Metalstech (MTC.AX) has signed a binding agreement with MedGold Resources (MED.V) whereby the latter is selling its Tlamino gold project in Serbia to Metalstock for a total consideration of A$3M consisting of an A$100,000 option fee which has already been paid, and a final cash payment of A$2.9M upon completing the acquisition which is expected before the end of February.

The Tlamino project is relatively well known outside of Australia as the Medgold share price reacted very well on the initial discovery news a few years ago. Unfortunately investor interest waned, and Medgold is now selling the project for just a fraction of what its market capitalization was just a few years ago, as Medgold investors had higher hopes for Tlamino.

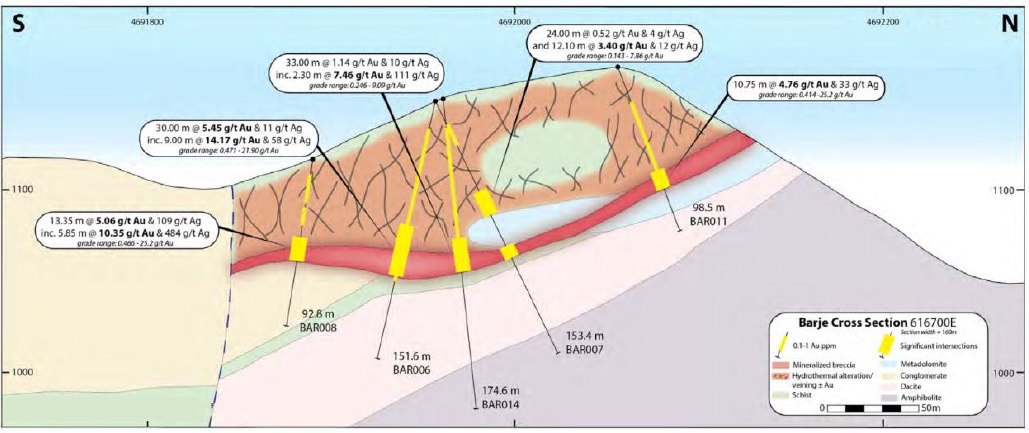

That being said, the project does come with an existing (inferred) resource estimate of 7.1 million tonnes with an average grade of 2.5 g/t gold and 38 g/t silver for a total of 570,000 ounces gold and 8.6 million ounces silver (which represents a gold-equivalent resource of 680,000 ounces using a gold price of $1350/oz and a silver price of $16/oz). As you notice, the grades and the gold:silver ratio are similar to the Sturec project in Slovakia, and that’s perhaps not a surprise considering both resources are hosted in the Tethyan gold belt.

The initial metallurgical test work conducted on the Tlamino resource was excellent as initial tests indicated the recovery rate for the gold was 88.2-90.5% while about 88.2-96.4% of the silver could be recovered. And although the resource is currently small and doesn’t meet the critical mass required for development (one of the reasons why Medgold is selling it at just a fraction of the amount it has invested in the project), sometimes a project benefits from having a fresh set of eyes having a closer look. And that’s exactly the strategy applied by Metalstech at Sturec where the company has been changing the scope of the project.

Disclosure: The author has no position in Metalstech. Metalstech is a sponsor of the website. Please read our disclaimer.