Constantine Metal Resources (CEM.V) has announced its joint venture partner Dowa has proposed a US$8.8M exploration program for the Palmer polymetallic project in Alaska. Dowa will bankroll the entire budget which will result in Constantine seeing its interest in the project drop to about 44%.

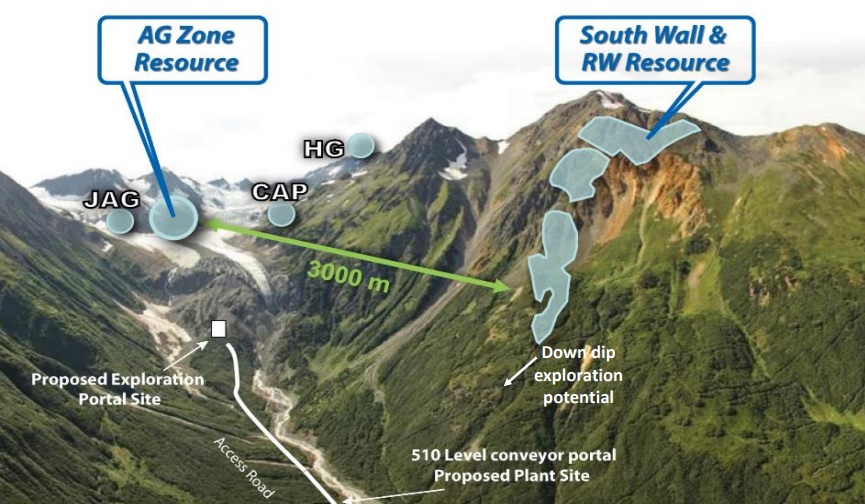

Dowa’s plans include about 6,000 meters of drilling of which 1,800 meters will be pure exploration drilling while 2,500 meters will be focusing on upgrading the existing resource at Palmer. The final 1,700 meters of drilling will be geotechnical drilling to gather more data ahead of the feasibility study and the planned underground exploration program.

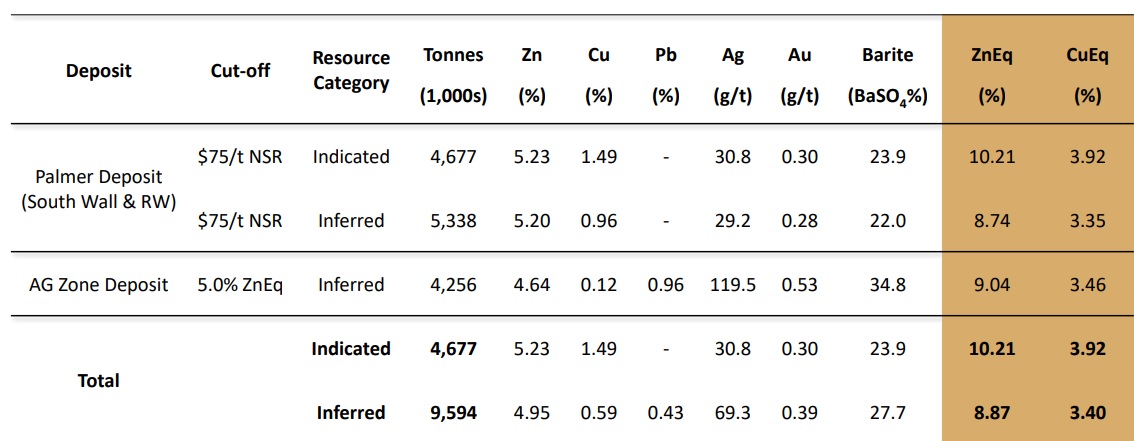

A 2019 PEA on the Palmer project indicated an after-tax NPV7% of US$266M using a copper price of $2.82 per pound, a zinc price of $1.22/pound while the gold and silver prices used were respectively just $1296/oz and $16.3/oz. Using the current metal prices (or even a 20-25% discount to the current spot prices) will likely have a very positive impact on the NPV of the project. A copper price of $3.40/pound (which still is a 25% discount to the current spot price) would have boosted the pre-tax NPV7% by about $70M. While the capex will likely higher than what has been budgeted in 2019 the current metal prices will likely increase the value of the project, even if no additional tonnes will be added to the mine plan.

Disclosure: The author has no position in Constantine Metal Resources. Please read our disclaimer.