Southern Silver Exploration’s (SSV.V) share price has been hit hard recently as both the silver price and the zinc price are doing pretty bad, but the company is still advancing its Cerro Las Minitas project (in which it owns a 40% stake with joint venture partner Electrum Holdings holding the balance).

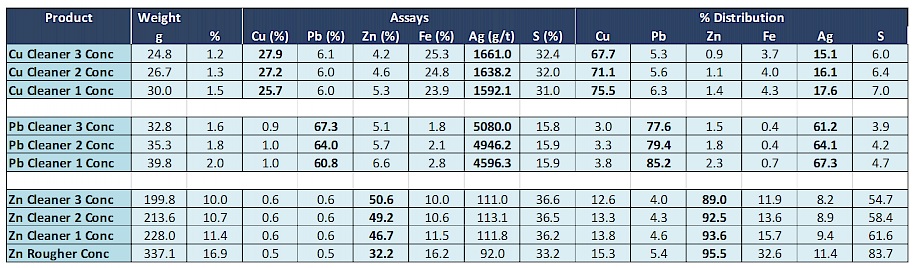

The metallurgical test work has now ticked another box as Southern Silver was successful in producing a copper concentrate with an average grade of 27.9% copper (and 1661 g/t silver) after three stages of cleaning. 27.9% is a marketable copper concentrate, and a recovery rate of almost 68% is very decent.

It’s interesting to see how the copper and zinc concentrate results are presented after three stages of cleaning, but it looks like in both cases just two stages would be sufficient to get to a saleable concentrate. We expect the company to further focus on a trade-off study between higher recovery rates and lower concentrate grades and vice versa. Especially for the zinc concentrate it could make sense to go for just 2 stages of cleaning resulting in a concentrate grade of 49.2% (which is still within the 48-52% ‘sweet spot’ demanded by the smelters). That’s a grade which is indeed 1.4% lower than after the third stage of cleaning, but the recovery rate of 92.5% is 3.5% higher than the 89% that would be recovered in a three-stage cleaning process.

Ideally, Southern Silver should focus on reducing the silver content in the zinc concentrate (as virtually none of the silver will be paid for by the smelters), but we are definitely impressed by these results as A) the recovery rates are good and B) the concentrate grade meets the minimum requirements of the smelters, indicating the penalties on the concentrate will be very low (although we are unsure about the impact of the iron ore in all three concentrates).

But in any case, these (good!) results are an important step forward for Southern Silver in de-risking the Cerro Las Minitas project.

Go to Southern Silver’s website

The author has a long position in Southern Silver. Southern Silver is a sponsor of the website. Please read the disclaimer