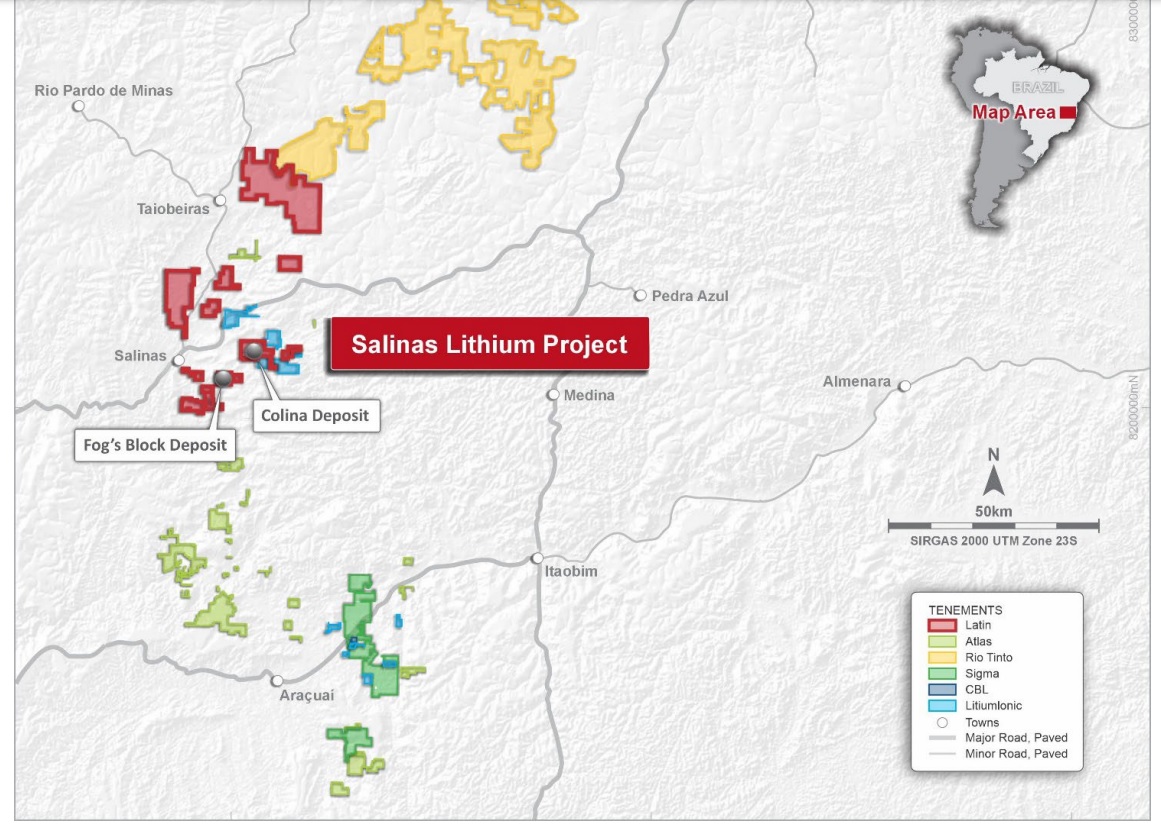

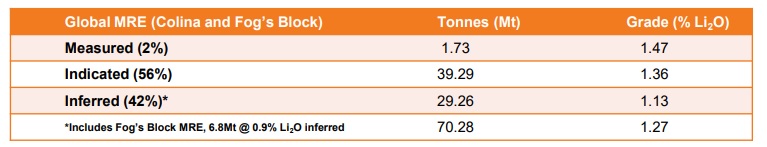

Latin Resources (LRS.AX), a lithium exploration company close to Sigma Lithium (SGML, SGML.TO) in Brazil, recently released the updated resource estimate on its flagship Salinas project. The project now contains 70.3 million tonnes across all resource categories and about 58% of the resource is included in the measured and indicated categories at an average grade of approximately 1.36%. The average grade in the inferred resource category is 1.13% which works out to an average grade of 1.27% across all resource categories.

The updated resource calculation will now be used in the upcoming definitive feasibility study which should be completed by this summer. The PEA called for an initial production plan focusing on 525,000 tonnes per year of 5.5% concentrate and 159,000 tonnes per year of 3% concentrate from 2029 on. An initial Phase 1 production plans was designed with an anticipated start-up date in 2026 and the average production rate in this phase would just exceed 200,000 tonnes of 5.5% concentrate per year. Using a spodumene price of US$1699/t for the 5.5% concentrate and US$927/t for the 3% concentrate, the after-tax NPV8% came in at A$3.6B based on the initial capex of US$253M for phase 1 followed by an US$55M investment to complete the phase 2 construction.

As the total resource is now larger than the 45 million tonnes used in the PEA, it will be interesting to see the impact on the NPV, especially at lower concentrate prices. Also keep in mind a definitive feasibility study will be based on mineable reserves and it will be equally interesting to see what percentage of the 70.3 million tonne resource estimate will end up in the mine plan.

Disclosure: The author has no positions in Latin Resources. Please read the disclaimer.