A lot of eyes were on Mexican Gold (MEX.V) as the company has released the results from its Preliminary Economic Assessment completed on its Las Minas project in Mexico. The mine plan is based on the updated resource estimate of 4.13 million tonnes, of which just over 4 million tonnes are included in the PEA. Those tonnes will be mined over an 8.5 year mine life resulting in a total production of 239,000 ounces gold, 719,000 ounces silver, 94 million pounds of copper and 635,000 tonnes of magnetite concentrate. At the current spot price, it actually looks like copper may be the primary metal here.

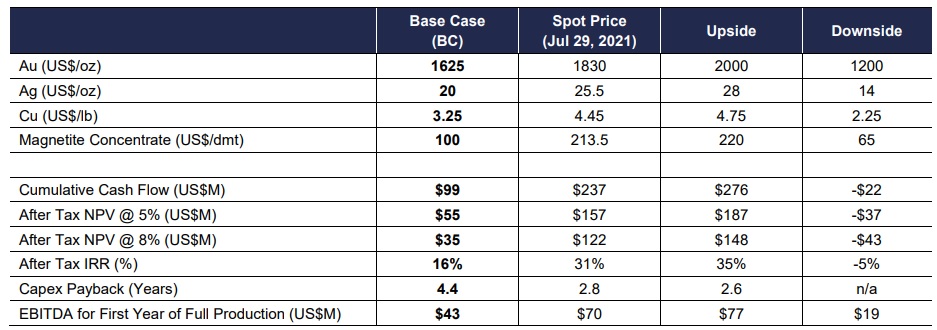

The initial capex is estimated at US$90M while an additional sustaining capex of US$55M will be required as well. A relatively high capex which means that based on the relatively low output, the economics are pretty poor. Using a base case scenario of $1625 gold, $20 silver, $3.25 copper and $100/t for the iron ore concentrate, the after-tax NPV5% is just around US$55M, while the total cumulative cash flow is just US$99M.

This basically means the magnetite concentrate may actually be the deciding factor in this scenario as it will contribute about $64M in revenue over the mine life. While Mexican Gold used a magnetite concentrate price of $100/dmt which is very acceptable given the current spot price of around $160/t (the iron ore price collapsed last week and lost more than 20% in just two weeks), one has got to wonder about A) the quality of the iron ore concentrate (grade, impurities,…) and B) the efficiency of getting the iron ore concentrate to the market. As the annual concentrate output will be very low at just 75,000 tonnes per year, we cannot expect the company to realize the same efficiency to bring the concentrate to the market as the big players can.

Transportation expenses will likely be high on a per tonne basis as there likely are zero economies of scale to be achieved. So to effectively receive $100/t, the iron ore price will likely have to be closer to $150/t. The press release doesn’t mention how the transportation cost is impacting the $100/t sales price so we will have to wait for the PEA to be filed to see all the details. And perhaps the company has been conservative in its iron ore assumptions and the received price for the iron ore concentrate is substantially lower than the quoted $100/t, but we’ll wait to form a definitive opinion until we have been able to study the details.

Using the spot prices in the PEA obviously makes the project a lot better. Although one could wonder if an after-tax NPV5% of US$157M or an NPV8% of US$122M is sufficient to get the project financed at acceptable terms considering the NPV is just slightly higher than the initial capex. And if we would use all spot prices but continue to use $100/t for the magnetite, the cumulative cash flow would drop by at least 20%. Which means the magnetite may be the ‘swing factor’ that could decide on the project’s fate.

At this point, it looks like Las Minas lacks the critical mass to move forward, and more tonnes will have to be added to the mine plan to boost the economics.

Disclosure: The author has no position in Mexican Gold. Please read our disclaimer.