In a previous article, we expected Victoria Gold (VIT.V) to receive more attention after Goldcorp (GG, G.TO) decided to acquire Kaminak Gold, thereby validating the thesis it is indeed possible to discovery and design profitable gold projects in the Yukon Territory. Victoria has now released the feasibility study on its fully permitted (!) Eagle Gold project in the Yukon, and we can’t really be unhappy with these results.

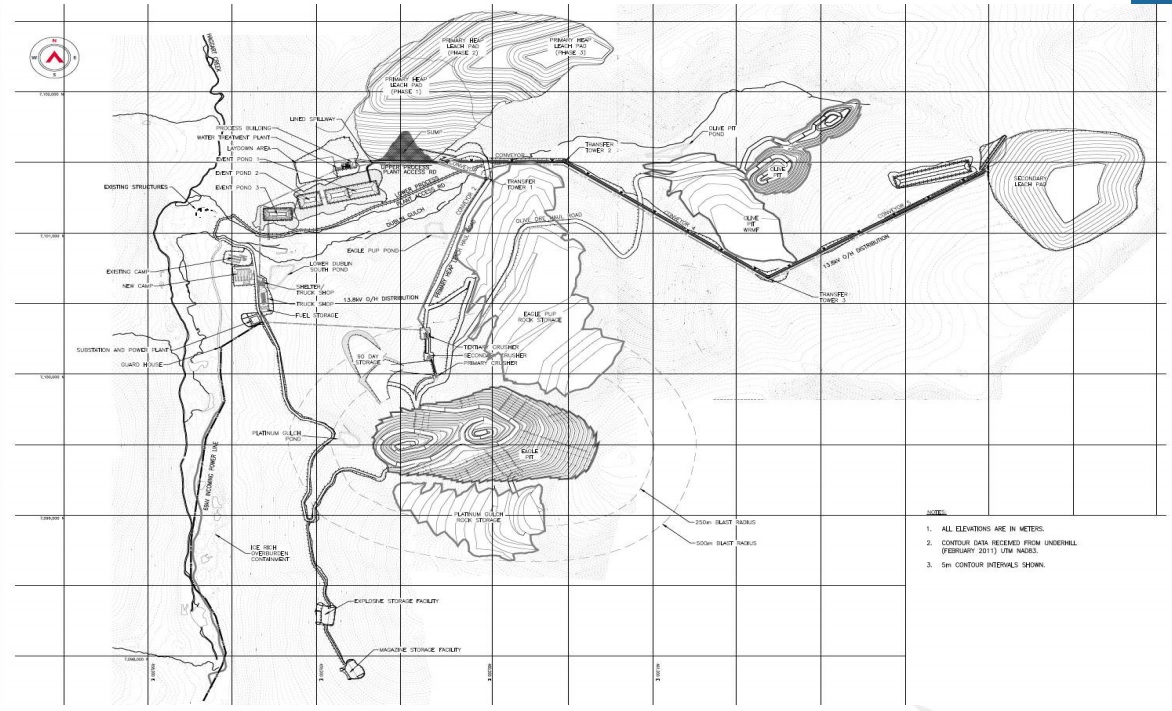

The initial capex of Eagle Gold has been estimated at C$370M, which should allow the company to produce an average of 190,000 ounces of gold during the entire 10 year mine life, at an AISC of just US$638/oz. This results in an after-tax NPV5 of C$508M and an IRR of 29.5% using the base case scenario with a gold price of US$1250/oz. However, at US$1300 gold, the NPV would increase to C$567M and you should keep in mind this is based on just 2 million ounces of the 3.9 million ounces in all resource categories. Additionally, drilling at the Olive-Shamrock zone will very likely add more ounces (and value) the Eagle Gold.

With a robust feasibility study which has been filed at the end of October, Victoria Gold is now more than ever a valid buyout candidate.

Go to Victoria’s website

The author has no position in Victoria Gold. Please read the disclaimer