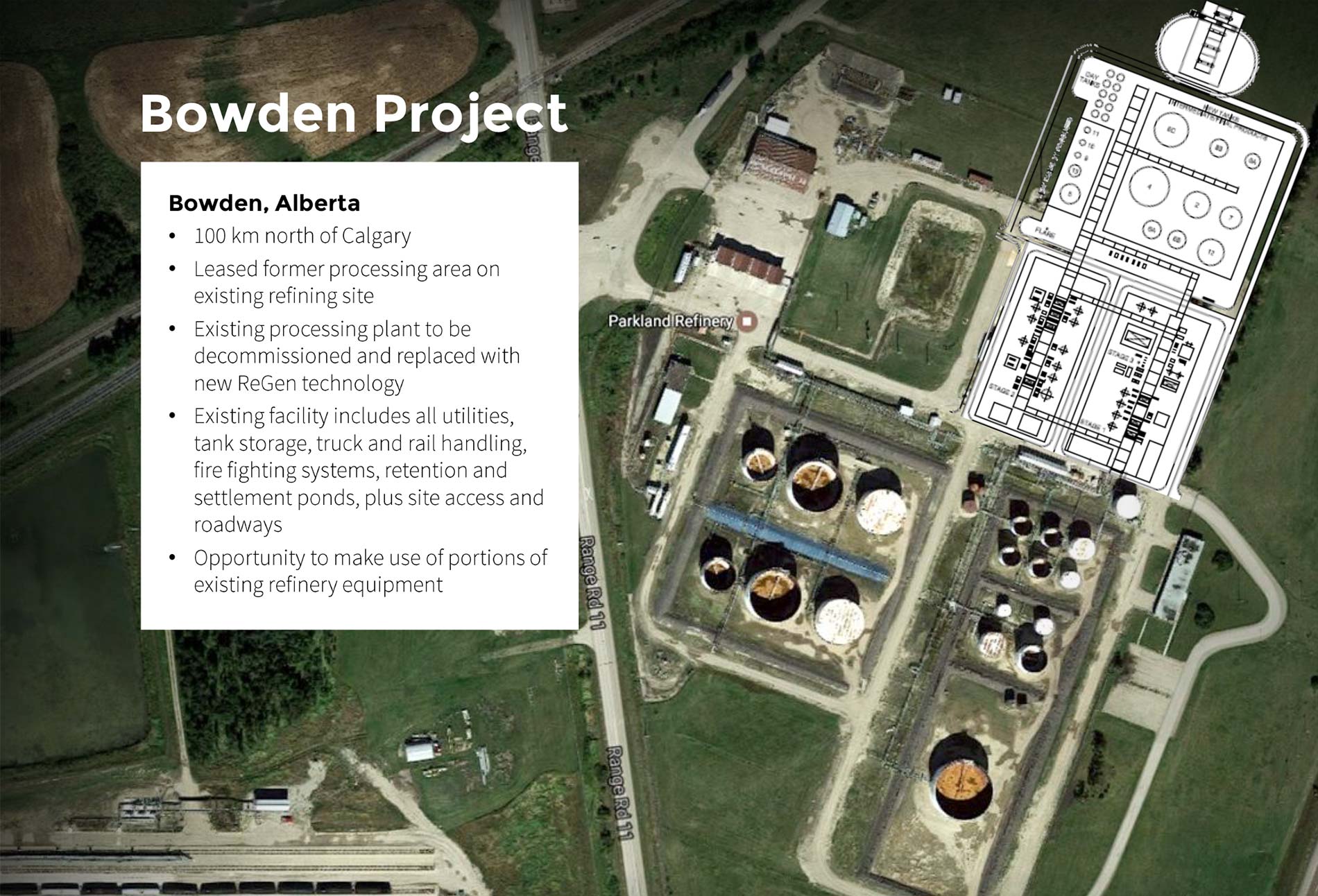

The next step was obviously to find a good location to build this (re-)refinery, and that’s where Parkland fuels entered the scene. Parkland agreed to lease its Bowden refinery to Gen III Oil, and leasing this facility offers a major advantage. Not only is it easily accessible by rail and road, the simple fact a Brownfields facility could be used has a huge impact on the permitting timeline and the environmental responsibilities.

The Bowden facility is in an excellent location as it’s close to some major Canadian cities (Calgary, Edmonton and Vancouver) which should generally allow Gen III Oil to easily access its main feedstock: motor oil. That being said, the used motor oil could actually be sourced from practically anywhere in Canada and the USA thanks to the excellent access to the existing rail network. When Gen III was putting the economic model together, it also already included the transportation cost to ship used motor oil to the Bowden facility.

On top of that, Parkland Fuels agreed to market the end-products produced at Bowden. These two deals with Parkland Fuels increased the credibility of Gen III Oil as a company as it no longer is ‘a company with a plan’, but a company looking forward to generate its first revenues in 2019.

And finally, PCL Construction, the third largest engineering firm in North America, accepted the EPC contract for the Bowden facility. Another vote of confidence.

Looking at the economics

According to a study, only 50% of the used motor oil is re-refined into Group I and Group II lubricants, whilst the remaining 50% is sold as burner fuel. Needless to say that’s a very inefficient way to ‘dispose’ of used motor oil, and that’s why Gen III Oil’s 97% efficiency ratio is absolutely outstanding (and the 3% which isn’t converted into a saleable product is just water, which will be retained and used within the plant.

Not only is there an abundance of motor oil (which reduces the cost to purchase the input for the Bowden plant as this is a simple relationship between supply and demand), the demand for Group III oils in North America is also very high.

In fact, the ‘domestic’ supply of Group III Oil is taking care of just 28% of the total demand of 17,000 barrels per day, with the balance being imported from other countries like the UAE and South Korea. And this puts a Canadian plant in an enviable position. Not only will it be able to cater to an existing demand, its main competitors are abroad which means the end-buyers in North America have to take care of the shipping expenses as well. And transporting Group III oils through the extensive rail network in Canada and the USA should be cheaper than putting it on a boat in South Korea or Abu Dhabi. As you can see on the next image, the average price of Group III and Group II lubricants has actually remained very stable over the past few years and this allowed the company and the consultants to collect the data to determine an average sales price for the products.

Stantec has built an economic model used by the company to determine the viability and operating margins of the project. In fact, WSP, another independent consulting firm, also vetted the strategy and built its own economic model; both the WSP and Stantec model reached the same conclusions but Gen III Oil decided to continue with Stantec as its performance guarantee was superior to the guarantees offered by WSP). According to the summarized model (which envisages a C$90M capex), Gen III Oil is expecting to incur a total amount of operating expenses of C$91.7M per year, whilst it will be able to sell its 2,700 barrels per day of output (based on an input of 2,800 barrels/day at a 97% efficiency) for almost C$191M (based on the spot price of the Group I, II and III oils as of at the end of February). On top of that, Gen III also expects to receive a tax credit to the tune of C$9M per year as part of a government incentive scheme to recycle used oil.

The 2,800 barrels per day plant will reduce the CO2 emissions by approximately 1,000 tonnes per day, and this will generate C$9M per year in greenhouse tax credits. Taking these elements into consideration, the operating income will be C$108M per year and even after paying taxes and interest expenses on the construction funding, Gen III Oil Corp expects to generate a net income of C$75M per year.

As you can see in the table here below, the largest cost is effectively purchasing the used motor oil (which includes an allowance to transport the used oil to the Bowden refinery), followed by a C$15M cost to ship the end product to the customers (logistics and access to infrastructure are very important for an operation like this).

The parameters provided by the company actually allow us to build our own economic model to determine a Net Present Value of the facility in Bowden, Alberta.

Our economic model

Gen III Oil is providing a summarized economic model in its corporate presentation, and we will use those parameters to calculate a Net Present Value of the project. Let’s first start with the data provided by the company to calculate the NPV10% based on the spot prices as of February 28th:

Based on the spot prices as of at the end of February, Gen III Oil is expecting to generate a total revenue of C$200M per year (based on a 2,800 barrel per day plant), which includes a C$9M greenhouse gas emission tax credit (‘carbon credit’) from the government of Alberta. As you can see, the company is estimating its net operating income to be C$108M per year, and expects to pay C$33M per year in taxes and interest payments. If we would add the C$4.5M in depreciation rate back to the equation, the plant will generate an annual after-tax free cash flow of C$79.5M. Assuming a 20 year ‘plant life’ and using a discount rate of 10%, our calculations indicate an after-tax NPV10% of C$587M.

We obviously don’t always blindly believe what a company tells us, even when the model has been checked and vetted by Stantec.

We obviously don’t always blindly believe what a company tells us, even when the model has been checked and vetted by Stantec.

In a second scenario, we will include a 15% lower revenue whilst increasing the operating expenses by 10%. That’s pretty harsh as the prices of the Group II and III lubricants usually track the price of used motor oil and vice versa. So when the Group II and III prices are down, the purchase cost of the used motor oil should also be trending down, and it’s really important to keep this in mind as Gen III Oil is basically agnostic to the price of crude oil. So, we’re stress-testing the model pretty hard with this double-negative assumption.

We will also increase the initial capex to C$105M to assume a 17% cost overrun.

As you can see, even when stress-testing the model, the after-tax NPV10% remains high at C$342M. Applying a discount rate of 8% in the stress-tested model would increase the after-tax NPV8% to C$410M. Keep in mind these NPV calculations are based on a 100% ownership. As per the term sheet for the debt agreement, the debt provider will be issued warrants to purchase up to 4% of the operating subsidiary. As the purchase cost of this 4% remains confidential, you should assume a margin of error of a few percent in the calculations.

As you can see, even when stress-testing the model, the after-tax NPV10% remains high at C$342M. Applying a discount rate of 8% in the stress-tested model would increase the after-tax NPV8% to C$410M. Keep in mind these NPV calculations are based on a 100% ownership. As per the term sheet for the debt agreement, the debt provider will be issued warrants to purchase up to 4% of the operating subsidiary. As the purchase cost of this 4% remains confidential, you should assume a margin of error of a few percent in the calculations.

Needless to say these results are very impressive as the payback period in the adverse scenario will still be just 2-2.5 years…

After the Bowden plant: the world?

As mentioned before, Gen III Oil is leasing the facility from TSX-listed Parkland Fuels whilst the latter also entered into a 5-year marketing agreement with Gen III Oil. Based on the Group II and Group III oil prices when the contract was signed, this represented a total value of C$760M which very likely increased to C$900-950M as the Group II + III prices have increased since the marketing agreement was signed.

But it appears to be clear the Bowden plant is just the very first phase of rolling this technology out all over the world. As you can see in the economic model provided by Stantec to the company, the initial expenses of effectively constructing new refineries is quite low once a few important pieces of the puzzle (like logistics) are in place.

So there’s nothing stopping Gen III Oil to conquer the world by either building its own plants, or by licensing out its technology to franchisees in other countries. The first scenario would perhaps be the most accretive for the Gen III shareholders, but the latter would be the least intensive process of generating additional revenues at a low initial investment whilst it also excludes the technological risks and the risks associated with operating in other countries.

So there’s nothing stopping Gen III Oil to conquer the world by either building its own plants, or by licensing out its technology to franchisees in other countries. The first scenario would perhaps be the most accretive for the Gen III shareholders, but the latter would be the least intensive process of generating additional revenues at a low initial investment whilst it also excludes the technological risks and the risks associated with operating in other countries.

But first, let’s start with the Bowden processing plant. As the technology has been proven by several independent parties, Gen III Oil has a very aggressive timeline towards production, as you can see on the next image.

So, subject to effectively raising the capital needed to fund the construction of the refinery, Gen III expects to be in production as early as Q2 2019. Even if you’d add a few months to err on the cautious side, the refinery should be up and running and generate EBITDA by the end of next year.

The current capital structure and capital needs

As of today, Gen III Oil has a total of 63.7 million shares outstanding, giving it a market capitalization of C$37M based on the recent closing price of C$0.58. There also are a total of 11.3 million options and warrants outstanding, which are currently slightly out of the money. Should Gen III Oil be able to deliver on its promises, we do expect these warrants and options to be in the money and exercised. However, this might come too late to fund a part of the equity requirement of the initial C$90M capex. Keep in mind the company has already signed a term sheet for a debt facility of up to C$72M, indicating another independent party (the potential lender) has vetted and greenlighted the business plan. In fact, the debt provider will be issuing warrants to purchase up to 4% of the Alberta subsidiary which will own and operate the plant.

Gen III’s management team is expecting to raise the C$90M with a 40/60 equity/debt ratio which would put the equity component at C$36M. If we would now add an additional working capital and G&A requirement to this equation (as we like to err on the cautious side), Gen III Oil will need to raise C$45M. At C$0.60/share, this would represent 75 million additional shares, bringing the total share count (+ the options and warrants) to almost exactly 150 million shares.

But let’s be clear. During our 90-minute call with Gen III Oil, the management indicated it was absolutely not interested in raising the money at these levels. In fact, the company will embark on a North American road trip to increase the awareness of the company. The roadshow could be a very efficient tool as we are also expecting some near-term catalysts to materialize as we would expect to see news on the final permitting in the second quarter which will get the ball rolling to finalize the construction financing efforts.

Considering the free float of the company’s stock is relatively low, a successful roadshow could get things moving, and we don’t think it’s unlikely Gen III Oil might be able to secure equity funding at C$1/share. Should that indeed be the case, the total amount of shares outstanding would remain limited to just 120 million and this would obviously have a very positive impact on the NPV/share.

At a share count of 120M, the after-tax NPV10% of the adverse scenario would be almost C$3/share and even if we would use our worst case scenario 150M share count and the adverse NPV-model, the NPV/share would still be in excess of C$2.

And that’s based on the Bowden plant alone, and doesn’t take potential lease extensions into account at all and completely ignores the potential additional revenue from building and operating new plants and/or licensing the technology to third parties.

Gen III Oil’s executive team

Gregory Clarkes – CEO

Mr. Clarkes is an experienced financier with over 30 years’ experience in raising capital for private and public companies in the resource, industrial, entertainment and technology sectors. He has been a senior officer, director and major shareholder of many private and publicly listed companies. Mr. Clarkes provides leadership and direction leveraging his extensive capital markets, M&A and strategic planning experience.

He was the founder, director, and significant shareholder of Skye Resources Inc., which was sold to HudBay Minerals Inc. in 2008 for $460 million.

Gordon Driedger – COO & President

Mr. Driedger is an award winning professional engineer with 35 years’ experience in design, management and construction of a diverse spectrum of industrial, institutional and civil projects including 20 years as founder/owner/manager of SILCO, an EPC firm; 10 years as VP, Project Delivery with Plenary Group, a leading North American developer of infrastructure utilizing public private partnerships; and 5 years in the role of Director, Project Management Office, University of Alberta, overseeing the University’s $2 billion capital program. He has successfully completed over 70 major capital projects to date.

Mr. Driedger has a comprehensive understanding of project lifecycle including engineering, financing, construction, commissioning and start-up. His extensive EPC experience also covers project risks and management, project governance/best practices and ethical tendering .

George Davidson – Executive VP

Mr. Davidson studied civil engineering at the University of Western Ontario prior to a 35 year career which includes extensive experience in major construction projects as a site engineer, estimator, project manager and president in both Canadian and North African multi-million dollar projects.

More recently, after obtaining his MBA from the Richard Ivey School of Business, Mr. Davidson was VP Operations for a major North American supply chain company; has led the acquisitions team for both private and public companies; and led multiple commercial and industrial construction projects through planning, engineering design and implementation.

Denis Dionne – Process Engineer

Mr. Dionne is a chemical engineer with over 28 years of practice in the fields of refining, petrochemicals, energy, mining and metals and risks studies. During his first fifteen years of service, he gained production experience in the petrochemical industry, where he developed expertise in the optimization and improvement of facilities, feasibility and conceptual studies, construction, commissioning, problem solving and troubleshooting.

The skills he has achieved throughout the years include the coordination of process engineering deliverables for projects of more than $1B, Business Development in the sectors of Oil and Gas and well as Process Safety Management (PSM). Mr. Dionne is a certified PHA Team Leader (HAZID, HAZOP, What-if) and LOPA Analyst.

What convinced us

When stories sound too good to be true, they usually are. But when a story has been vetted by three independent parties, has survived a pilot plant test and is being backed by Parkland Fuels which has committed to market the Bowden plant production, Gen III Oil seems to do everything in its power to reassure the market the patented technology works. We think COO Gordon Driedger’s experience will play a very important role for Gen III Oil in developing the Bowden plant and get it up and running.

Our NPV calculations indicate the sum of the cash flows to be generated at the Bowden plant are a multiple of the current share price, even if we would factor in a share count of 150M shares. And that’s just the beginning, as Gen III Oil will be able to duplicate its success all over the world.

It’s important to note the Gen III Oil management isn’t just talking the talk, but is also walking the walk. They confirmed us during our call there are no cheap founder’s shares, and according to recent filings, several board and management members have actually bought more stock on the open market. Since March 1st, insiders have bought a total of almost 60,000 shares on the open market, and that does give us a comfortable feeling as it’s in their best interest to get the share price as high as possible.

We did initiate a long position within a week after our conference call with the management and after running our numbers. The proof is in the pudding, but if everything checks out, Gen III Oil shouldn’t be a penny stock for much longer.

Disclosure: Gen III Oil is not a sponsoring company but we were compensated by a third party. The author has a long position in Gen III Oil.