TriStar Gold (TSG.V) has announced the Secretariat for the Environment and Sustainability of the state of Para confirmed the public hearing related to the permitting of the Castelo de Sonhos gold project will be held on November 22nd. This public hearing is the last milestone in the process to obtain the preliminary license for the gold project.

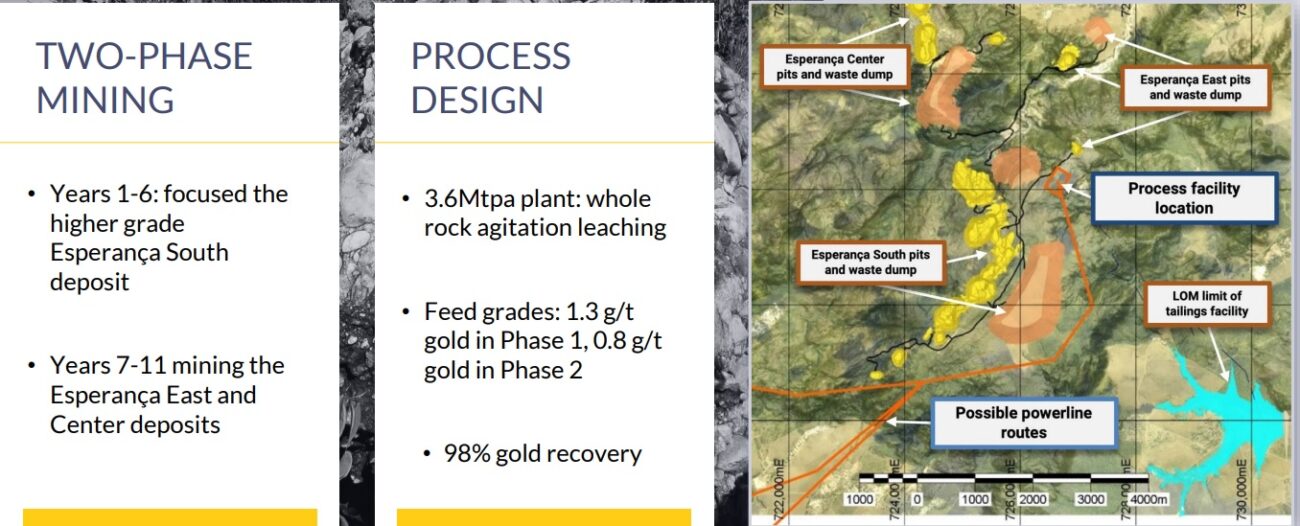

The company is obviously still advancing its flagship project where the pre-feasibility study outlined an 11 year mine life with an annual production of 121,000 ounces of gold per year at an all-in sustaining cost of less than US$900/oz. As the pre-feasibility study was completed in 2021, we will likely have to take a higher capex ($261M in 2021) and higher operating expenses into consideration. On the other hand, the company will now also be able to use a higher gold price, so odds are the after-tax NPV7% of US$261M will come in higher as the higher gold price should mitigate the impact of a higher capex and opex considering the pre-feasibility study used a gold price of $1550/oz.

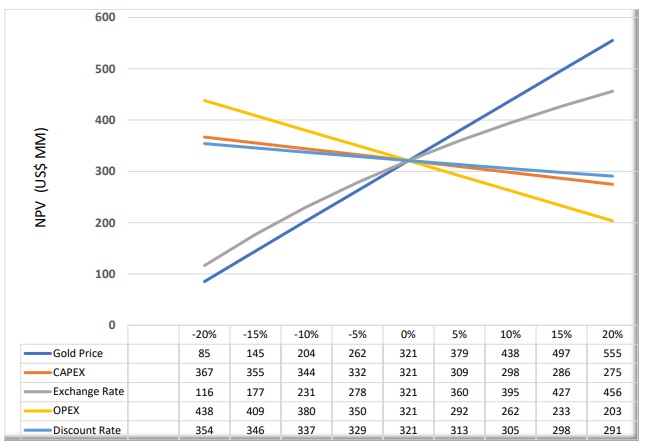

The image above shows that a 20% higher capex would reduce the after-tax NPV5% from US$321M to US$275M (-$46M) while a 15% increase in the opex would have a negative impact of $88M. That being said, using a 15% higher gold price ($1785/oz) would add $176M to the after-tax NPV and ultimately add about $40M to the after-tax NPV5% on a net basis. So while we expect costs to increase, using a higher gold price will likely offset those cost increases.

Additionally, TriStar is investigating potential optimization possibilities to further increase the value of the project.

Disclosure: The author has a small long position in TriStar Gold. Please read the disclaimer.