Kenorland Minerals (KLD.V) has announced it entered into an agreement with Double O Seven Resources, a private company registered in British Columbia.

As per the agreement, Double O can earn full ownership of the project by making cash payments totalling C$1.5M. C$0.1M was already paid and additional annual payments will be due on the anniversary of the agreement with C$150,000 due on the first anniversary, C$200,000 on the second, C$250,000 on the third, C$300,000 on the fourth and C$500,000 on the fifth anniversary. These are cash payments, so Kenorland will not be stuck with shares in a private company.

Additionally, Kenorland will be the operator of the exploration programs in the first two years and will earn a 10% operator fee for that. So if Double O Seven Resources decides to spend C$2M on exploration in those two years, Kenorland will make C$200,000 in management fees. And finally, upon the completion of the sale, Kenorland will also retain a 2.5% Net Smelter Royalty.

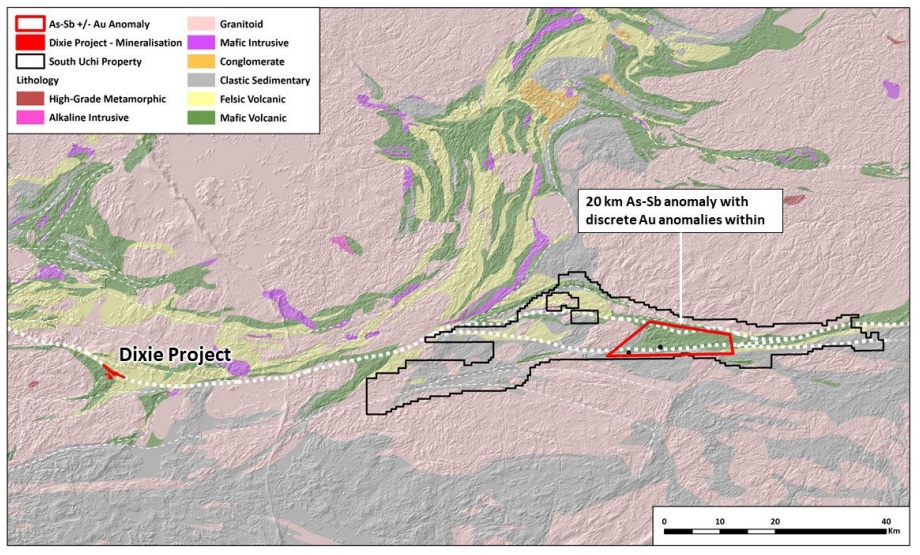

Kenorland has also provided an update on the South Uchi project in Ontario’s Red Lake District where Barrick Gold (GOLD, ABX.TO) is earning an initial 70% stake in the project by making C$6M in exploration expenditures before the sixth anniversary of the option agreement and publishing a compliant resource estimate with at least 1 million ounces of gold. There also is a firm commitment to spend at least C$3M on exploration within the first three years.

Meeting that C$3M threshold within three years likely won’t be any problem as Barrick has approved a C$1.8M budget to complete infill glacial till geochemical sampling within the large anomaly on the land package.

Disclosure: The author has a long position in Kenorland Minerals. Kenorland is a sponsor of the website. Please read our disclaimer.