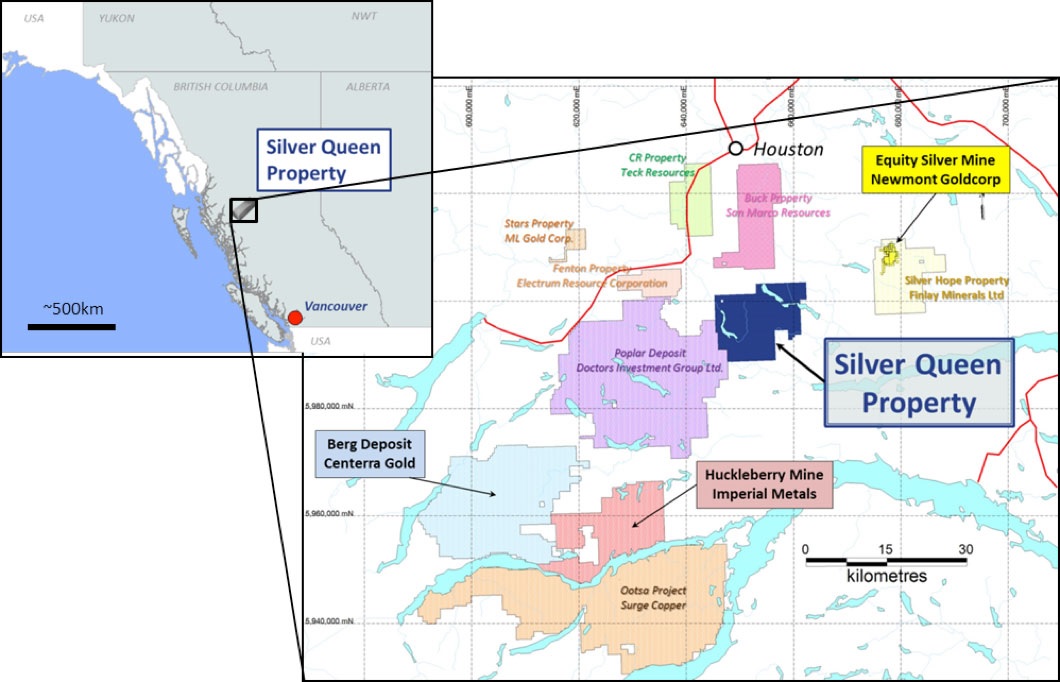

Equity Metals (EQTY.V) has announced it has started the 2020 work program on its Silver Queen silver-gold project in British Columbia. The company is still waiting for the official approval of its 5 year and 50 hole drill program, but has already identified three veins that will be earmarked for drilling this year as Equity will focus on rapid resource expansion of the existing resource estimate.

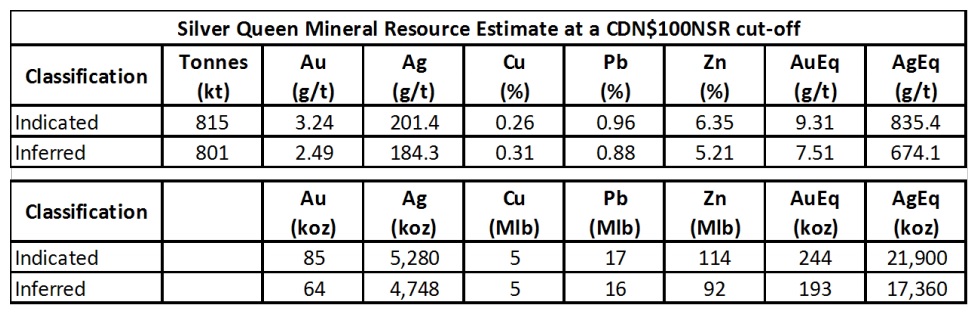

That estimate (fully NI43-101 compliant) currently has 85,000 ounces gold and 5.3 million ounces of silver in the indicated resource category while an additional 64,000 ounces of gold and 4.75 million ounces of silver can be found in the inferred resource category. Including the base metals, the project hosts 21.9 million silver-equivalent ounces in the indicated resource category and 17.4 million silver-equivalent ounces in the inferred category with an average silver-equivalent grade of respectively 835 g/t and 674 g/t using a cutoff grade based on a C$100/t NSR.

Equity mentioned it aims to double this resource in the near- to midterm, and it will be interesting to see if the ratio of the different metals will remain the same or if we will see higher precious metal values.

The company has also filed its financial statements for the first half of the year (H1 ended on February 29th) and the balance sheet shows a working capital position of approximately C$400,000 as Equity has been quite frugal in the first semester. The total cash outflow was just C$545,000 and contained C$88,000 in exploration expenses. While an overhead expense of C$460,000 is reasonable and spending C$88,000 on exploration is all we could ask for considering the winter season isn’t very inviting to conduct exploration programs in Northern British Columbia, we are expecting the ratio of exploration expenditures versus overhead to improve as more money will go into the ground. Based on the share count of 28.2M shares, the current market capitalization of Equity Metals is still just C$1.5M.

Disclosure: The author has a long position in Equity Metals. Equity is a sponsor of the website.