The market finally seems to be realizing the potential of Redstar Gold’s (RGC.V) Unga project in Alaska, as the Company’s share price has now more than doubled to $0.125 in just over one month since July 12, 2016 when it traded at $0.055 when we released our first report, a gain of 127%. Redstar Gold is getting its ducks in a row and after CEO Peter Ball discussed the Redstar’s strategy to divest of its non-core assets in our previous report, a first step has been set as Redstar is selling its Nevada exploration assets to NV Gold (NVX.V).

But perhaps more important is the final report of Dr. Jeffrey Hedenquist, who is recognized as one of the world’s most renowned experts on epithermal deposits.

The Hedenquist Report indicates there’s “District-Scale” potential

We already briefly discussed the impact of the Hedenquist report in a blurb on the Caesars-blog on July 28, 2016, but we are obviously also interested in the opinions from other geologists (or people who know quite a bit more about epithermal deposits than we do). Fortunately, the professionals we consulted agreed with both Hedenquist and our view.

Our in-house geologic consultant has read the Hedenquist report and summarized his review with the following:

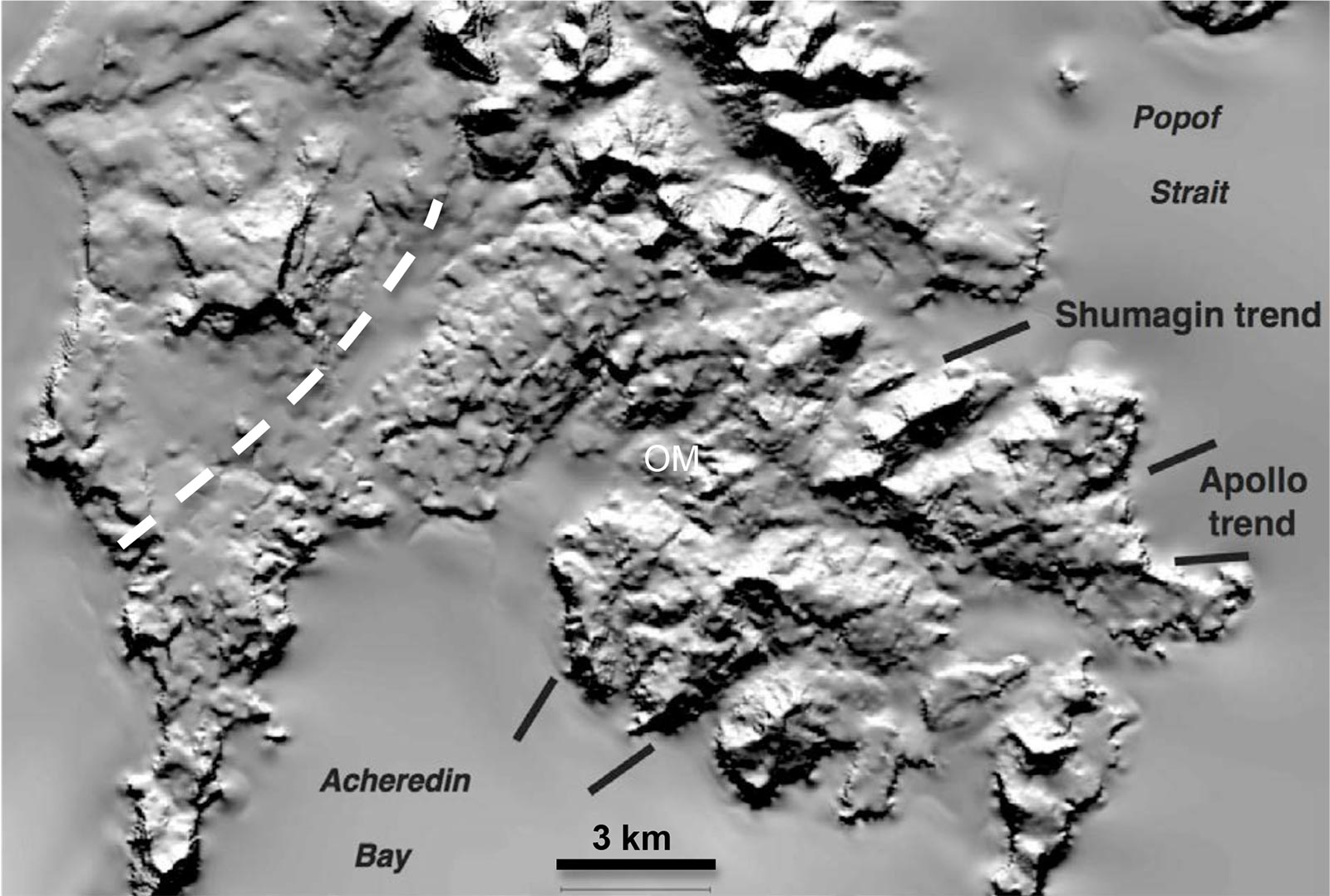

“After reading Dr. Jeffrey Hedenquist’s report, prepared on behalf of Redstar Gold, there are a number of highlights worth noting. Up to now the focus on exploration work, including the most recent drilling, has been on the existing defined structures. While the strike extent of Apollo and Shumagin cover the entire breadth of Unga Island they have been minimally explored. The drilling of Shumagin has focused on a mere 400m strike length of the 7km structure along the northern Shumagin Trend.

It’s not surprising to have the focus on a better understood part of the epithermal vein system (Shumagin) and the (generally) narrow (but up to 10+ meters), vertically dipping veins which yielded high-grade results starting from surface and justified the approach. What is intriguing is not just the additional targets along the known structures, but the scale of the district wide potential that exists and that was highlighted in the report.

While there is always that overwhelming need to provide investors with drill results and project related exciting news to elevate the story, sometimes slow and steady is the right way to go, and many of the recommendations of the report allude to zooming exploration out to a more regional focus to fully understand the geology and mineralization which should not only help in the development of the best targets on the untested sections of Shumagin and Apollo, but equally importantly assist in the discovery of potentially new “blind” targets capable of hosting similar high grade epithermal gold.

Redstar controls 100% of this now defined (by Hedenquist) district-scale epithermal system that clearly presents in a number of high grade structures over significant strike and down-dip extents. While the existing focus of drilling the Shumagin structure has confirmed the high grade nature of the gold mineralization, there remains tremendous upside in the identification of new targets that have previously been untouched. Notwithstanding the excellent potential across their land holdings, Shumagin alone has the scale to host a couple of million ounces at a diluted mining grade that could reasonably be north of 10 g/t and that should make the project of great interest to investors and other mining companies alike.”

As highlighted in the Hedenquist report, interesting statements were made highlighting many characteristics or “Insights from similar deposits” such as the following named in the report:

- The Comstock Lode in Nevada (8.2 million ounces gold),

- Kushikino IS vein system in Kyushu, Japan (1.8 million ounces gold),

- Victoria-Teresa-Nayak IS vein system (~2 Moz Au) in northern Luzon, Philippines,

- Cerro Moro IS vein district in Patagonia, Argentina (2.4M gold-equivalent ounces),

- Guanajuato epithermal Ag-Au vein district in Mexico.

The report shares many graphics, illustrations and figures highlighting the interesting comparisons, and you can read it in its entirety here.

How should Redstar Gold advance the project?

It wasn’t easy to try to set up a conference call with CEO Ball to discuss the final Hedenquist report, as he was up in Alaska for several site visits with other gold-focused companies that wanted to visit the asset. Ball never made it a secret that multiple gold companies, both producing and non-producing requested a site visit to follow-up after signing confidentiality agreements on Unga. In fact, he told us one large precious metals company requested a site visit on August 4th, after discussing the project with Hedenquist, and arrived on site on August 6th, which one again re-emphasizes the importance of the Hedenquist report.

This doesn’t mean anything will happen on the corporate front, but with this much interest from other precious metals companies, we can’t rule out a joint venture on some of the Unga hot-spots. Ball made it very clear that noting the size of the multiple different zones at Unga, his preference would be to have any interested partner to initially focus on the Shumagin zone to build a resource to earn into that part of the project, while Redstar continues to evaluate and understand the multiple other zones/systems and “up the market value” before potentially handing it off to any partner in the future.

Ball did note that Unga is currently viewed as one project in the marketplace and interested parties, but as they continue to explore the various systems, Redstars’ technical team are seeing multiple zones that need to evaluated independently of each other, and each could yield potential future resources to add to Shumagin at a later stage. A single partner or partners could potentially have the right to control the entire district, but Redstar needs to understand the upside in each area before packaging it up into one JV deal. Subdividing- Unga Island’s top prospective zones into different claim areas is yet to be seen, but it’s a possibility, as the gold anomalies appear to be lighting up like a Christmas tree.

Our view is that it may be hard to have multiple partners on one island, as we would expect any major player in the gold business to own the entire district, but we do agree with Redstar that they need to understand each zone before packaging it with Shumagin out of the gate. A likely scenario would be to offer one partner a ROFR (Right Of First Refusal) on other zones to provide assurance to the Partner they have the opportunity, but also giving Redstar the opportunity to not lose out before increasing their knowledge.

But Redstar doesn’t have to find a joint venture partner to start drilling at Unga. Last year, the company extended the expiration date of almost 40 million warrants by one year, and these 40 million warrants expire on October 21st 2016. Indeed, that’s only two months away, and as the strike price of these warrants is just C$0.10, they are in the money and the majority will very likely be exercised.

Should all warrants effectively be exercised, Redstar will receive almost C$4M in proceeds and this will go a long way to fund a drill program in the very near future. Another note is that 27.5 million warrants at $0.12 are also currently (just) in the money which could bring in another C$3.3M. Keep in mind this is an Aleutian island and drilling is possible year round, unlike other projects up in the Yukon or in the middle of Alaska’s mainland. A drill rig has been stored on-site and could be mobilized really fast.

And starting its own drill program before signing any JV deals could also help the company to unlock more value for its shareholders as a better understanding of the mineralized system at Unga could improve its position at the negotiation table.

Selling the Nevada assets is just a first step to regain a 100% focus on Unga

The Company has also entered into an agreement with NV Gold (NVX.V) whereby the latter will acquire all of Redstar’s exploration stage assets in Nevada. NV Gold will be allowed to acquire the projects and the existing database compiled by AngloGold-Ashanti (AU) and the 11 projects after completing its due diligence, by issuing 6 million shares to Redstar Gold.

As Redstar will become a major shareholder of NV Gold, it will also be allowed to appoint two directors to the (six-man) board of NVX. The small Nevada outfit will also have to raise C$350,000 in cash within 90 days of closing the acquisition. Should NV Gold not be able to raise the cash, it will have to return the project to Redstar Gold which will subsequently return 5.7 million of the 6 million shares, keeping the remaining 300,000 shares as a compensation for the failed transaction.

This transaction isn’t surprising as CEO Ball already shared their vision at finding ‘solutions’ for its non-core assets, and this does confirm Redstar Gold is focusing 100% on Unga. Selling the Nevada assets whilst keeping exposure to the potential upside of those assets by retaining 6M shares (which is in excess of 30% of NV Gold’s share count before the mandatory capital raise) will add interesting upside for Redstar shareholders going forward. The technical team behind Nv Gold is solid with John Watson, Quinton Hennigh, and Odin Christensen who bring extensive Nevada experience and track record. Who better to advance the Nevada portfolio for Redstar, as they sit on the Board with to Redstar nominees.

This also makes it more likely Redstar Gold will do ‘something’ with their remaining 30% of the Newman-Todd gold property in Ontario’s Red Lake gold district. As the bull market in gold seems to be back, joint venture partner Confederation Metals (CFM.V) might be tempted to consolidate the ownership of the project, or perhaps a third party will run off with either Redstar’s 30% share, or the entire property should an agreement be reached with Confederation as well as another company might have a new approach for Newman Todd, where in excess of 50,000 meters have already been drilled.

Conclusion

Redstar Gold is executing on its plans to focus where the gold is, and there appears to be a lot of it up on the Unga project in Alaska, as it is monetizing its exploration assets in Nevada, and Ontario is expected to follow suit. It’s not like Redstar is accepting just any offer for its non-core assets, as the dominant share position in NV Gold will allow Redstar to maintain a healthy exposure to the underlying assets. If NV Gold has some exploration success, and its share price increases, Redstar will directly benefit from this and the 6 million shares currently already have a total value of C$1.35M.

The Hedenquist report confirms the expectations we voiced in our previous report; Unga should be seen as a district rather than the project it currently is. We expect the company to design a drill program to build a high grade resource at Shumagin for next summer (or even sooner), which will be carried out with or without a partner, as the warrants that are ‘in the money’ will allow Redstar Gold to top up its cash position to potentially over C$7M.

The author has a long position in Redstar Gold. Redstar Gold is a sponsor of the website. Please read the disclaimer