Avanco Resources (ASX:AVB) has released the results of a pre-feasibility study which was completed on its Pedra Branca copper-gold project.

The mine plan calls for an average throughput of 1.2 million tonnes of rock per year, and this should allow Avanco to produce in excess of 50 million pounds of copper and 16,000 ounces of gold per year. The initial capex is estimated at US$158M, whilst the after-tax NPV7% is estimated at US$200M based on a cumulative cash flow result of US$386M based on the 8-9 year mine life.

We were quite happy to see the company used a reasonable copper price, and with an anticipated price of $2.74/lbs in 2019 and $2.94/lbs from 2022 on, Avanco’s assumptions are less aggressive and more credible than the mine plans from companies using $3 copper as a base case scenario. Of course, the accuracy level of the PFS is still based on a -20%/+20% ratio, but we are very encouraged by the outcome of the PFS, as it does meet the criteria based on NPV (higher than the initial capex) and IRR (34%). It’s now up to Avanco to try to confirm its PFS findings in a definitive feasibility study, which will be completed before the end of May next year.

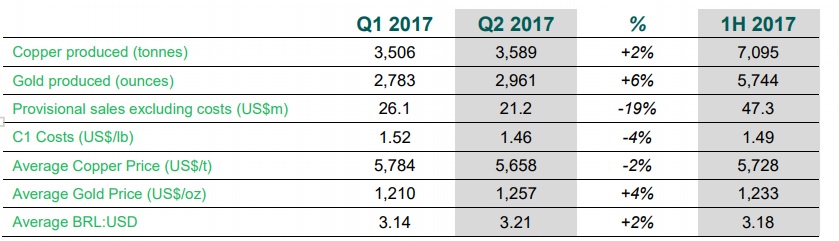

In other news, the company produced almost 8 million pounds of copper and almost 3,000 ounces of gold in the second quarter, at a C1 cost of $1.46 per pound of copper. That’s an excellent result and thanks to the strong gold and copper price, the company should be in a position to post a strong operating cash flow when it announces its H1 results on August 18th.

Go to Avanco’s website

The author has no position in Avanco. Please read the disclaimer