Nevada Copper (NCU.TO) has now finally made the construction decision on the Pumpkin Hollow underground copper mine, after having lost 4 years and missing out on a copper price spike by spending too much time on an integrated feasibility study to combine the underground mine with an open pit. Nevada Copper’s previous management team undoubtedly had good intentions with the integrated feasibility study but unfortunately the results of that study didn’t yield the desired results, and postponing a construction decision eventually culminated in a recapitalization of Nevada Copper resulting in an eight-fold increase of the share count to in excess of 660 million shares. Granted, at first we weren’t objecting against completing an integrated feasibility study as we assumed someone had run the numbers on an internal basis and decided it made sense to officially launch a study…

But let’s focus on the future, and it’s definitely encouraging to see that a construction decision has now finally been made, and this should result in the first copper concentrate being shipped to a port in the fourth quarter of next year.

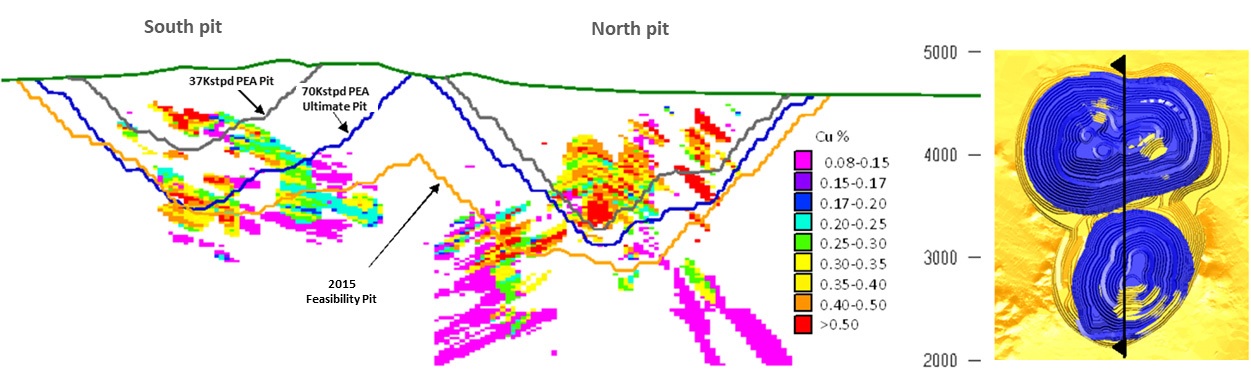

Meanwhile, Nevada Copper has now also released the results of the Preliminary Economic Assessment of the open pit (indeed, the company moved from two independent projects that were pretty much shovel-ready to an integrated feasibility study only to end up with ‘just’ a PEA on a standalone open pit again). And the open pit still isn’t viable at the current copper price.

The title of Nevada Copper’s press release proudly mentions ‘positive PEA results’. If NCU meant with ‘positive’ that it obtained a result ‘above zero’, sure, that’s an accurate description of the results of the PEA. If Nevada tried to imply the PEA is ‘good’, it should re-think its choice of words.

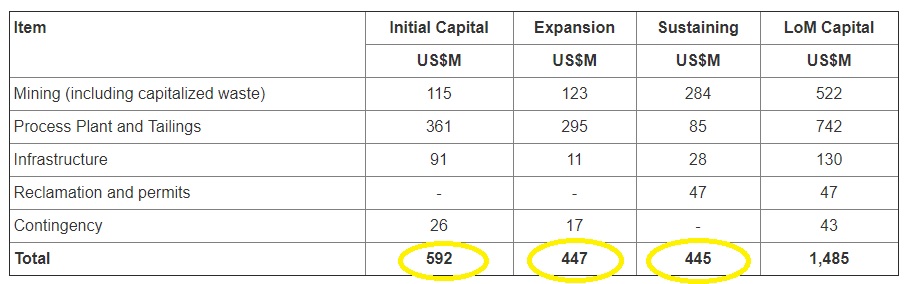

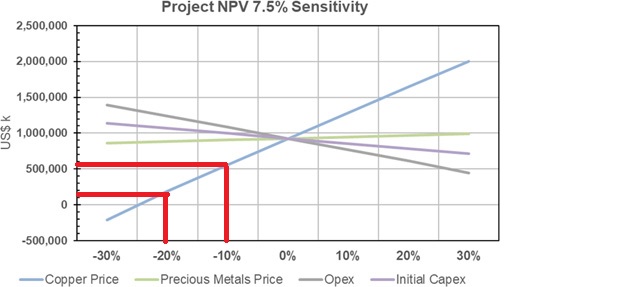

NCU did a good job in building the suspense by highlighting the positive features in bullet points. A post-tax NPV7.5% of US$927M and an IRR of 19% appears to be attractive, and the expected EBITDA of $272M per year sounds really good. But it took an awful lot of scrolling to see the base case copper price used by Nevada Copper to get to these results: $3.20 per pound. Or roughly 20% higher than the current spot price…

If we would use a copper price of $2.90/pound, the NPV would decrease by 50%, and the $272M EBITDA would decrease by in excess of 20%. At the current spot price, the open pit is virtually worthless as the cost of debt to fund the construction will very likely reduce the NPV to pretty much zero.

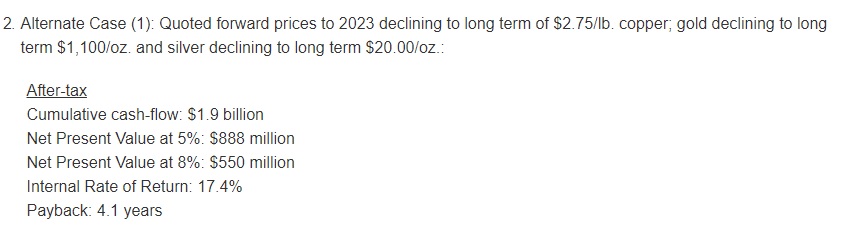

In the past four years, Nevada Copper went from two standalone scenario’s to an integrated scenario before deciding to go back to the standalone scenarios. And the NPV of the open pit PEA at $2.90 copper is almost EXACTLY the same as the NPV of the feasibility study that was published in October 2013:

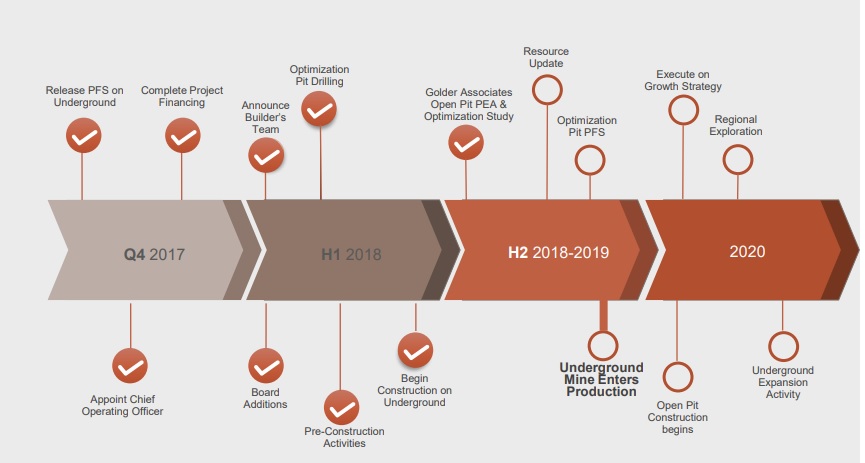

This means Nevada Copper wasted 4-5 years, only to get back to square one on the project level, while its share count more than eight-folded (the share count as of at the end of Q3 2013 was just 80.5M shares). Note how this massive waste of time has been conveniently left off Nevada Copper’s time line.

These chains of decisions have ruined the potential of Nevada Copper doing well for its shareholders, and the only way out is hoping for a higher copper price to materialize (again).

Go to Nevada Copper’s websiteThe author has a long position in Nevada Copper. Please read the disclaimer