Life hasn’t been easy for uranium companies and only a handful of investors haven’t lost faith in the prospects of the uranium market and we hope the expression ‘it is usually the darkest right before dawn’ will hold up in this case as the fundamentals of the uranium market remain positive for a bullish set-up. Yes, tough to believe, but in this report, we will provide an updated background of the uranium market to explain why we still believe in higher uranium prices although we wholeheartedly admit it is taking much longer than we expected a few years ago.

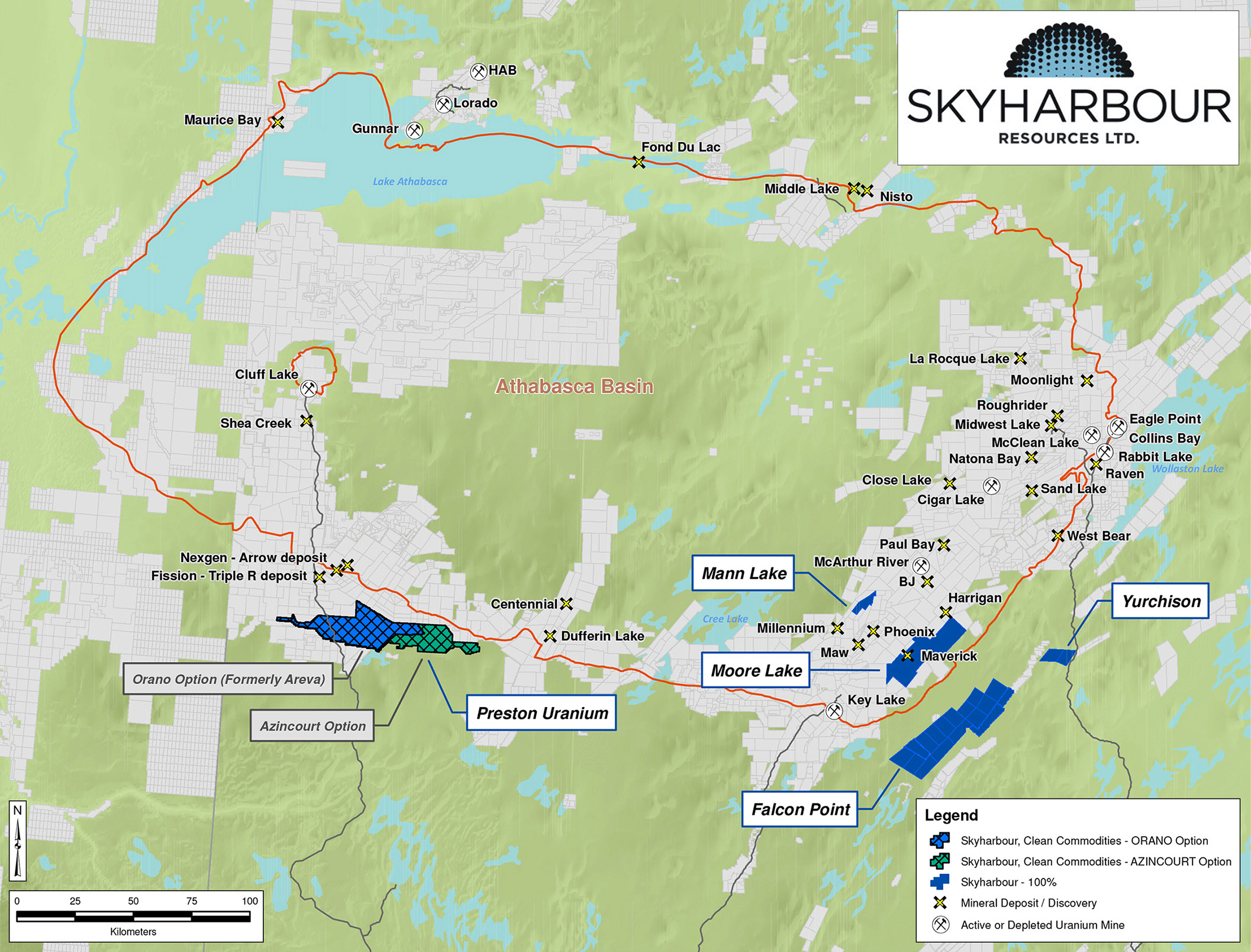

Skyharbour Resources (SYH.V) is one of the companies that has been able to raise sufficient amounts of money to keep on advancing its properties. In addition to offering investors high-grade uranium discovery potential, a few years ago as a part of its prospect generator strategy, the company attracted two partners to work on two of its projects. Skyharbour has also now retained full ownership of its flagship Moore uranium project which means the company is advancing on three different fronts.

Skyharbour has just announced the commencement of its 2020 winter drill program

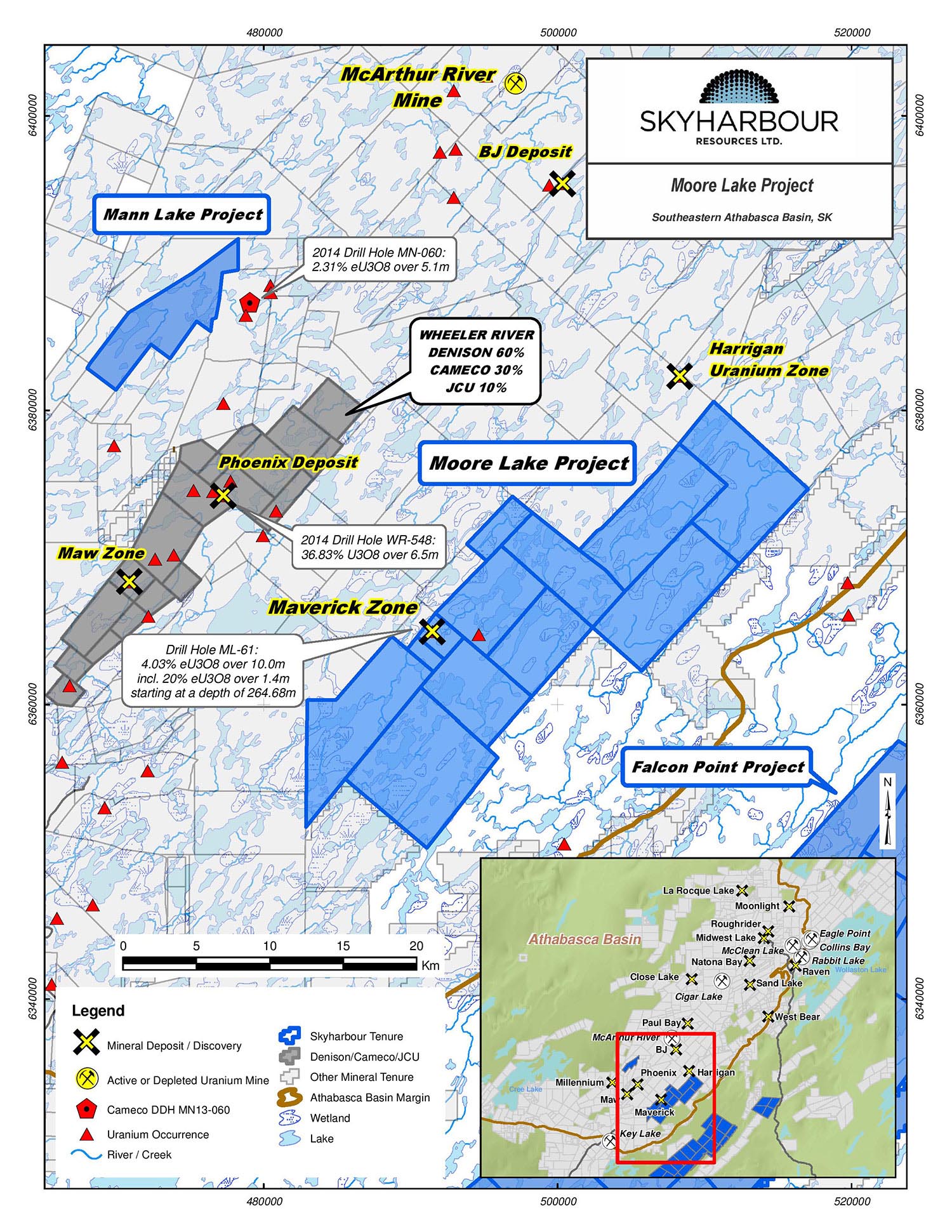

Skyharbour Resources (SYH.V) has announced it has started its winter drill program on its Moore Uranium project in Saskatchewan’s Athabasca Basin proximal to Denison Mines’ (DNN, DML.TO) Wheeler River project. Denison is a large strategic shareholder and partner company of Skyharbour.

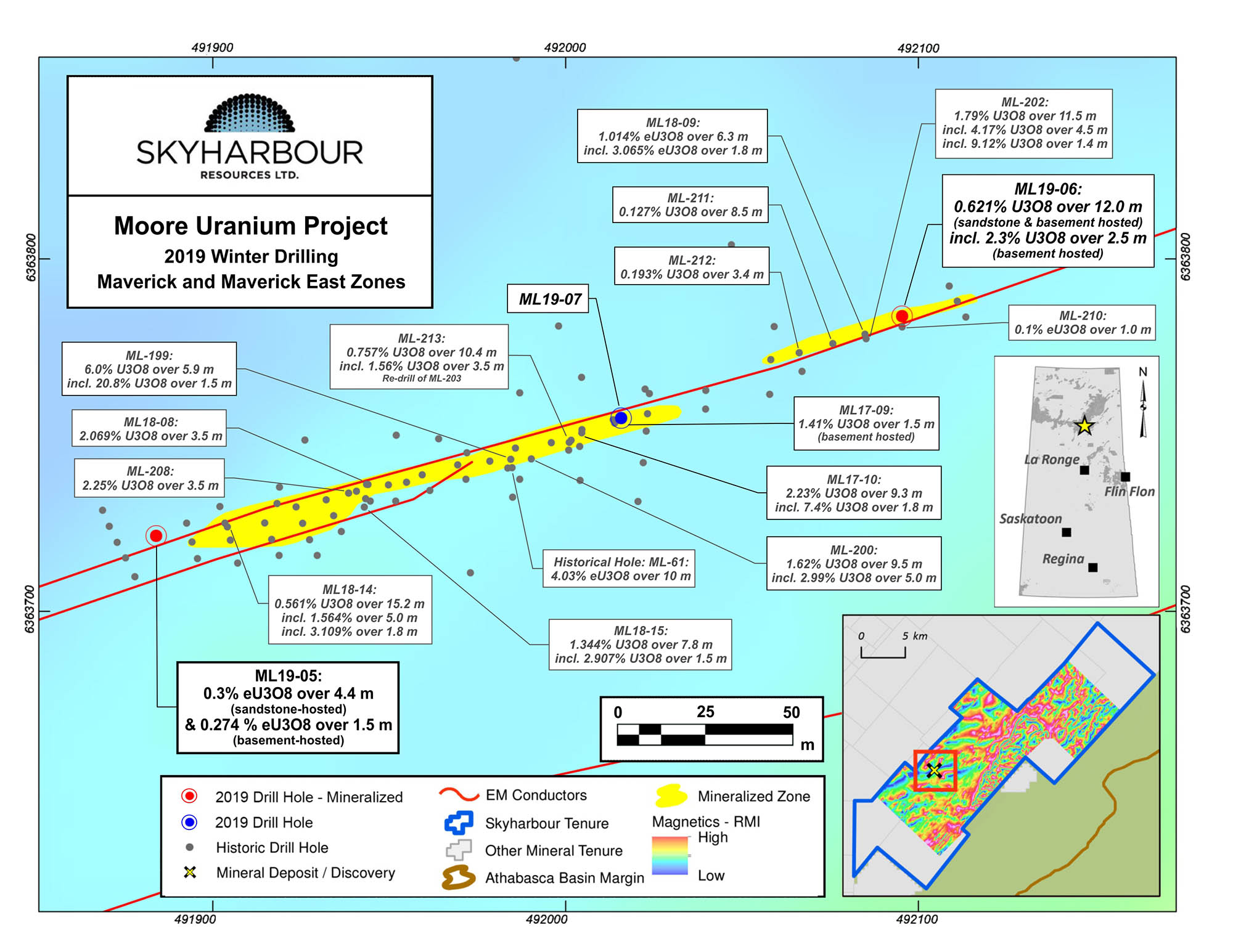

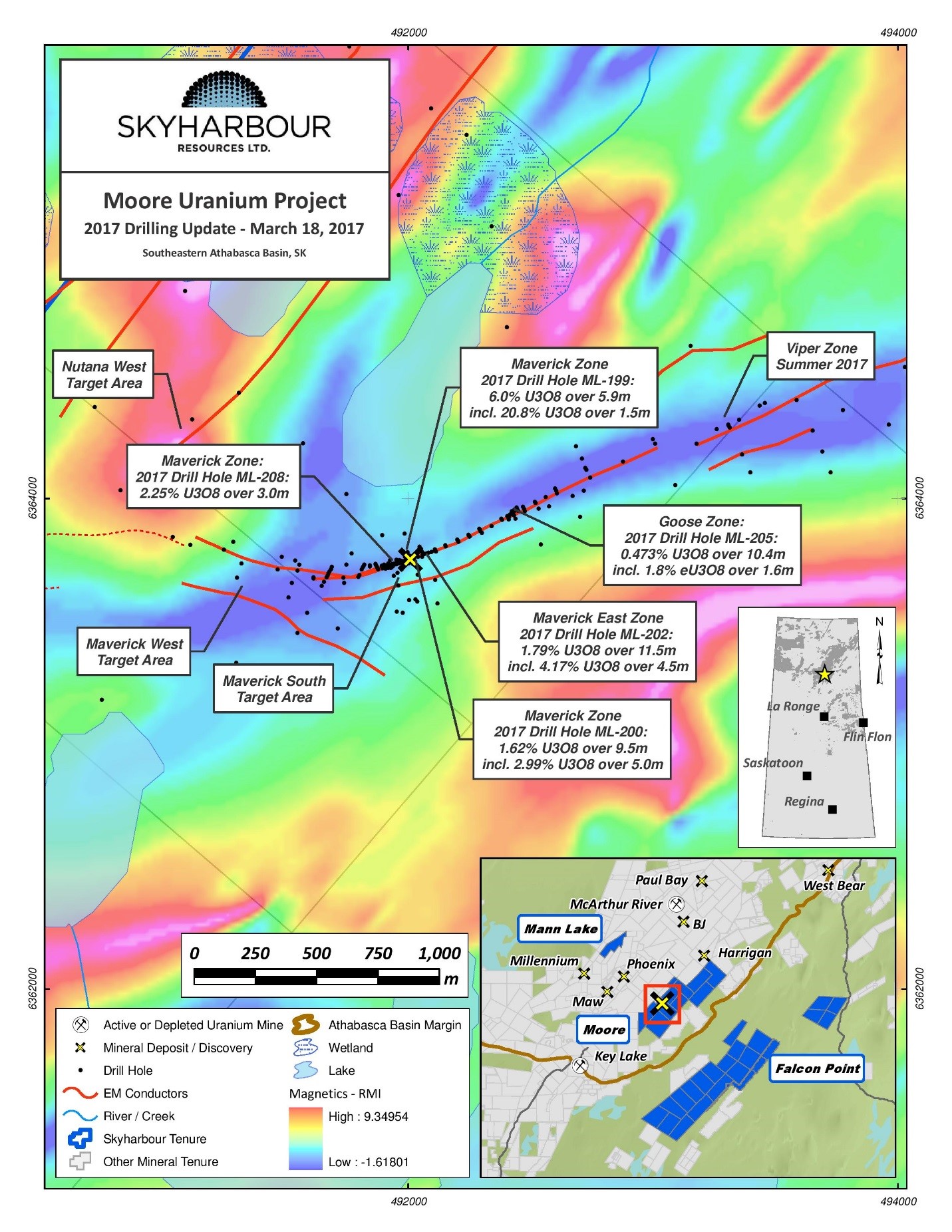

The company plans to drill a total of 2,500 meters in 7-9 holes where Skyharbour has done additional work to upgrade the ‘interesting’ zones to high-priority drill targets. Over the past six-seven months, Skyharbour has done a lot of geophysics and geologically modeling to further refine the targets and this drill program that has just been announced will focus on these high priority drill targets along the four-kilometer long structural corridor at Maverick. With a focus on basement rock hosted targets.

At Maverick East, Skyharbour will follow up on the best hole it has drilled in 2019 which consisted of 12 meters containing 0.62% U3O8 for a gross rock value of $545/t using a uranium price of $40/pound (and about $325/t using the current spot price for uranium) including a narrow but very high-grade interval of 2.31% U3O8 over 2.5 meters. As the exploration season came to an end before Skyharbour was able to follow up on this hole, the company must be very keen to re-test this target and according to its press release, Skyharbour will be focusing on the strike extensions and potential zones down dip of last year’s high-grade basement hosted discovery.

Additionally, Skyharbour will also drill-test the potential north-eastern extension to the Maverick mineralized corridor and the other exploration targets there are 0.5-1.5 kilometers away from the ‘main’ Maverick zone and within the 4 kilometer long structural corridor that hosts the mineralization at Maverick. These other mineralized zones have already been the subject of drill programs but as the spacing between drill holes was quite wide, Skyharbour will now narrow down its focus and zoom in on the most promising areas and we are looking forward to see if the refined exploration targets in the underlying basement rocks will help the company find wider mineralized intercepts (historical drilling did encounter some uranium mineralization but generally in narrow intervals). Most exploration targets that will be drill-tested by Skyharbour are basement-hosted as this is where the feeder zones to the high grade mineralization in the sandstone and at the unconformity are located. Worth noting is that at the current valuation, one high grade drill intercept can change the fortunes of the company and management of Skyharbour clearly recognizes this as they have been accumulating shares over the last 6 months.

The company will be advancing on three fronts – thereby confirming the prospect generator model in the uranium space

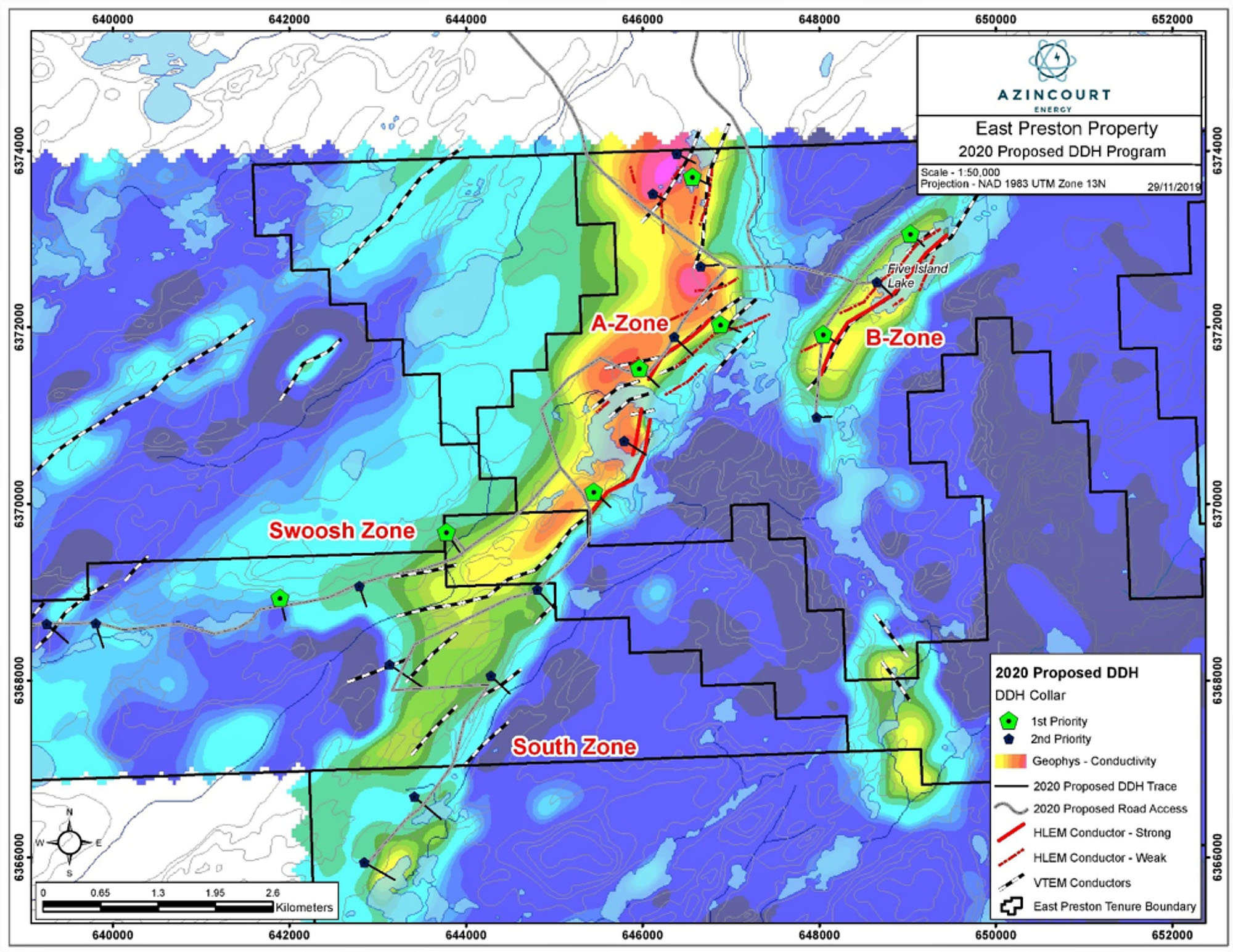

Skyharbour’s own 2,500 meter drill program announcement comes hot on the heels of the announcement of option partner Azincourt Energy (AAZ.V) which announced the start of its own 2,500 meter drill program on the East Preston uranium project where it is currently earning a 70% stake. Azincourt aims to drill up to 15 holes and has earmarked C$1.2M for drilling purposes at the East Preston project.

This means Skyharbour will be able to announce drill results from two projects where a cumulative 5,000 meters of drilling will be completed. Its other option partner Orano (previously AREVA) announced a large geophysical field program at Skyharbour’s Preston project which will commence soon followed up by drilling later in the year. Keep an eye out for updates on these programs.

The main question remains unchanged – When will the uranium price turn around?

The uranium market remains a relatively opaque market but it is possible to put the pieces of the puzzle together by combining information from different sources. The uranium-focused companies usually do a decent job in explaining (or at least trying to explain) the current situation on the uranium market as that’s the only way to keep the investor bases engaged.

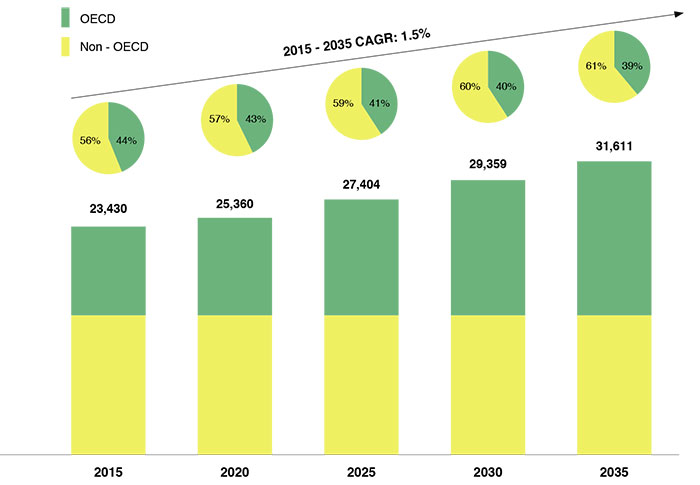

As of the end of 2019, 442 nuclear reactors were operable for a total capacity of 392,400 MWe. During the calendar year six new reactors were opened, adding just over 5,200 MWe to the equation but this just mitigated the impact of the closure of nine other reactors which had a capacity of almost 6,000 MWe. Those nine closures were mainly age-related. The Muhleberg reactor in Switzerland, for instance, is almost 50 years old so it was about time to retire the reactors. Additionally, the construction process on three new reactors has actually started with one new reactor being built in Russia, China and Iran.

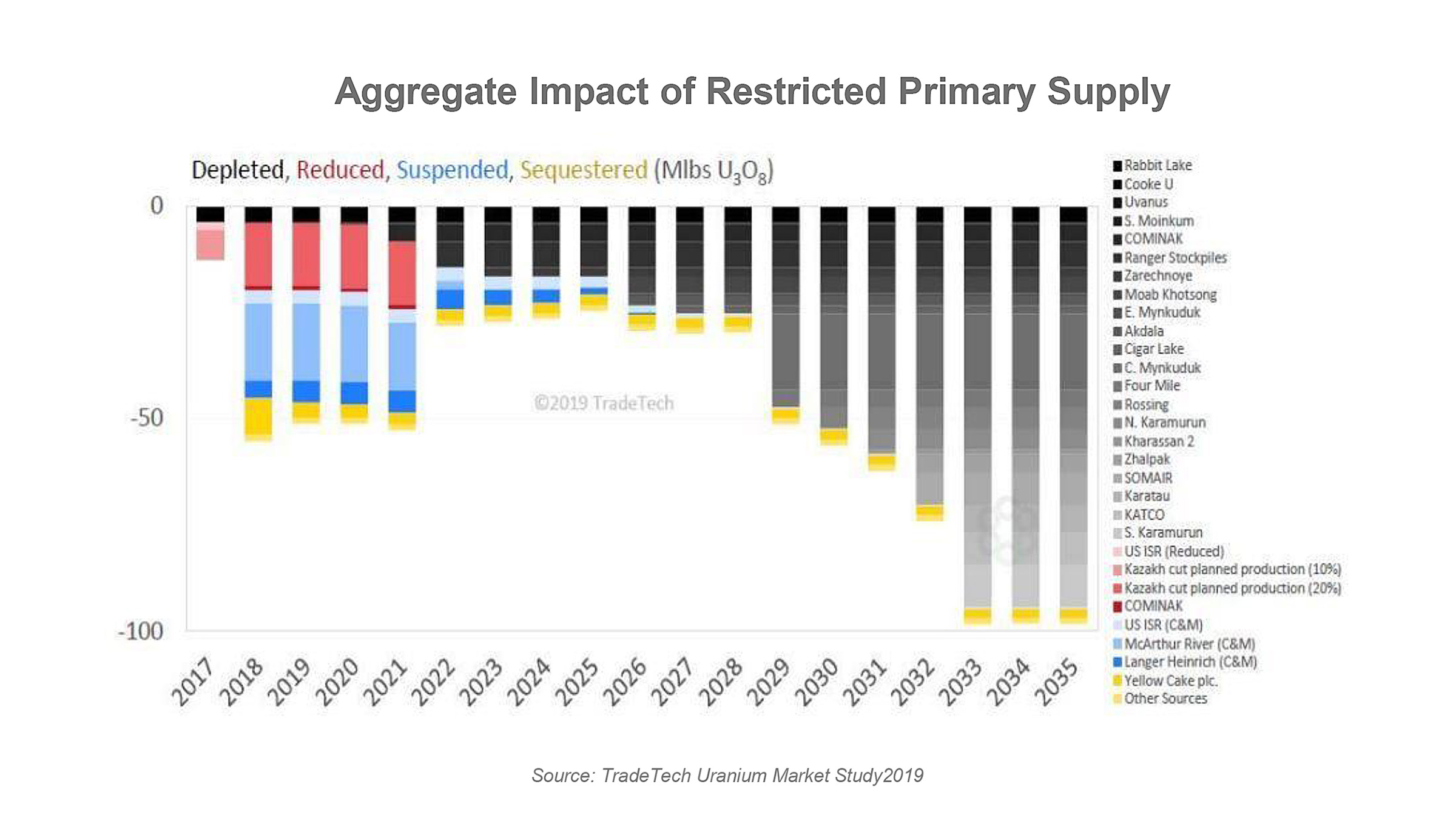

According to UxC, the annual uranium production in 2019 slightly increased to 140 million pounds (compared to 138 million pounds in 2018) as Kazakhstan increased its output by almost 3 million pounds due to pre-arranged approvals that had to be honored despite the commitment to reduce the country’s production by 20%.

Considering the current annual demand for uranium is still way above the primary mine output, the uranium market remains in undersupply and the shortfall is being covered by the availability of secondary sources (think about reactor operators selling off some of their stockpile, dismantling nuclear warheads to convert bomb-grade material to uranium for nuclear reactors). That is a situation that has lasted longer than we expected as we anticipated these secondary sources to dry up years ago.

We were wrong about that. We were also wrong when we expected the situation to improve in 2019. But that could change in 2020. As you may remember Cameco (CCJ, CCO.TO) didn’t just shut down its very prolific McArthur River Mine (with a nameplate capacity of 18 million pounds per year) but also entered the spot market as a net buyer. Rather than producing uranium at break-even or at a loss, Cameco’s financial department ran the numbers and decided it would make more sense to just buy the uranium it needs to fulfill its obligations under its long term delivery contracts as the price difference between buying at spot and selling into higher-priced long-term contracts makes a lot of economic sense.

It was also very interesting to listen in to the conference call of Cameco (CCU.TO, CCJ) as the CEO discussed the current situation with some more color. The entire transcript of the conference call can be found here and the 33 pages are quite an interesting read for anyone who is interested in the uranium space.

During the conference call, Cameco’s CEO mentions the demand is on an upswing (which is encouraging to hear) while the supply rate is on a downswing resulting in an increased confidence in the transition on the uranium market. He also claims there is an increased recognition by policy makers and some environmental groups which now acknowledge that nuclear power will be ‘an indispensable tool for addressing what is being referred to by many as the climate change crisis’.

The exact size of the open market purchases of Cameco remains a well-kept secret as Cameco doesn’t want to tip off its (potential) sellers how much it needs and how urgently it needs the uranium. This could mean two things: either Cameco is overly careful or the oversupply on the secondary uranium market isn’t as high as expected. There might be less for sale on the spot market than what everyone has generally been assuming at this point. Cameco’s secrecy is intriguing and the fact that a very low volume of 1.5 million lbs of uranium transacted on the spot market in January indicates a tightening market.

Of additional interest is Cameco’s CEO’s commentary in the press release which announced ‘We added just over 36 million pounds of deliveries to our long-term contract portfolio, more than replacing what we delivered in 2019, while maintaining leverage to higher future uranium prices. In addition, we have more prospective long-term business in the contract pipeline than we have seen since 2011.’

Does this indicate the era of depressed uranium prices is over? Maybe.

Conclusion

It’s not easy to be a uranium exploration company these days and the recovery of the uranium market has taken longer than expected. It’s undeniable nuclear reactors play and will continue to play an important role in the energy generation cycle and it is now just a game of numbers before the secondary supply of uranium runs out in the backdrop of growing demand.

Skyharbour is subject to external factors. But the company’s approach with exposure to three uranium projects where exploration and development is being carried out is perhaps the best possible way forward. Orano and Azincourt are spending their money on their respective earn-in projects and although Skyharbour would be a small minority partner once both companies complete the earn-ins, even a small ownership of a sizeable discovery could be very valuable.

It’s now up to the technical crews of Azincourt Energy and Orano to work on the interpretation of their assets while we are looking forward to see what Skyharbour will pull out of the ground during its fully-funded winter drill program on its 100% owned Moore Uranium project.

Disclosure: The author has a long position in Skyharbour Resources. Skyharbour Resources is a sponsor of the website.