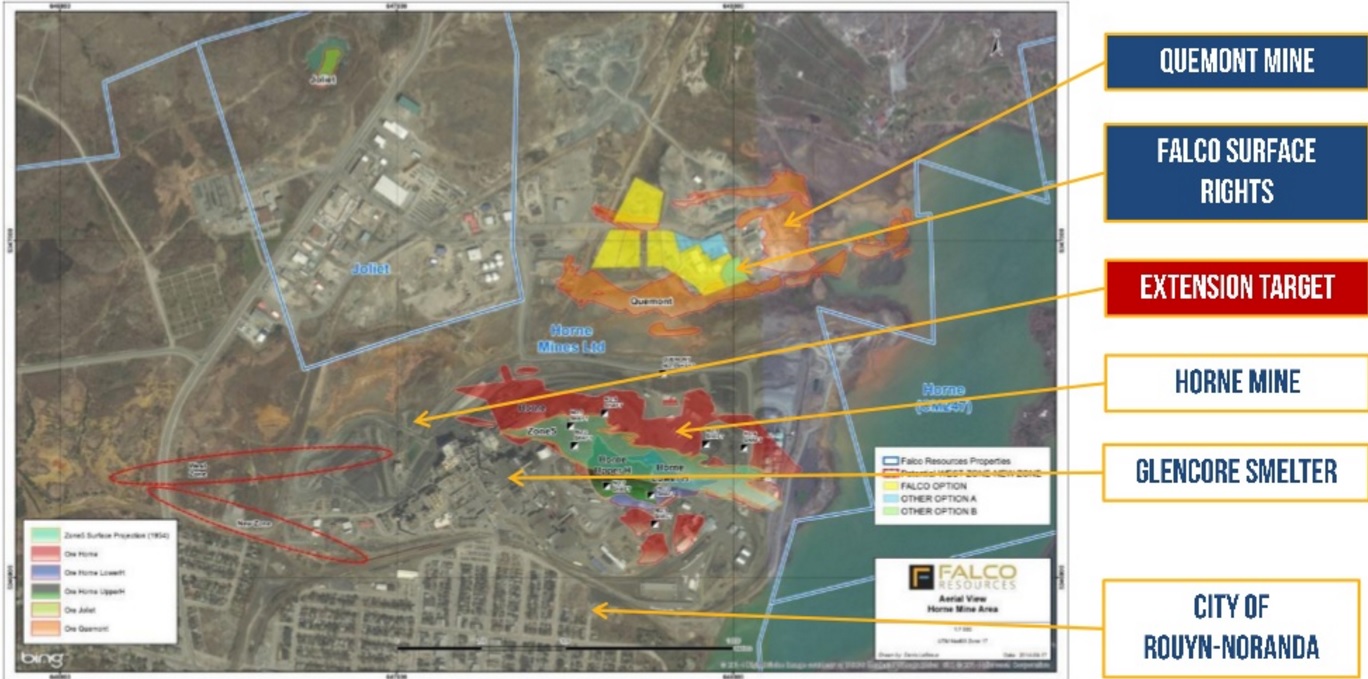

Falco Resources (FPC.V) has been quiet for a while, but earlier this week the company announced it was mobilizing two drill rigs to start a new surface drill program at the Horne 5 mine in Québec, Canada. Falco is planning to drill a total of 20,000 meters, divided in 10,000 meters at Horne 5 and 10,000 meters at Quemont.

At Quemont, the company will follow up on the western plunge of the historic deposit where 3.2 million ounces of gold and almost 15 million ounces of silver have been produced. The average grade of the historic production at Quemont was very high at 6.5 g/t gold, 1.3% copper, 30.8 g/t silver and 2.4% zinc. Using today’s spot prices (and not taking the different recovery rates into account) this would be a gold-equivalent grade of just in excess of 9.6 g/t.

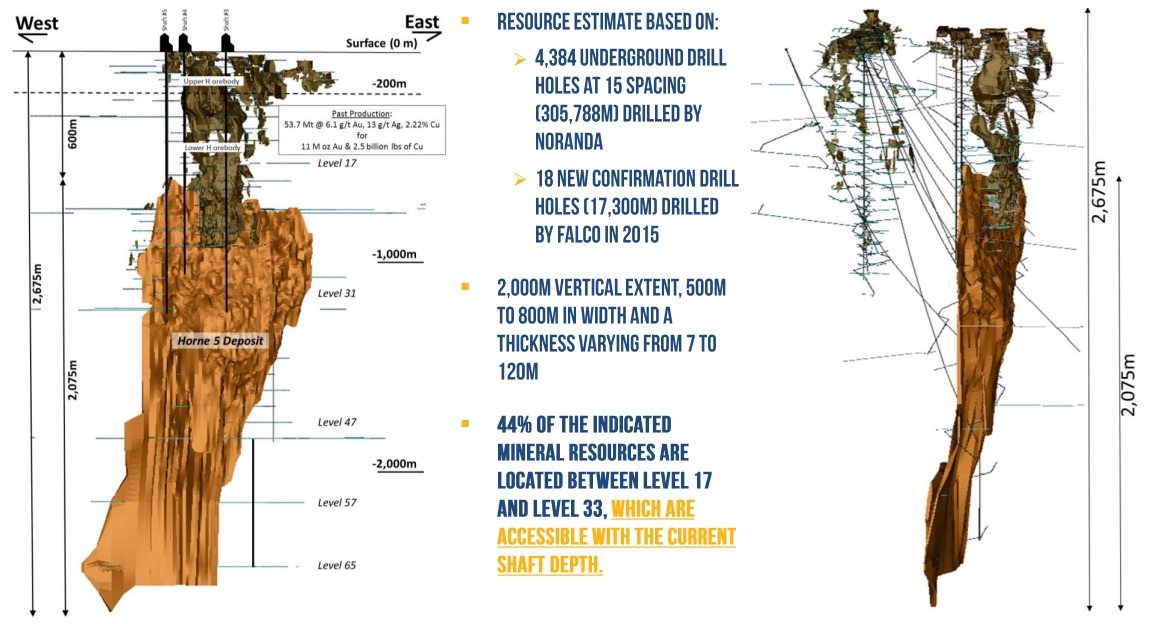

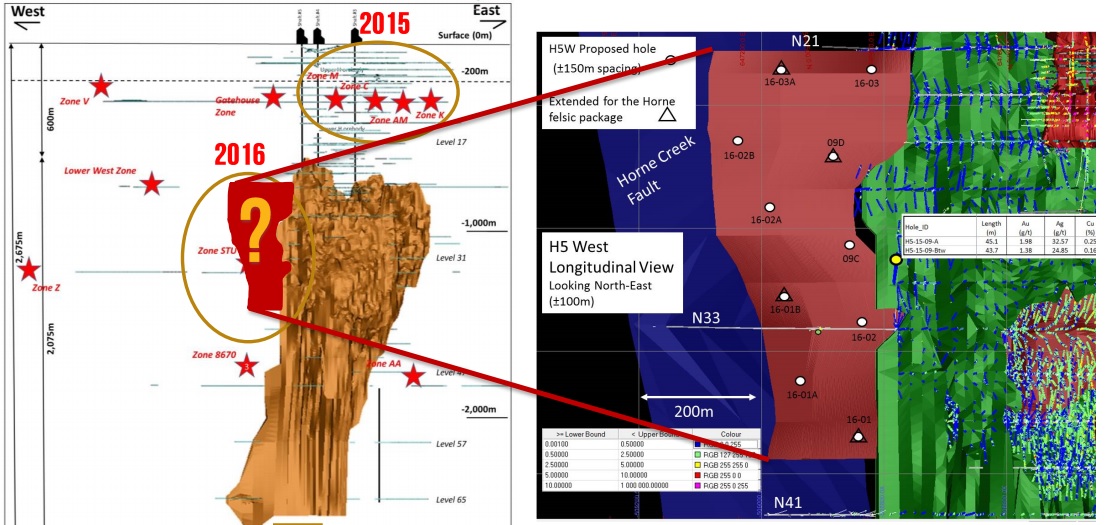

At Horne 5, Falco is planning to drilla total of 10 holes consisting of 7 wedges and 3 pilot holes, targeting a mineralized structure located at a depth of 600-1,200 meters below surface. This drill program will follow up on and try to extend the excellent results from the 2015 drill program where the company discovered 34 meters at 3.4 g/t AuEq. Should the drill program prove to be successful, there’s no reason why this couldn’t result in an updated (and expanded) resource estimate for the total Horne 5 mine.

Falco says it’s also still on track to release its Preliminary Economic Assessment (‘PEA’) in the current quarter, and we’re really looking forward to see if CEO Luc Lessard will indeed be able to build the mine at the current commodity prices. Fortunately the gold price has been cooperating lately, and since we released our first report on Falco Resources, the company’s share price has increased from C$0.405 to C$0.58, an increase of almost 45%!

Go to Falco’s website

The author has a long position in Falco Resources. Falco is a sponsor of the website. Please read the disclaimer