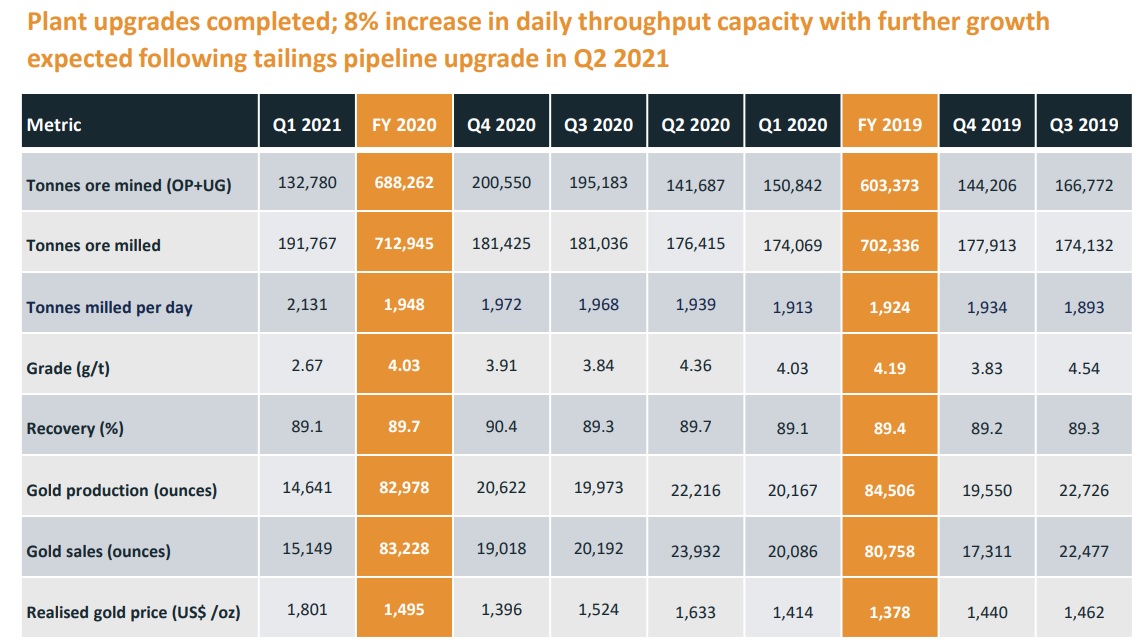

Shanta Gold (SHG.L) has produced just over 14,600 ounces of gold in the first quarter of this year, which is about 30% lower than the 20,600 ounces it was able to produce in the first quarter of 2020. The lower production rate also caused the AISC to jump, and the aforementioned 14,600 ounces were produced at an AISC of about $1300/oz.

Despite the disappointing performance in the first quarter, Shanta Gold has confirmed its full year guidance to produce 80,000 ounces of gold at an AISC of $1050/oz which means the three remaining quarters of the year will see an average production of in excess of 20,000 ounces per quarter at an AISC of less than $1000/oz. This will be the direct result of the third mill being ramped up at New Luika and this will boost the processing throughput from 2,130 tonnes per day in Q1 to about 2,300 tonnes per day by Q3. Additionally, the average grade was slightly lower in Q1, and the gold grade of the processed rock will increase throughout the year. As Shanta Gold is guiding for 45% of the gold to be produced in H1, it implied a H1 2021 production of 36,000 ounces of gold which means the Q2 production will likely exceed 21,000 ounces of gold as that will be required for Shanta Gold to meet its expectations.

Shanta Gold’s balance sheet remains strong with in excess of $50M in cash and just $11M in gross debt. The net cash position has remained relatively stable at just over $30M (which is a decrease on a QoQ basis, but this could be explained by changes in the working capital).

Disclosure: The author has no position in Shanta Gold. Please read our disclaimer.