Shareholders of Helio Resource (HRC.V) had been waiting years for a deal to materialize, but Shanta Gold (SHG.L) has now (finally) made an offer to acquire Helio in an all-share deal.

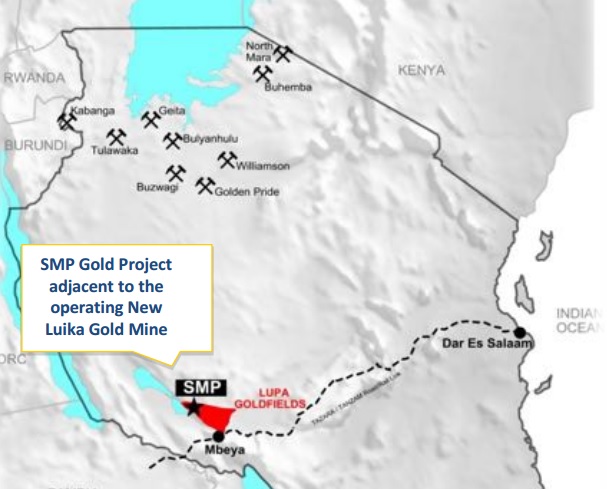

Shanta Gold is offering 0.227766 new shares of Shanta per share of Helio to get its hands on Helio’s SMP gold project in Tanzania, which is located within wheelbarrow distance from Shanta’s existing processing plant. Helio’s 635,000 ounce resource estimate (with 332,000 open pit ounces at an average grade of 1.8 g/t gold) is appealing for Shanta as it will allow the company to keep its mill running at full capacity whilst the company continues to explore the wider New Luika region.

That being said, this transaction really looks like Helio’s management and shareholders are finally throwing in the towel (taking a haircut considering the most recent private placement in 2014 was conducted at C$0.05 per share). The company hasn’t filed its full-year financials for the year ending in March 2017 yet, but at the end of calendar year 2016, the company still had a positive workin capital position of approximately C$600,000.

So Helio is really throwing in the towel when you look at the valuation. Shanta Gold’s current share price is 7.32 pence, and 0.227766 times this results in a value of 1.67 pence per share of Helio. Using the current GBP/CAD exchange rate of 1.68, the CAD-equivalent value of the transaction is approximately C$0.028, a 7% discount compared to yesterday’s closing price of C$0.03.

The transaction values Helio at C$7.3M or US$5.5M which is approximately US$9 per ounce in the ground (but Shanta Gold obviously won’t be able to add every single ounce in its updated mine plan, so the transaction cost per recoverable ounce will be around US$20). Is it a good deal for Helio shareholders? No. But it probably is the best deal possible.

Go to Helio’s website

The author has no position in any of the companies mentioned. Please read the disclaimer