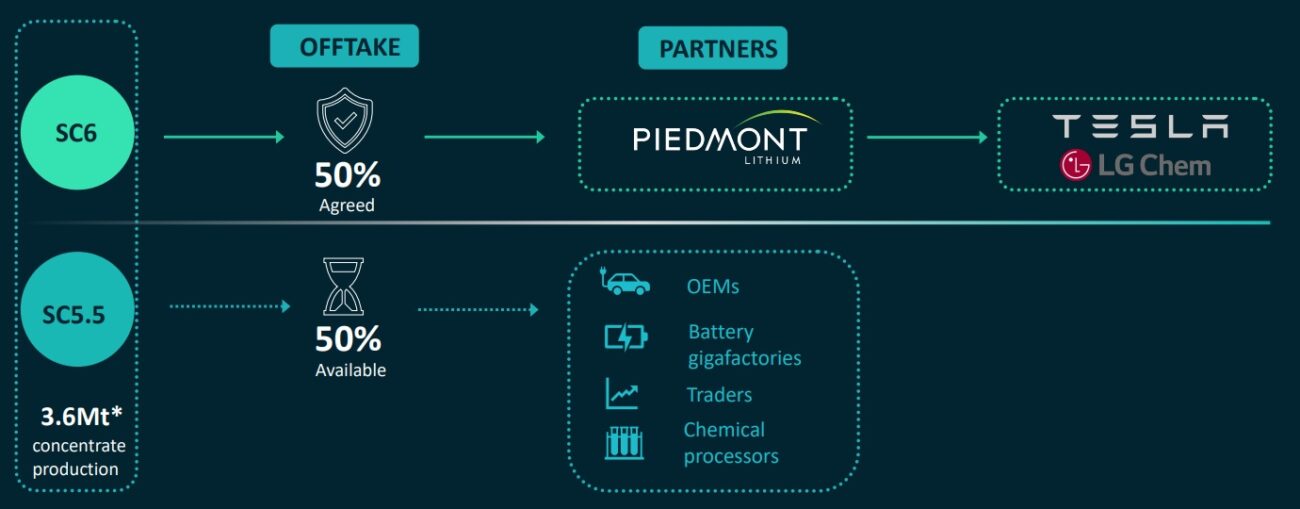

Atlantic Lithium (ALL.L, A11.AX) confirmed last month partner Piedmont Lithium (PLL, PLL.AX) will advance to the third stage of the earn-in agreement on the Ewoyaa spodumene project in Ghana. Piedmont recently completed the requirements to earn a 22.5% interest in Atlantic’s Ghana portfolio after spending US$17M on exploration and funding the pre-feasibility and feasibility study of the Ewoyaa project, and that project will now go ahead with construction activities expected to commence soon in order to produce the first batch of concentrate in 2025.

As part of the third stage of the agreement, Piedmont will have to fund the first US$70M of the construction followed by contributing 50% of the remaining capex. The total initial capex was estimated at US$185M which means Atlantic Lithium will only be required to fund US$60M in capex while retaining 50% of the project. It would of course be wise to expect the capex to come in slightly higher but the total investment should remain below US$100M.

This also means The after-tax NPV8% attributable to Atlantic Lithium will be around US$800M, and the base case spodumene price used in this scenario is US$1,587 on a FOB Ghana basis. The AISC is anticipated to be just US$610/t so at a production rate of 300-350,000 tonnes of spodumene per year, the project will still generate US$120-140M per year in cash flow on the operational level at a spodumene price of ‘just’ $1000/t.

While one could argue Atlantic Lithium gave away too much of the upside, let’s not forget this agreement was signed in 2021 when lithium prices were lower and let’s also keep in mind Piedmont has already spent US$17M on advancing the project through pre-feasibility and definitive feasibility, thereby using their own cash to substantially derisk the project.

Disclosure: The author has no position in Atlantic Lithium. Please read the disclaimer.