Oroco Resource Corp (OCO.V) has released the assay results from an additional 3,600 meters of drilling completed on the Santo Tomas North Zone. The company released the assay results from holes N019 to N026 and not only did every hole contain copper mineralization, the grade is pretty consistent with the 0.35-0.40% CuEq grades that could generally be expected at Santo Tomas. This deposit will never be a high-grade copper deposit, and its main strengths are the low strip ratio, the consistency of the mineralization and the good metallurgy. An added bonus is the close proximity to the deepwater seaport of Topolobampo.

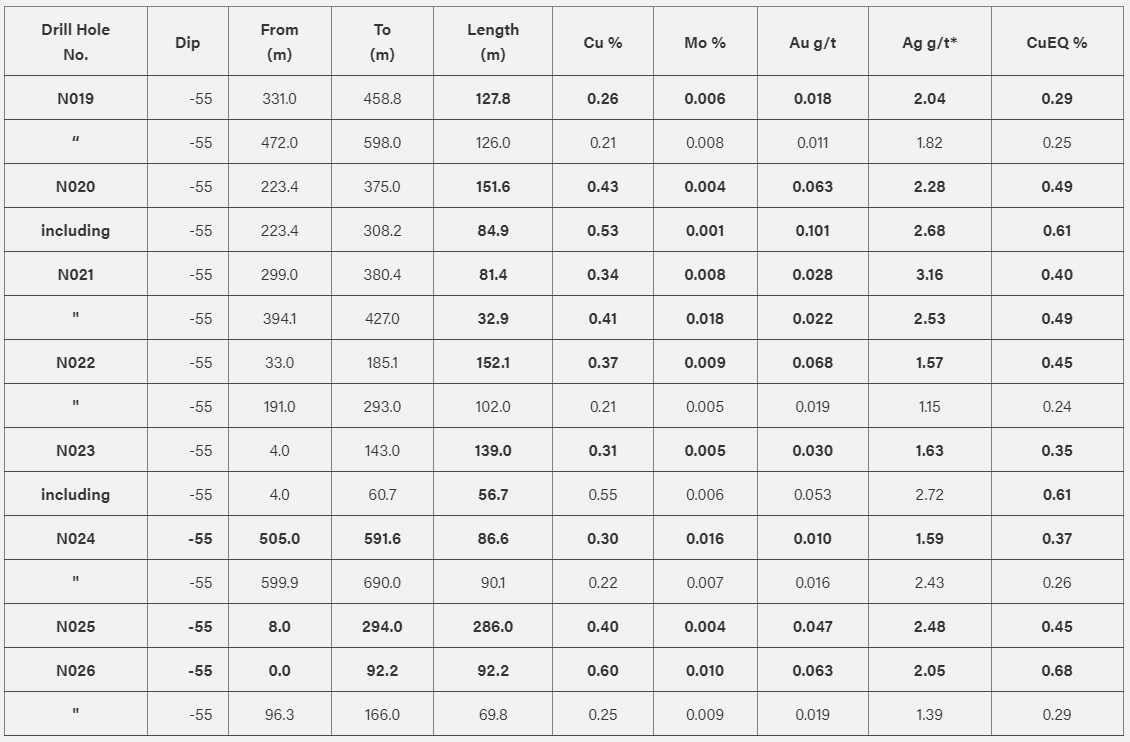

As you can see in the table above, some of the holes contain higher grade zones. N020 for instance contains almost 85 meters of 0.61% CuEq while hole N023 contains 0.61% CuEq over almost 57 meters. While that is excellent, keep in mind these are sub-sections of broader but lower grade intervals. If we would for instance look at hole N023, filtering out the 56.7 meters at 0.61% CuEq means the remaining 82.3 meters carries an average grade of 0.17% CuEq. So while the higher grade intervals clearly stand out from the results, they are ‘needed’ to make sure the broader interval reaches an acceptable average grade. And that is fine, as the key word for these types of deposits is ‘consistency’. Grade variation within a hole is to be expected.

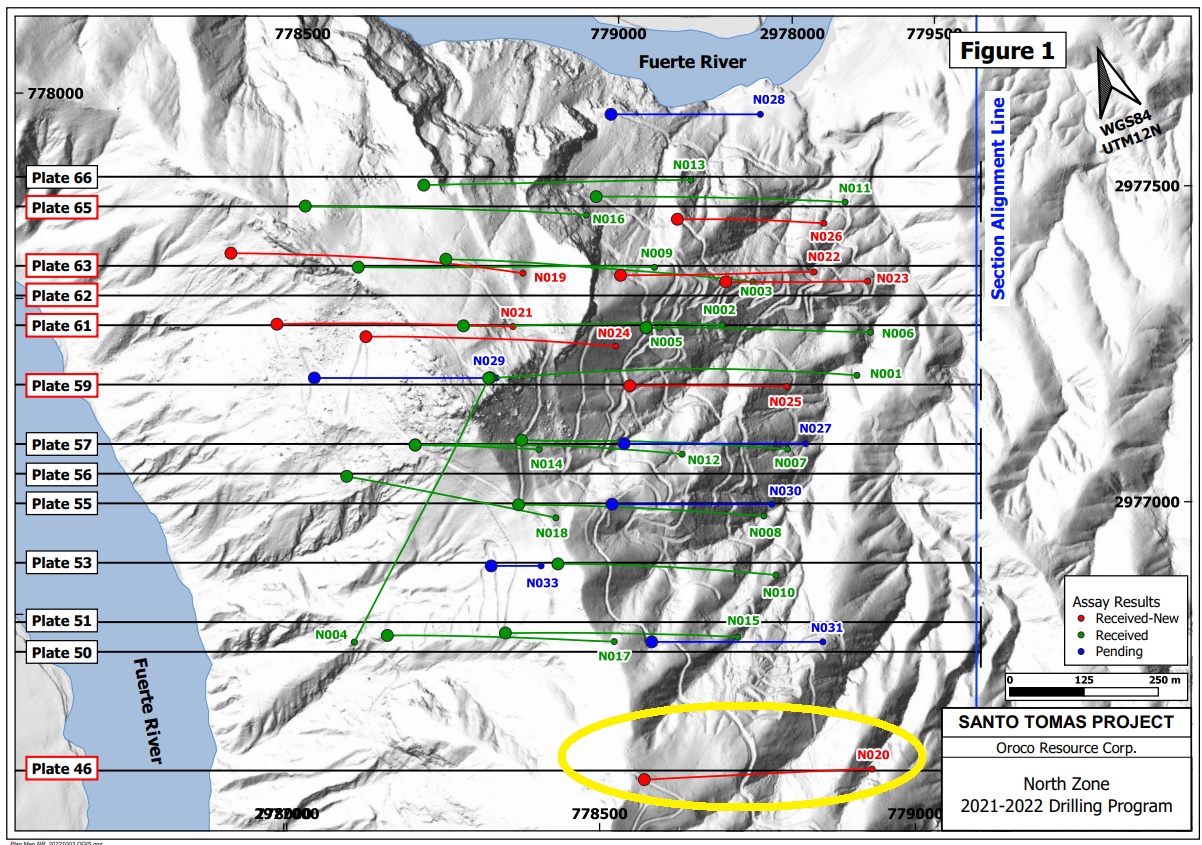

The main takeaway from the press release is not the confirmation of higher grade copper zones within the grade shell but actually encountering copper-bearing material outside of the grade shell as well. On top of that, hole 20 actually does stand out. Not only is the average grade outside of the higher-grade 0.61% CuEq interval still good, the location makes hole 20 particularly intriguing.

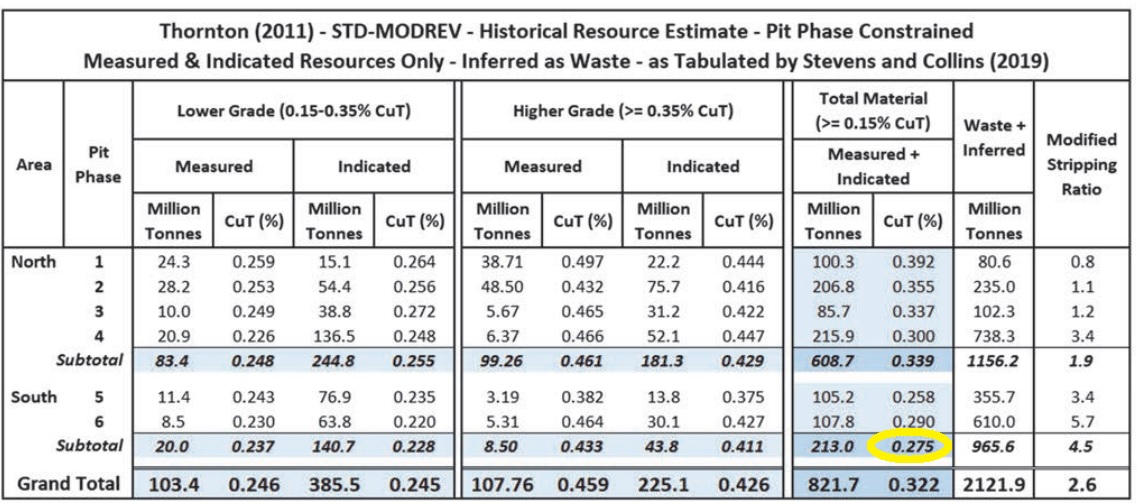

The hole was drilled about 200 meters south of holes N017 and N031 and clearly is a step-out hole confirming the mineralization continues towards the south. And as the South Zone was expected to have a lower average grade than the North Zone (the average grade of the South Zone in the historical resource estimate was approximately 20% lower than the North Zone), the almost 152 meters containing 0.49% CuEq actually bodes well and surpasses our expectations.

The lower-grade results in for instance Hole 21 are also interesting. As you can see below, the 81 meters containing 0.40% CuEq and 33 meters of 0.49% CuEq are good, but even the lower grade zones with 0.22-0.28% CuEq are interesting. While this may sound like a trivial element, this will actually be a bigger benefit to the project than encountering higher grade zones within the grade shell. This basically confirms that rock that was anticipated to be waste could actually end up in the mine plan. And that could potentially have some serious economic benefits as virtually all of that rock would have to be mined anyway so as long as it meets the cutoff grade it makes more economic sense to put it through the mill than to discard it. Oroco won’t make much money on 0.22-0.28% CuEq rock, but it should be able to cover the costs of mining the tonnes (which would have to be mined anyway) as we anticipate the cutoff grade to be 0.15-0.18%.

We met up with President Ian Graham in Hermosillo, Mexico earlier this week and were happy to hear the drill pace continues to pick up. The core shack has been able to handle the acceleration of the drill pace and there don’t appear to be any bottlenecks. Hopefully this will enable the company to publish its resource and PEA by the end of Q1 2023 but the mining sector is obviously known for its delays. And we wouldn’t mind a small delay if it is beneficial for the PEA.

Disclosure: The author has a long position in Oroco Resource Corp. Oroco is a sponsor of the website. Please read our disclaimer.