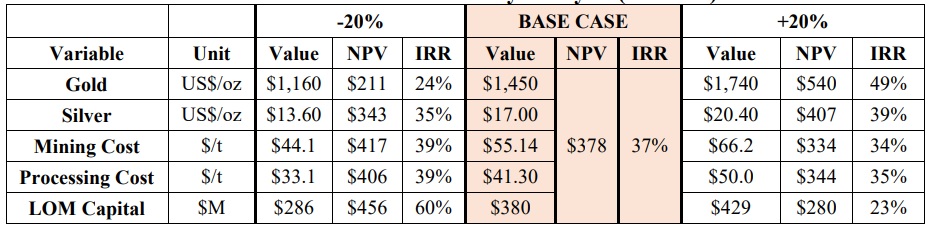

Rockhaven Resources (RK.V) has finally released the results of the anticipated preliminary economic assessment on the Klaza gold-silver project in Canada’s Yukon Territory. The PEA uses a base case gold price of $1450/oz and boasts an after-tax NPV5% of C$378M (although this number will come down considering Rockhaven used an optimistic USD/CAD exchange rate of 1.39 (compared to the current spot FX of 1.34). The IRR of 37% is good, and this IRR even increases to 49% on an after-tax basis using $1740 gold. At $1950 gold, the IRR will very likely come in at around 60%, according to our estimates.

While the after-tax NPV5% of C$540M at $1740 gold is good, applying the current exchange rate would indicate the NPV drops slightly to C$520M but given Rockhaven’s current market capitalization of less than C$50M post-raise, the company is still very reasonably valued.

The current mine plan calls for the total production of 751,000 payable ounces of gold and 13.8 million payable ounces of silver while there will also be 50 million pounds of copper and zinc that will be recovered as a by-product credit. Keep in mind the aforementioned NPVs and IRRs were using a silver price of US$17/oz and applying a silver price of $25/oz would increase the life of mine cash flow by US$100M. On an after-tax and discounted basis, it looks like the current silver price could add C$50-70M to the C$520M NPV in the 1740 gold scenario.

The PEA is based on the current resource estimate which only takes three of the eleven mineralized zones into account. It’s probably not unrealistic additional ounces will be added in future drill programs, indicating the pre-feasibility study could contain more gold and silver, and this could further boost the NPV of the project.

Disclosure: The author has no position in Rockhaven Resources.