After Metanor’s (MTO.V) huge production miss in the fourth quarter of 2014, we were hoping to see the company avoiding a huge cash outflow as that would put the balance sheet in an even worse state. Keep in mind the reported AISC of C$1395/oz was per ounce of gold the company sold and not per produced ounce. As its sales number was higher than the production number, the real AISC per produced ounce was very likely in excess of C$1500/oz.

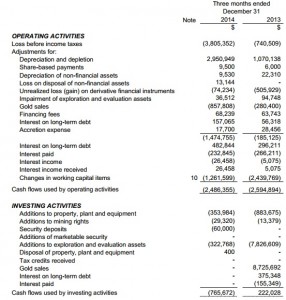

Unfortunately it was a bad quarter on all levels, and not only did the company report a net loss of C$3.75M, it also was free cash flow negative. The operating cash flow was already negative to the tune of C$2.5M, and after deducting C$350,000 in capital expenditures, Metanor’s free cash flow was definitely negative and the company saw a total cash outflow of almost C$4.5M which is nothing to sneeze at.

Indeed, the bad cash flow numbers have a direct impact on the company’s balance sheet which showed a negative working capital position of approximately C$10M. Even if Metanor would be able to extend the maturity date of its debt, the working capital would remain negative, and that’s very likely the main reason why the lenders required Metanor to raise at least C$3M as part of the debt extension deal.

Metanor will need to step up its game as another quarter with a gold production of less than 10,000 ounces gold could have disastrous effects on the balance sheet which is in quite a bad shape right now. Fortunately the cheaper Canadian Dollar will continue to work in Metanor’s favor, but more action will be needed and the Metanor team will have to get the production rate back up to 45,000 ounces per year to be able to restore the balance sheet.

Disclosure: The author holds a long position in Metanor Resources. Metanor is a sponsor of the website. Please see our disclaimer for current positions.