Cypress Development (CYP.V), which aims to develop its Clayton Valley lithium project in Nevada, has provided a few updates in the past few weeks as it continues to advance the project to the feasibility study stage.

Earlier in September, the company reported its pilot plant is almost ready to be commissioned as the majority of the components have been assembled and are operational. Initial test runs are expected to occur after initial inspections and approvals of the pilot plant. As you may remember, seeing the metallurgical test results from the pilot plant will be very important to complete the feasibility study as the data will enable Cypress to finetune all the parameters it needs to put an economic study together.

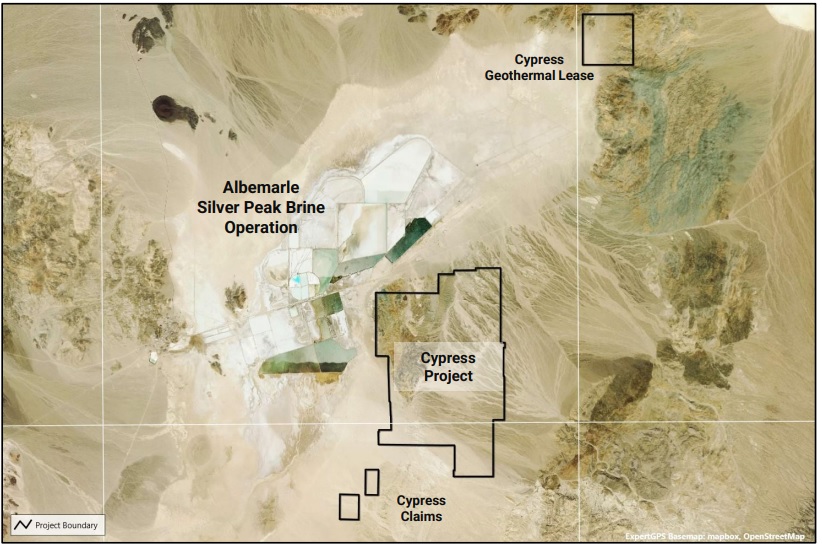

In a separate release, Cypress announced the acquisition of an additional 24 unpatented mining claims for a total of 480 contiguous acres for a payment of 49,000 shares (with a market value of approximately C$75,000). These additional claims bring the total size of the land package to just over 6,500 acres and according to Cypress, the new claims were acquired for their exploration potential.

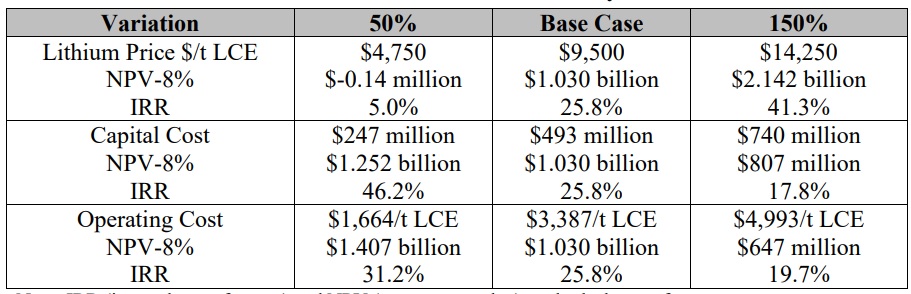

Lithium carbonate prices are currently trading at $20,500/t and although the sensitivity analysis did not provide a scenario with an LCE price exceeding $14,250/t, our rough calculations indicate the current spot price would result in an after-tax NPV8% of around US$3B for the Clayton Valley lithium project. Of course, with cost escalations across the board, we should expect the initial capex (and sustaining capex) to increase as well, but given the strong lithium price, the impact of the cost escalation on the NPV and IRR should remain at least limited and likely negligible.

Disclosure: The author has a long position in Cypress Development. Cypress is a sponsor of the website. Please read our disclaimer.