Helped by a substantial boost in the silver price and having the word ‘silver’ in its company name, Southern Silver Exploration (SSV.V) was able to fill its C$10M placement in no time, and added a subsequent C$4M placement at slightly inferior terms to raise even more than the C$10M it wanted.

The initial C$10M was completed by issuing 50 million subscription receipts which will convert into one share and half a warrant with each full warrant allowing the warrant holder to purchase an additional share of Southern Silver at C$0.25 in Y1, C$0.30 in Y2 and C$0.35 in Y3. The C$4M non-brokered financing was completed by issuing 19.05 sub receipts at C$0.21 which will convert into a share and half a warrant with strike prices of C$0.28 in Y1, C$0.33 in Y2 and C$0.38 in Y3.

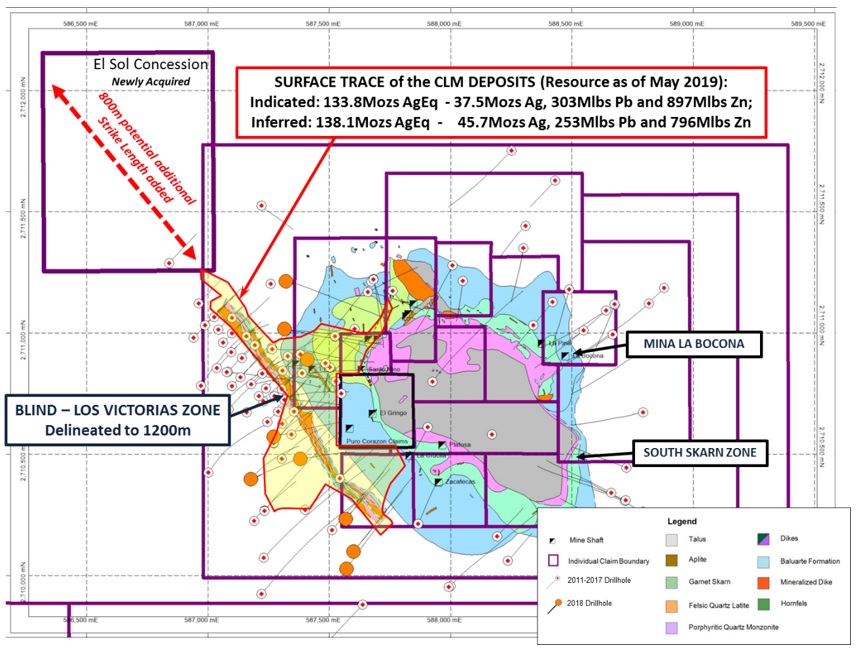

The subscription receipts will be converted into common shares (and warrants) once Southern Silver obtains shareholder approval to close the deal with Electrum whereby Southern will acquire full ownership of the Cerro Las Minitas polymetallic project. An initial 10,000 meter drill program will already start in a few weeks and this should provide some news flow in the fourth quarter of the year.

As of the end of April, Southern Silver had a working capital position of C$3.5M and we expect the company to currently have a working capital position of around C$17-18M (including the sub receipts and assuming a bunch of historical warrants were exercised the past few weeks). Roughly C$6.6M will have to be paid to Electrum on the closing date of the deal in September, so Southern Silver will have plenty of cash on hand to fund the upcoming exploration programs and make the next few cash payments to Electrum (US$2M in March and September 2021).

Disclosure: The author has a long position in Southern Silver and participated in the sub receipt offering. Southern Silver is a sponsor of the website.