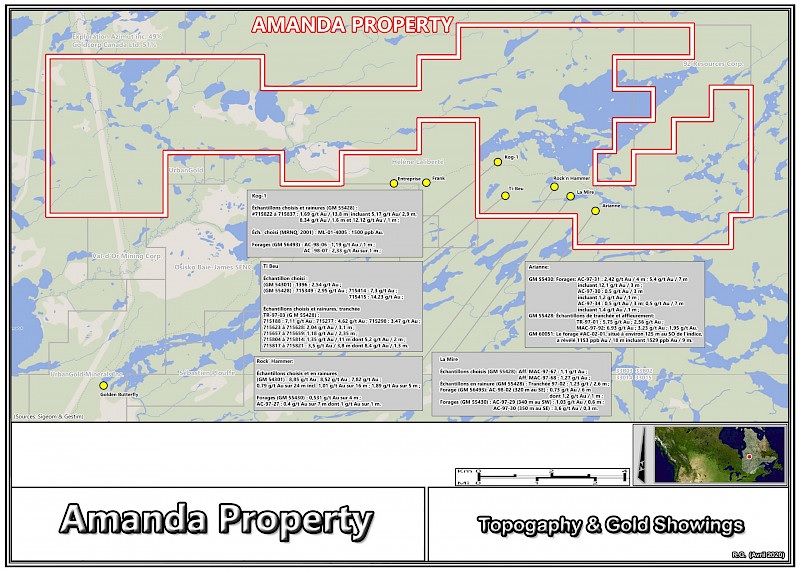

As Vanstar Mining (VSR.V) is focusing on the Bousquet-Odyno project while partner IAMgold (IMG.TO, IAG) is funding 100% of the exploration activities on the Nelligan gold project, Vanstar decided to allow Mosaic Minerals (MOC.C) to earn into the early stage Amanda property in Québec.

Although Amanda has always been seen as a gold project, Mosaic Minerals also plans to kick off an exploration program focusing on lithium as historical reports from a Quebec government agency indicated the presence of pegmatites.

As part of the agreement, Mosaic can obtain an initial stake of 50% by spending C$1M on exploration (C$0.25M in Y1 and Y2 followed by a commitment of spending at least C$0.5M in YR) while it also needs to issue 4 million shares (with value of just under C$0.3M at the current share price of C$0.07 per share of Mosaic). Once Mosaic has established a 50% ownership in the project, Vanstar can opt to either continue to work on Amanda in a 50/50 joint venture, or Vanstar could allow Mosaic to earn an additional 30% stake by filing a NI43-101 compliant resource by the end of 2030. No minimum size of the resource has been mentioned, so it looks like completing a resource calculation, even if there’s only one symbolic ounce of gold or tonne of spodumene would be sufficient for Mosaic to obtain the 80% ownership in Amanda.

In any case, Vanstar is retaining a substantial portion of the upside potential. Should Mosaic make a large discovery as part of its C$1M exploration commitments, Vanstar can always elect to continue to advance the project in the aforementioned 50/50 joint venture structure while the 4 million shares in Mosaic should also be rerated.

Disclosure: The author has a long position in Vanstar Mining. Vanstar is a sponsor of the website. Please read our disclaimer.