Millennial Precious Metals (MPM.V) made good progress on its projects in 2022 but unfortunately it was not rewarded by the market with an increasing share price.

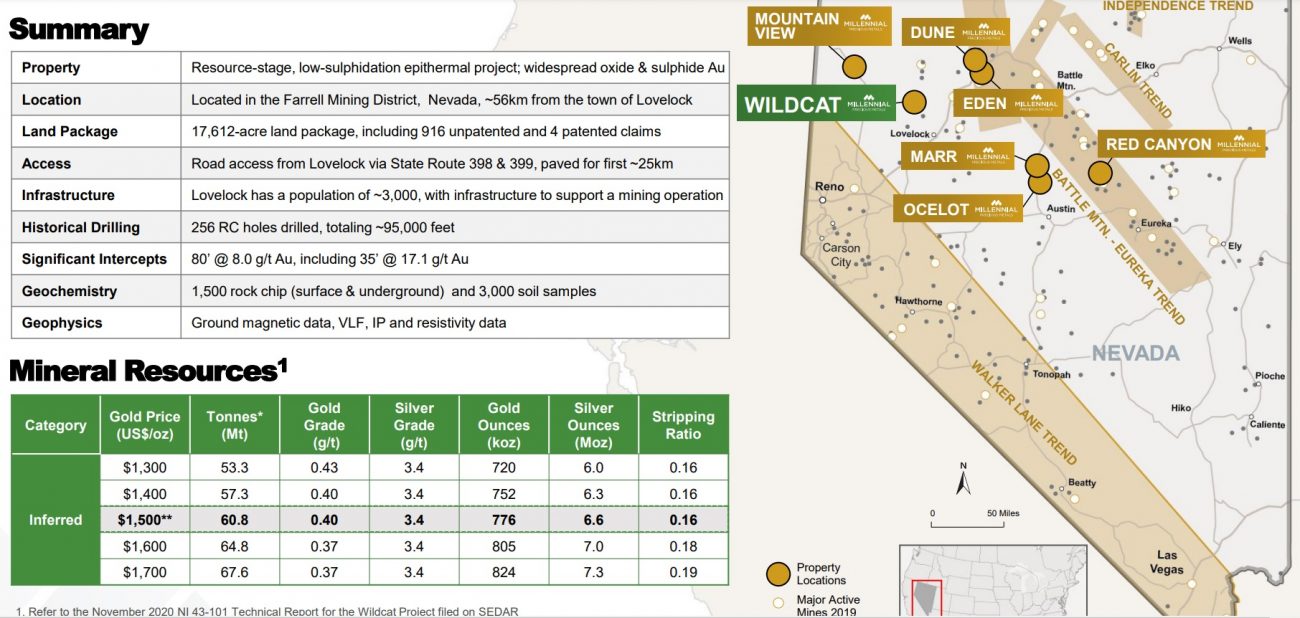

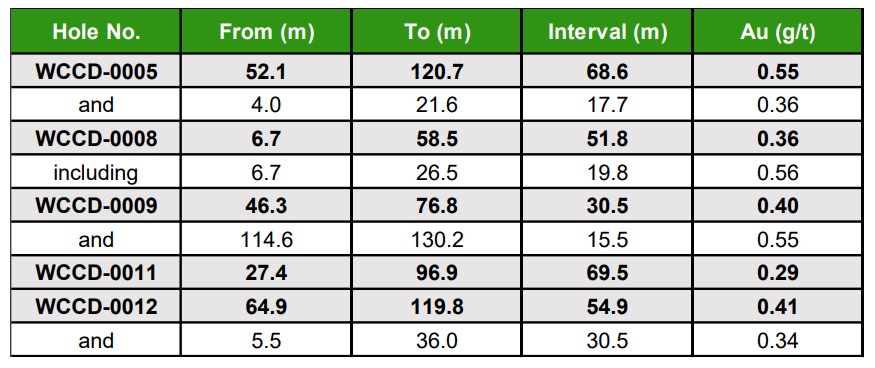

Even when the company released the final batch of its assay results from the Phase 1 drill program at Wildcat (which consisted of 1,250 meters of drilling) which aimed to upgrade the current resource on the project as well as to gather more material for geotechnical and metallurgical analysis.

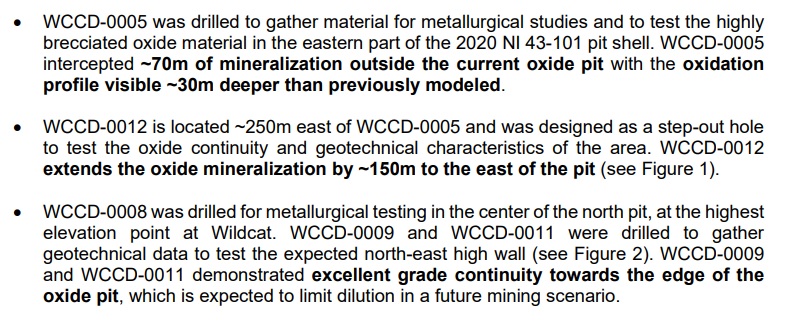

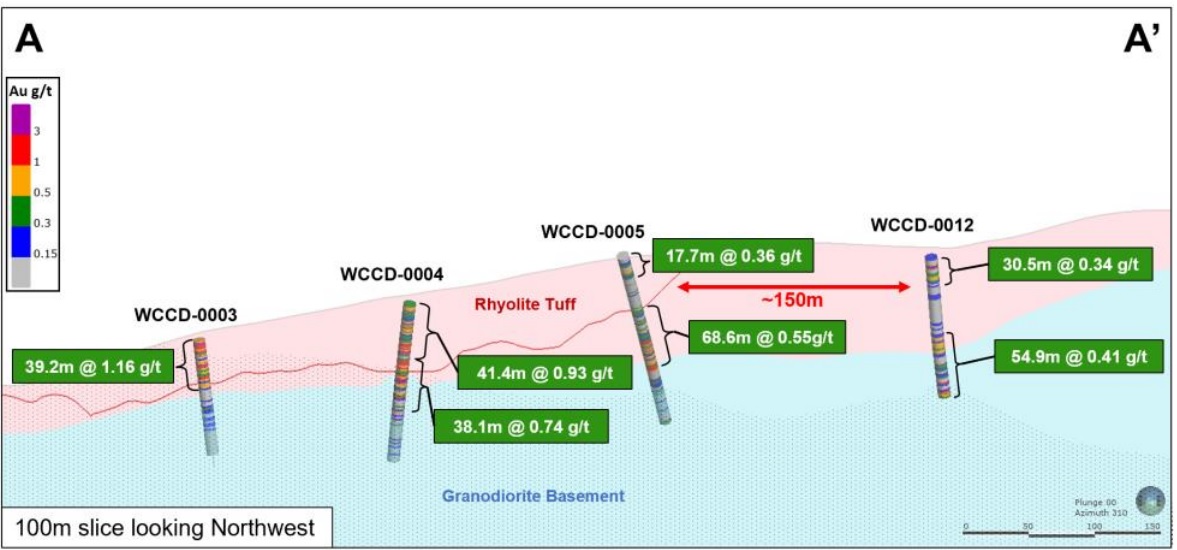

All five holes released in the exploration update contained gold mineralization with hole WCCD-0005 containing almost 69 meters with an average grade of 0.55 g/t gold while the same hole also encountered a lower-grade but shallower zone of 17.7 meters at 0.36 g/t gold. That seemed to be the general interpretation of most holes as three of the five holes Millennial reported on contained two distinct zones of mineralization, as you can see in the table above.

The location of hole WCCD-0012 is also important. This hole, which encountered 30.5 meters of 30.4 g/t gold starting at a depth of just 5.5 meters followed by an additional 54.9 meters containing 0.41 g/t gold starting at 64.9 meters down hole was drilled approximately 150 meters towards the east from the current pit outline, thereby opening up that entire area.

These drill results now confirm the presence of gold mineralization over an area of 3,000 meters by 2,000 meters which is almost three times as large as previously thought (1,500 meters by 1,500 meters). 2023 will be important for Millennial Precious Metals as the company aims to publish updated resource estimates and maiden PEAs on both Wildcat and Mountain View. Both projects currently contain 1.2 million ounces of gold and 8.6 million ounces of silver on a combined basis in the inferred category but the upcoming resource updates will likely increase and upgrade these resources.

Disclosure: The author has a long position in Millennial Precious Metals. Please read our disclaimer.