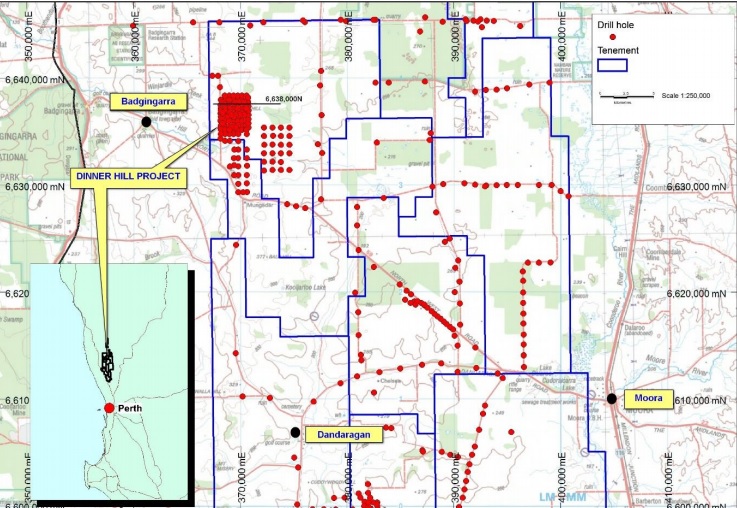

Potash West (ASX:PWN) is aiming to develop its Dinner Hill potash project where it is planning to produce a Single SuperPhosphate (SSP) at a rate of 400,000 tonnes per year. The updated scoping study is based on ‘high-grading’ the resource during the first few years of the mine life as the average grade in the first five years of the mine life is now expected to be 5.5% P2O5, substantially higher than the average grade of the project which is just 2.9% P2O5.

The economics are based on a 40 year mine life with an average throughput of 3.8 million tonnes per year resulting in an output of 400,000 tonnes of SSP per year. Despite the lower price for SSP (down to US$227/t coming from $350/t), the cheaper Australian Dollar and lower operating expenses (thanks to the lower oil cost) have improved the outcome of the study. The initial capex is A$205M, and the pre-tax NPV8% is A$378M. Based on the proposed SSP prices, the payback period is approximately 5-5.5 years with an IRR of 20.5%.

This is an interesting project but a lot more work needs to be done to effectively confirm the viability of the project, and the company has started a pre-feasibility study which should be completed in 2016. The anticipated project start-up date in 2018 might be a tad optimistic though as we wouldn’t expect this mine to be in production before 2020.

Go to Potash West’s website

The author holds no position in Potash West. Please read the disclaimer