In February of this year, Riverside Resources (RRI.V) sold its existing Ontario portfolio to iMetals Resources (IMR.V) for 8 million shares of the company (which currently have a value of just over C$600,000) and a 2.5% Net Smelter Royalty (1.5% for base metals). Riverside will also be entitled to a C$500,000 cash or stock bonus if the drill bit intersects a 100 gram-meter interval on any of the three projects.

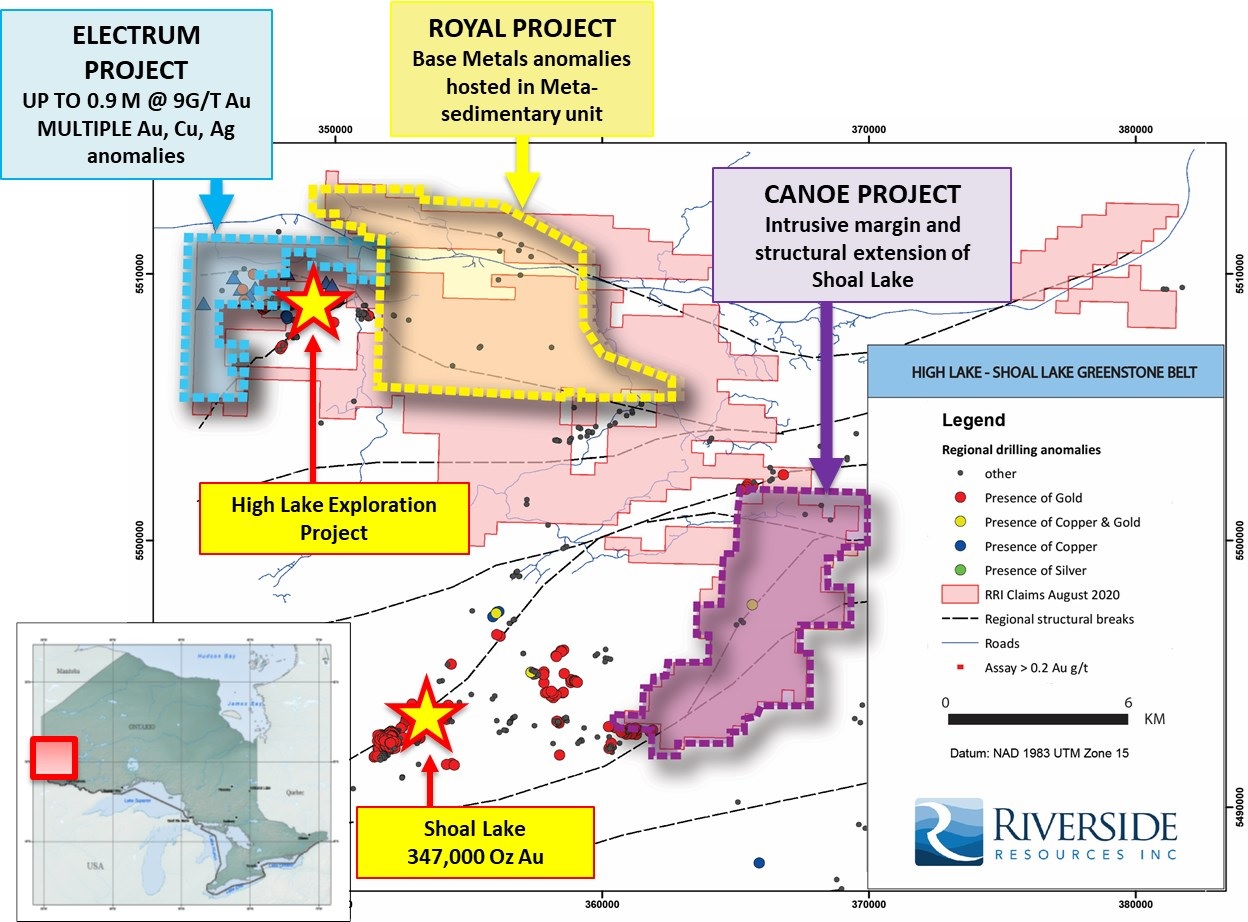

An exit from these three Ontario projects, but Riverside clearly likes the area as the company has advanced the High Lake Greenstone belt which it staked last year in August. The company has now defined three projects on this 230 square kilometer land package: Electrum (1,800 hectares), Royal (6,150 hectares) and Canoe (4,260 hectares).

The company’s press release provides a good overview and summary of these three new projects so we won’t bore you with just rehashing what you could easily find on the Riverside website, but we will be following up with CEO John-Mark Staude soon.

Disclosure: The author has a long position in Riverside Resources. Riverside is a sponsor of the website. Please read our disclaimer.