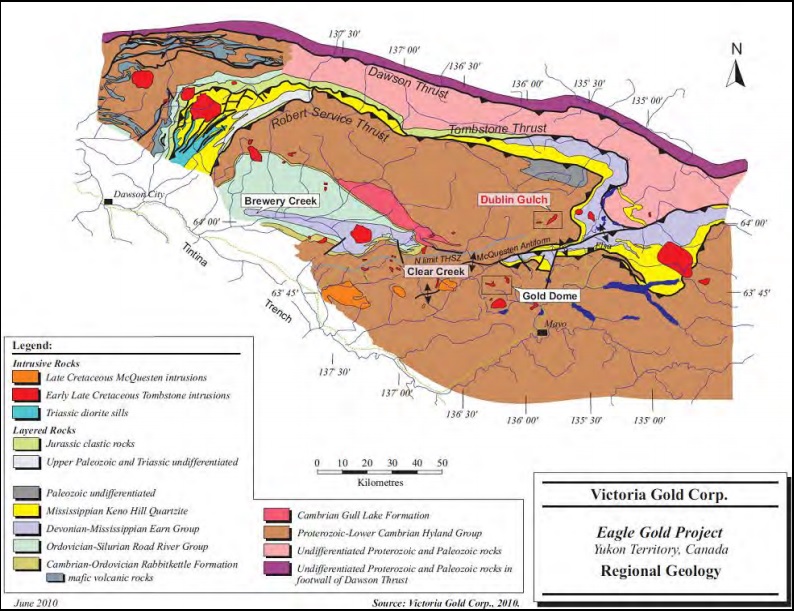

We all know Kaminak Gold (KAM.V) has been acquired by Goldcorp ( GG, T.TO) a few weeks ago and as this signals an increased appetite for safe Canadian gold stories (even though they are located in remote regions, the market is now obviously focusing on Victoria Gold (VIT.V) as the potential next buyout target.

The company has now released a third batch of drill results from the 2016 diamond drill program at Olive-Shamrock, and these results confirm the continuity of the mineralization at that zone. Victoria Gold is absolutely correct when it says these results are validating its exploration model to drill-test zones with potential near-surface and high-grade material.

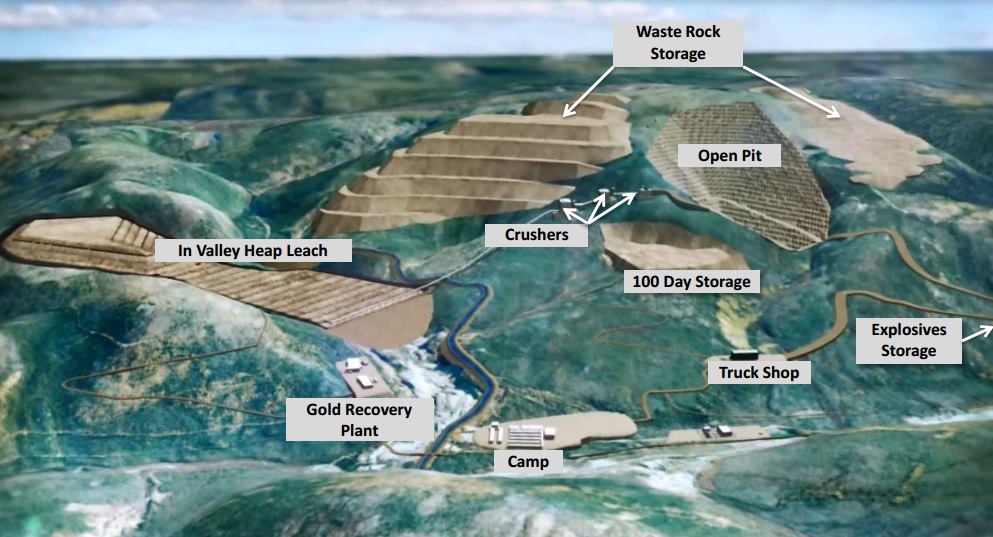

With drill intervals of 52 meters at 4.4 g/t and 22 meters at 1 g/t and almost 30 meters at 1 g/t of gold as well, the Olive zone could improve the economics of the Eagle Gold project as the average grade of the gold reserves is just 0.78 g/t. The higher grade might be a nice kicker for the entire operation considering this zone is located just a few kilometers from where Victoria Gold intends to build the production facilities for the Eagle Gold mine, so it shouldn’t be too difficult to incorporate ore from Olive-Shamrock into the existing mine and processing plan.

This will please Electrum, the company’s newest large shareholder which acquired 60 million shares of Victoria Gold at a price of C$0.30 per unit (witch each unit consisting of one share and half a warrant whereby an entire warrant allows the warrant holder to acquire one additional share at C$0.40 for 3 years).. Victoria’s other large shareholder, Sun Valley, also topped up its position by investing an additional C$6M in Victoria Gold, to increase its stake to 18%. Sun Valley and Electrum Strategic Opportunities now own almost 32% of Victoria’s shares.

Go to Victoria Gold’s website

The author has no position in Victoria Gold. Please read the disclaimer