Cora Gold (CORA.L) has released the final batch of drill results completed on its flagship Sanankoro gold project in Mali. A total of 89 holes were drilled: 11 were AC holes with an average depth of just around 80 meters while the company also completed an additional 78 Reverse Circulation holes for a total of almost 7,000 meters (which also indicates the average depth of the RC holes was just around 90 meters). Some of the highlights of this drill program again confirm shallow good-grade mineralization over good widths.

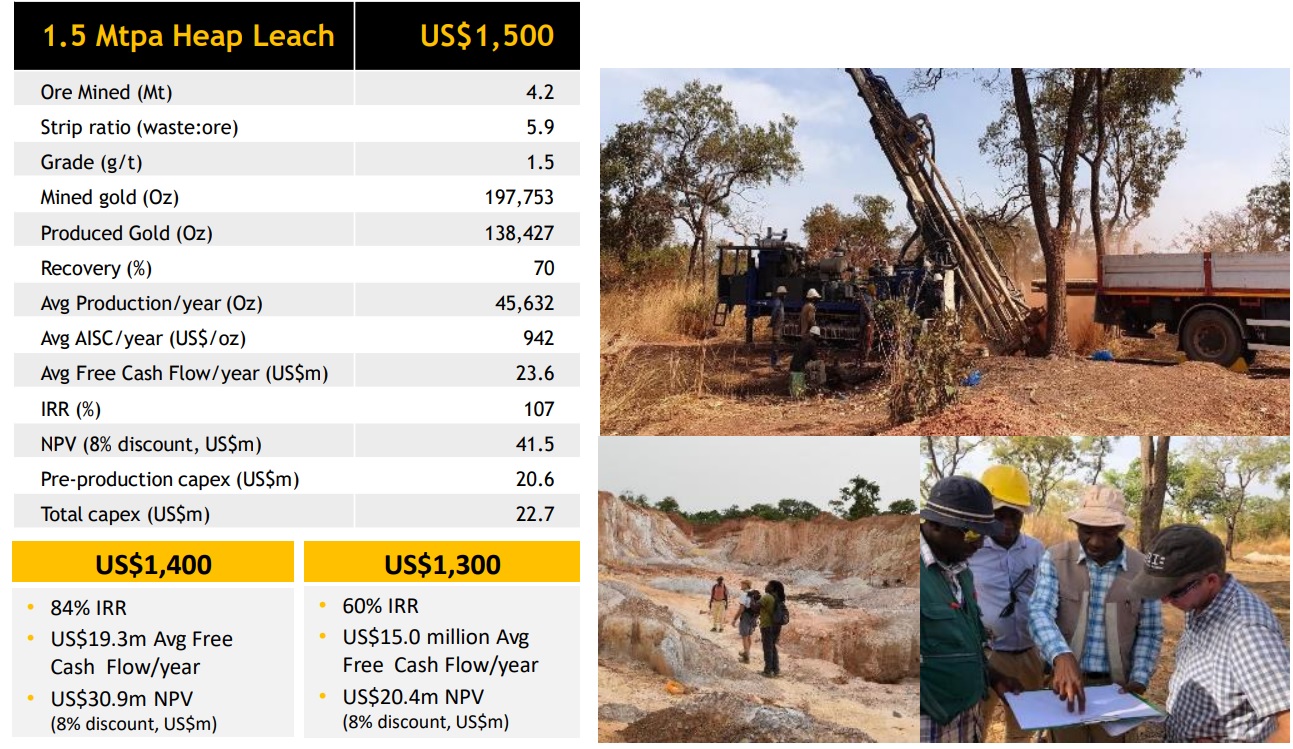

The drill program was aiming to convert inferred resources into a resource category with a higher confidence level (a definitive feasibility study will be based on reserves so it is important to further enhance the credibility of the ounces in a resource estimate) but the 89 hole drill program also discovered two new zones, close to the existing resources. This should help the company to extend the mine life from the current 3.5 years. Less than 200,000 ounces of the 809,000 ounce resources were incorporated in the scoping study and although only 138,000 ounces were estimated to be recovered over the life of mine, the IRR of the project was a triple digit number at a $1500 gold price.

Cora Gold will now use the data from the drill program to update the resource estimate at Sanankoro and this updated resource will be incorporated in the upcoming Definitive Feasibility Study which should be complete in the third quarter. We expect to see the total capex to increase (and perhaps Cora Gold will have to go back to the drawing board to update its anticipated financing mix) but we wouldn’t be surprised to see the total amount of ounces come in (at least) twice as high compared to the scoping study and perhaps the NPV8% will exceed US$100M.

Meanwhile, the Environmental and Social Impact Assessment should be completed pretty soon as well, where after Cora Gold will immediately commence the environmental permitting process at Sanankoro.

Disclosure: The author has no position in Cora Gold. Please read our disclaimer.