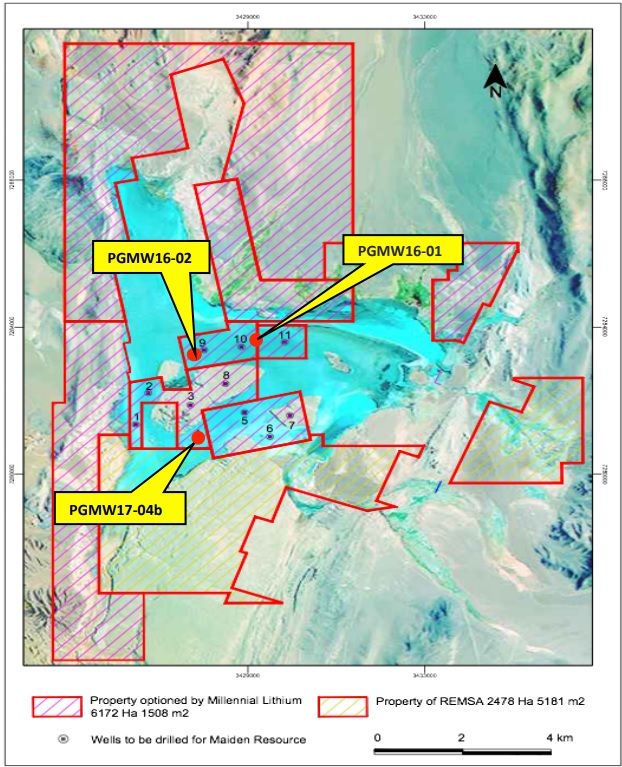

Millennial Lithium (ML.V) remains very active in Argentina as the company has announced the Pre Award Committee has recommended REMSA (the energy and mining company of the Salta province) to award almost 2,500 hectares of Pastos Grandes to Millennial Lithium, as ML’s offer scored the best on four parameters.

This acquisition won’t be cheap (Millennial Lithium will be required to pay a total of almost US$7.5M and complete US$15.4M in expenditures within the first year after securing environmental approval). Acquiring the additional 2,492 hectares indeed isn’t cheap as the total financial commitment will total almost C$30M, but apparently the claims are adjacent to the two high-grade discovery holes, so it makes perfect sense for Millennial to consolidate the ownership of the entire area.

In order to make the first cash payment to REMSA, three executives have lent the company US$2M which has been structured as a one-year secured loan with an interest rate of 12%. The interest rate itself is reasonable for an exploration stage company, but the lenders also received 266,667 common shares of Millennial Lithium (which currently have a total value of US$294,000). This means the three lenders will receive a theoretical return of 26.7% for a one-year secured loan which is quite expensive (although we understand the business decision as there very likely was a sense of urgency to make sure all payment commitments could be guaranteed to allow the transaction to proceed).

Go to Millennial’s website

The author has a long position in Millennial Lithium. Millennial also is a sponsor of the website. Please read the disclaimer