Contact Gold (C.V) has now closed its underwritten offering which ultimately resulted in the company issuing almost 74M units at C$0.20 to raise a total of C$14.8M. Each unit consisted of one share as well as half a warrant with each warrant entitling the warrant holder to acquire an additional share of Contact Gold at C$0.27 during a two year period.

C$5M of the offering will be used to redeem a portion of the preferred shares while Waterton also subscribed for C$13.4M in new shares priced at C$0.195 per share, which will subsequently be used by Contact to redeem the remaining preferred shares. This means that ultimately, Contact Gold will be issuing around 136M common shares, retain about C$8M in cash from the placements while getting rid of almost C$20M in liabilities related to the preferred shares. Not having to deal with that liability on the balance sheet will increase the flexibility of Contact Gold as this move substantially de-risks the company: should Contact have defaulted on the full repayment of the preferred shares (and accumulated interest payments) when they became due in 2022, Waterton could theoretically have seized Contact’s assets.

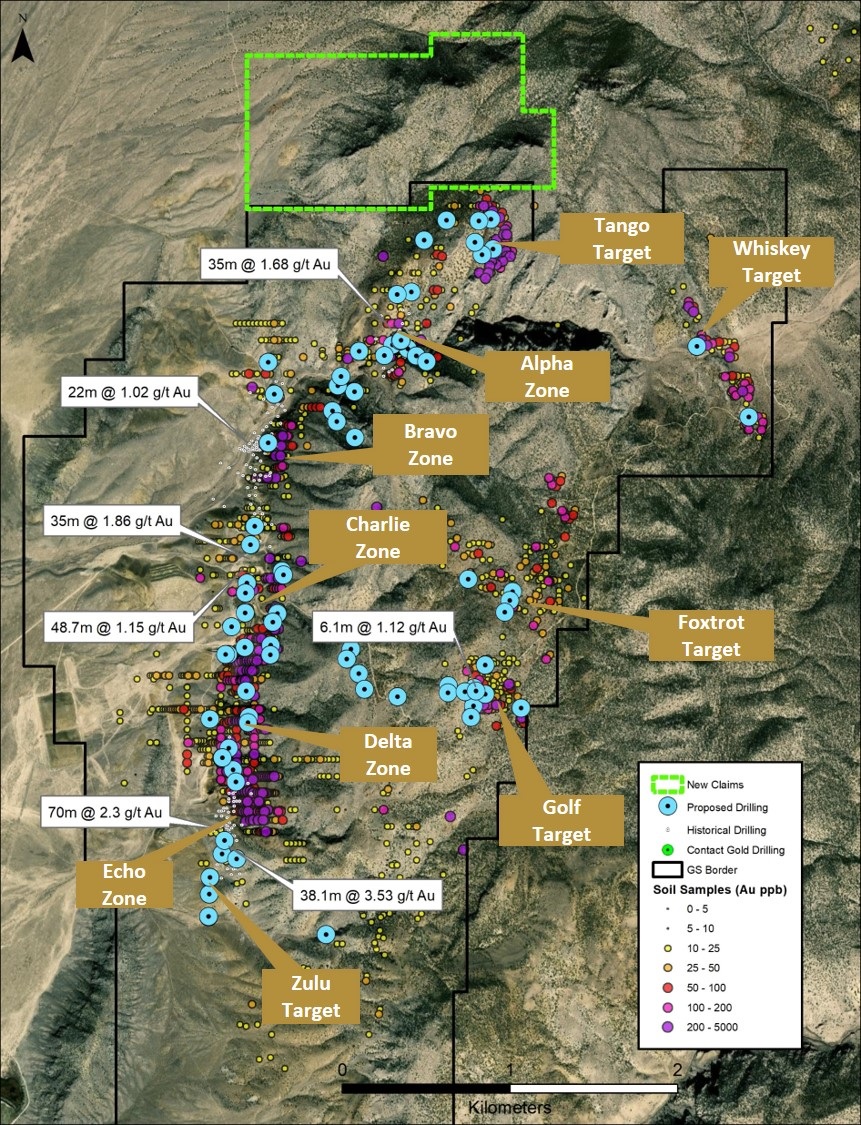

With that potential issue solved ahead of the issue potentially becoming a problem and with in excess of C$8M in cash in the bank, we are looking forward to seeing the drill results of the company’s Green Springs drill program. Drilling started about three weeks ago, and we expect to see initial assay results by the end of October.

The news flow should accelerate in the fourth quarter as Contact Gold announced yesterday a second drill rig has arrived on site. Not an RC rig but a core rig this time which will drill deeper holes in an attempt to reach the Pilot shale, located below the Chainman shale. This is the first time in the history of the Green Springs project a core rig will be used as Contact wants to push through to check for mineralization in the Pilot shale.

Disclosure: The author has a long position in Contact Gold. Contact is a sponsor of the website.