After about a decade of drilling and numerous resource updates with each update better than the preceding one, Southern Silver Exploration (SSV.V) has finally published a Preliminary Economic Assessment on its flagship Cerro Las Minitas project in Durango. This polymetallic project offers interesting exposure to not just silver but zinc, as both metals are providing almost equal revenue contributions. And at the current spot price, the zinc revenue will be higher than the silver revenue and Cerro Las Minitas technically is a zinc project with a strong silver component. Of course, at $25 silver and $1.50 zinc the situation would reverse again so the best way to look at Cerro Las Minitas is to consider it a silver-zinc project although the case could be made to look at it from a silver perspective with a (very substantial) zinc credit.

Looking at the details of the PEA

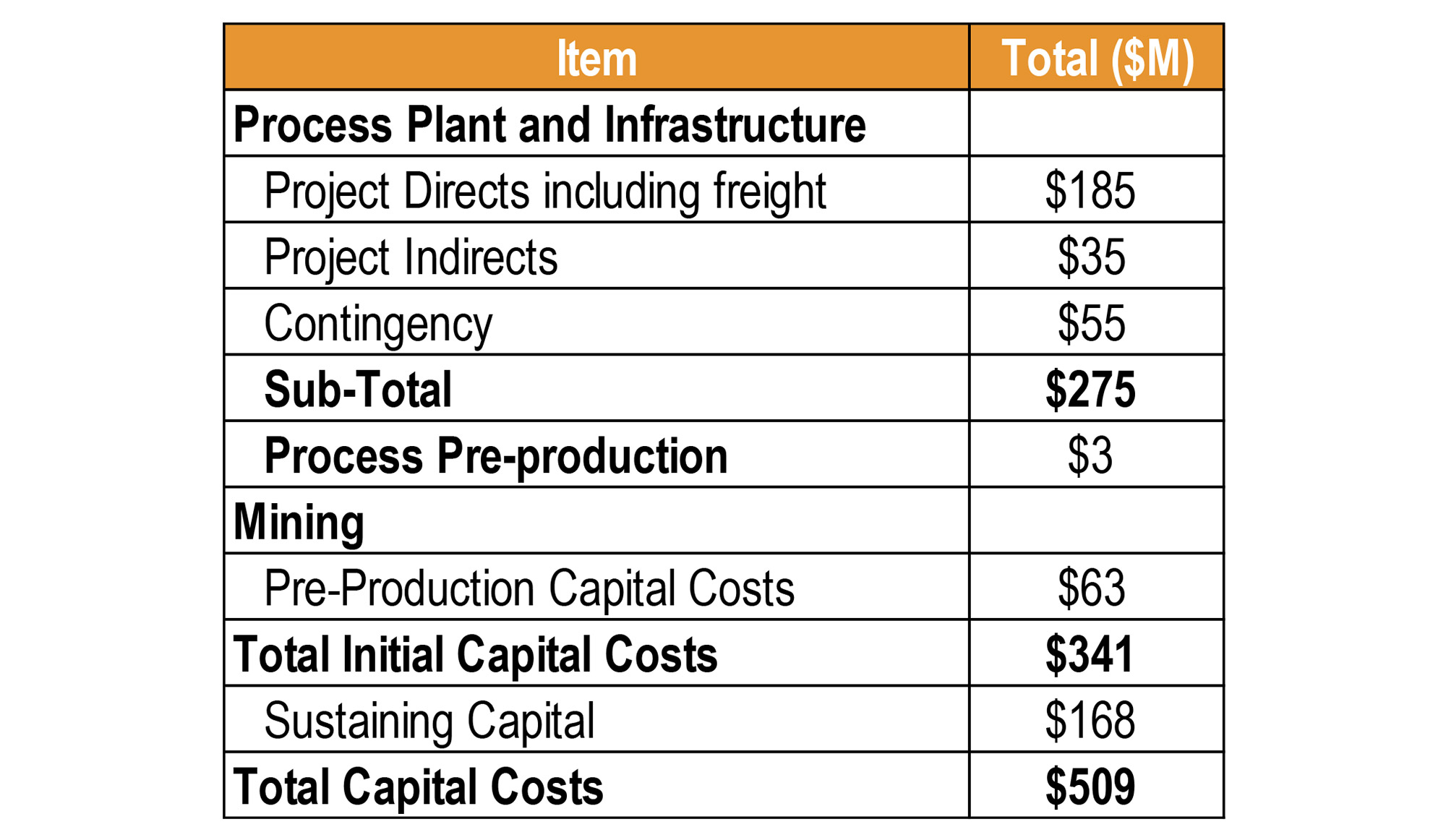

Southern Silver used a silver price of US$21.95 and a zinc price of $1.33 per pound as its base case scenario, and those are very acceptable long-term prices (we’ll discuss the sensitivity analysis in a little bit). The initial capex for the 4,500 tonnes per day operation is estimated at US$341M. This includes the equipment capex but also already includes the US$63M mining costs associated with the underground workings to access the first ore. Keep in mind the mill will be able to produce up to 5,500 tonnes per day in ‘short bursts’ and Southern Silver expects to beat the official nameplate capacity of 4,500 tonnes per day.

Of interest above is that the equipment capex (project directs and indirects) are estimated at just US $220M and a 25% contingency was slapped onto that. That’s remarkable as most contingency allowances we see tend to hover around 10-12%. By using 25%, Southern Silver already appears to be taking potential further inflationary impacts into consideration. Read: that capex number is pretty robust). The pre-production mining costs and sustaining capex (which will be related to the continuous underground development) came in lower than expected so that’s a little bit of a windfall.

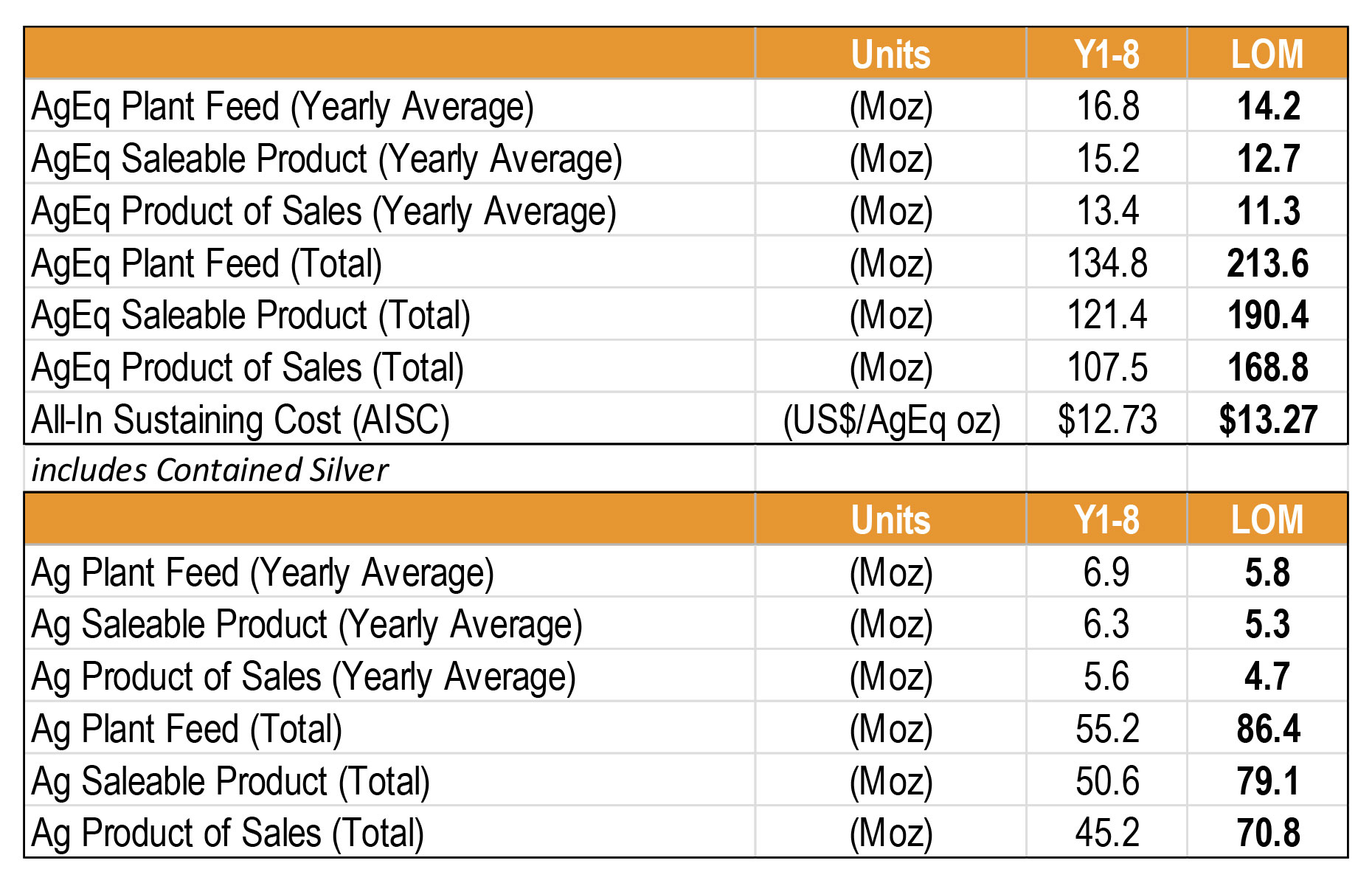

The ‘plant feed’ of 14.2 million ounces silver-equivalent mentioned in the press release is actually irrelevant, especially as the bullet points in the update correctly use an AISC per sold ounce of silver-equivalent. It doesn’t matter how much silver goes into the plant, the only thing what matters for an investor is what’s coming out on the other side and that’s 12.7 million ounces of silver equivalent. Of those 12.7 million ounces, about 11.3 million ounces silver-equivalent will be payable after deducting treatment and refining costs and penalty charges.

In order to simplify the message and avoid any confusion, Southern Silver should simply publish the total payable production rate of 11.3 million ounces of silver-equivalent and keep the message clear and consistent. The AISC of $13.27 per ounce of silver-equivalent sold relates to the 11.3 million ounces anyway. And according to our calculations, if we would look at Cerro Las Minitas on a silver-only basis, the 4.7 million ounces of silver would be produced at an all-in sustaining cost of just US$1-1.5/oz after taking the by-product credits into account.

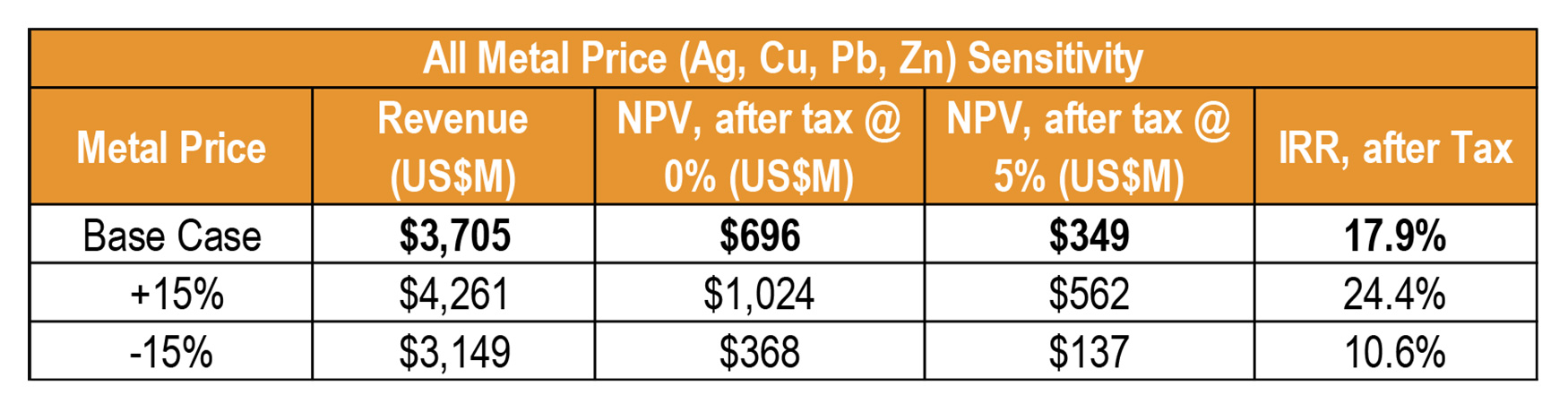

This results in a total after-tax NPV5% of US$349M using the base case prices of $21.95 for silver, $1.33 for zinc, $0.94 for lead and $3.78 for copper.

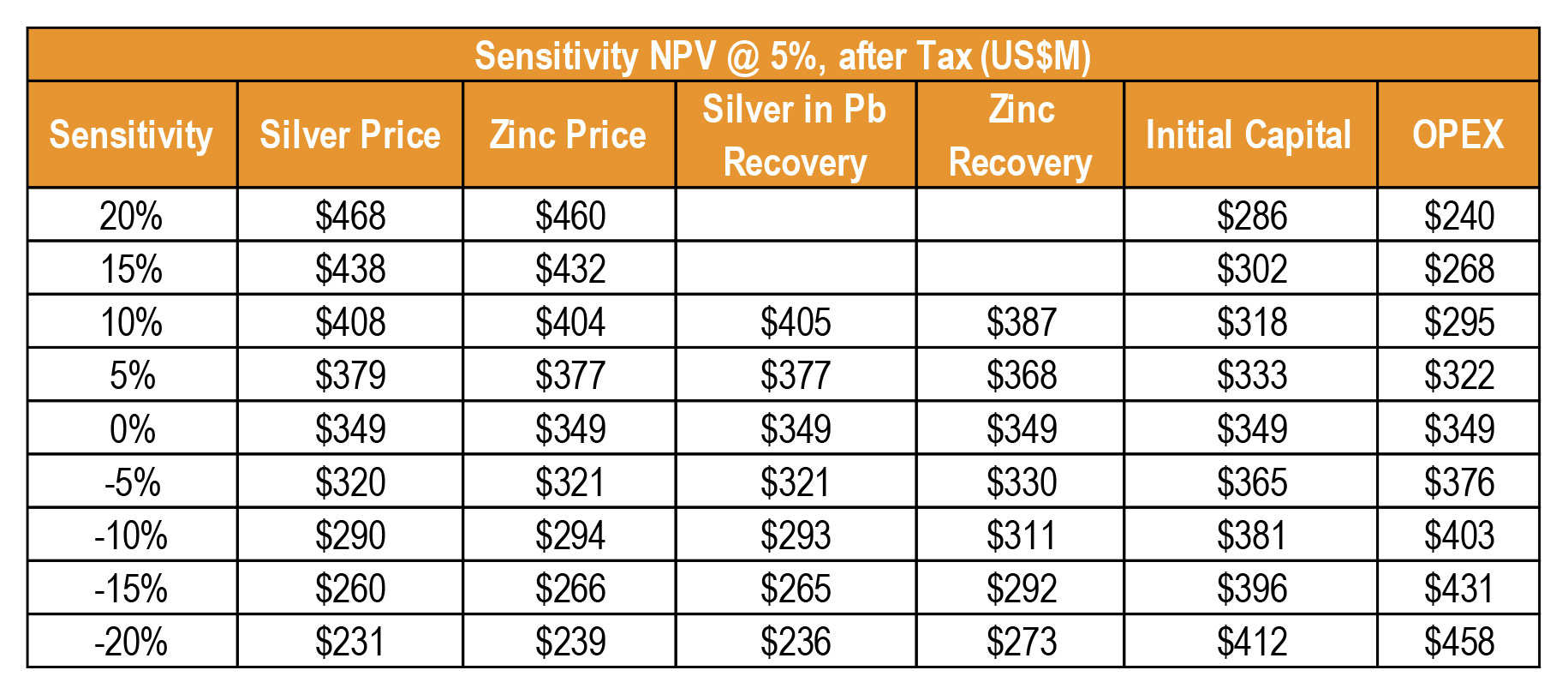

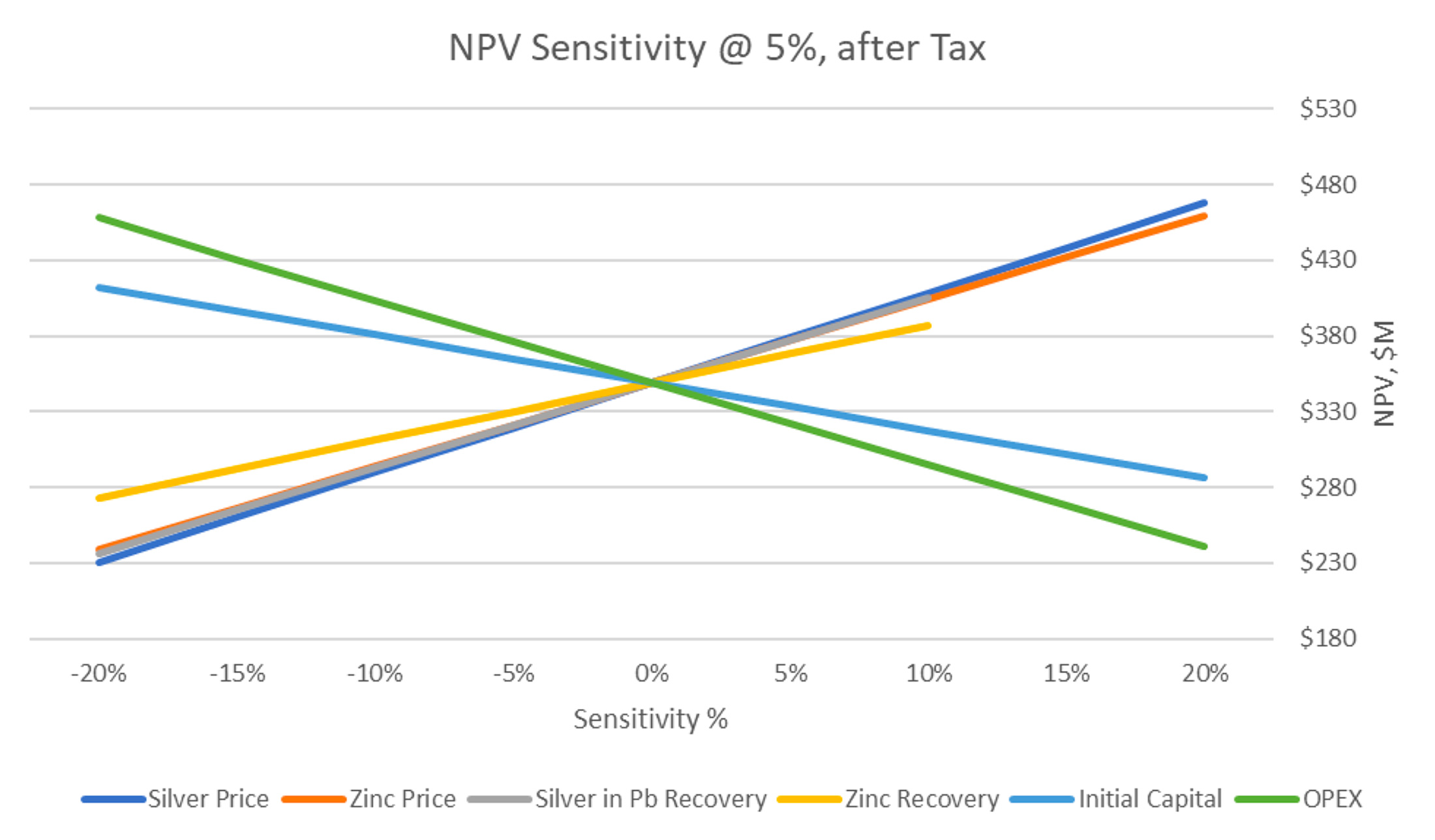

And kudos to Southern Silver for providing an excellent sensitivity analysis table with a multitude of options to choose from. We have highlighted the base case below.

This allows us to play around with a few scenarios. At the current spot price of just under $19 for silver but around $1.60 for zinc, the NPV will lose about $89M due to the lower zinc price but gain about $111M thanks to the higher zinc price to end up with an after-tax NPV5% of approximately US$370M.

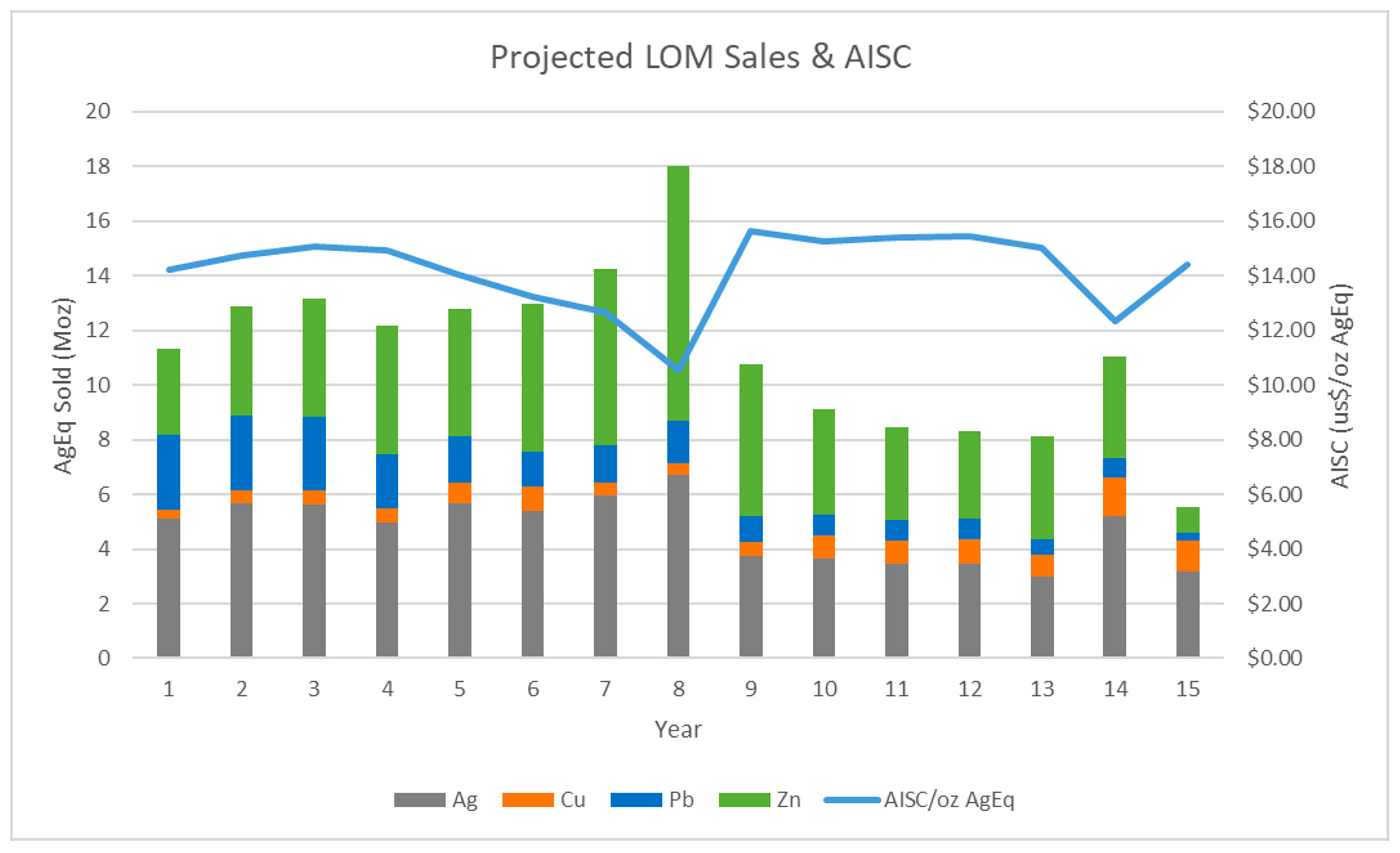

Are you bullish on silver but slightly bearish on zinc? Using a $25/oz silver price (+15%) and a $1.20 zinc price (-10%), the NPV will gain about $89M on the silver side and lose about $55M on the zinc side for a net increase of approximately $34M to end up with an after-tax NPV5% of around $380M. Of course that’s not exact science as some years will be zinc heavy and others will be more silver rich depending on which zones are being mined as you can see below. So consider this ‘combined’ sensitivity analysis whereby we use different sensitivities on the metals as just ‘background’.

The image above also shows year 8 will be the best year in terms of silver-equivalent output (with a total of 18 million ounces silver-equivalent on a payable basis, including 6.7 million ounces of actual silver. That’s a pity because reaching this new zone in Y8 means the cash flows in this year are already heavily discounted. Assuming a two year construction period, cash flow in year 8 is discounted by a factor of 1.05^10, so 1.63. This means that if for instance US$125M of free cash flow is generated (this is an arbitrary number to explain the impact of a discount rate), it will only contribute US$125M / 1.63 = US$77M to the NPV. If this area would have been mined in Y4 (which it won’t, to be clear!), the contribution to the NPV would have been US$93M or approximately US$16M higher. Timing is important and to illustrate this, Southern Silver has also provided the undiscounted cash flows.

As you can see above, excluding the 5% discount rate, the net present value on an after-tax basis is US$696M. This means that once you add back the US$341M in capital expenditures, the sum of the cash flows exceeds US$1B in the base case scenario, and approaches US$1.4B in a +15% commodity price scenario. Of course you cannot just use undiscounted cash flow, that would be a bridge too far. But the timing of the cash flows plays an important role.

How do these compare with our March calculation?

In March, we ran the numbers again on Cerro Las Minitas to get a better understanding of what we could expect from the PEA and it’s always interesting to look back to see where we were wrong or what is materially different from our assumptions.

We actually ended up with a NPV7% of US$342M so seeing US$349M as final result is pretty close to what we had anticipated but with the caveat we used a higher discount rate. If Southern Silver would have used a 7% discount rate, the NPV would have come in below our expectations.

The explanation isn’t too difficult. A lot has changed since March and life hasn’t gotten cheaper. Although we are pleasantly surprised by the capex of just US$341M versus the US$400M we used, the operating expenses are slightly higher than we anticipated. In our calculations we expected a total cost of $66/t but in the PEA a total operating cost of US$80/t is used. It looks like we underestimated the operating cost ($39/t vs $25/t) but fortunately a lower than anticipated processing cost ($15 vs $17) and a lower G&A expense ($3.5/t vs $5/t) saved the day. Also keep in mind the company added the treatment and refining charges to the operating cost (in our model we deducted the TC/RC expenses from the revenue), so all things considered, we weren’t too far off.

Another explanation for why the NPV is coming in slightly below our expectations is the metals price used by Southern Silver. We ran our scenario at $23 silver while SSV used $21.95 as its base case scenario. And as we established before, a 5% increase in the silver price (from $21.95 to $23.15) would add US$30M to the NPV. So if we would be able to compare the results using the exact same metrics, the PEA outlines an economic scenario that’s almost exactly the same to our model from March.

Finetuning

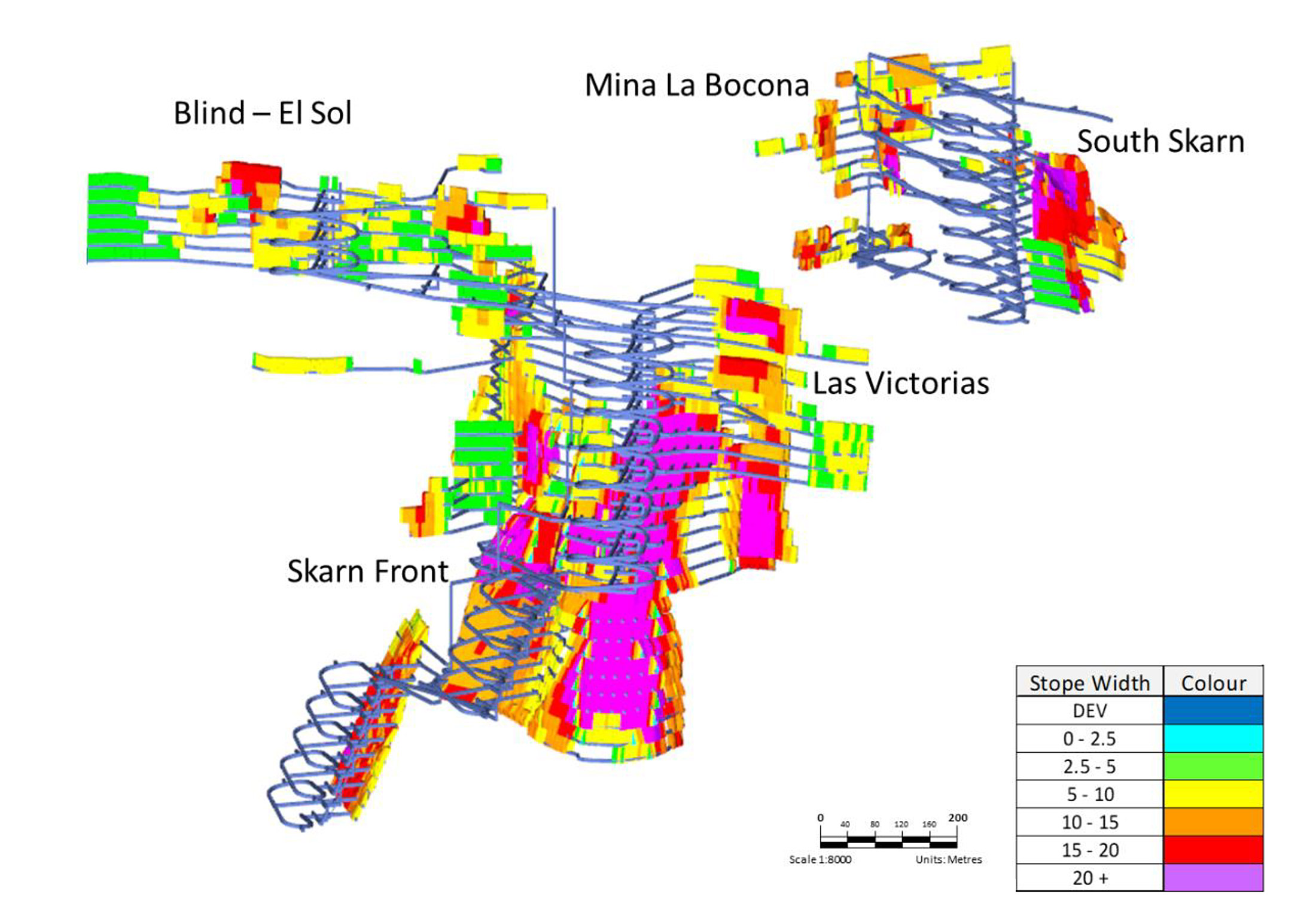

The easiest opportunity to add value is bringing more tonnes into the mine plan. According to the current mine plan, the total processing rate in the first eight years of the mine life will be 1.8 million tonnes per year followed by 1.44 million tonnes per year in the final seven years. This means a total of 24.5 million tonnes will be processed during the mine life.

The total resources at Cerro Las Minitas currently stand at 32 million tonnes which means that about 20% of the resource is not included in the mine plan. While we can reasonably expect a bunch of tonnes to get dropped from a mine plan as a company progresses from a PEA to a PFS to a FS (it’s just the nature of the beast as not all inferred ounces will make it into a final mine plan), keep in mind recent drill results have confirmed the presence of additional mineralization at Cerro Las Minitas. Meanwhile, the mineralization also remains open at depth at most zones so there definitely is additional upside exploration potential which will help to mitigate the impact of tonnes being dropped from the mine plan. And for every additional year that could be added to the current scenario, the after-tax NPV5% will likely increase by around US$25-30M.

The risk of some of the inferred tonnes falling outside the mine plan in a pre-feasibility and feasibility study can also be mitigated by completing additional infill drilling which undoubtedly will be on the menu in the next few years.

An additional kicker could come from the gold component of the resource. Recent metallurgical test work indicated that a pyrite and arsenopyrite rich concentrate could be produced and this concentrate could contain up to 80% of the in-situ gold. This refractory gold could potentially be recovered and sold but this is still subject to additional studies. To be clear: at this point gold is NOT considered in the PEA due to the uncertainty around the recovery method.

And while producing a pyrite concentrate will generate additional revenue, it isn’t the holy grail for this project as only about 75-80,000 ounces of gold will be fed to the mill over the 15 year mine life. Recovering 80% would result in 60,000 recoverable ounces, or approximately 4,000 ounces per year. While it would add value, the additional NPV5% on an after-tax basis would likely be just around $20-30M over the entire mine life. Interesting, but not a game changer.

The balance sheet

Southern Silver’s balance sheet is still in an excellent shape. The most recently filed financial results provide an overview of the company’s year-end situation at the end of April. While we realize that’s four months ago and the company clearly will have spent money on drilling in those past few months, the total working capital position of almost C$11M was a comfortable position to be in.

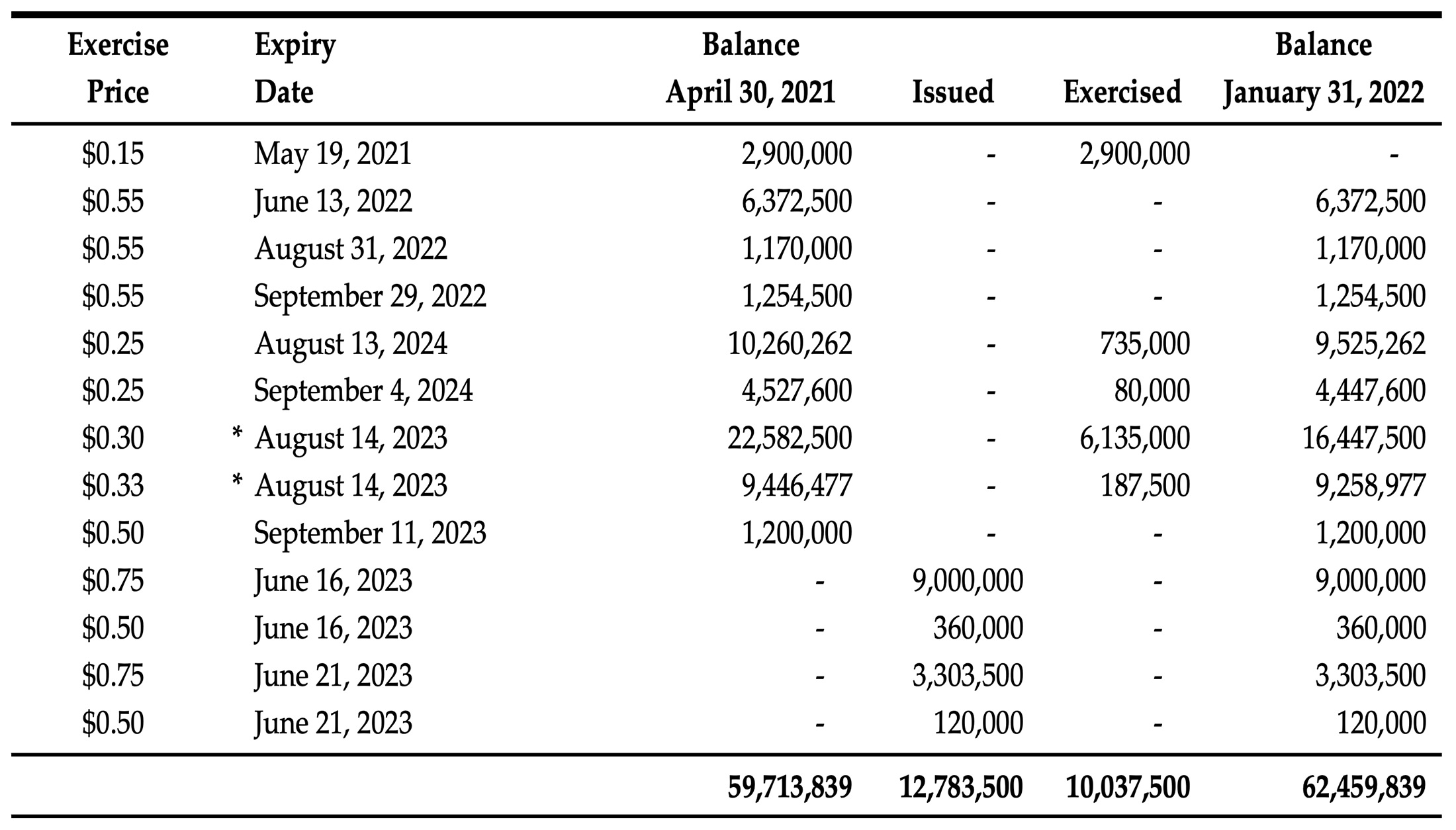

Unfortunately the low share price also means we shouldn’t really expect any cash proceeds from warrant exercises. While some shareholders will be happy to see the fully diluted share count go down, we wouldn’t have mind seeing the recently expired 7.5M warrants at C$0.55 been exercised. As of the end of April, the total warrant count was 62.5M but by the end of this month, 8.75M additional warrants will have expired.

Conclusion

If we would use the company’s base case scenario with US$21.95 silver and US$1.33 zinc, the after-tax NPV5% comes in at US$349M. That’s approximately C$450M at the current exchange rate and divided over the current share count of 292M shares, the NPV/share exceeds C$1.50 according to the official study. What would be a fair NPV multiple at this point? 0.20? 0.25? In those cases the fair value per share would be C$0.31-0.40 as the company is currently valued at 0.12 times the NPV in the base case scenario. And as Southern Silver advances this project, that multiple ratio should increase as boxes are ticked.

While the PEA does not contain a ‘wow-factor’, it does appear to be a robust study. The 25% contingency in the capex calculation provides an additional layer of safety while using a silver price of $22 isn’t extraordinarily optimistic. The zinc production is a nice bonus here because even if one would use a silver price of just US$17.5 per ounce while keeping the zinc price unchanged, the after-tax NPV5% would still exceed US$200M as the combination of a precious metal and a base metal is providing torque on both metals.

Exploration is ongoing and recent drill results have indicated the presence of more continuous mineralized systems in areas that aren’t included in the resource nor in the PEA just yet, so there still is additional upside potential. This Preliminary Economic Assessment provides a nice starting point to continue to build the project and the company.

Disclosure: The author has a long position in Southern Silver Exploration. Southern Silver Exploration is a sponsor of the website. Please read our disclaimer.