Base Resources (BSE.AX, BSE.L) has released the results of a pre-feasibility study on the possibility to mine the higher-grade subsets of the Bumamani and North Dune deposits at the same time the Kwale South Dune will be mined. The study has shown that the approach would work and the North Dune (which contains 194 million tonnes at 1.5% heavy minerals) and the smaller Bumamami resource (5.9 million tonnes at 1.9% heavy minerals) could be high graded resulting in about 11.4 million tonnes to be processed at an average grade of 2.3% heavy minerals.

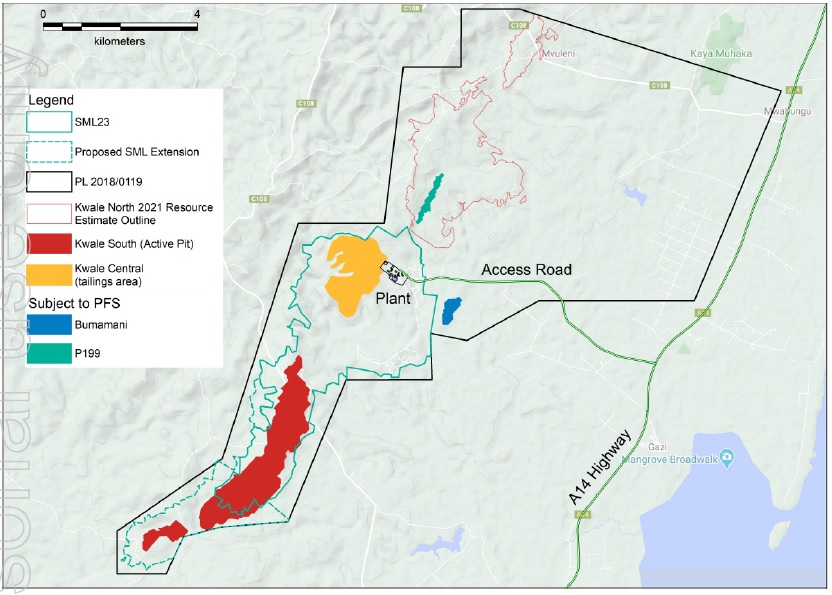

While both deposits are located within the valid prospecting license, they are not covered by the Special Mining Lease, so Base Resources will have to apply to the relevant ministries to get the permits expanded – and that shouldn’t be an issue at all.

The total capex is estimated at just under US$14M and mainly consists of the purchase of additional equipment as well as land, and according to the plans, the new zones will likely be mined from early 2023 on. The total recovered output will be 34,000 tonnes of rutile, 113,000 tonnes of ilmenite and 13,000 tonnes of zircon for a total gross value of just over US$90M, using the company’s pricing assumptions. This will not be a main contributor to the project economics but it will keep the mine running for about 7.5 additional months and will provide additional cash flow to fund reclamation and closure costs once Kwale will be depleted.

Disclosure: The author has no position in Base Resources. Please read our disclaimer.