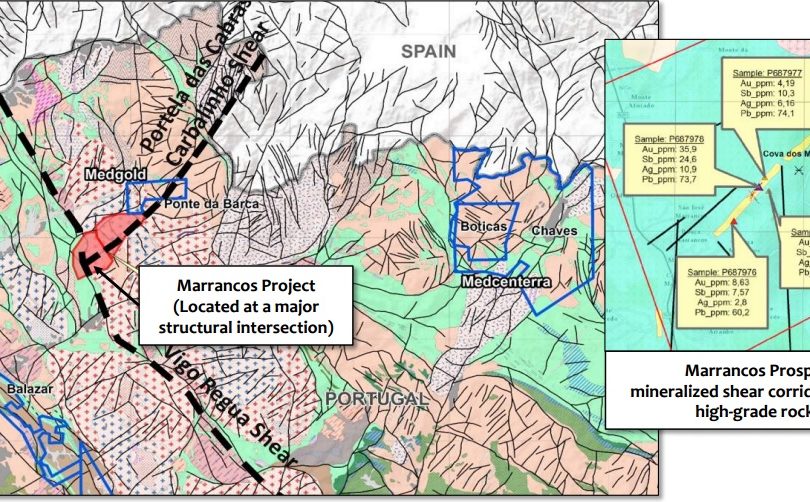

Medgold Resources (MED.V) has released some sampling results from a chip channel sampling program at its Marrancos project in Northern Portugal. The exploration program was designed to test a set […]

Tag: #Serbia

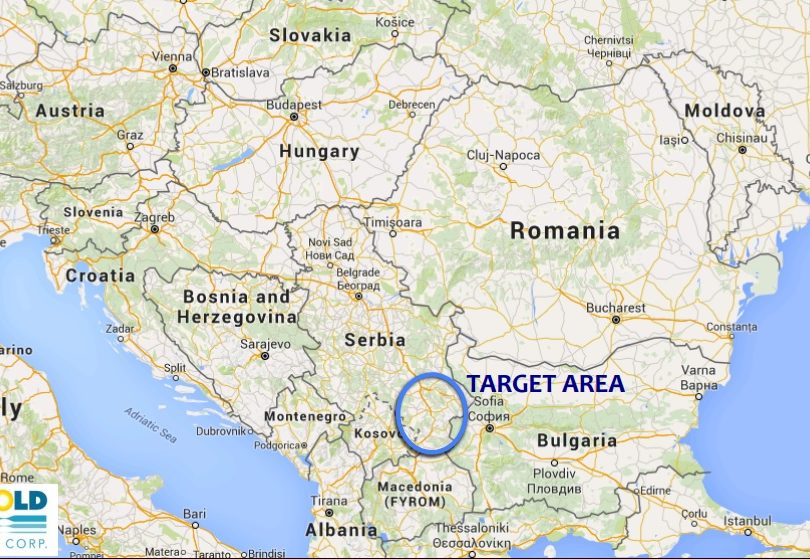

Medgold is teaming up with Fortuna Silver to explore in Serbia

Medgold Resources (MED.V) has signed an agreement with Fortuna Silver (FVI.TO, FSM) whereby the latter has invested C$1.5M in Medgold by purchasing 10 million units priced at C$0.15 per unit. […]

Columbus Copper is selling its Turkish assets

Columbus Copper (CCU.V) has announced it has reached an agreement with Teck Resources (TCK) whereby the latter will buy all of Columbus’ Turkish assets for a $1M consideration. A non-refundable […]

Columbus Copper is swapping its Serbian exploration assets for First Quantum’s stake in Bursa

Columbus Copper (CCU.V) has announced it has entered into an agreement with First Quantum Minerals (FM.TO) whereby the latter agrees to give Columbus Copper its 20% stake in the Bursa […]

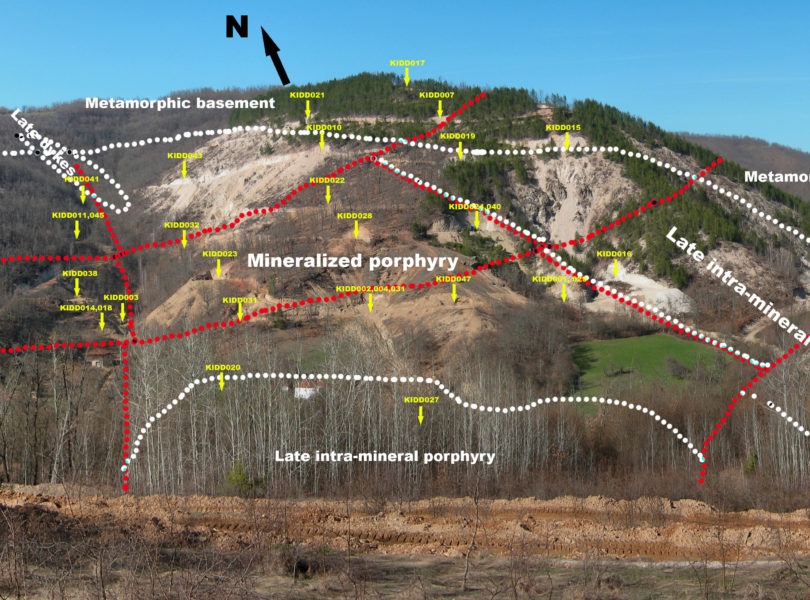

Dunav increases resources and merges with Avala Resources

Dunav Resources (DNV.V) has announced a resource update on its Kiseljak and Yellow Creek deposits in Serbia. The total resource estimate now stands at 2.8 billion pounds of copper and […]

Euromax Resources is spiking

Back in April, we recommended to average down a position in Euromax Resources (EOX.V) at C$0.10. Since the company has released the results of a very decent pre-feasibility study late […]

EurOmax updates the Ilovitza resource estimate

EurOmax Resources (EOX.V) has released an updated NI43-101 compliant resource estimate on its 100% owned Ilovitza copper-gold project in Macedonia. The company was able to increase the tonnage in the […]

Columbus Copper is now a real prospect generator

Columbus Copper (CCU.V) has announced it has signed an agreement with First Quantum Minerals (FM.TO, LON:FQM) whereby First Quantum can earn an interest of up to 80% in the company’s […]