Imperial Metals (III.TO) has been able to avoid financial hardship by selling a 70% stake in the Red Chris copper-gold mine in British Columbia to Newcrest Mining (ASX:NCM) a major gold and copper producer with its main operations in Australia. From Imperial’s side, this transaction was absolutely necessary to secure and protect its future as the US$807M will help the company to erase its net debt which was pretty much paralyzing the company. As of the end of September 2018, Imperial Metals had a total gross debt of C$873M, and its cash interest payments in the first nine months of 2018 totalled C$58M. Needless to say selling a majority stake in Red Chris to an experienced mining company should clean up the balance sheet as Imperial Metals will end up with a net cash position and a minority stake in Red Chris.

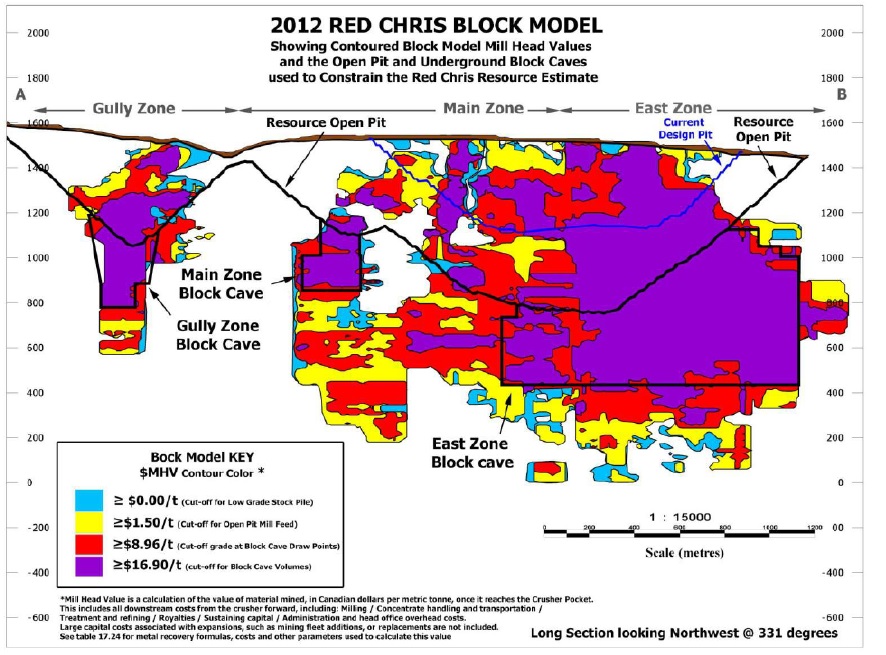

But why is Newcrest Mining so interested? The total resource estimate contains in excess of 20 million ounces of gold as well as 13 billion pounds of copper, but the majority of this resource is situation below the open pit which means it very likely will not and cannot be mined using the pit.

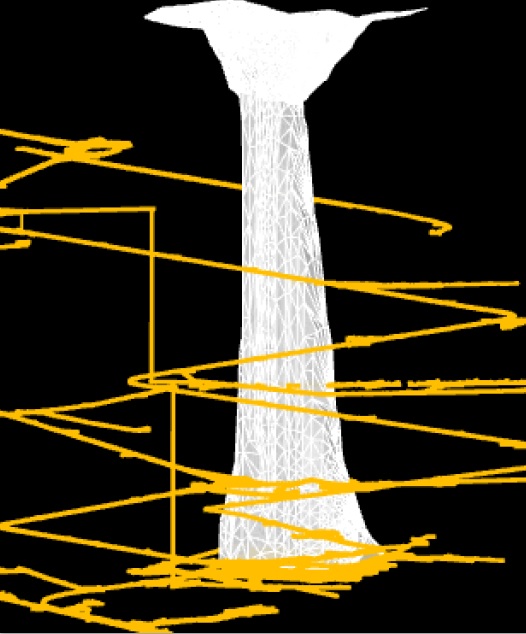

And that’s where Newcrest comes in. The company has decades of experience using the block cave mining method which it has successfully applied in Australia where it has now reached a depth of almost 1.5 kilometers at its Cadia copper-gold operations. Despite that depth and the relatively low grade (the average grade of Cadia East is just 0.36 g/t gold and 0.26% copper, so that’s a very similar grade to Red Chris), the mine remains very profitable for Newcrest, and the company is now looking to apply its expertise on similar deposits around the world, and it seems to think it will be able to apply its operational expertise on Red Chris.

The resource estimate at Red Chris hasn’t been updated yet, but back in 2015 it contained 1 billion tonnes at an average grade of 0.35% copper and 0.35 g/t gold in the measured and indicated categories, as well as an additional 700 million tonnes in the inferred resource at a slightly lower grade of 0.29% copper and 0.32 g/t gold. Using the average grade of the measured and indicated resource, the gross rock value based on $2.90 copper and $1300 gold is US$37 per tonne, so a very efficient block cave model could work, but it all depends on the operator. We wouldn’t have been too impressed if Imperial Metals would like to give it a shot themselves, but Newcrest definitely has the technical skills to improve the odds to making this work.

Additionally, Newcrest has identified additional ways to optimize the operating performance at Red Chris:

Newcrest has also ‘identified opportunities’ to expand the resource at Red Chris at depth and along strike and also thinks there’s a good chance of finding additional copper-gold porphyry deposits on the greater Red Chris land package that could be satellite deposits to ‘feed the mill’ which has a capacity of 11 million tonnes per year.

From Imperial Metals’ perspective, it’s clear why they wanted/needed to sell a majority stake, as this allows it to repay most of its debt while retaining exposure to the Red Chris mine under Newcrest’s operatorship. From Newcrest’s point of view purchasing a 70% stake in a 1.5+ billion tonne asset also makes sense as the mine life has the longevity a major player would want, and on top of that, Red Chris is located in a Tier-1 mining country. However, Newcrest will have to show it knows what it’s doing to justify the US$807M purchase price.

And there’s one additional bottom line. Newcrest has substantial stakes in SolGold (SOLG.L) (15.2%) and Lundin Gold (LUG.TO) (27.1%) which both have projects in Ecuador. But when Newcrest needs to write a large cheque, it does look like it’s going back to a Tier-1 jurisdiction.

Go to Newcrest’s website

The author has no position in either Imperial Metals or Newcrest Mining. Please read the disclaimer