Tier One Silver (TSLV.V) is now cashed up after completing a C$6.2M raise at C$0.45 per unit. Each unit consisted of one common share as well as a full warrant allowing the warrant holder to acquire an additional share in Tier One Silver at C$0.75 for a period of three years.

While the financing seemed to be ill-timed at the moment it was announced (the stock was trading over C$1 as recent as November 2021), Tier One Silver made the right decision to raise C$6.2M rather than the C$3M it originally announced. The current share price of C$0.345 means the most recent raise was conducted at a premium of 30.4% to the current share price. So although the C$0.45 price may initially have seemed disappointing to longer term shareholders, the financing conditions would clearly be worse now and in hindsight, the company made the right decision.

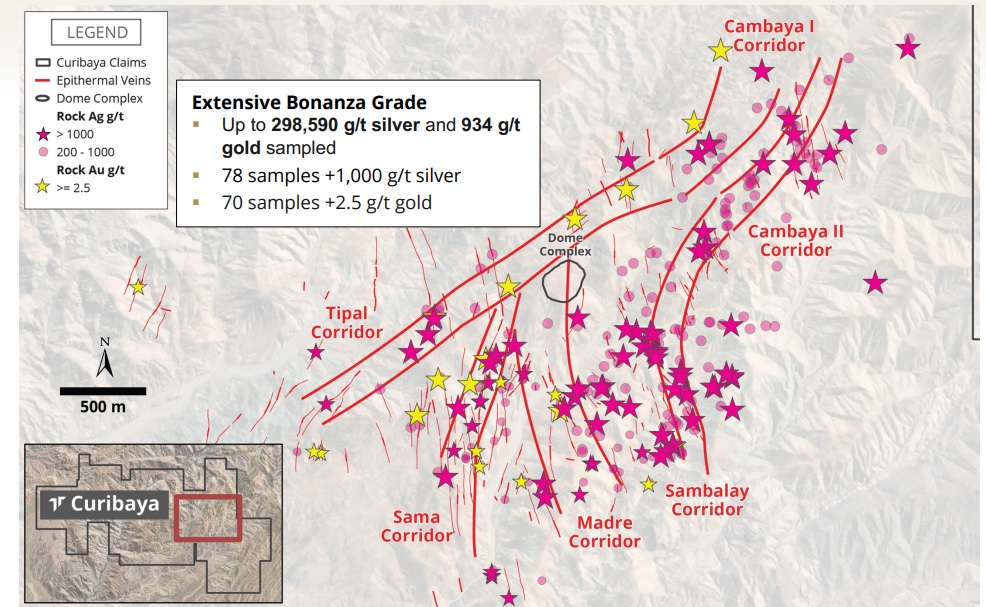

The C$6.1M raised (after taking finders fees into consideration) have put the company in a comfortable position now and the exploration activities in Peru have restarted. At Curibaya, the company is moving towards a second phase of drilling and although Tier One still needs to provide the details of a drill program, it is planning to drill 2,000-4,000 meters and hopefully the company can follow up on some of the high-grade drill results it encountered in the first drill program.

Tier One will also send field teams to the Hurricane project where it is planning to conduct additional geochemical and geophysical surveys at the Magdalena target area where recent channel sampling results identified five mineralized vein corridors. Additionally, Tier One Silver will do some surface work on the Cu-Ni-Pt-Pd-Ag prospects at Hurricane to define new drill targets ahead of permitting drill sites.

Disclosure: The author has no position in Tier One Silver. Please read our disclaimer.