Inca One Gold (IO.V) has announced it is pulling out of the letter agreement with Montan Mining (MNY.V) and Goldsmith Resources whereby Inca One originally intended to acquire the Mollehuaca plant as well as the Eladium gold mine.

During the due diligence process, Inca One has detected potential problems and Inca One says the DD has brought ‘certain financial liabilities and legal burdens’ to the surface. Therefore, it has decided to pull the plug as the company would only be interested in a ‘clean’ deal. Even though we were counting on a 70% capacity expansion with the addition of the Mollehuaca plant to Inca One’s Peruvian operations, it’s better to cancel the deal than to stubbornly continue with it and encounter severe legal problems.

Meanwhile, Inca One has also closed the first tranche of its private placement right before Christmas, raising C$506,000 in hard dollars by issuing approximately 4.6 million units at C$0.11 Per unit. Each unit consists of one common share and one warrant allowing the warrant holder to purchase an additional share at C$0.18 during five years after the closing date.

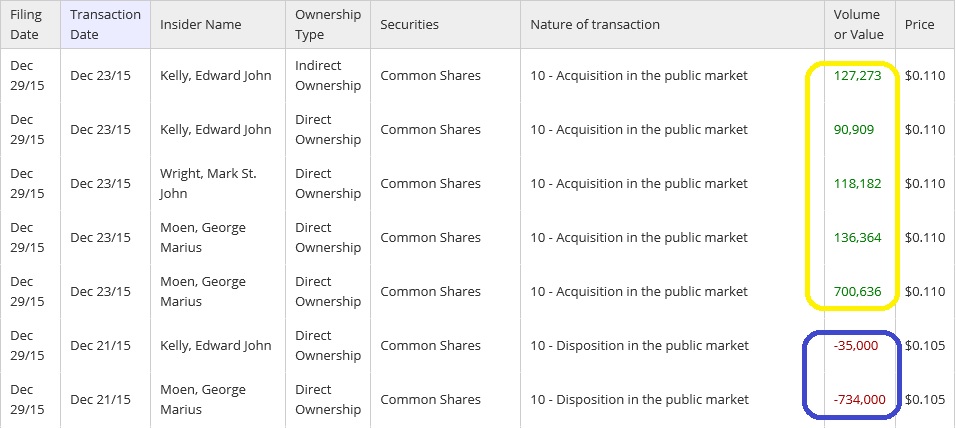

Looking at the insider filings (see above), it looks like CEO Ed Kelly and COO George Moen have once again participated in a gypsy swap. They sold a combined total of almost 770,000 shares at C$0.105 in the open market, but subsequently participated in the private placement, adding a net amount of almost 300,000 shares to their positions. Additionally, Mark Wright acquired an additional 118,182 units, resulting in insiders acquiring a net amount of in excess of 400,000 shares in the company at a premium to the current share price, which is an additional vote of confidence. There seems to have been a filing error as Canadian Insider has listed the purchases as an ‘acquisition in the public market’, but looking at the price (C$0.11) and transaction date (Dec 23), the shares will have been acquired as part of the private placement.

Go to Inca One’s website

The author holds a long position in Inca One Gold and has participated in the private placement. Inca One is a sponsor of this website. Please read the disclaimer