The most attractive feature of any precious metals project out there is probably the average grade of a project, as it might make or kill a project. When we’re talking about an open pit mine we’re already happy with grades of 1-1.5 g/t and an open pit mine with an average grade of more than 2 g/t is quite exceptional.

But imagine there’s gold and silver mineralization located near surface with an average grade of 27.4 g/t gold and 127 g/t silver, what would you think? Indeed, ‘wow’. And that’s the feeling we had when we started to dig deeper into Redstar Gold’s (RGC.V) Unga high-grade gold-silver project on the coast of Alaska. The project will require some more drilling to highlight its potential, but Unga seems to be one of the most intriguing high-grade exploration stories out there.

Unga, high-grade gold and silver on an uninhabited Alaskan island

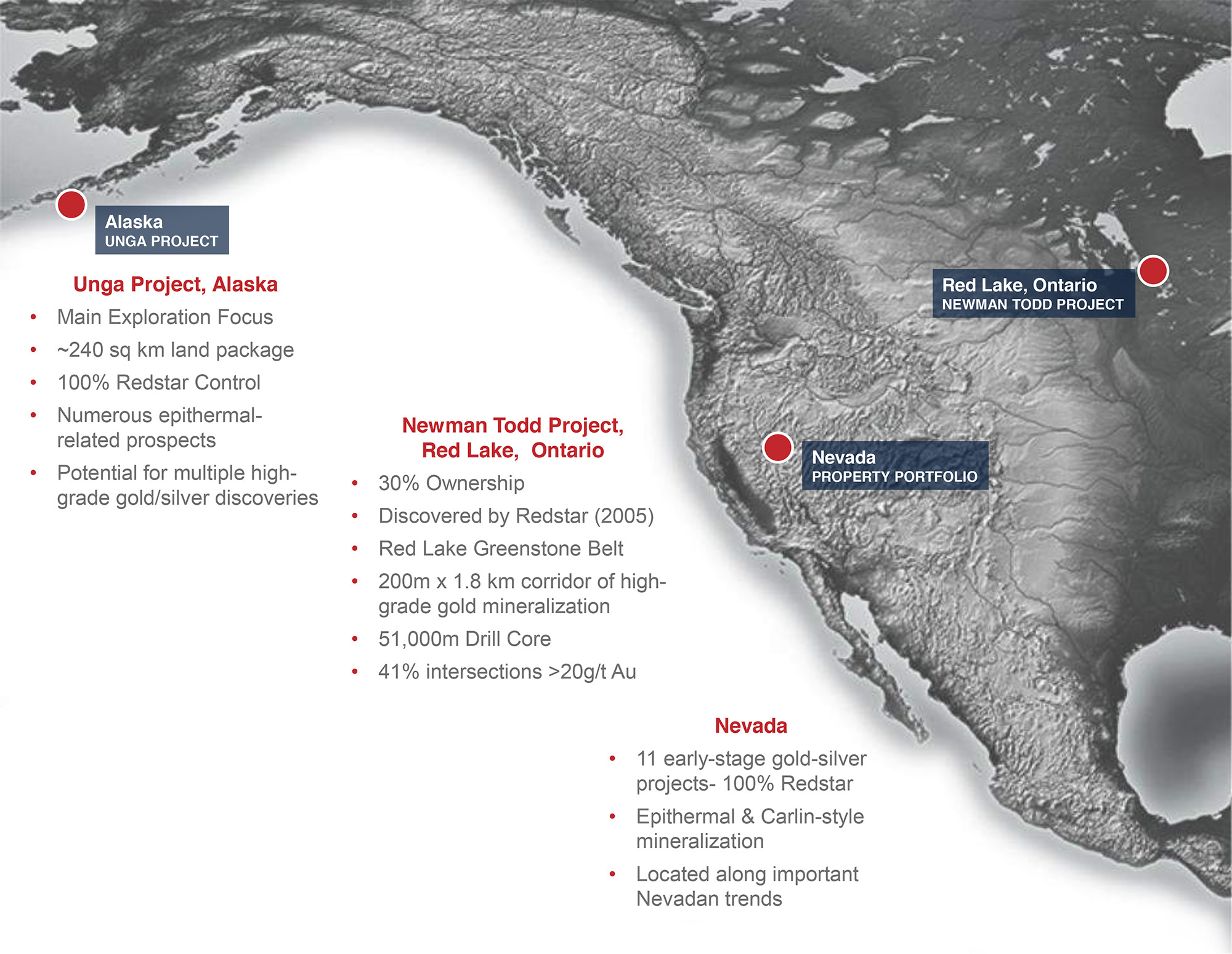

It’s pretty clear Redstar’s flagship project is the Unga gold-silver project. This project is located on Unga Island (as well as parts of Popof island) on the Alaska coast in the Aleutianislands. Even though you would associate Alaska with remote areas that are difficult to reach, Popof island actually has a regional airport at the community of Sand Point with an asphalted runway (5,300 feet long) which is capable of handling C-130 Hercules aircraft. On top of that, there are 6 commercial flights per week from Anchorage, operated by PenAir with Saab aircraft with a seating capacity of up to 30. That’s a dream for most exploration companies, specifically Redstar, where they can fly directly to their project, out of the airport on Popof Island. Infrastructure wise this makes everything so much easier and avoids a lot of logistical headaches! From the Sand Point airport, it’s just a short 15 kilometer helicopter or boat ride to Redstar’s claims on Unga Island but keep in mind the company’s Centennial project is almost literally located at the end of the runway.

Not only is the company’s location absolutely stunning, it’s remarkable to see how a small company like Redstar Gold was able to end up with this project. The Unga project was discovered in the late 1800’s and between 1891 and 1922, miners recovered approximately 150,000 ounces of gold from the high-grade Apollo-Sitka deposit (the average grade is expected to have been approximately 10 g/t). The Apollo-Sitka gold mine is actually the first high-grade underground gold mine in Alaska’s history. That’s remarkable considering the techniques used by these miners was very basic, resulting in a relatively inefficient mining operation. Redstar Gold moved to acquire the Shumagin property as well as the Unga-Popof property earlier this decade, consolidating its interest in a land package with a total size of approximately 250 square kilometers.

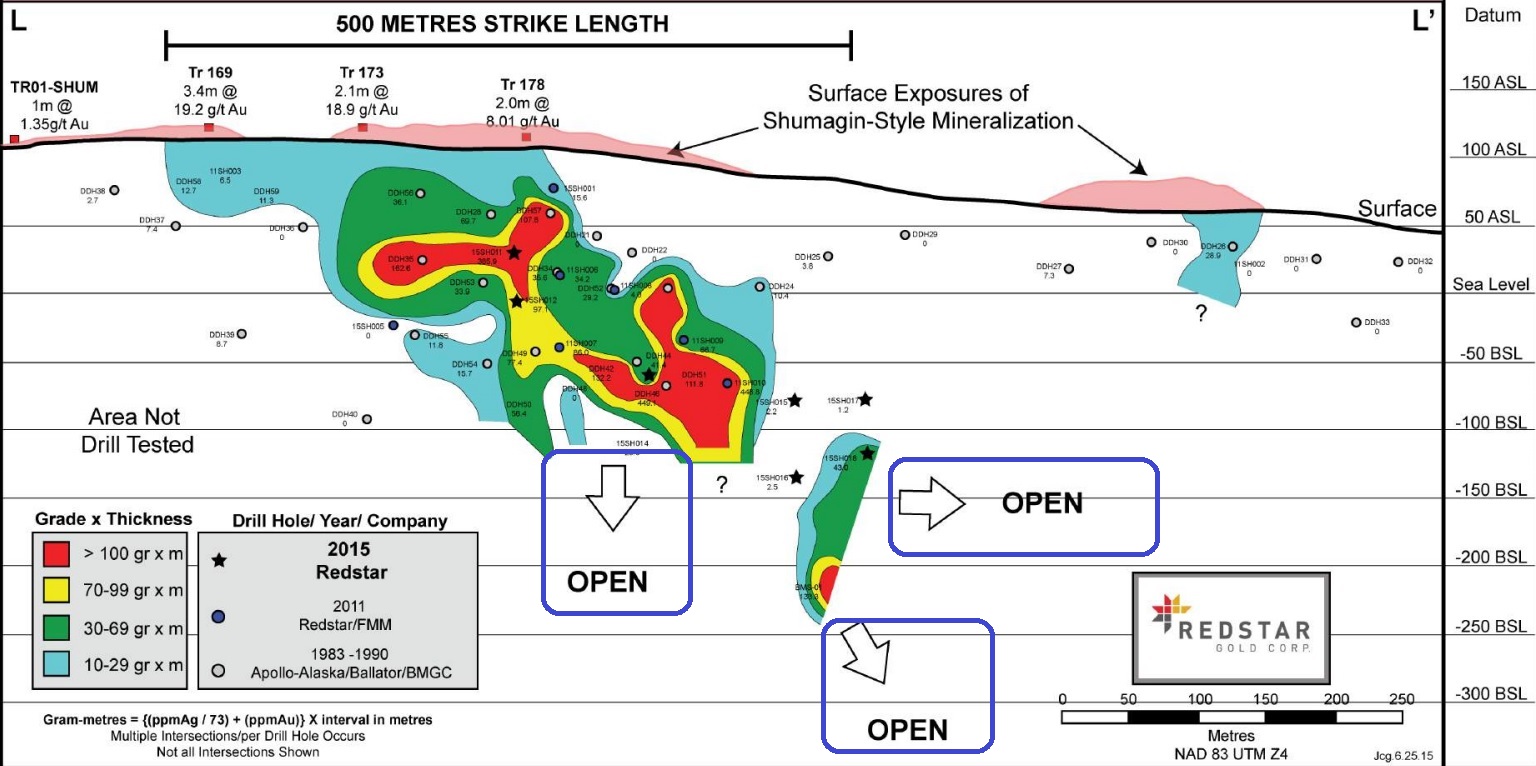

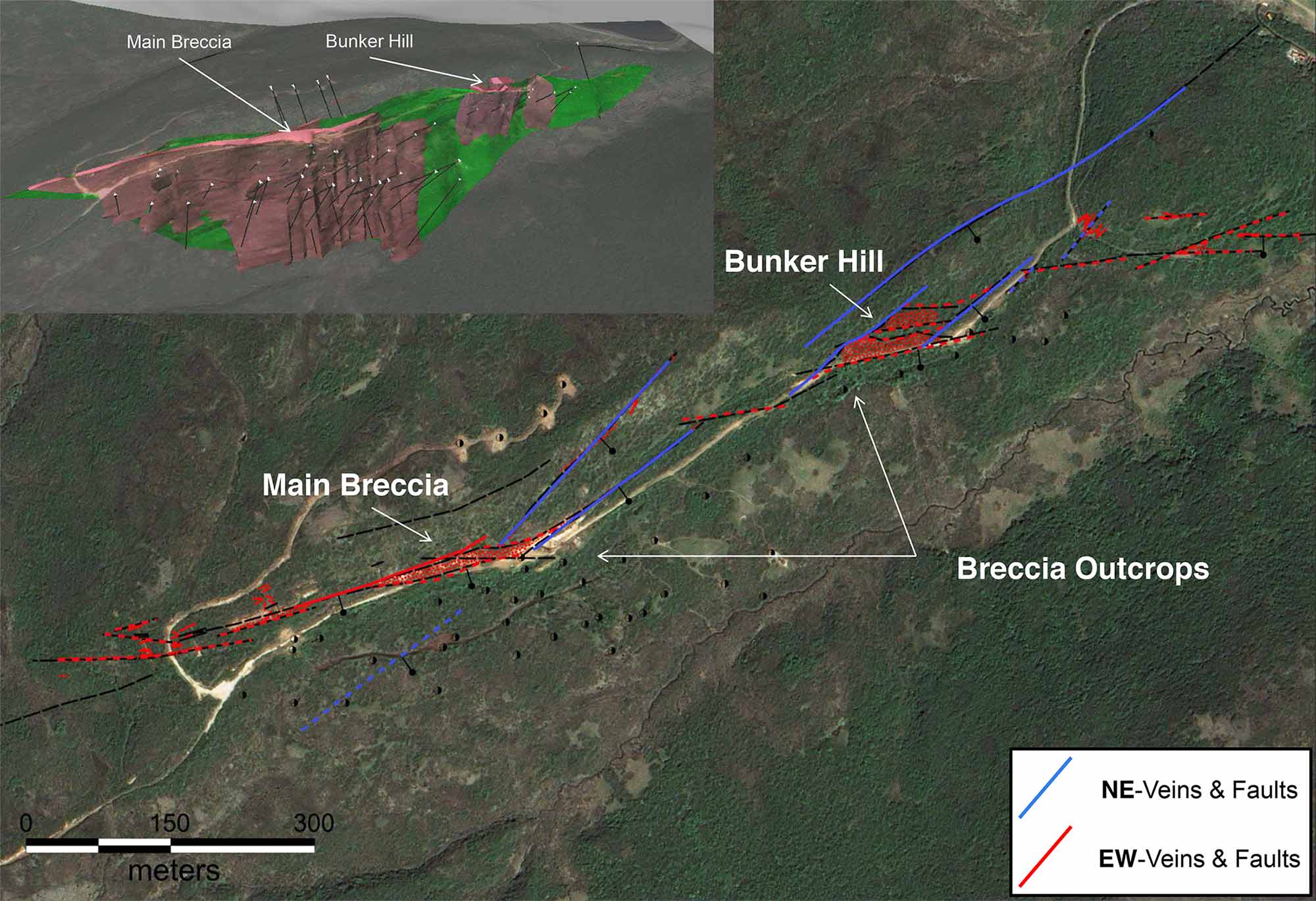

Whereas the mining activities in the early 1900’s were focusing on the Apollo-Sitka trend on the southern end of Redstar’s claims, it’s the Shumagin trend, 3 kilometers to the north west, that really caught our attention, as this zone seems to have all characteristics of a district scale project. The Shumagin trend is approximately 9.5 kilometers long and the main vein has been traced for over 1,200 meters to-date on surface making it easy to know where future exploration programs will have to focus on.

Keeping in mind the historic resource estimate contains almost one ounce of gold and 4 ounces of silver per tonne of rock, you would expect the veins to be very narrow, but nothing could be further away from the truth, as Redstar Gold has drilled some veins up to 7-10 meters in true width. This means that should the company be in a position to develop a mine plan further down the road, the average mining dilution should be quite limited considering the veins are pretty wide. Also, if you throw in the high grade mineralization, one can expect even a small portion of the known veins systems to contain a significant amount of gold as you don’t need a lot of tonnes to build up an inventory of ounces.

Size doesn’t really matter here

You know what the nicest thing is about having a very high average gold and silver grade? The size of a mining operation won’t be important at all. Whereas large low-grade mines need a high throughput to make up for the low grade, Unga’s average grade unlocks a lot of potential possibilities here.

A current historical resource is estimated to contain ~280,000 tonnes at an average grade of 28 g/t gold and 127 g/t silver, so you absolutely don’t need a throughput of 10,000 tonnes per day or even a 1,000 tonnes per day to have a viable operation. Even if you’d make a pro forma calculation based on a mill with a capacity of 250 tonnes per day, the operation would be viable, as the annual production rate (based on a recovery rate of 90% for the gold component and 70% for the silver) would be 70,000 ounces of gold and 250,000 ounces of silver, which is already quite respectable. The company is in the early stages of working in a project that may become a very robust mining operation as drilling defines similar grades and widths over the other known areas that have been seen at surface. With these types of deposits you just need to drill to find out how much gold and silver you really have.

In fact, the gross value of the silver in the ore is approximately $71/t ($50/t after applying an (arbitrary, we admit) recovery rate of 70%, which will be very useful to reduce the cash cost of the gold (on a net of the by-product credits basis). So you don’t need to have a huge throughput to make a high-grade project like this work. In fact, a lower throughput of just a few hundred tonnes per day might be preferred anyway, as it would allow the company to focus on the higher grade zones. Choosing quality tonnes over quantity usually is a winning mining concept!

Of course, you shouldn’t rely on these back of the envelope calculations as any potential mine plan will be based on an official NI43-101 compliant technical report, but we just wanted to highlight the potential of a relatively small low-capex operation thanks to the exceptionally high grade at Unga.

Redstar is getting ready for a summer exploration program

Redstar Gold has raised just in excess of C$1M in the second quarter, and the company intends to use these proceeds to fund its summer exploration program which will mainly consist of a sampling program over specific zones (new and known) at Unga island including Orange Mountain, Shumagin and Empire Ridge.

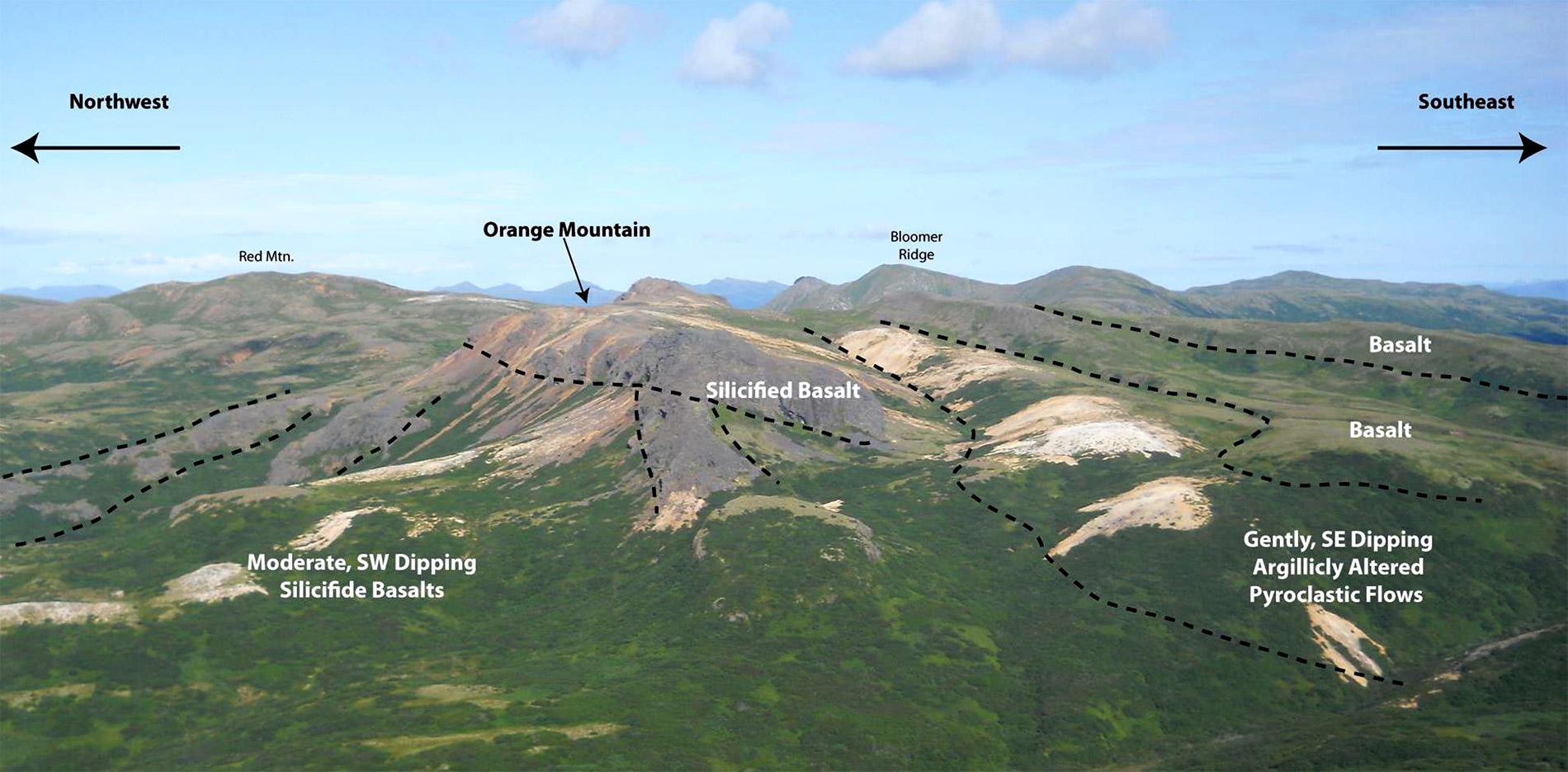

One of the company’s targets will be to get a better understanding of the structural formation of the Orange Mountain zone on the Shumagin trend. Orange Mountain isn’t a vein system but a so-called alteration zone with a total size of approximately 1- 2 square kilometer, which is pretty sizeable and definitely a good enough reason for Redstar Gold to try to find out what it really has there. Orange Mountain also happens to be along strike from the drilled Shumagin Zone, where exceptional grades were discovered in 2015.

It’s also important for you to realize Unga isn’t just ‘one type of mineralization’, but actually consists of different geological types. The majority of Redstar’s targets consist of intermediate epithermal vein systems (hence the high grades), but with Orange Mountain on the Unga island and Red Cove on the Popof Island, Redstar Gold also has some alteration zones on its land package. On top of that, Redstar also owns a ‘lottery ticket’ type of deposit as well, with Zachary Bay being a copper-gold porphyry system. Those usually tend to be relatively low-grade, but can be quite large (so economies of scale will be important there). Another zone that will be sampled this summer is Empire Ridge, which lies along strike of the historical Apollo-Sitka Gold Mine, where previous samples returned assay results of up to 400 g/t gold.

It’s pretty obvious Redstar Gold will initially focus on the high grade zones rather than trying to define a porphyry-based resource estimate, and we’re looking forward to see which drill targets Redstar will be able to outline based on this summer’s sampling program.

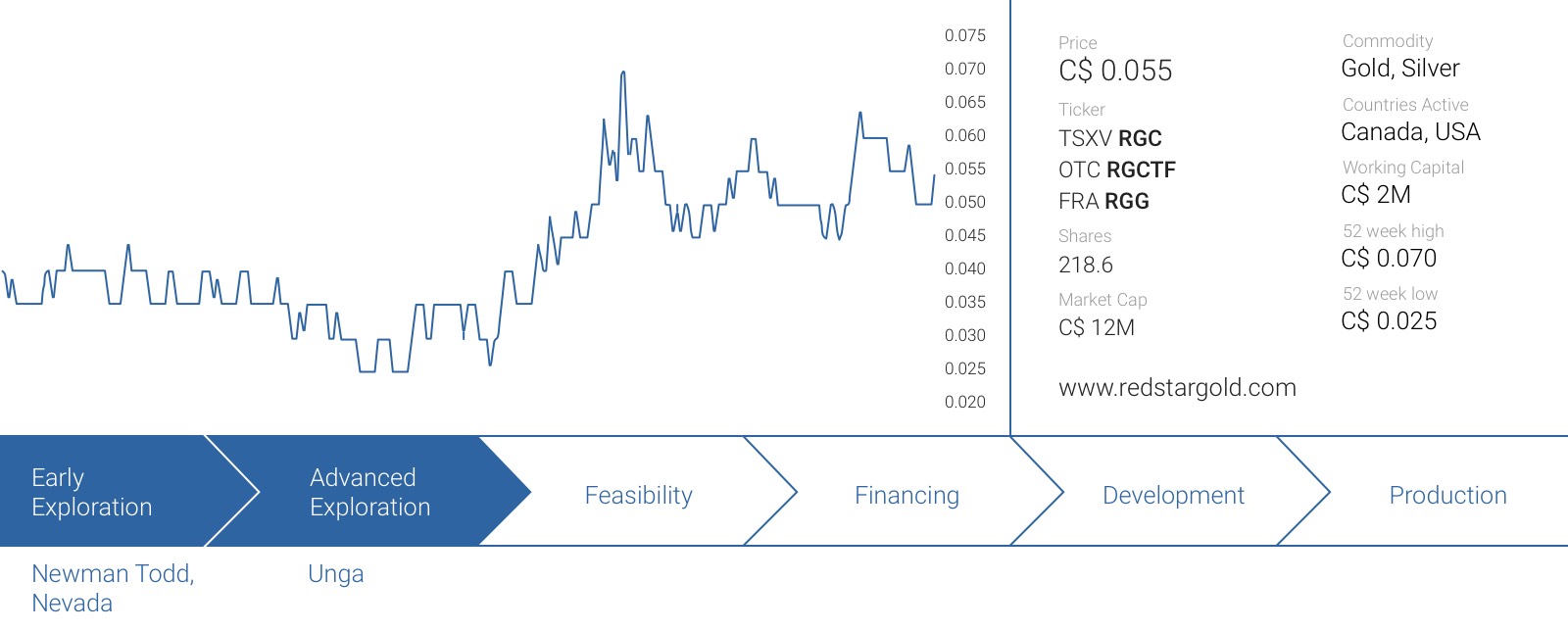

It would make sense to monetize the other assets in the portfolio

Redstar Gold isn’t a one-trick pony and even though its Unga project most definitely is the flagship project, it has some other assets in its portfolio, of which the Newman-Todd project in Ontario is probably the most widely known. Redstar currently owns 30% of Newman-Todd as joint venture partner Confederation Metals (CFM.V) has fulfilled its requirements to earn a 70% stake in the property.CFM looks now, with its recent consolidation, that it may be planning something, and we wouldn’t be surprised if Redstar and Confederation take efforts to push this project forward.

This project has over 150 holes drilled into the Newman-Todd structure, where over 41% of the holes intersected grades over 20 g/t Au. And yes it is located in the Red Lake Gold Camp, one of the richest gold camps in the world. Next door, another company called West Red Lake Gold Mines (CNSX: RLG) is drilling what is known as part of the Newman Todd structure.

The same thing will probably also happen with Redstar’s assets in Nevada which could still be considered to be in the early stage exploration phase. It’s great to have them, but since Redstar recently hired Peter Ball as its new CEO, we have the impression the company is now fully focused on Unga (which absolutely makes the most sense).

So even though Redstar has other assets besides Unga, we currently consider none of these assets to be a core project for the company and we wouldn’t be surprised if Redstar would divest all of them within the next couple of quarters.

Executive Chairman Vaillancourt has a lot of skin in the game

Besides owning a high-grade gold and silver project on an uninhabited island in a mining-friendly Alaska, there’s something which makes Redstar Gold stand out. The company’s executive chairman, Jacques Vaillancourt, is one of the major shareholders of the company with in excess of 31 million shares, giving him a total stake of almost 15% of Redstar Gold.

We always like it when the management of a company puts its money where its mouth is, and Vaillancourt is an excellent example here. Forget about getting cheap 1 cent founders shares as he built his position on the open market, continuously supporting the company in its efforts to advance the projects. He also acquired an additional 2 million shares of Redstar Gold by participating in the private placement which closed in April, for an additional investment of C$120,000 in the company. Talk about commitment! Mr. Vallaincourt ran the BMO and HSBC Global Equity and Mining desks out of London for over 30 years and has been involved in over $30B in financings.

Now he has turned his experience to building a precious metals exploration and mining company, amongst running a couple investment funds. We had the opportunity to meet Mr. Vaillancourt and Mr. Ball at PDAC in Toronto, Canada in March, where both were side by side for the 4 days as a lot of interested people stopped by the booth to have a look at the high-grade core.

And Vaillancourt isn’t the only strong shareholder, as basically in excess of half of the company’s shares are in pretty strong hands with US Global (USA), Geologic Resource Partners (USA), Gold 2000 (Switzerland), Odey Asset Management (London) and Gabelli Gold (USA) owning almost 35% of the shares as well. That’s a great vote of confidence, and it does indicate the smart money does agree the Unga project looks extremely promising, as there’s no other way to explain why these funds would invest in a company with a market capitalization of less than C$10M at the time the investment decision was made.

Conclusion

Redstar now has a working capital position of in excess of C$1M and this will enable the company to complete its summer exploration program at the 100% controlled Unga Island, which could be one of the most overlooked high-grade gold projects in a safe jurisdiction with excellent infrastructure in the past few years. In excess of half of the company’s shares are held by ‘strong hands’ which is one of the reasons why the volume on the market is quite low, but we actually see this as an encouraging sign; how often do you see a chairman owning 15% of an exploration company? And how often would you see said chairman buying more stock in placements to inject more cash in the company? Not very often.

Redstar is quite prudent with its cash resources so you shouldn’t expect the company to go out there and start a multi-million dollar drill program. Not at all, as Redstar has a methodological approach to make sure that whatever it does, it will be accretive to its shareholders. The gold and silver is there, the only question is how much there is! And finally, it’s our understanding several parties have already visited the Unga Island, so even though Redstar Gold is a small company, it definitely has already attracted the interest of larger players in the sector.

The author holds a long position in Redstar Gold. Redstar Gold is a sponsor of the website. Please read the disclaimer