The share price of Predictive Discovery (PDI.AX) has been on a run in the past two years as it moved up sharply higher from less than a cent to about A$0.22/share for a market capitalization of approximately A$300M. That’s a massive valuation increase but recent drill results released by the company help to understand this move.

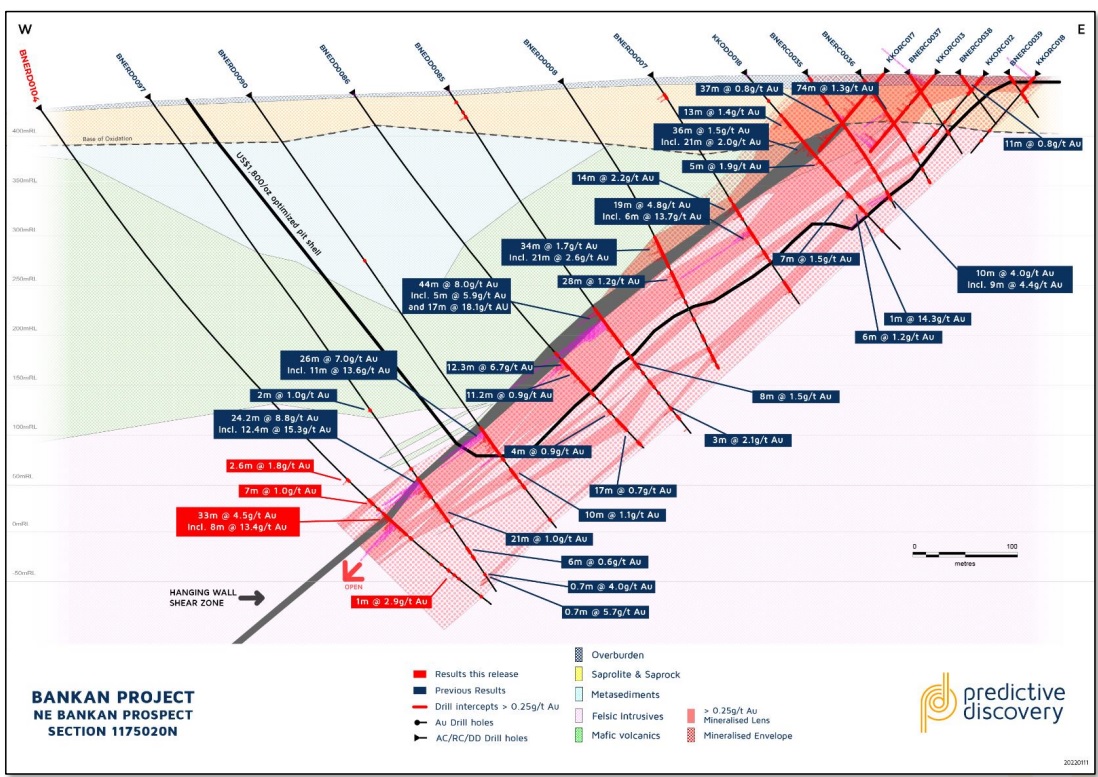

Earlier in January, the company released assay results from its Bankan gold project in Guinea. The drill bit intersected 33 meters of 4.5 g/t gold including 8 meters containing 13.4 g/t gold while another hole encountered 48 meters containing 2.1 g/t gold and a little bit further down-hole an additional 8 meters of 1.4 g/t gold was intersected. The mineralization in both holes started at in excess of 500 meters but keep in mind the gold-bearing zones were encountered just over 100 meters below the existing pit outline so they would likely be seen as an underground target that could potentially be tackled when the open pit is exhausted in a few decades from now.

That open pit currently contains 3.3 million ounces of gold at an average grade of 1.57 g/t gold while the greater Bankan project now contains 3.65 million ounces at 1.56 g/t in two separate areas. This is based on a cutoff grade of 0.5 g/t gold and if this cutoff grade would be lowered to 0.3 g/t the total resource would increase by approximately 220,000 ounces. On the other hand, if the cutoff grade would be increased to 1 g/t, both pits would still contain in excess of 2.8 million ounces at an average grade of around 2.30 g/t gold. This creates a lot of flexibility on how to tackle these potential future open pits, depending on the gold price environment and the strip ratio.

Disclosure: The author has no position in Predictive Discovery. Please read our disclaimer.