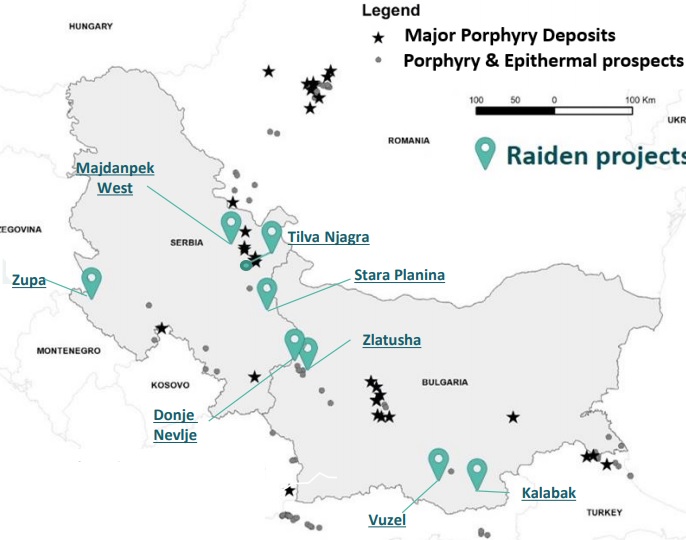

Gold Bull Resources (GBRC.V) is now fully focusing on its newly acquired Nevada properties but we shouldn’t forget about the projects in Eastern Europe where Raiden Resources (RDN.AX) has an option to earn a 75% stake in the Kalabak project in Bulgaria. As part of the 2020 drill program, two high priority drill targets will be drill-tested.

The Sbor target has been selected for its 400 by 400 meter gold in soil anomaly, which appears to be coinciding with a molybdenum and copper anomaly which could indicate the presence of a larger porphyry system at depth and this will be the first drill program trying to punch a few deeper holes into Sbor. The second target to be drill-tested is the Belopoltsi epithermal gold target which was defined based on the 2019 mapping campaign by Raiden and the company’s geologists will drill-test a gold target they think may be 100-200 meters below the surface. Drilling has now been completed and the company is awaiting the assay results from the lab.

Raiden Resources can earn a 75% stake in Kalabak starting with an initial 51% stake after spending US$1M on the project within two years which needs to include at least 3,000 meters of drilling. The company can subsequently earn an additional 24% (to end up at 75%) by completing a pre-feasibility study which has to be supported by at least 30,000 meters of drilling over a 7 year period (with a minimum of 2,000 meters to be drilled in every two year period).

Gold Bull will be focusing on the US based assets (Big Balds and Sandman in Nevada and Coyote Mine in Utah), but we will keep an eye on the Bulgarian assets as well, as that was originally the reason we got into QX Metals (now renamed into Gold Bull Resources). The current share price of close to half a dollar may see some pressure in the next few weeks as the C$0.035 and C$0.05 placements completed in June will come out of the 4 month lockup on October 24th. Although these placements were pretty small (a total of C$550,000) and the current market capitalization is still just around C$15M, perhaps there will be some shares hitting the market.

The question now is how focused Raiden will be on Bulgaria after its acquisition of a Pilbara-located gold and nickel asset portfolio.

Disclosure: The author has a long position in Gold Bull Resources, and no position in Raiden Resources.