The stars finally aligned for zinc earlier this year and the zinc price jumped to in excess of 2 dollars per pound. One would think this would have set the share prices of zinc exploration companies on fire but that couldn’t be further from the truth. Zinc producers are printing money at the current prices but the market still seems to be shunning the exploration-stage companies.

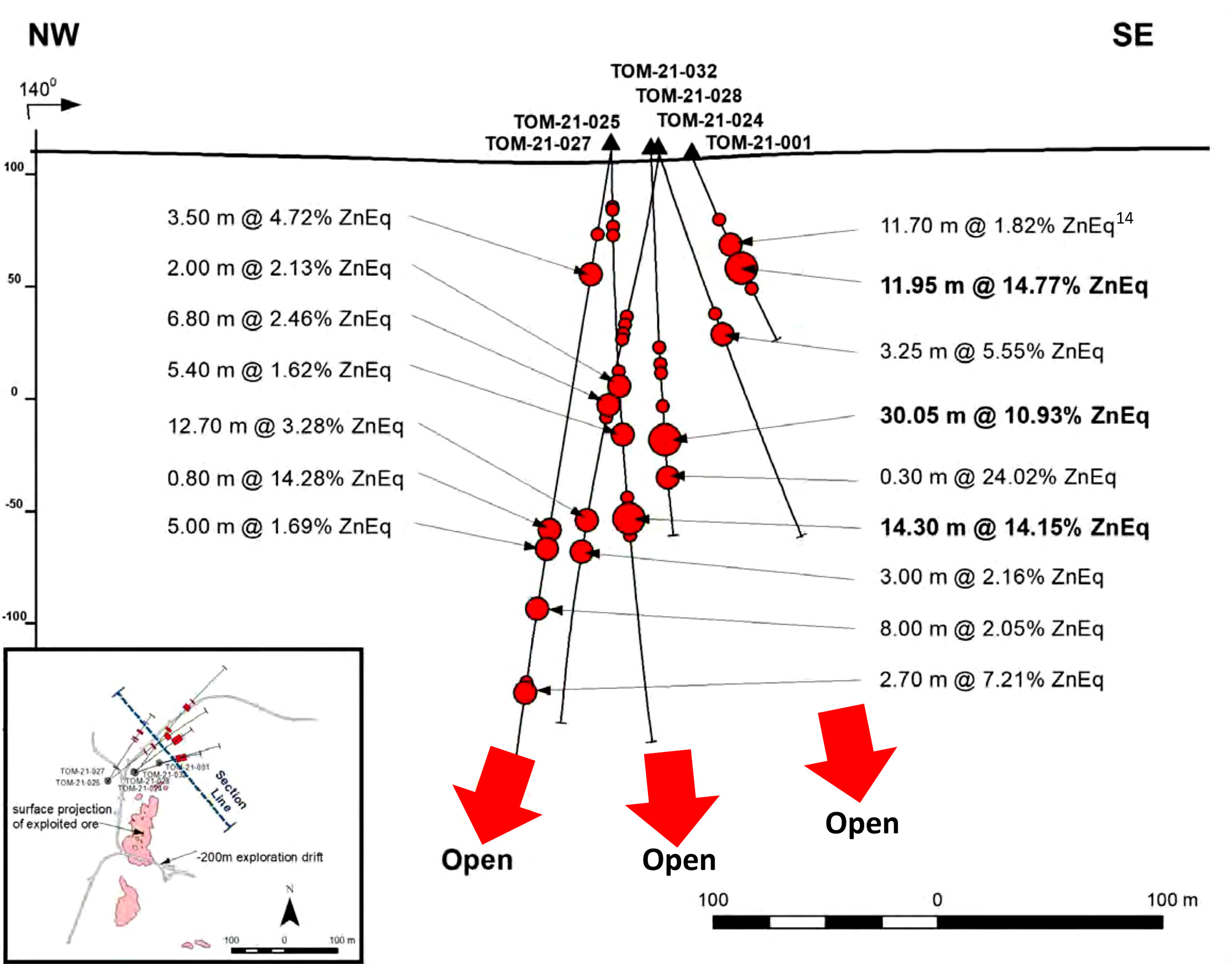

District Metals (DMX.V) shared that pain. The share price never moved up with the zinc price but in the past few weeks and months, we saw its share price fall by 40% despite publishing excellent drill results from its Tomtebo flagship project. The Steffenburgs Zone is shaping up quite nicely with an interval of 30 meters containing 10.9% zinc-equivalent, following up on last year’s interval of 14.3 meters containing 14.2% ZnEq.

The market didn’t care. But with every meter drilled, District Metals is further derisking the Tomtebo project and we wanted to discuss the recent exploration results with CEO Garrett Ainsworth.

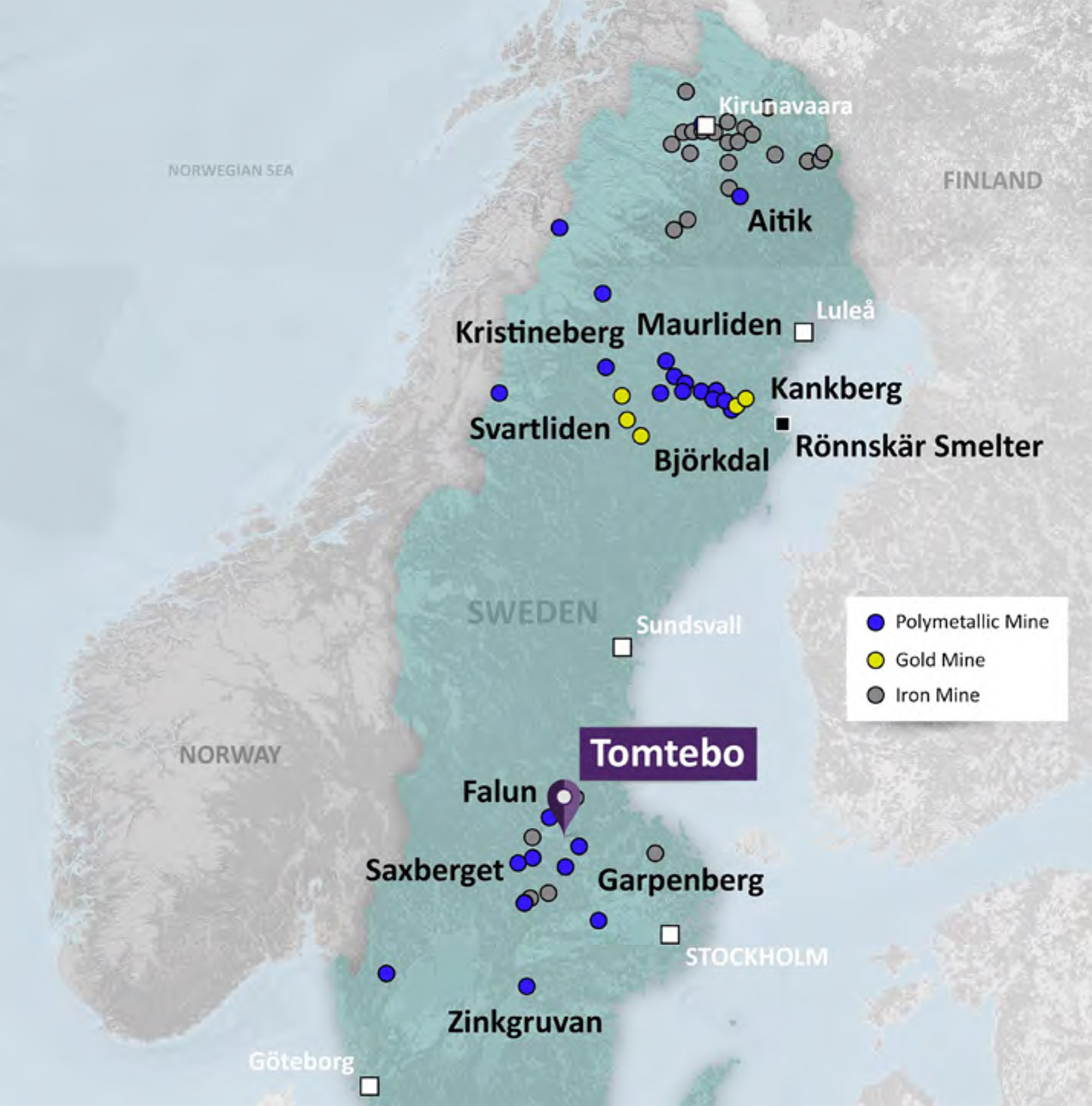

Tomtebo

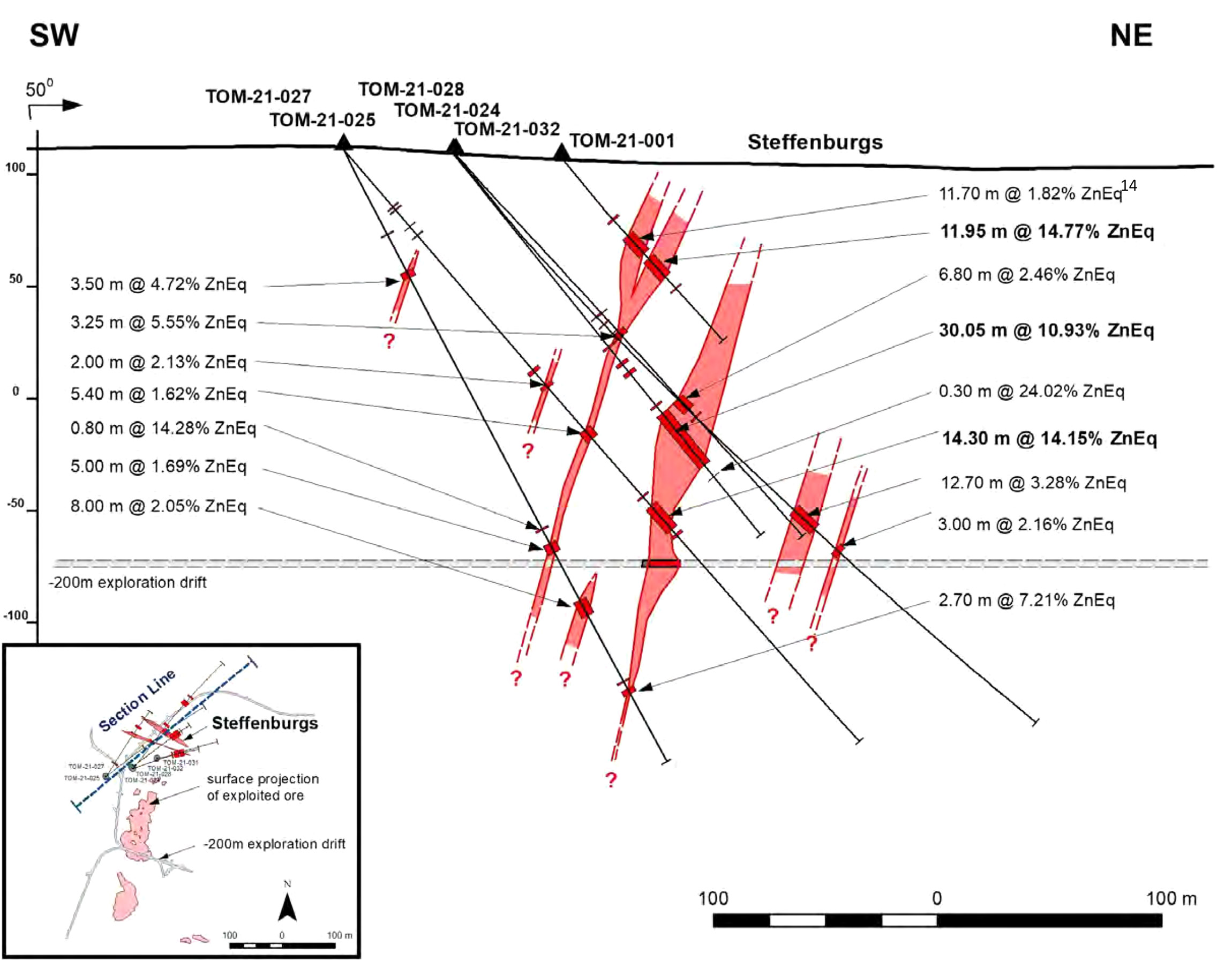

The Steffenburgs Zone at Tomtebo has already provided you with several thick and high-grade zinc-heavy intervals with for instance 14.3 meters of 14.15% ZnEq and 30 meters containing 10.93% ZnEq. How has this high-grade find at Steffenburgs impacted the exploration model?

We have been very impressed with the drill results that have come out of the Steffenburgs zone where our recent drill results have returned thick intervals with massive sulphides that equate to dense and high grade polymetallic mineralization.

This drill core has been examined in detail by Rodney Allen, Technical Advisor for District Metals, where he has determined that mineralization at Steffenburgs is a classic volcanogenic massive sulphide (VMS) lens that occurs at a specific level of the volcanic host stratigraphy, above a large volume of intensely altered and vein-mineralized footwall rocks, and below a succession of less altered hanging-wall rocks. Rodney has a long history working in the Bergslagen District where our Tomtebo Property is located, so his interpretation of the Steffenburgs zone is a giant step forward in understanding the mineral system at the historic Tomtebo Mine.

Knowing that we are dealing with a classic VMS system at the Steffenburgs zone enables us to interpret where new undiscovered polymetallic lenses most likely occur, which has fine tuned our exploration model at this zone.

Will this area be prioritized in order to rapidly build tonnes, or are you still applying a very open-minded approach?

We are still keeping an open minded approach at Tomtebo given that it’s a large property with numerous targets. However, given the volatile market conditions and our limited drill meterage at Tomtebo for H1 2022 we are definitely focused on the Steffenburgs zone for the time being.

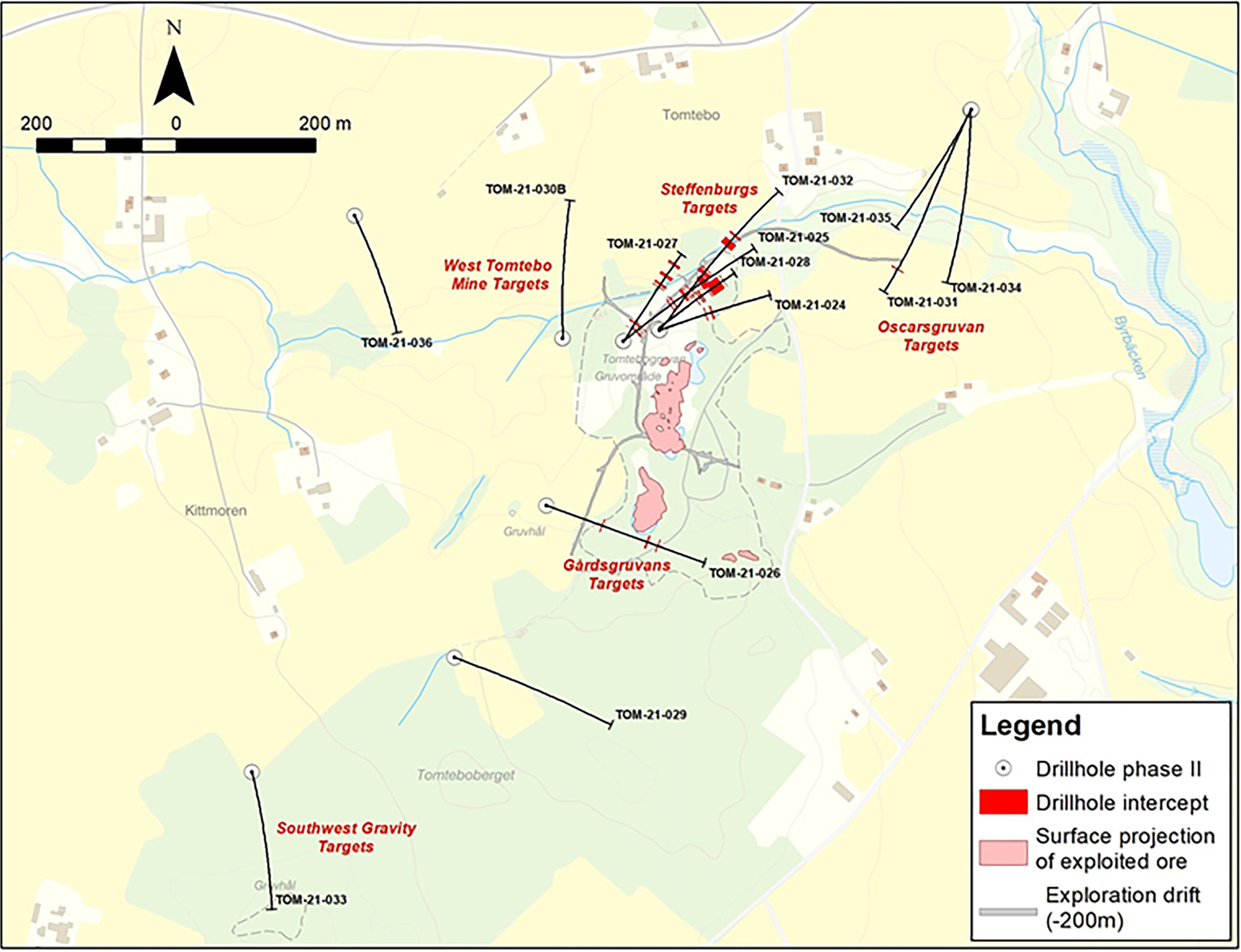

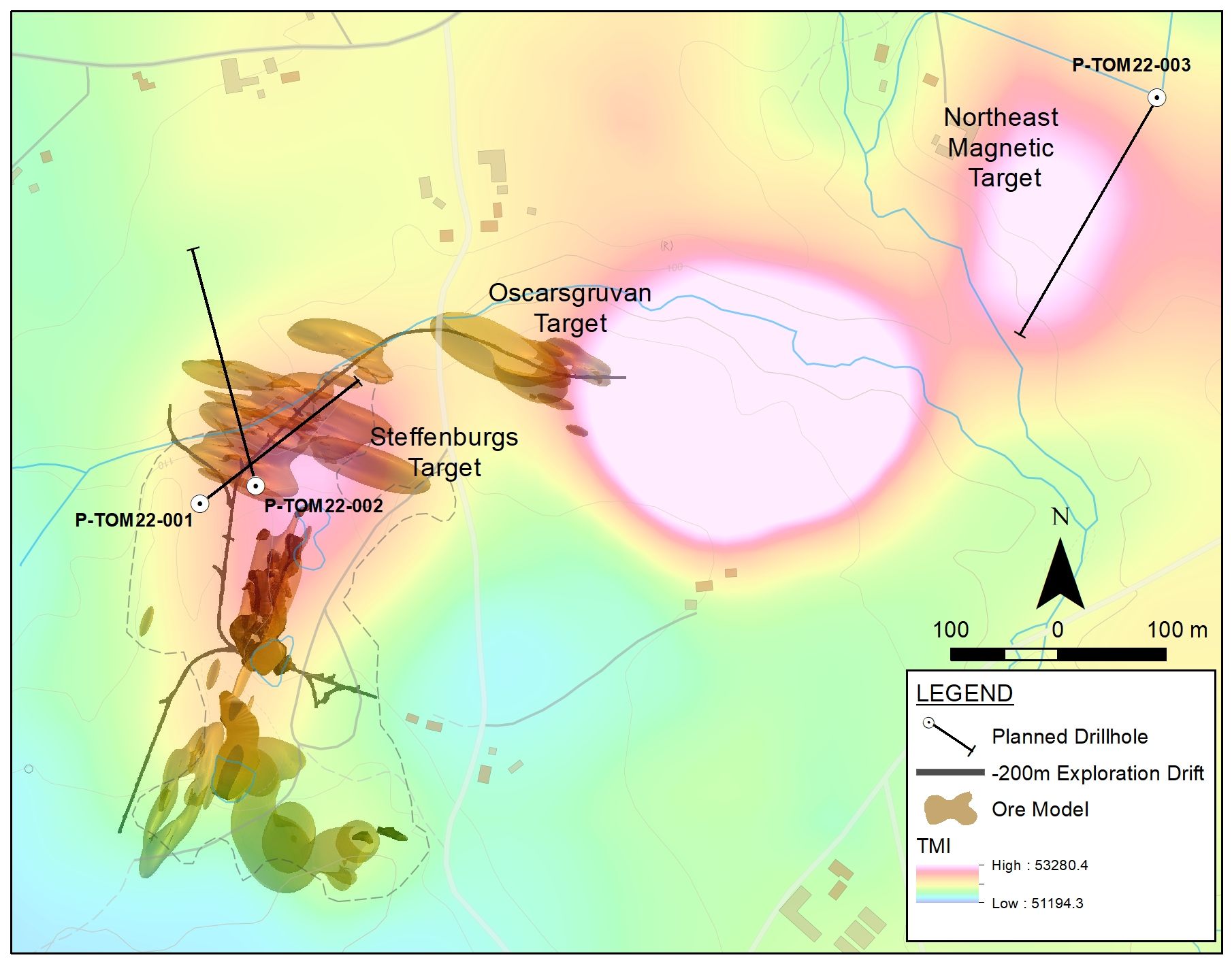

You are currently drilling three holes (or have completed them) at Tomtebo. Can you elaborate on the purpose of those holes? What are you trying to achieve?

For H1 2022 drilling at Tomtebo we have two holes planned at the Steffenburgs zone to drill beneath the massive sulphide lens where hole TOM21-028 intersected 30.0 m at 10.93% ZnEq, and hole TOM21-025 intersected 14.3 m at 14.15% ZnEq with the objective of extending this mineralization at depth.

We also have an aggressive 665 m step out northeast from the historic Tomtebo Mine at a virgin regional target to test a magnetic high anomaly along the Tomtebo Mine VMS mineralized horizon. The magnetic high anomaly at this target has a similar signature to the magnetic high associated with polymetallic mineralization at the Steffenburgs zone. The location of the favourable VMS mineralized horizon has been established through the use of whole rock geochemistry that connects the Oscarsgruvan zone to regional drill hole TOM21-023B, which was drilled 1.0 km northeast along trend from the Tomtebo Mine.

Svärdsjö and Gruvberget

You recently released the results of the interpretation of the data from the airborne EM survey completed on Svärdsjö and Gruvberget. For readers who aren’t familiar with what this exactly is, could you perhaps briefly explain how an EM survey works and how it helps you to define and prioritize drill targets? And how do conductivity and magnetic high and lows play a role?

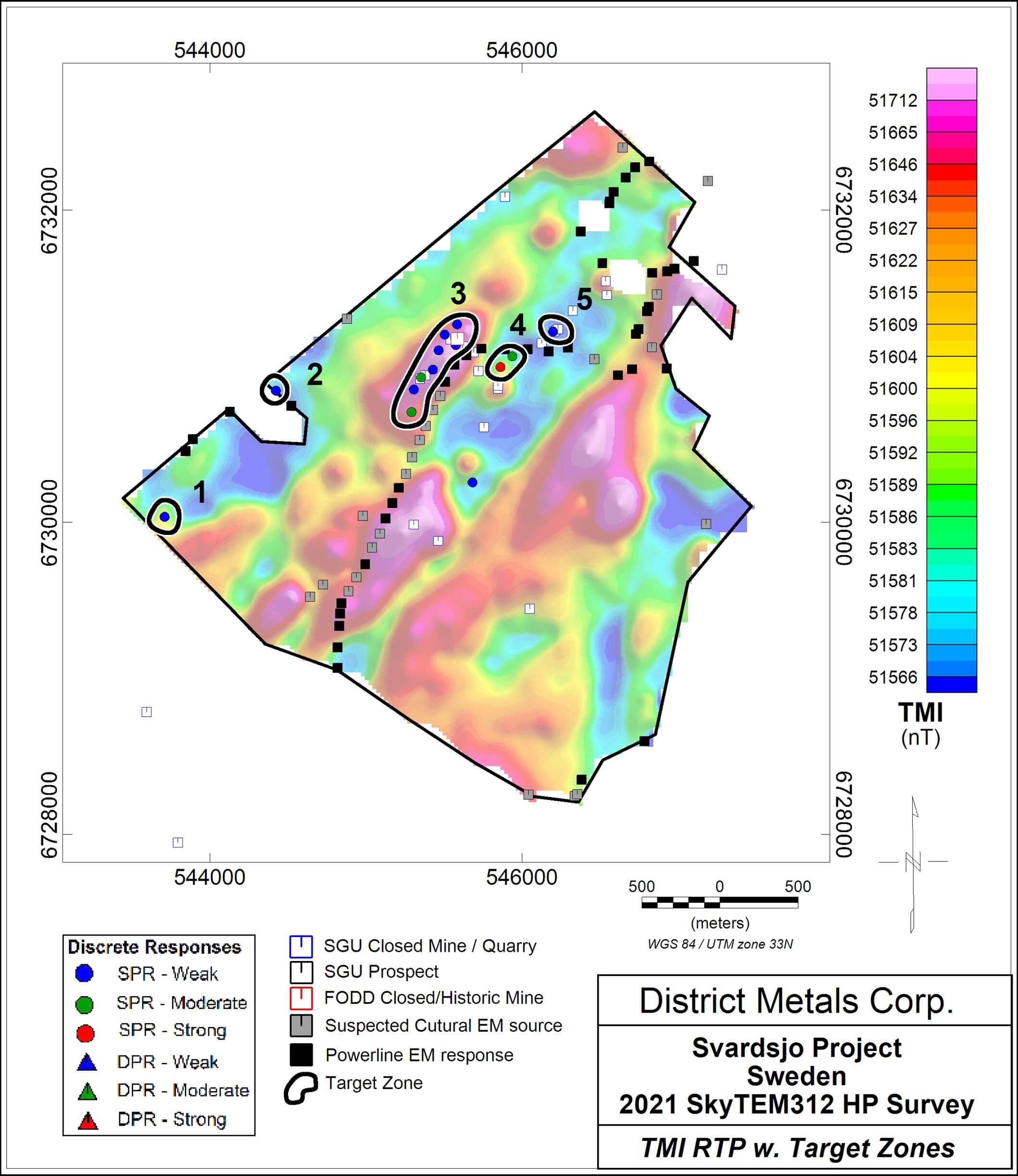

Great questions here! An airborne electromagnetic (EM) survey is a geophysical survey that we’ve used a few times in Sweden now. We retained SkyTEM Surveys ApS based out of Denmark to conduct detailed heliborne SkyTEM312 HP (transient electromagnetic – high power) and magnetic surveys over Svärdsjö and Gruvberget. This EM system has a generator that emits an electric pulse that is reflected from the rocks from near surface to depths of greater than 500 m. The EM system also has a receiver that records how the electric pulse interacts with the rocks below. The recorded EM response is interpreted by geophysical consultants where they pick out conductive zones. The SkyTEM survey concurrently obtains magnetic data, which is interpreted to locate magnetic high and low areas.

The use of EM and magnetic surveys is step one when exploring for polymetallic deposits in the Bergslagen District. The SkyTEM 312HP survey that we flew at Svärdsjö and Gruvberget is capable of identifying potential copper-gold dominant sulphide mineralization (feeder zones) as a moderate to strong conductor while the potential silver-zinc-lead dominant sulphide mineralization (distal zones) may show as non-conductive to weakly conductive due to the zinc sulphide mineralization. However, the silver-zinc-lead mineralization in the district often has associated magnetic sulphides, which is expected to be detected as a moderate to strong magnetic high. The conductive and magnetic data acquired from the SkyTEM312 HP survey gets further interpreted into 3D inversions and conductive and magnetic plates to assist with interpreting the geological setting where there is no outcrop, and to optimize the best drilling orientations.

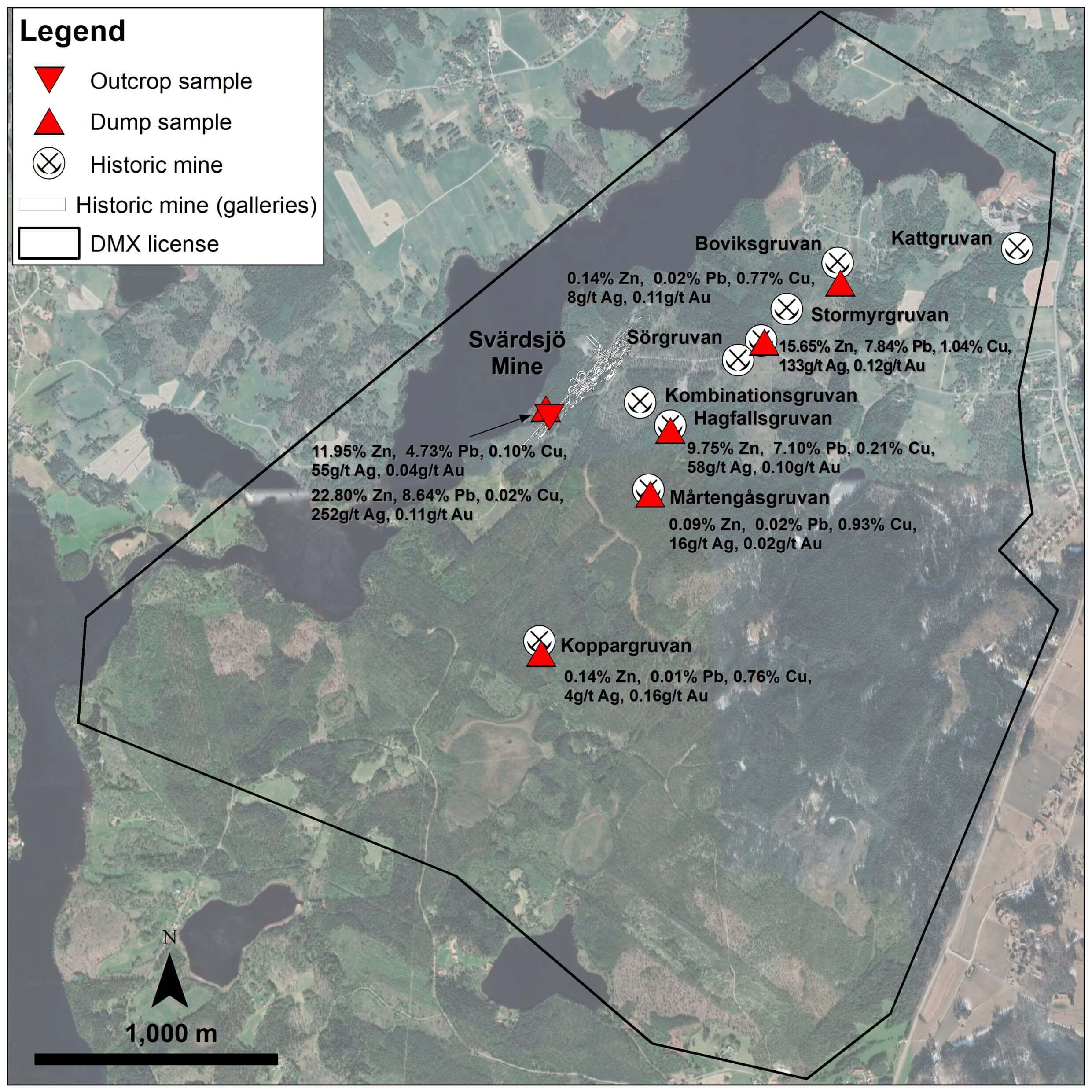

Let’s start with Svärdsjö. The survey identified five potential targets of which number three is by far the most intriguing one, not just due to its size but also due to its location as it appears to highlight the extension of the historical mine at Svärdsjö. Does this mean this zone is becoming your absolute number one drill target now?

For our Svärdsjö Property Target Zone 3 is definitely the highest priority, and it’s a great example of why we use airborne EM surveys. Target Zone 3 picked up the historical Svärdsjö Mine as a conductive and magnetic high zone, but very importantly these geophysical anomalies extend far beyond the historic workings to the southwest of the Svärdsjö Mine, which produced 1.03 Mt at 112 g/t Ag, 6.0% Zn, 2.7% Pb, 0.6% Cu and 0.4 g/t Au from 1887 to 1989. Without a doubt this is the number one target to drill on our Svärdsjö Property, but the significance of the other target zones with associated outcropping polymetallic mineralization won’t be overlooked.

At Svärdsjö, the historical mining activities have reached a depth of almost 400 meters and the EM anomaly seems to correspond well with the (original) claim (made in 2021) the mineralization remained open along strike and at depth. Why were mining activities ceased on the property in the late eighties?

The Svärdsjö Mine was in production intermittently since the 14th Century, which is a common theme in the Bergslagen District. For instance, the Garpenberg Mine was in production intermittently since 400 BC, and it almost closed down in the 1990s before it was properly explored and became a tier one asset for Boliden. Similarly, the Falun Mine shut down in the nineties while ample polymetallic mineralization was left in the ground. A combination of low metals prices and the inability of foreign companies to own mineral licenses in Sweden until the 1990s caused some turbulence for mining operations in Sweden during the eighties and nineties, which is likely what led to closure of the Svärdsjö Mine in 1989.

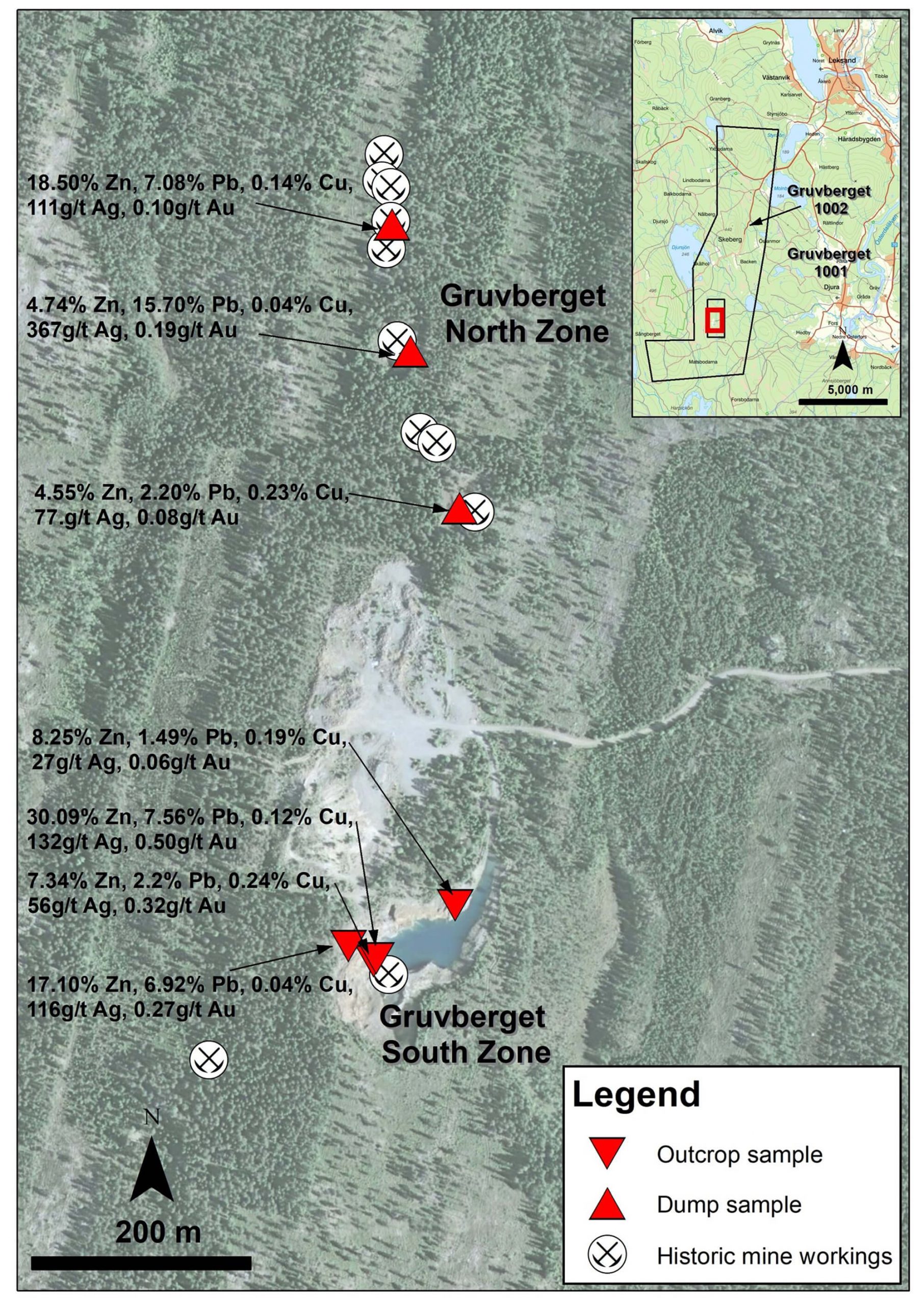

While the airborne survey at Svärdsjö only highlighted a handful of targets (with one very obvious one), the survey at Gruvberget allowed you to identify no fewer than 13 targets with some more interesting than others. At Gruvberget, your area of interest appears to be zones 3 to 8 which are six targets in very close proximity to each other. What is your planned approach there? And how did you decide on where to drill the 10 holes?

We were very please with the geophysical target zones identified at our Gruvberget Property, and it just gets better as we found some historical assessment reports from the 1980’s that has increased the Property’s potential to host a significant polymetallic deposit.

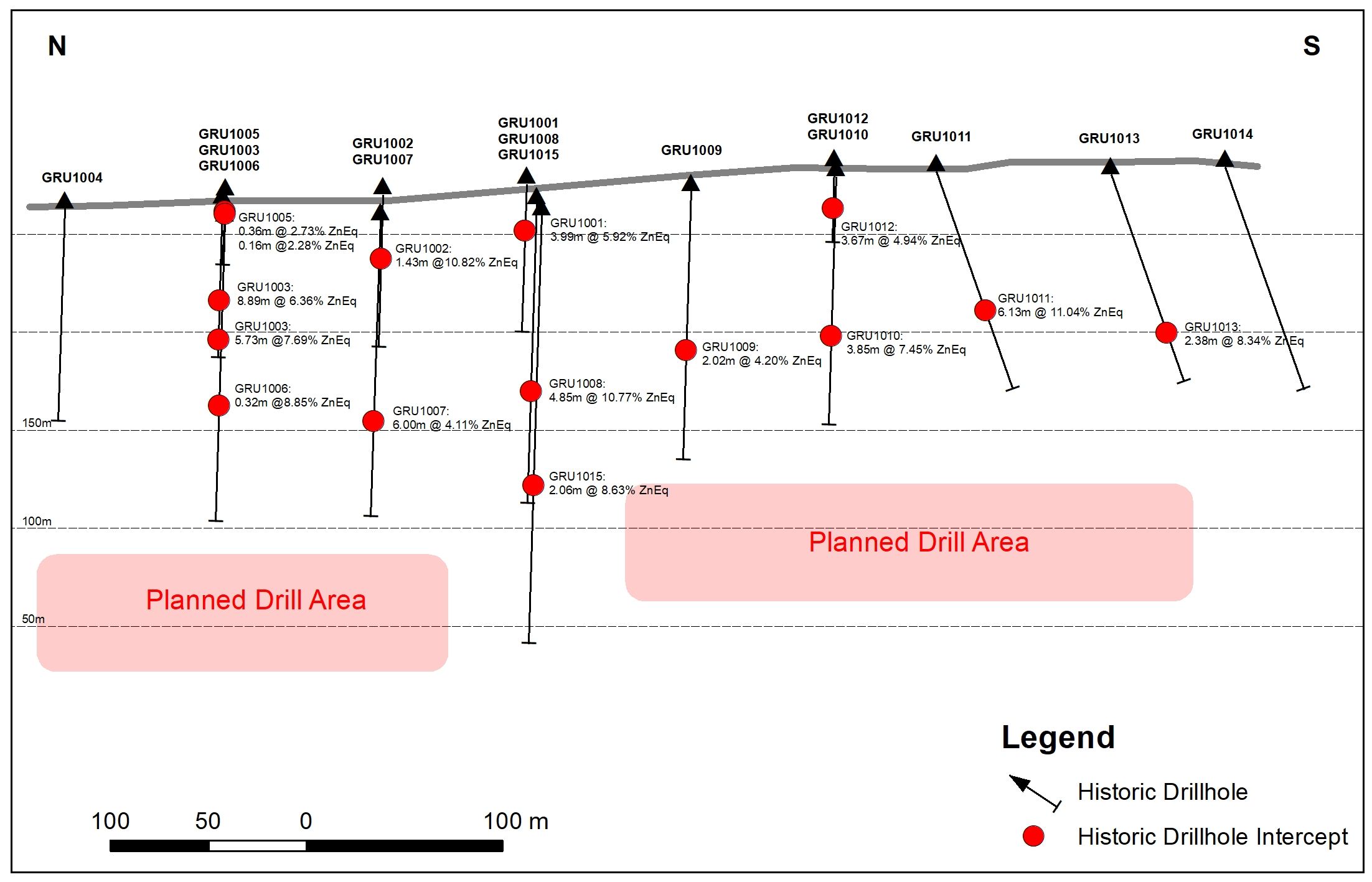

Target Zone 1 is our main focus for drilling in H1 2022 as the EM and magnetic anomalies here are associated with the North Zone where 15 historic drill holes delineated continuous polymetallic mineralization along a 550 m strike to depths of 160 m that is wide open at depth and partially open along strike. The continuity of the North Zone is impressive, and holes such as GRU10-011 that intersected 6.1 m at 11.0% ZnEq is the reason why we fast tracked drilling at Target Zone 1.

Target Zones 3 to 8 have quite strong conductors with associated magnetic highs, but they require further work before drill targets can be developed. Target Zone 8 is particularly exciting as it has the strongest conductor on the Property, and it happens to be in the “up-ice” direction from a couple of high grade polymetallic boulders that assayed up to 15% Zn and 4% Cu.

In hindsight, you must be pretty happy the agreements to acquire Svärdsjö and Gruvberget are straightforward and not very cash-intensive. Does this mean you can just continue to advance the projects at your own pace rather than having to face very strict cash payments and exploration commitments?

One of the advantages of working in Sweden is that there aren’t hoards of Canadian junior exploration companies operating in the Country. With less competition to acquire mineral properties in Sweden we have been able to acquire high potenial advanced stage exploration projects in a world class district at a very reasonable cost to the Company. The volatile markets in 2022 are the only thing holding us back from larger exploration and drill programs on our Properties in Sweden.

Corporate

The zinc price exceeded $2/pound for a while just over a month ago, but nobody seemed to care. In fact, although the DMX share price didn’t rise in correlation with the zinc price, it does look like the share price decreases in line with the zinc price. Although you are a pre-resource stage exploration company and the market may have some difficulties valuing a company without a resource, there seems to be a complete disconnect between the zinc price and the zinc companies (as it really isn’t just District Metals whose share price is hurting). Do you have any explanation for that other than the ’risk off’ mentality on the markets now?

The markets have been very volatile since late-2021, and especially in the past two months there are not many public companies that have come out unscathed. Gold, silver, copper, and even uranium focused companies have almost all declined as of late, so it’s not just isolated to zinc focused companies.

What is your current cash position and how much of a runway does this provide?

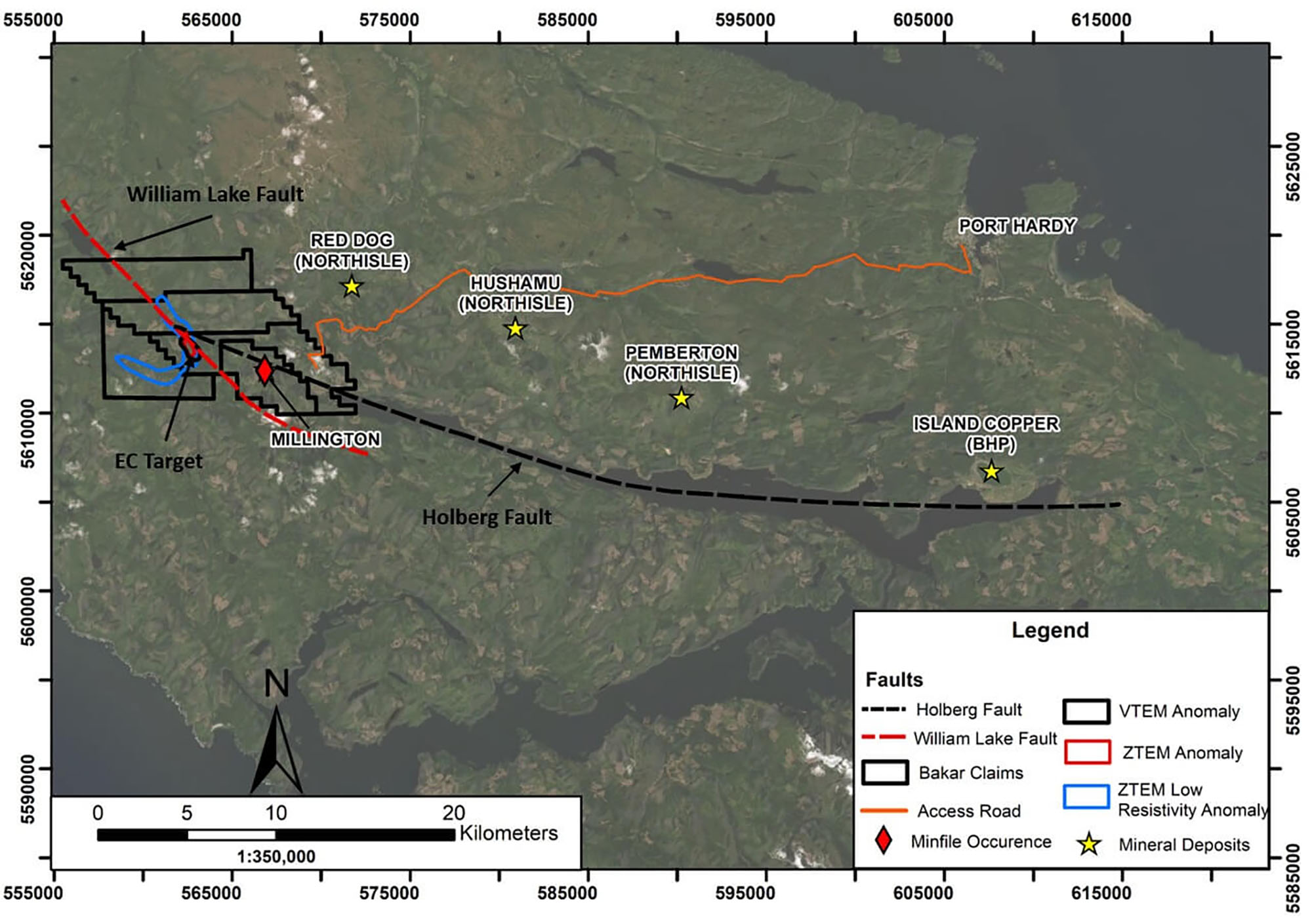

Our current cash position is at about C$1.8M, and after all of the invoices are paid for our ongoing drilling at Tomtebo and Gruvberget we’ll have just over C$1.0M left in the treasury. Our G&A burn is quite low at C$30-40,000/month, so even with some fieldwork planned this summer and drilling at our Bakar Property this autumn we have quite a long runway.

You have just returned from a trip to Sweden. How was it to be back on the ground there? Were you just having a look at the projects or were you also keeping the local communities and/or the government appraised of your progress?

My trips to Sweden have been very positive, and the latest one was no exception. Having a physical presence with our technical team is very important, and improves the way we communicate from afar after I have seen and discussed the lay of the land in person.

It is very convenient having our three advanced stage exploration properties (Tomtebo, Gruvberget, and Svärdsjö) all within 40 km. We covered a lot of ground on all three properties while I was in Sweden where we followed up on recently identified geophysical anomalies from our SkyTEM surveys.

Much of our community work at Tomtebo was completed in 2021, so in 2022 it has been more about brief updates for any interested parties. I continue to be very pleased with the understanding and support from the local communities in which we are working.

Boliden is obviously doing very well in the current market circumstances and the company reported an operating cash flow in excess of US$500M in the first quarter. How important is it to have a large and cash-flowing senior producer in the immediate vicinity of all your projects?

This is a good point that you raise! Part of the selection criteria when we were reviewing projects as a shell company from 2018 to 2019 included the presence of a potential suitor. Our mandate is to explore, discover, delineate, develop, and monetize a mineral property, so having majors nearby that are financially healthy is critical to monetizing an asset. In the Bergslagen District you have Boliden and Lundin Mining who could be suitors if the right asset was developed. For District Metals it is very important that Boliden and Lundin Mining are creating excess cash flow.

Any parting thoughts?

It’s been a tough time in the stock markets so far in 2022 where many mineral resource companies are not getting valued properly, but this will change at some point in the future as it always does. In the Meantime, we will continue to advance our high grade polymetallic properties in a world class district with a stellar team driving the exploration process.

Conclusion

The only thing District Metals can do is continue its exploration activities in Sweden to further unlock the value of first of all Tomtebo where the drill bit has intersected some very exciting intervals. We shouldn’t forget about the Svardsjo and Gruvberget projects either. Although these are still earlier stage than Tomtebo, both projects obviously have merit and District Metals has been diligently and methodologically working to define the drill targets there.

The recent airborne surveys on both projects have identified a myriad of drill targets but the company’s focus will obviously remain on the flagship Tomtebo project. It is a pity the company’s share price did not benefit at all from the recent surge in the zinc price but we’re comforted knowing this team is working hard and taking all the right steps to get the projects across their respective finish lines.

Disclosure: The author has a long position in District Metals. District Metals is a sponsor of the website. Please read our disclaimer.