Cora Gold (CORA.L) has entered into a mandate letter agreement with Atlantique Finance to secure a medium term loan to the tune of US$70M. The proceeds of the term loan – should an agreement be reached – will be used to fund the construction activities on the Sanankoro gold project in Mali. The company recently completed a definitive feasibility study on the project resulting in a total production of just under 400,000 ounces of gold over a 7 year mine life (based on the reserves).

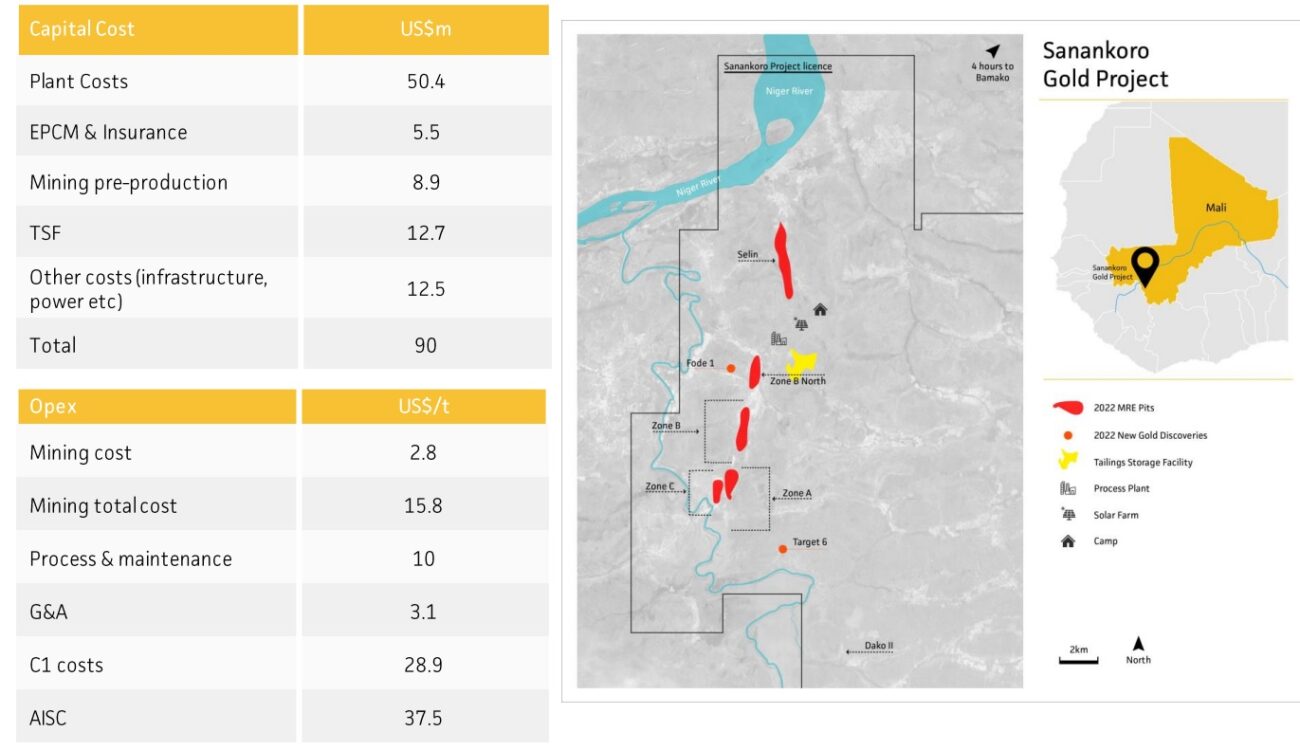

The initial capex is estimated at US$90M and this should be sufficient to produce 56,000 ounces of gold per year at an AISC of just under $1000/oz. Using a gold price of $1750/oz, the payback period is just 15 months while the mine will generate about $234M in free cash flow over the entire life of mine. The after-tax NPV8% is estimated at $95M and even using a gold price of $1650/oz would still result in an after-tax NPV8% of $75M.

The NPV is based on the 422,000 ounces of gold in the reserves but it’s interesting to note there are an additional 121,000 ounces of gold in an in-pit inferred resource and even converting just half of that inferred resource would at 1-1.5 years to the mine life and generate tens of millions of dollars in additional free cash flow and this would boost the after-tax NPV as well.

Disclosure: The author has no position in Cora Gold. Please read our disclaimer.