KGL Resources (ASX:KGL) has completed the pre-feasibility study at its Jervois project earlier this quarter, so we decided to have another look at this project, located in Australia’s Northern Territory.

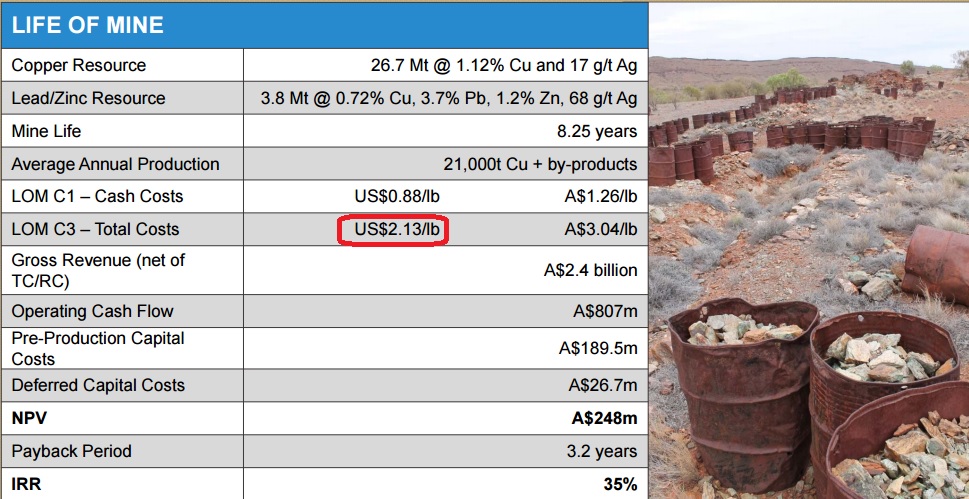

The mine plan is now calling for a total mine life of 8 years and three months with an average production rate of 21,000 tonnes of copper (46.5M lbs) per year which should be recovered at a C1 cash cost if US$0.88/lbs and a C3 cash cost of $2.13/lbs. The company is quite proud to announce it’s a A$190M costing project has a net present value of A$248M, but despite having used a rather conservative discount rate of 10%, you shouldn’t forget the company used a base case scenario with what now seem to be rather optimistic price assumptions. The used copper price is $3.25/lbs (60% higher than today’s spot price) whilst the used gold and silver price are also much higher than the current spot price.

Jervois has a chance, but not at $2.00 copper. However, should the copper price move back up to $2.75-3/lbs, then Jervois could be an interesting small copper project, but for now there’s no reason to put the company on our list of favorites. It will be very interesting to see whether or not the company’s recently announced A$3M capital raise will succeed.

Go to KGL’s website

The author holds no position in KGL Resources. Please read the disclaimer